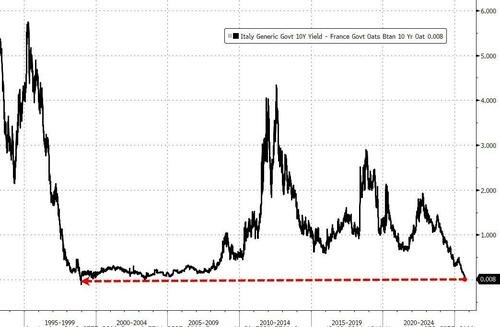

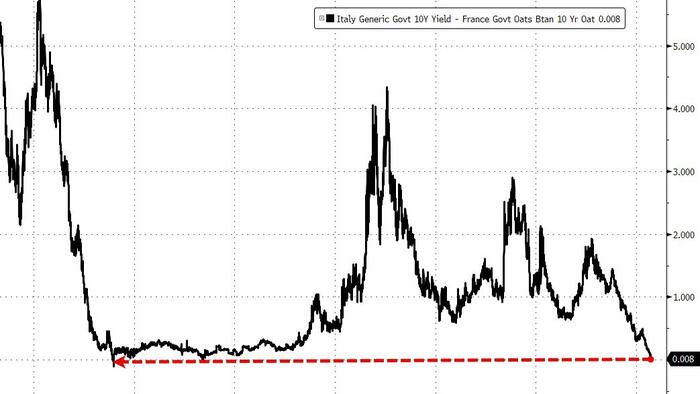

For the first time since the euro-zone's inception, French 10Y borrowing costs exceeded those of Italy as investors anxious amid the ongoing dysphoria over budget deficits and debt piles.

As Bloomberg reports, for market veterans, it’s a remarkable development given lower-rated Italy was for years the region’s poster-child for fiscal profligacy.

Now it’s France that’s worrying investors over the size of its deficit, with Prime Minister Francois Bayrou set to resign later Tuesday after losing a confidence vote.

“Expectations for a speedy resolution to France’s political and fiscal woes are likely to remain constrained,” said Sam Hill, head of markets insights at Lloyds.

Its bonds will remain sensitive to broader market concern over budget deficits and debt piles, he added.

Bayrou’s successor will need to find a way to pass a budget in a splintered parliament, an exercise that’s toppled the last two prime ministers.

French bonds have been the worst performing in the region since President Emmanuel Macron called a surprise election last year.

We do note that it's not quite apple to apples as a maturity mismatch distorts the comparison between the two nation’s yields.

The new French benchmark yield is based on a bond maturing in November 2035, several months after the Italian equivalent. That means the French yield reflects additional duration risk.

Still, it’s the latest unwanted market milestone for French officials.

President Macron is expected to name a successor from the center (defined broadly) or with a technocratic profile.

“The expectation is for the next French PM to be a placeholder,” said Elliot Hentov, head of macro policy research at State Street Investment Management.

“For investors, the real concern is that the electorate is neither coalescing around a clear majority nor seems particularly concerned with fiscal deterioration.”

The market is likely to judge any incoming PM on their ability to pursue budget consolidation while creating room for compromise within the current make-up of parliament, in particular with the center-left.

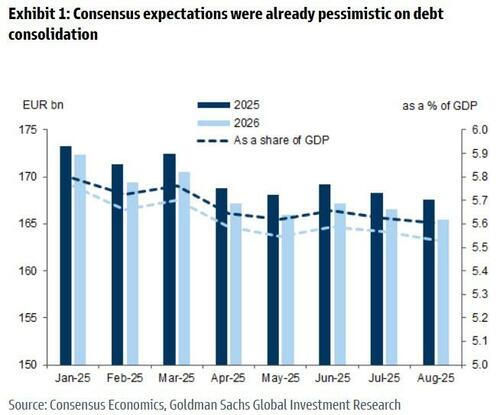

2026 deficit expectations are already relatively pessimistic, suggesting markets were already primed for substantial slippage vs the 4.6% deficit target of PM Bayrou.

