Goldman hosted its Private Real Estate Retail (shopping center) Webinar on Thursday with panelists Mary Rottler from First Washington, Daniel Zatloukal from Inland Real Estate, and Joseph Tichar from Raider Hill. The webinar discussed many topics, including the consumer, 2025 same-store NOI growth, retailer bankruptcies, transaction market and cap rates, and the financing environment.

Our focus on the webinar centers around discussing high-end and low-end consumers trading down. This phenomenon occurs as macroeconomic headwinds mount, including elevated inflation and high interest rates due to backfiring 'Bidenomics.' More importantly, trading down occurs when incomes don't keep up with inflation or when purchasing power decreases.

Here are the key takeaways of the high-end and low-end consumers trading down, penned in a note by a team of Goldman analysts led by Caitlin Burrows:

The high-end consumer remains strong while lower-end sees softness, and both are trading down.

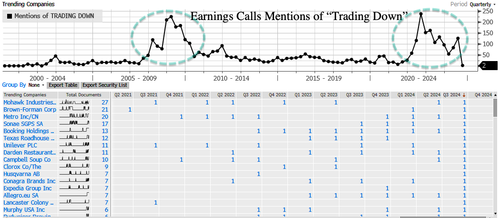

At the beginning of August, we noted that the last time "trading down" mentions spiked on earnings calls was during GFC.

The latest inflation data for September printed hotter than expected, and the persistent inflation storm has wreaked havoc on low/mid-tier households. The note above from Goldman is just more evidence that the consumer downturn has spread to wealthier households.

Could we really replay the '70s once again?

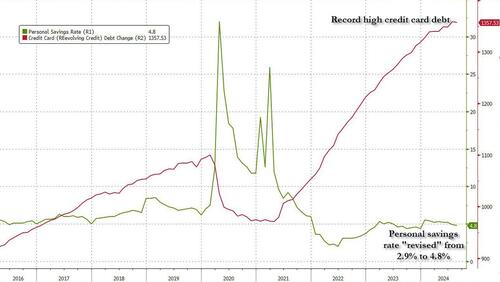

After all, the consumer has never been in worse financial shape, with record-high credit card debt and drained personal savings.

Looking at Goldman's consumer baskets, middle-income consumers are outperforming high-end consumers, while low-income consumers continue to face mounting pressure.

The big takeaway is that our consumer downturn theme continues and possibly now signals stress for the more wealthy households as the Biden-Harris inflation storm persists. Everyone appears to be pissed off about food inflation.

Also, an energy price shock at the gas pump could be ahead if Israel bombs Iran's crude oil export facilities. Price shocks of this kind could trigger a recession.