The power bill crisis has gone mainstream in recent months, with soaring electricity prices epicentered across the Mid-Atlantic region. Legacy grids and misguided "green" energy policies have been colliding with surging new power demand from AI data centers. We first warned about this crisis in August 2024. Ignored at the time, it has taken more than a year for corporate media to catch up (read here) - now being framed as a "major political issue" in states across the region, most of which are controlled by Democrats.

A new report from Goldman Sachs, led by analyst Carly Davenport, sheds light on the surge in electricity costs sweeping across key U.S. regions, particularly the Northeast, Mid-Atlantic, and California, where affordability concerns are soaring just as utilities begin a historic capital-investment cycle. The situation has all the ingredients for a political reckoning: years of grid mismanagement under far-left leadership, which prioritized climate change ideology over reliability and aggressively retired stable fossil-fuel generation, have become a key driver of today's affordability crisis.

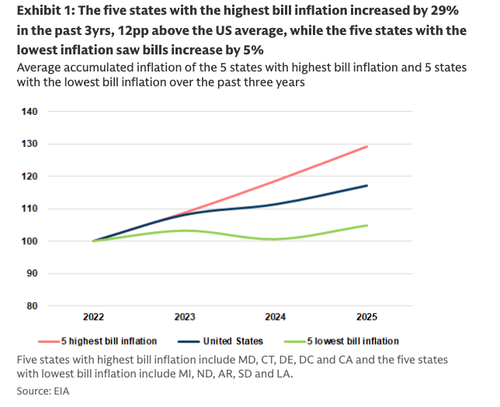

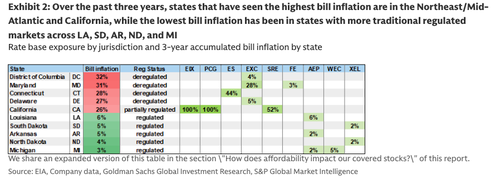

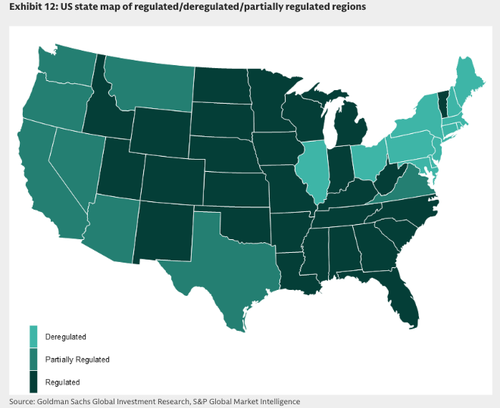

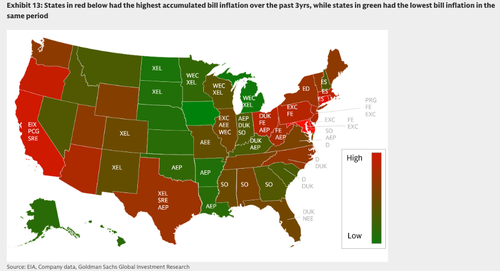

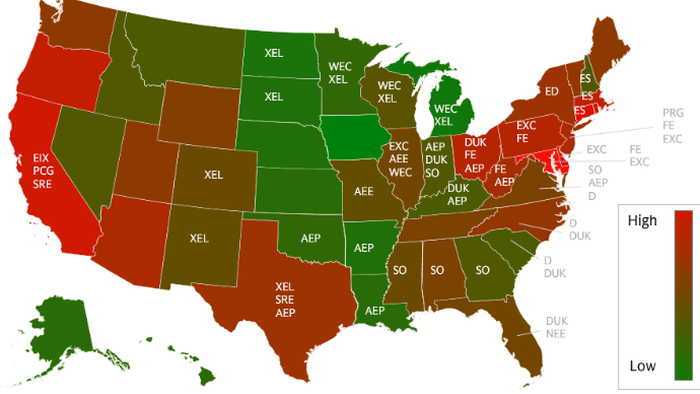

Davenport told clients that over the past three years, residential power bills jumped 29% in states like Maryland, Connecticut, Delaware, the District of Columbia, and California, roughly 20 percentage points above the Consumer Price Index, while regulated states such as Michigan, North Dakota, Arkansas, South Dakota, and Louisiana saw only about 5% growth. She pointed out that deregulated markets experienced higher power bill inflation due to capacity-price spikes, natural gas price volatility, and rising "public benefit" charges tied to climate change mandates.

Davenport includes a Q&A section that adds more clarity about the unfolding affordability crisis:

What is driving this regional dispersion in bill inflation?

