Highlighting mixed consumer trends, discount retailer Five Below reported a smaller-than-expected decline in second-quarter comparable sales, beating analysts' projections tracked by Bloomberg. Although the company lowered its full-year comparable sales forecast, it still exceeded analysts' expectations.

Here's a snapshot of second-quarter results (courtesy of Bloomberg):

Third quarter forecast:

Full-year forecast:

Commenting on Five Below's mixed earnings is Goldman's Kate McShane.

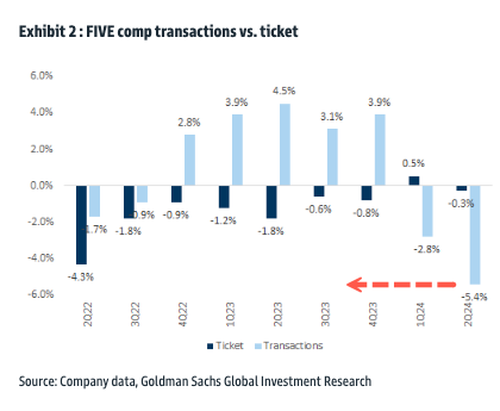

McShane noted that "declines in comp ticket during 2Q with lower units per transaction" only "suggests that FIVE's core customer remains pressured and is continuing to reduce discretionary spending, and that FIVE's assortment is not currently providing an attractive value to their customers."

"While we were encouraged to hear that traffic trends have improved quarter to date, conversion likely remains pressured as guidance implies that comp trends for 2H24 will be similar to 2Q's -5.7%," McShane said.

She continued, "We also note that FIVE continues to see diverging trends between income cohorts, with softer trends from lower-income households but stronger trends from higher-income households, suggesting at least some element of trade down is taking place. Although the implied trade-down trends are encouraging, we believe pressure on FIVE's lower-income customers will continue to weigh on conversion in the near term."