Second-quarter earnings season is in full swing this week. Ahead of earnings reports from dating app companies, Goldman analysts went limp on Grindr, the LGBTQ-focused dating app, maintaining a "Buy" rating while slashing their 12-month price target.

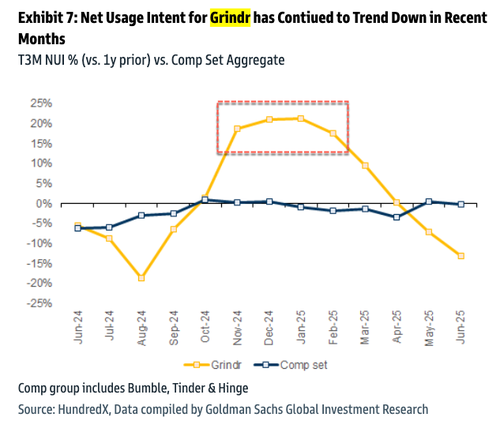

"Grindr user trends have continued to slow in recent months," analysts Eric Sheridan and Julia Fein-Ashley wrote in a note to clients on Tuesday.

The analysts lowered their price target on Grindr (GRND) to $24 from $26 but maintained a Buy rating, citing confidence in the dating app's long-term secular growth story, high margins, and strong revenue compounding dynamics. However, they noted that the near-term focus has shifted to concerns about waning user growth, particularly regarding increasing ad loads and a degraded app experience.

"While there has been a number of ads on the app that target the end user base, user commentary around advertisements leads us to believe that the ads are detracting from the core user experience and resulting in some user friction dynamics," they said.

The analysts pointed out, "We believe that Grindr users churn at a higher rate relative to social media apps."

Next, the analysts cited data from intelligence firm HundredX showing that the consumer sentiment metric "Net Usage Intent" peaked in late 2024 and has been declining ever since. This forward-looking indicator, commonly used to gauge user momentum and brand health, suggests that app users are pulling out of the platform.

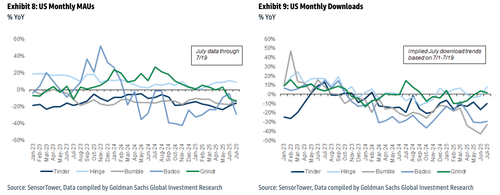

Download app trends for the overall dating app space appear negative.

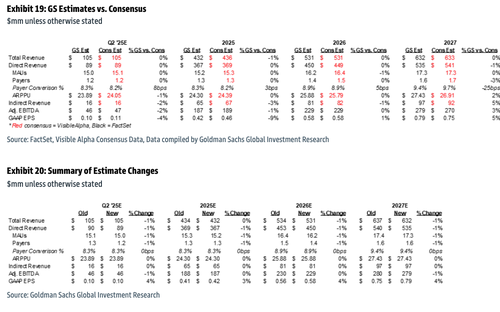

Based on third-party user data trends, the analysts decided to lower Grindr's 12-month price target to $24 from a previous level of $26.

Ahead of Grindr's earnings, expected after hours on August 18, the analysts outlined their estimates in comparison to consensus expectations.

. . .