Some important thoughts from the head of Goldman hedge fund coverage, Tony Pasquariello

Following five days of extraordinary price action -- and headed into today’s quarterly expiry -- five quick takes and three charts:

1. Point-to-point, the equity market has largely treated the recent events as a surgical strike on a specific cohort of stocks. Don’t take my word for it: compared to last Thursday at 4:15 PM, S&P futures are net positive and NDX is ... 5% higher. When coupled with the additional fact that implied volatility is nearly unchanged from where it was marked before this storm hit, again the pattern suggests the market has mostly compartmentalized, if cauterized, stresses in the banking sector. I find that a bit remarkable, especially when you confront the inconvenient truth that central banks are in a very different position today than they were in during past financial shocks. With that on the table, I will note that we’re only five trading days into a new chapter -- and, as detailed below, I believe the balance of risks are shifting to the downside.

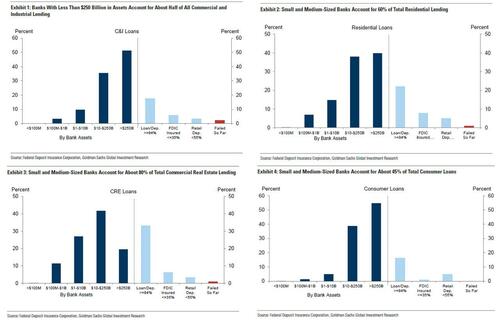

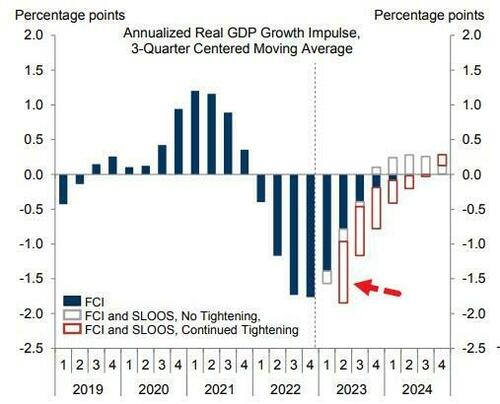

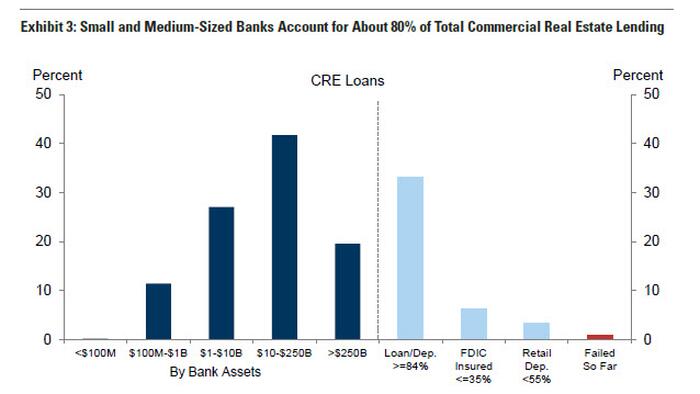

2. US regional banks: To my eye, now this is less a story of creditworthiness, and more a story of the degradation of forward earnings power. At current levels, one can argue that’s largely in the price of these stocks. Looking further ahead, however, it’s hard to not be concerned around the medium-term availability of bank lending into the real economy. This is a new challenge and the impulse for financial conditions -- broadly defined in a practical sense -- is likely to worsen. Instinctively, it’s very hard for me to see how this impingement of credit availability isn’t problematic for the heart of the US economy. For further reading from the in-house experts: link

3. The question that’s come up over and over since last week is how to calibrate the regional bank issue into units of GDP. our US economics team did the hard work, and this is the punch line (link):

What of the Fed? We can debate its local relevancy given everything else that’s happening, but CPI didn’t cement expectations for next week. The good news is headline has fallen for eight consecutive months; the bad news is 5.5% on core is still a long ways from target. to be clear: US inflation is still a serious issue and it’s not coming down as fast as most expected (particularly is it relates to “super core”). for next week’s FOMC, I will leave the handicapping to the experts, but assume the Fed will deliver whatever the rate market is pricing into the event (currently a ~ 75% probability of a 25 bps hike). two attendant points:

- With all of that thrown into the blender, here’s my general take on market direction:

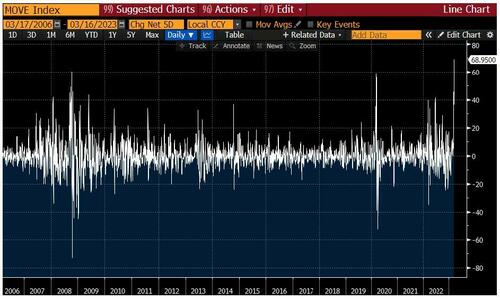

i. This is the showstopper ... a plot of the 5-day rate of change of US interest rate implied volatility ... again, I find it incredible that stocks haven’t been more intimidated by this.

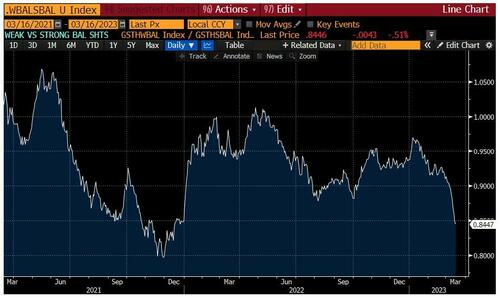

ii. The ratio of weak balance sheet stocks over strong balance sheet stocks ... I don’t have an MBA, but I reckon the cost of capital will be going up from here as credit provision becomes harder to come by:

iii. The ratio of cyclical companies over defensive companies ... if you’re worried about long and variable lags, you should be selling this pair

More in the full note available to pro subs.