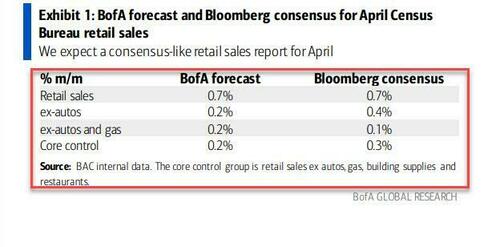

Weak tax refunds were expected to weigh on retail spending going forward, but perhaps not quite yet as expectations were for a MoM rebound from March's unexpected decline with omnciscient BofA forecasting around consensus:

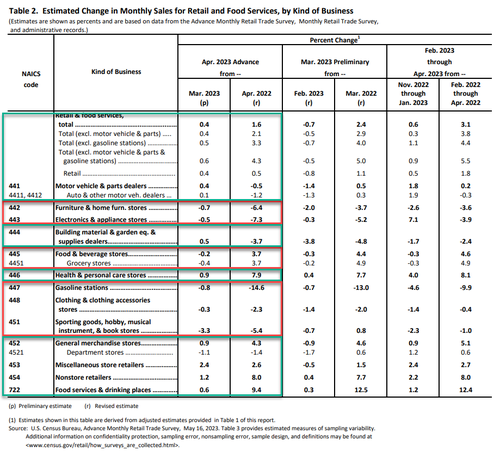

And rebound it did, but the headline print was disappointing - up only 0.4% MoM (vs +0.8% MoM exp) - but core and control group data (which fits into GDP calcs) were better than expected...

Prior months were revised little stronger:

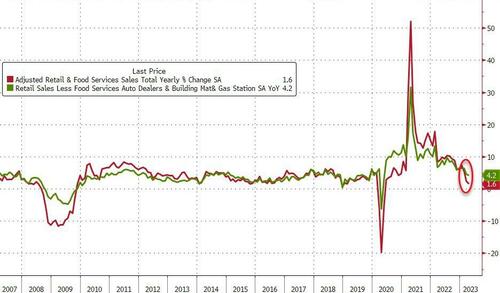

What is more notable is that (nominal) retail sales rose just 1.6% YoY (well below inflation) - the slowest since May 2020 - suggesting the consumer is feeling the pinch in a big way...

Source: Bloomberg

All of the YoY measures are at their slowest pace since COVID lockdowns...

Under the hood, 7 out of 13 retail categories rose last month.

The value of motor vehicle sales increased 0.4%, while receipts at gasoline stations fell 0.8%...

The market seems most focus on the Control Group's beat with 10Y Yields up 4bps post-date.