Danish pharmaceutical giant Novo Nordisk announced a major restructuring, including the reduction of 9,000 jobs, while slashing guidance for the second time in two months. The move comes as its new chief executive takes the helm and seeks to save the sinking ship amid waning market share for its blockbuster Wegovy weight-loss drug.

"Novo Nordisk today announced a company-wide transformation to simplify its organisation, improve the speed of decision-making, and reallocate resources towards the company's growth opportunities in diabetes and obesity," Novo wrote in a press release.

Novo added that it "intends to reduce the global workforce by approximately 9,000 of the 78,400 positions in the company, with around 5,000 reductions expected in Denmark." This round of job cuts represents about 11% of total global staff and is expected to generate annual savings of around 8 billion Danish kroner (roughly $1.25 billion) by the end of 2026.

Sales of blockbuster drugs Ozempic and Wegovy have been battered by the flood of cheaper copycat versions of GLP-1 drugs. This is primarily due to a shortage of the weight-loss drug, which led to the practice of compounding. Now Novo is planning to crack down on GLP-1 knockoffs, as outlined in its latest earnings report:

"Novo Nordisk is pursuing multiple strategies, including litigation, to protect patients from knockoff 'semaglutide' drugs. Novo Nordisk is deeply concerned that, without aggressive intervention by federal and state regulators and law enforcement, patients will continue to be exposed to the significant risks posed by knockoff 'semaglutide' drugs made with illicit or inauthentic foreign active pharmaceutical ingredients."

Related:

Here are more details about Novo's latest transformation:

The new Novo CEO, Mike Doustdar, stated: "As the global leader in obesity and diabetes, Novo Nordisk delivers life-changing products for patients worldwide. But our markets are evolving, particularly in obesity, as it has become more competitive and consumer-driven. Our company must evolve as well. This means instilling an increased performance-based culture, deploying our resources ever more effectively, and prioritising investment where it will have the most impact – behind our leading therapy areas."

Doustdar's actions mark his first major attempt to stop the hemorrhaging of the stock, which is down 44% year-to-date. Today's announcement sent shares in Copenhagen up 4%.

Comments from Goldman and UBS analysts to clients earlier signaled disappointment and heightened uncertainty around Novo.

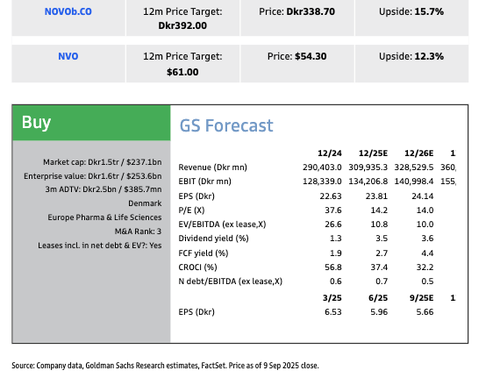

Goldman analyst James Quigley (Novo superbull)

UBS analyst Matthew Weston (Neutral)

. . .