Housing affordability is at its worst in decades, but a new Goldman report suggests some of the most severe pressures may begin to ease, offering modest relief in the years ahead. That's welcome news for prospective homebuyers who've been priced out by soaring home values and the Federal Reserve's aggressive interest rate hiking cycle.

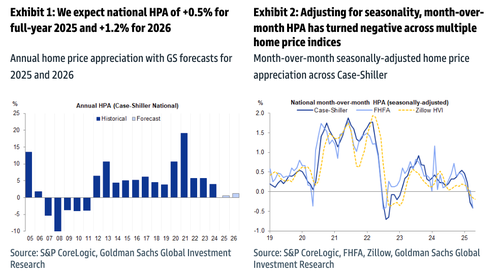

"We are lowering our forecasts for U.S. home price appreciation over the next two years," analyst Vinay Viswanathan wrote in a note to clients. He cut the firm's national home price appreciation (HPA) forecast from 3.2% to .5% in 2025, and from 1.9% to 1.2% in 2026.

Viswanathan outlined three specific drivers that underpinned his decision to revise the HPA forecast down:

The analyst emphasized that this does not signal a significant downturn in prices, writing: "...but meaningful national home price declines remain unlikely."

What caught our attention in the 33-page report was the section outlining modest affordability relief for prospective homebuyers. This is especially important for the folks who've been sidelined in recent years because of higher prices and elevated rates.

"Mortgage rates will likely grind lower," Viswanathan wrote in the report, with the 30-year conforming mortgage rate forecasted to end the year at 6.5%.

Viswanathan continued, "Alongside a downtick in mortgage rates, the growing gap between income growth and HPA should help slightly improve housing affordability, albeit remaining historically poor..."

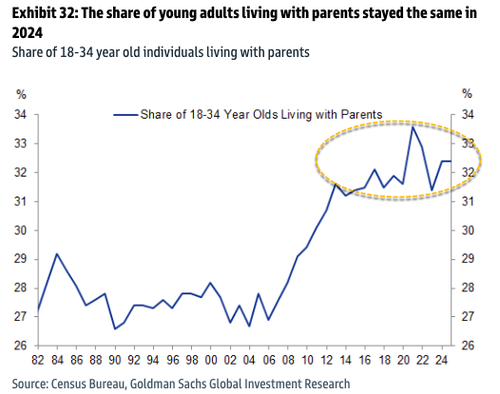

How many young people are still on the sidelines? A lot....

According to Census Bureau data, about a third of all 18- to 34-year-olds are still living in their parents' basements or attics.

And this.

Real estate agents and mortgage originators are praying for a new Fed chief who'll slash rates and bring life back into an industry crushed by Fed Chair Powell.

More here from Goldman's Research team available to pro subs.