Combining a deficit likely to land at 5.4% this year and the ambitious initial target for 2026, Goldman continues to see a path for sequential improvement in deficits, with concessions to opposition parties – their economists’ baseline forecast is for a deficit of 5.2%.

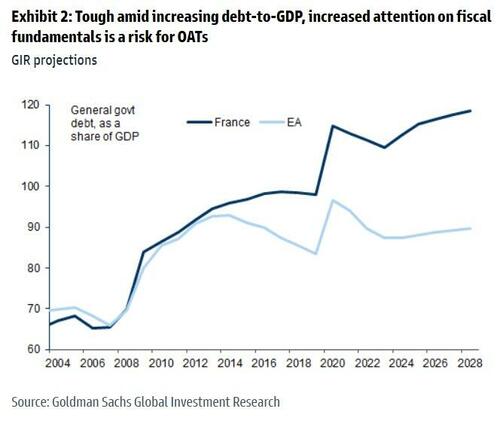

With debt-to-GDP on an increasing trend and diverging from Euro area peers for a number of years, political uncertainty may place higher scrutiny on fiscal sustainability, including from a more medium-term perspective.

Assuming such a budget can be passed, Goldman believes it would be sufficient to provide relief to OATs into year-end. Under this baseline, Goldman expects OATs to settle at ~70bp over Bunds at the 10y point.

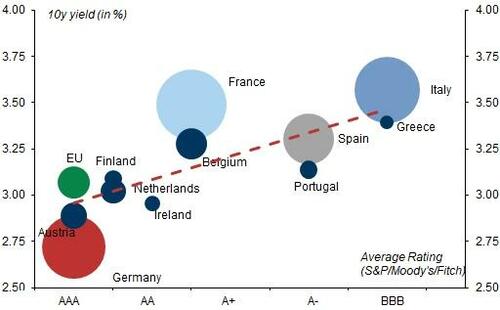

Goldman sees limited market risk from rating decisions given OATs already trade wider than their current rating and should remain investment grade.

France will see a sequence of rating actions in coming months, starting with Fitch (AA-, negative outlook) on September 12, followed by Moody’s (Aa3, stable outlook) on October 24, and S&P (AA-, negative outlook) on November 28.

A collapse of the Bayrou government, in itself and/or associated with an increase in deficit expectations, would make further rating downgrades more likely. That said, we do not expect a meaningful market impact from such decisions. A scatter of EGB yields against ratings suggests OATs already trade wider than their rating.

This is consistent with the view that markets have moved ahead, as the macro and policy environment evolved. For that reason, we do not expect rating decisions to carry a lot of forward-looking insights for markets and instead expect them to validate current pricing. We had shown in prior research that only a downgrade to non-investment grade provided a reliable signal of spread widening against peers.

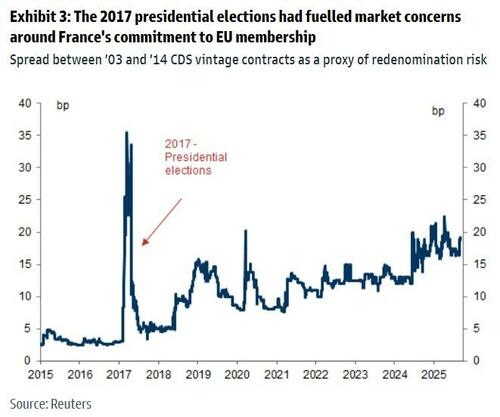

Finally, the biggest tail risk Goldman sees for France is a scenario where the market prices risks of an earlier presidential election.

In this scenario, policy uncertainty would broaden beyond the headline deficit reduction, and markets could even price deeper tails, for instance questioning France’s commitment to EU rules and membership, as in 2017.

Frexit fears are on the rise...

The path for that is very narrow as it likely entails a succession of events that are individually off our baseline view.

Namely, it may require a failure to negotiate within the current make-up of parliament, fresh elections that deliver a strong majority outside of the center, and President Macron forfeiting his prerogative to set the foreign policy agenda until mid-2027.

This is nonetheless a risk to bear in mind – a Polymarket contract shows 7% odds on that outcome by end-2025.