Goldman stock is tumbling this morning when the lack of a proper Net Interest Income revenue stream and overreliance on trading has - for once - come back to bite it, as the company's all-important FICC division reported far uglier results than most had expected, leading to a big and very rare miss in Goldman's revenue line.

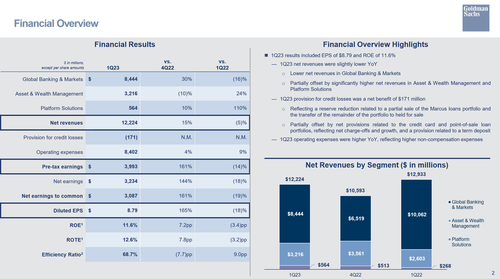

Here is what the bank reported in Q1:

So Net Interest Income missed; how did non-interest income do? Here is the top-line detail:

Goldman also offloaded a chunk of its $4 billion Marcus loan book, which led to a $440 million reserve release. That helped boost profit more than analysts expected, but earnings were still down 19% from a year earlier. Net revenue included a loss of approximately $470 million related to the partial sale of the portfolio and the transfer of the remainder to held-for-sale status.

Unlike other banks which suffered credit losses, for Goldman the Q1 credit loss provision was for a net benefit of $171 million; a vast improvement to the consensus estimate of a $828 million loss.

The gain reflected a reserve reduction related to a partial sale of the Marcus loans portfolio and the transfer of the remainder of the portfolio to held for sale, and was partially offset by net provisions related to the credit card and point-of-sale loan portfolios, reflecting net charge-offs and growth, and a provision related to a term deposit.

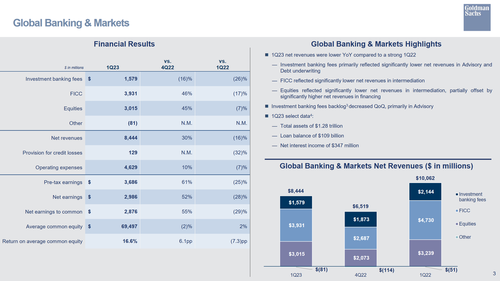

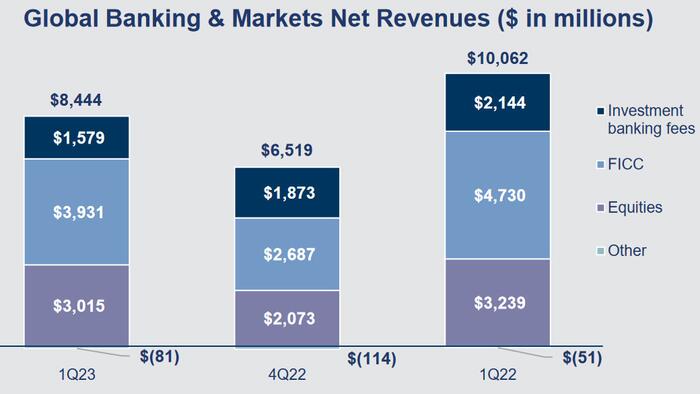

But while the confusion over the Marcus loan book sale was bad, the big miss in FICC was the gut punch: fixed-income trading revenue tumbled 17%, and badly missing expectations, leaving Goldman the only major Wall Street bank so far to have posted a drop for that business. Incidentally, the revenue figure for FICC for the same period last year was up more than 20%.

According to the bank, the drop in FICC revenue "reflected significantly lower net revenues in intermediation"

That said, the modest beat in equities-trading revenue helping to soften the blow; equities revenue reflected significantly lower net revenues in intermediation, partially offset by significantly higher net revenues in financing.

Investment banking revenue of $1.58BN beat expectations of $1.54BN, but was down a whopping 26% Y/Y "primarily reflected significantly lower net revenues in Advisory and Debt underwriting." The investment banking fees backlog also decreased QoQ, primarily in Advisory.

Here is some other select Q1 2023 data:

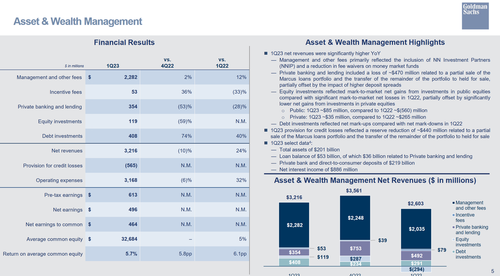

Turning to Goldman's Asset and Wealth Management business, which is the closest thing GS now has to a prop desk, the bank reported Q1 net revenues that were "significantly higher". It is also here that we find some more detail on the $470 million loss incurred as part of selling the Marcus loan portfolio.

Management and other fees primarily reflected the inclusion of NN Investment Partners (NNIP) and a reduction in fee waivers on money market funds

Private banking and lending included a loss of ~$470 million related to a partial sale of the Marcus loans portfolio and the transfer of the remainder of the portfolio to held for sale, partially offset by the impact of higher deposit spreads

Equity investments also reflected mark-to-market net gains from investments in public equities compared with significant mark-to-market net losses in 1Q22 (and most previous quarters), partially offset by significantly lower net gains from investments in private equities:

Debt investments also reflected net mark-ups compared with net mark-downs in Q1 22. The Q1 23 provision for credit losses reflected a reserve reduction of ~$440 million related to a partial

sale of the Marcus loans portfolio and the transfer of the remainder of the portfolio to held for sale

Adding some more details on the group, Goldman notes that Q1 23 Management and other fees from alternative investments were $494 million, up 21% compared with 1Q22; during the quarter, alternative investments AUS increased $5 billion to $268 billion. Finally, Q1 23 gross third-party alternatives fundraising across strategies was $14 billion, including:

Commenting on the quarter, Goldman Chief Executive Officer David Solomon said that “the events of the first quarter acted as another real-life stress test, demonstrating the resilience of Goldman Sachs and the nation’s largest financial institutions." He added that “our deeply rooted risk-management culture, strong liquidity and robust capital position enabled us to continue to support our clients and deliver solid performance.”

Te market disagreed and following the disappointing FICC numbers, hammered the stock which is down more than 3% on the dump, in the process depressing the Dow where Goldman is one of the largest members.

Goldman's investor presentation is below.