From the unveiling of China's ultra-cheap DeepSeek rival to ChatGPT to Microsoft's global pullback on AI data center projects and Alibaba Chairman Joe Tsai's warning about an AI infrastructure investment bubble in the U.S., the warning signals are flashing red: The AI data center boom may be set to deflate.

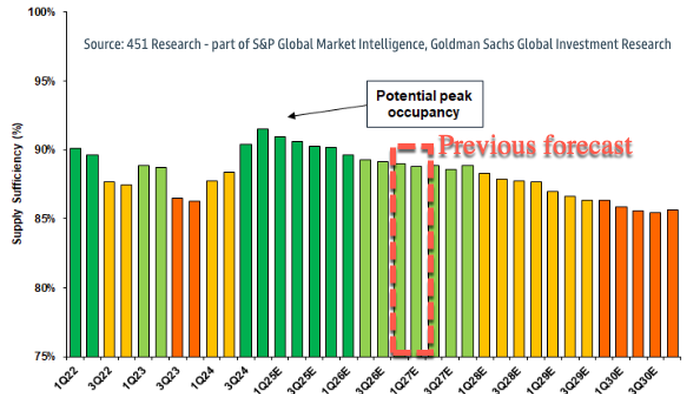

When the DeepSeek news broke in January, we outlined that the emerging "do more with less" theme—driven by more efficient large language models—could be enough for Goldman's James Schneider, Michael Smith, and others to revise their peak data center capacity forecasts forward from late 2026.

And that's precisely what the analysts did on Thursday.

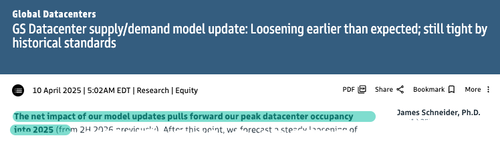

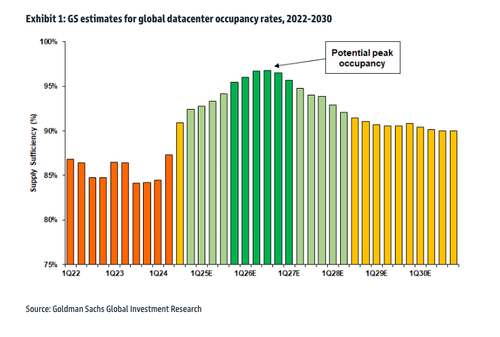

Schneider told clients that he updated his global data center supply/demand model, citing the impact of AI-related developments such as DeepSeek and new capacity announcements like OpenAI's Stargate. He offered a new outlook that pulls peak data center occupancy forward to 2025 (from late 2026) and predicts a gradual loosening of the supply-demand balance through 2027. Despite this shift, occupancy rates are expected to remain above historical norms.

The analyst outlined three key uncertainties for AI data centers: weak monetization from consumer-facing AI services, potential oversupply from large AI infrastructure projects, and increased efficiency from smaller, corporate-targeted LLMs.

Here's more color on the data center peak occupancy revision from the analysts:

We update our data center supply/demand model for the latest updates we see to both supply and demand estimates over the past quarter:

Schneider's previous peak data center capacity forecast was issued in January.

The revised peak data center capacity forecast was issued on Thursday morning.

Despite the revision, the analysts maintained a constructive view of data center operators like Digital Realty (DLR) and Equinix (EQIX), noting that the risk/reward profile has become more balanced amid tempered AI demand expectations.

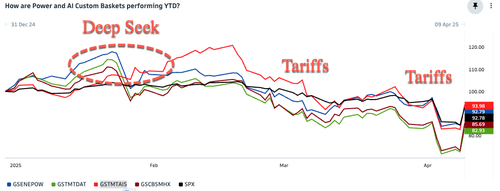

Year-to-date, Goldman's Power and AI baskets have been sliding ever since the Deep Seek moment in late January.

What could go wrong?

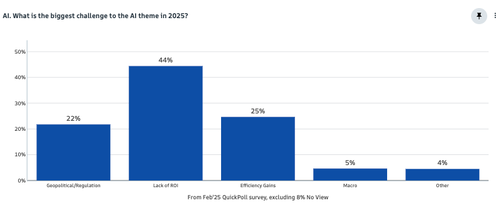

A quick poll of GS clients: What is the biggest challenge to the AI theme in 2025?

A quarter of the respondents answered: "Efficiency Gains."

Recall that U.S. Treasury Secretary Scott Bessent sat down with Tucker Carlson last week, pointing out that the stock market turmoil started earlier this year with Deep Seek.

. . .