In the Northeast/Mid-Atlantic and California, we believe higher bill inflation has been a function of (1) tighter regional power markets as demand inflects from electrification, data centers, and reshoring, and as coal units are retired, driving higher capacity prices that are passed onto customers, (2) volatility in natural gas prices as well as supply constraints on domestic natural gas flows in certain regions, (3) public benefits charges that support state/federal mandates around energy efficiency, wildfire mitigation, and clean energy goals increasing on bills, and (4) higher delivery charges, as utilities invest in aging grid infrastructure. In the states that have seen lower inflation, robust local resource availability (coal/wind/gas) have helped keep electricity rates lower with ample supply.

Why does affordability matter for utilities?

Ultimately, affordability matters as it increases regulatory risk. If consumers are too constrained by high electricity bill levels, regulators might be less lenient in approving returns or rate increases for the utilities, whether they are in a regulated or competitive power market. We believe we are in the midst of a capital investment upcycle across the regulated utility space, which can translate into higher earnings growth for utility companies, but this opportunity will need to be balanced with customer bill affordability. Stocks most exposed to states that had the five highest bill inflation in the past three years include EIX, PCG, EXC, SRE and ES, and those exposed to the lower bill inflation states include AEP, WEC and XEL (Exhibit 2).

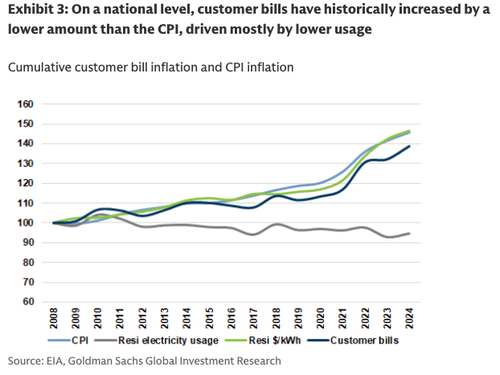

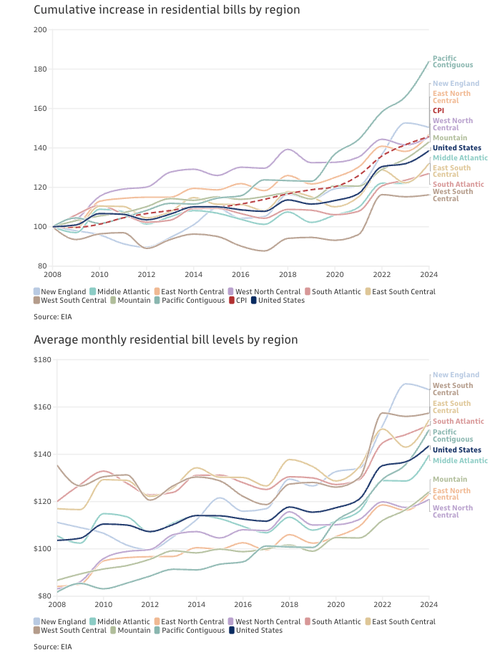

We believe the affordability concern is largely regional, and forecast national bill inflation as broadly in line with history, but higher capex poses risks. On a national level, resi utility bills have lagged CPI since 2008, largely due to declining usage trends, but in 2024, both usage and price inflation inflected, driving bills above CPI. Going forward, we expect customer bills to grow in line with historical levels of 3% through 2029 on average, based on our published utility capex forecasts and a number of other key factors we take into account such as electricity sales, customer growth and gas prices. However, if utility capex accelerates above our base case scenario, bill inflation could reach 6% through 2029, which increases regulatory risk for the regulated utilities, in our view.

The analyst explains the origins of this mess...

We believe the higher inflation in the Northeast/Mid-Atlantic and California regions are being caused by: (1) tighter regional supply/demand as load growth inflects from electrification, data centers, and reshoring, driving higher capacity prices that are passed onto customers, alongside coal plant retirements, (2) volatility in natural gas prices as well as supply constraints on domestic natural gas flows, (3) public benefits charges that support state/federal mandates around energy efficiency, wildfire mitigation, and clean energy goals, and (4) higher delivery charges, as utilities invest in aging grid infrastructure. In the states that have seen lower inflation, robust local resource availability (coal/wind/gas) have helped keep electricity rates lower given abundant supply.

Power bill inflation appears to be regional, not present on a national level, which means political pressure will be localized.

U.S. state map of regulated/deregulated/partially regulated regions

States in red below had the highest accumulated bill inflation over the past 3yrs, while states in green had the lowest bill inflation in the same period

The focus should be on the political ramifications at the local level - specifically, how skyrocketing power bills will impact voter sentiment with those in power that pushed endless amounts of fake climate change narratives to ram through green policies - loot the Treasury with climate bills (recall $20bln of taxpayer funds frozen at Citi, slated for Biden-Harris regime to funnel into shady NGOs) - all while making the grid more fragile (read this) in the era of AI data centers.

ZeroHedge Pro Subs can find the complete report in the usual place, full of more graphics and charts about regional power crises.