Goldman analysts led by Noah Poponak released their 3Q25 Aerospace & Defense (A&D) earnings preview that points to continued strength in commercial aerospace (both OEM and aftermarket) and defense technology, while warning about government IT (due to DOGE-related efforts) and some defense hardware names.

Under the Goldman defense coverage universe, Poponak and his research desk favor TransDigm (TDG), Huntington Ingalls (HII), Woodward (WWD), and AeroVironment (AVAV) into earnings, while stressing "risk" ahead of earnings for Booz Allen (BAH), General Dynamics (GD), and Lockheed Martin (LMT).

Here's the breakdown:

Aerospace OE:

Boeing 737 MAX production has been at 38/month since May, and product quality improvements are holding. We expect the company to request a rate increase to 42/month with the FAA in the near-term, and to increase production to that level by year-end. We recently toured the Renton 737 MAX facility (see our takeaways here); the production process appears stable and well-managed, and all 6 major KPIs are "green." Boeing is strategically holding high levels of inventory in anticipation of production rate increases, but is also more engaged with the supply chain as it looks to avoid supplier bottlenecks down the road. 787 production is currently at 7/month, and the company thinks it can move to 10/month next year, with higher rates requiring investment in capacity. 777X EIS looks to be delayed until 2027 as the company works through extended and delayed certification processes with the FAA, which could result in additional reach-forward losses between now and then. Overall, demand remains far above supply, which ultimately creates favorable economics for BA.

Business jet:

Heading into 3Q25, the market structure remains generally favorable, driven by flight activity above pre-pandemic levels, disciplined new aircraft supply, and tight inventory. This continues to support strong pricing and margins for OEs. Aftermarket businesses should continue to grow, providing high-quality, high-margin revenue. While forward indicators remain strong and book-to-bills have been solid, improvement in these metrics as slowed in recent quarters, and valuation has become fuller in pockets of the market (see our BBD downgrade from Buy to Neutral note here). We will be looking for signs of demand improvement in the quarter, as OEMs have noted improved customer confidence in the macroeconomic picture.

Defense Tech:

We continue to see evidence of the DoD's shift towards more nimble and commercial suppliers in defense, and the magnitude of growth potential for companies in the sub-sector is becoming clearer as they provide additional details on program wins (see our AVAV investor day takeaways here, and our KTOS management meeting takeaways note here). Focus is likely to remain on backlog trajectory in 3Q along with increasing attention on execution of key production ramps. We expect continued momentum driven by structural tailwinds in the sector, with program wins as additional catalysts. See our recent defense tech bus tour takeaways here.

Defense hardware:

We remain selective within defense hardware, favoring names that are exposed to high areas of growth within the DoD's $1tn budget FY26 request. Reconciliation spend prioritizes domestic shipbuilding, munitions and rocket production, and domestic missile defense. We think the Pentagon will continue implementing tougher terms of trade with defense contractors as efficiency initiatives in the department continue, which creates margin and cash flow uncertainty over the medium term.

Government IT & Services:

We remain cautious on gov't IT, driven by the US government's efficiency initiatives and the impact of DOGE's directives across federal civilian agencies and DoD contracts. There is still a degree of uncertainty regarding which programs and contracts may be subject to review or cancellation as the administration examines substantial volumes of government expenditure and contracted work scope. The federal government shutdown that commenced on October 1, 2025, due to a failure to pass funding bills, may disrupt new contract awards, modifications, and payment processing, creating cash flow and backlog challenges for contractors.

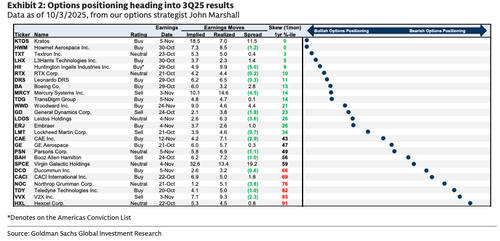

Options positioning heading into 3Q25 results

Ratings breakdown into earnings

ZeroHedge Pro Subs can access the full note in the usual spot, complete with additional color and positioning on key defense names heading into third-quarter earnings.

Related:

S&P Aerospace & Defense Select Industry Index...

Another bubble?