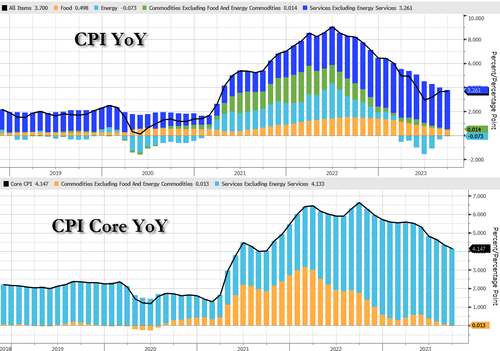

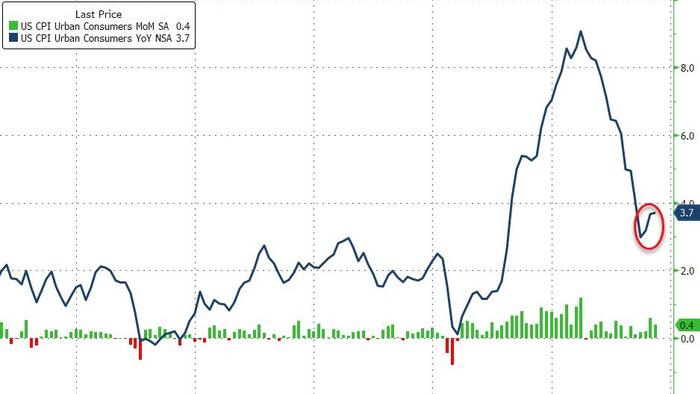

Following August's bigger than expected jump (driven by surging energy prices and healthcare methodology changes)., September's CPI was expected to slow (+0.3% MoM) with the YoY pace inching back lower (from 3.7% to 3.6%) after rebounding for two straight months.

However, headline CPI came in modestly hot at +0.4%, with YoY at 3.7% - that is the 3rd monthly rebound in a row.

Source: Bloomberg

Core CPI rose 0.3% MoM, with YoY sliding to +4.1% YoY (as expected)... it still hasnt been below 4.00% since May 2021....

Source: Bloomberg

Food and Commodities contribution to YoY CPI slowed while Services increased...

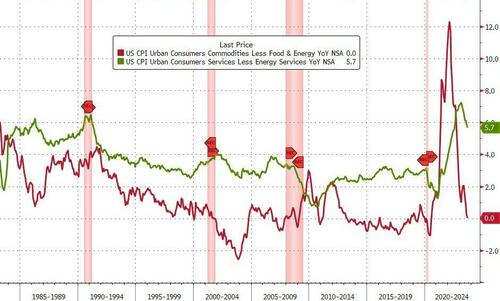

Goods inflation dipped back to unchanged YoY and Services CPI slowed to +5.7%...

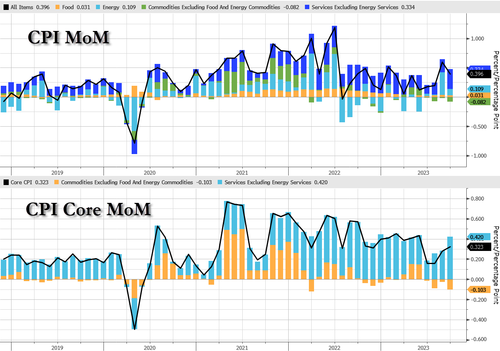

Services stands out on A MoM basis...

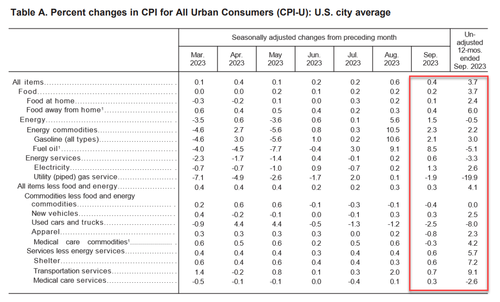

Under the hood, gasoline continues to rise and used car prices drop...

The index for all items less food and energy rose 0.3 percent in September, as it did in August.

The index for all items less food and energy rose 4.1 percent over the past 12 months.

Gasoline prices continue to rise...

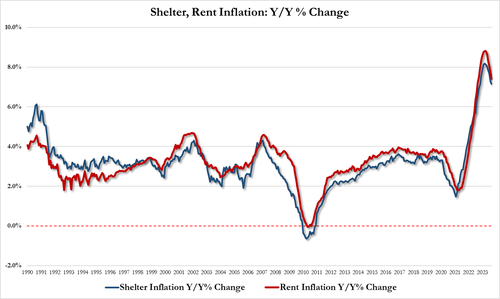

Shelter costs are slowing, but accounted for the largest part of core CPI...

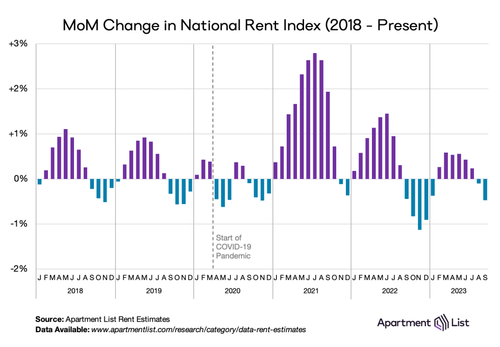

Bear in mind that while CPI very stale data is rising over 7%, real-time rent indicators are in freefall. Apt List's Sept rent drop was the biggest on record...

And perhaps most importantly, one silver lining is that The Fed's new favorite inflation signal - Core Services CPI Ex-Shelter YoY slowed to +3.74% (despite jumping 0.46% MoM). That is the lowest YoY since Dec 2021...

Is this third straight monthly increase in CPI YoY an inflection point? Or is M2 still leading the trend?

Turning from the cost of things to the ability to pay, "real" wages contracted 0.1% YoY (after 3 months positive)...

This is not the soft-landing cruise lower in inflation that the market (and The Fed) was hoping for...