By Michael Every of Rabobank

From a “because markets” perspective, the key story today is President Trump saying he would like the US to shift from quarterly to biannual corporate reporting: "This will save money, and allow managers to focus on properly running their companies… Did you ever hear the statement that, 'China has a 50 to 100 year view on management of a company, whereas we run our companies on a quarterly basis??? Not good!!!" One can hear the wails of those in the ouroboros of 3-monthly higher/lower games. Yet from an economic statecraft perspective, is this wrong?

Agree there and you have to ask why US firms are supposed to fixate on short-term returns to shareholders rather than a long-run vision. The Chinese EVs sweeping all before them --and cementing control of key supply chains-- are losing money hand over fist; does that matter if they can keep it up longer than western markets would allow? Neomercantilism says yes. Accept that, and you quickly turn to what quarterly GDP is and isn’t measuring and is and isn’t “for”.

That is starting to happen, as a quick round-up of geopolitics underlines:

Geoeconomics makes the same point:

Political news also flows away from a business-as-usual focus on GDP and quarterly earnings:

In markets, an appeals court ruled Trump can’t fire Governor Cook before the next Fed meeting, so how will Cook vote - unless the Supreme Court quickly steps in? That’s as Trump appointee Miran won confirmation to the Fed, which Bloomberg calls a “Watershed policy moment”. The current trend suggests a lot higher watersheds than that to come.

Meanwhile, Thailand is weighing taxes on physical gold trading as the metal is dragging THB higher as the struggling economy needs a lower exchange rate; and the Bank of England proposes strict limits on stablecoin ownership - that’s one way to avoid the threat of dollar stablecoins, but I doubt the US will stand for it. Does either move say, “because markets” or “expect further changes to the global architecture”?

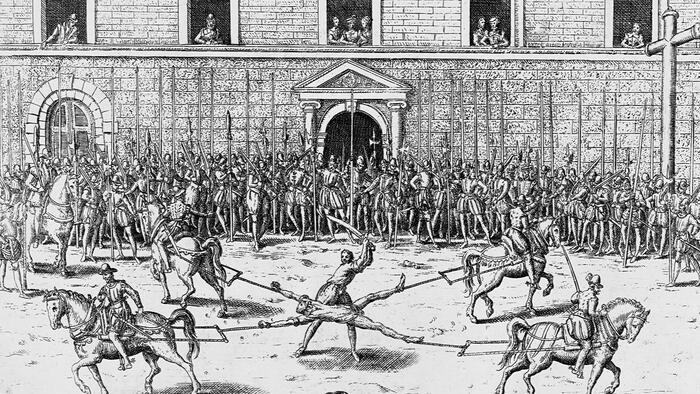

To summarize all of the above, just looking at the usual numbers in the usual “because markets” ways at times like these risks seeing you hung, drawn, and quartered.