Hawaii became the first U.S. state to establish a climate impact fee on tourism this week, placing an additional tax on visitors to fund "climate change resiliency projects". As the country's inaugural "Green Fee," Act 96 will raise the state's current transient accommodations tax (TAT) by 0.75% for a total of 11% placed upon the nightly lodging rate, effective Jan. 1, 2026, according to a press release by Governor Josh Green's office.

“Today Hawaiʻi ushers in the first Green Fee in the nation. Once again, Hawaiʻi is at the forefront of protecting our natural resources, recognizing their fundamental role in sustaining the ecological, cultural and economic health of Hawaiʻi. As an island chain, Hawaiʻi cannot wait for the next disaster to hit before taking action. We must build resiliency now, and the Green Fee will provide the necessary financing to ensure resources are available for our future,” said Governor Green.

Green is ostensibly referring to the disastrous Maui fires in 2023 which did $5.5 billion in property damage and became an international embarrassment for the Hawaiian state government. Of course, as we reported at the time, the fires had nothing to do with "climate change" and everything to do with the state's gross mismanagement of water resources and fire response.

The new Green Fee will apply to travelers staying in hotels, short-term vacation rentals and for the first time ever, cruise ships. For a nightly hotel rate of $300, the tax would add an extra $2.25 each day. This might not seem like much, but Hawaiian officials expect the tax to generate up to $100 million per year, and like all progressive governments, they are licking their chops over the possibilities.

In essence, carbon footprint schemes are a tax on an invisible byproduct with an imaginary climate impact. These are taxes to solve a problem which does not exist. So, the sky is truly the limit on how far carbon taxes can be taken to bleed the American public and fuel further government expansion. It begins with a tax on hotel rooms, but there's nothing stopping the state from adding the same fees to everything from boat rentals to tiki torches.

Furthermore, if Hawaiian residents think they will be spared from such taxes, they are in for a rude awakening. The new Green Fee also applies to people living in Hawaii who stay at hotels and resorts, and there's little doubt that more taxes are incoming as the Green Fee sets the precedent. Some legislators have pushed for carbon tax "kickback" to residents of the state, but this would represent a minimal offset if carbon taxes spread to all areas of the economy.

Keep in mind, Hawaii already has one of the highest tax burdens for citizens in the entire US.

Hawaii's carbon reduction plans call for a 70% cut in emissions by 2030, using a "phased-in system" with a carbon tax rate of $80 per ton of carbon emissions by that year. Hawaii want zero emissions by 2045. Meaning, a green fee on hotels is just the beginning and everything with a carbon footprint will ultimately be taxed into oblivion.

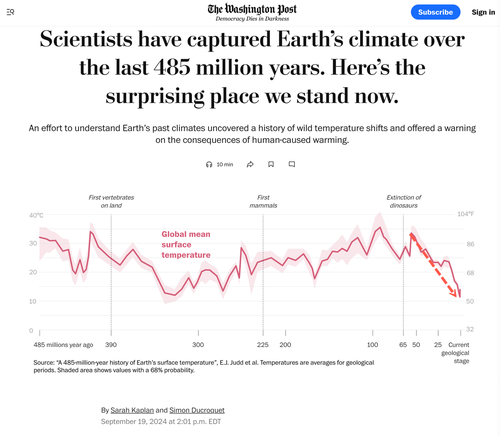

As we have noted many times, there is zero concrete evidence of a causation relationship between carbon emissions and climate change. All climate models used by scientists in the field to justify their global warming claims rely on data collected from the 1880s onward. That's a tiny window of 140 years in the Earth's climate history and conveniently ignores long term data from before the advent of human industry.

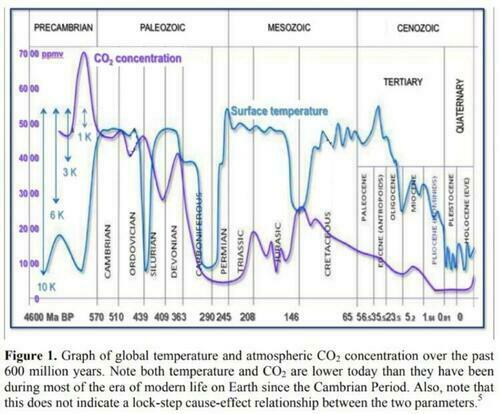

When we examine Earth's temperatures over millions of years, it's easy to see that modern civilization exists in one of the coldest periods, not the warmest. Numerous warming periods have occurred in the past with no human activity to cause the events.

And, if we look at the behavior of the carbon content of the Earth's atmosphere over this same time period, it's obvious that there is no correlation between rising carbon and rising temperatures.

In other words, the entire basis for carbon taxation has been debunked. The only reason governments continue to push for emissions fees is because they know a large percentage of the population isn't aware of this information. Government and NGO funded climate scientists continue to spread disinformation on global warming because they have access to billions upon billions of dollars in grant money if they promote the narrative. The farce is simply far too lucrative to abandon.