This year, the long-running US exceptionalism trade has shown signs of fatigue as concerns over a potential economic slowdown mount. Top market strategists, including Goldman Sachs' William Hosbein and Nomura's Charlie McElligott, have voiced concerns that a growth scare scenario could unfold.

On Thursday, Goldman's Diana Asatryan provided clients with an updated take on the "Growth scare and tariffs" narrative that continues to flash alarm bells:

A sequence of disappointing prints—UMich, PMIs, consumer confidence, Walmart earnings—brought growth fears back to the forefront, right next to the ongoing tariff uncertainties:

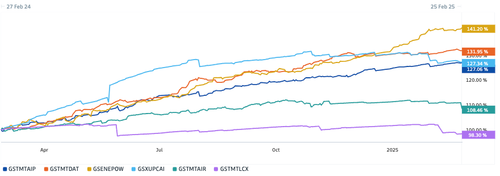

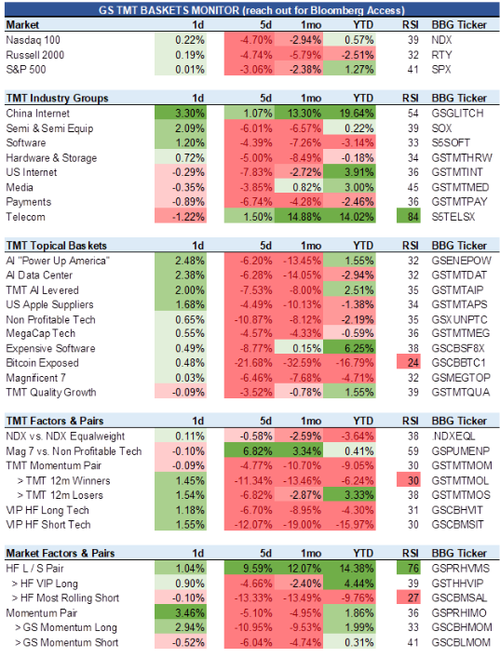

Asatryan provided clients with a chart pack focused on the trade policy and AI basket returns to offer a clearer view of the shifting economic landscape.

Here's part of that chart pack:

Where is the Trade Policy Uncertainty Index for the United States?

Where are the normalized earnings of AI Baskets?

GS Sector / Basket Performance:

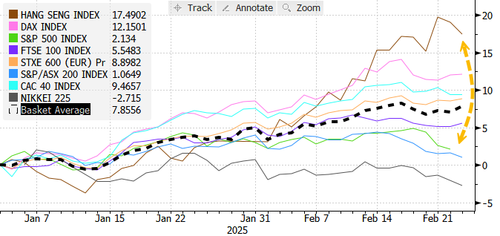

Our addition to the chart pack:

US Economic Surprise Indices are rolling over towards "misses" on average versus expectations...

AI Software: After a blazing start to the year, the AI software basket (GSTMTAIS) has suffered its worst five-day move in two years (-13%).

The takeaway is that US exceptionalism is now on pause.

Will this be enough for TSY yields to slide, considering the Trump admin is laser-focused on bringing down borrowing costs?