Remember when the Biden-Harris regime's controversial response to avian flu, which included culling roughly 150 million egg-laying hens, triggered a sharp, nationwide spike in egg prices? That reckless policy was baseless. Then, upon taking office for his second term, President Trump moved quickly to address the supply shock, implementing countermeasures aimed at stabilizing supermarket prices. Six months later, retail egg prices have retraced significantly.

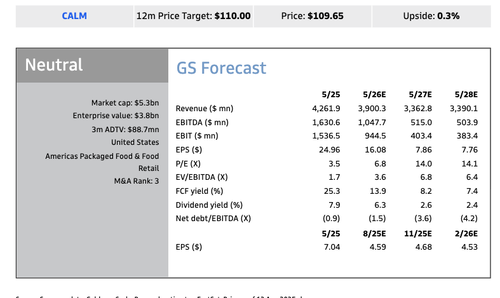

Goldman Sachs analysts Leah Jordan and Eli Thompson initiated coverage on Cal-Maine Foods with a "Neutral" rating and a 12-month price target of $110 on Thursday. The coverage comes as the analysts believe the nation's egg supply has likely normalized.

Cal-Maine, the largest egg producer in the U.S., has benefited from elevated egg prices stemming from extremely tight supply caused by avian flu.

Analysts expect that market conditions will normalize over the next year as flocks recover, while demand should remain robust thanks to eggs being an affordable protein source, given out-of-control beef prices.

"However, we expect egg fundamentals to normalize over the coming year as the supply backdrop improves with a recovery in the flock, coupled with a continuation of solid demand given eggs are a low-cost protein source," Jordan said.

The analysts provided further insight into the normalization of the egg market, adding, "egg supply to accelerate in 2H25":

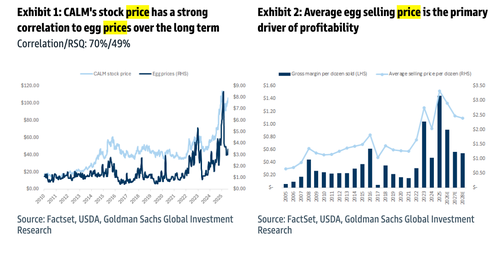

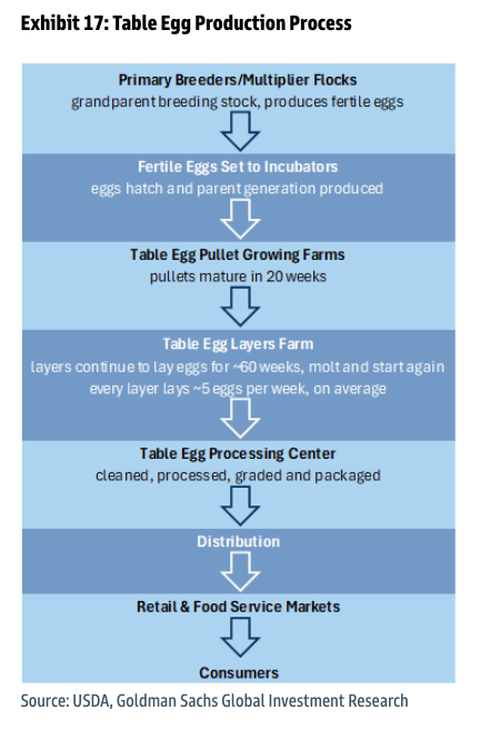

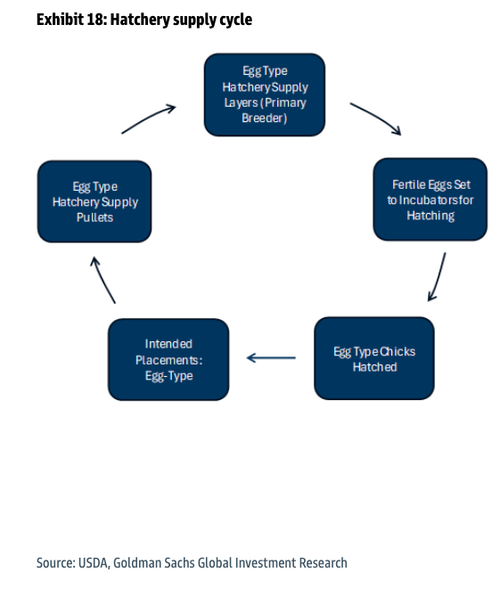

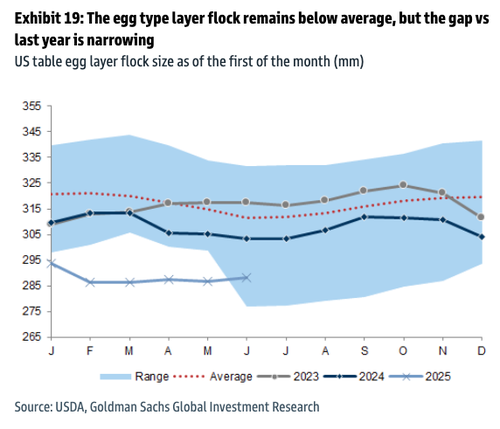

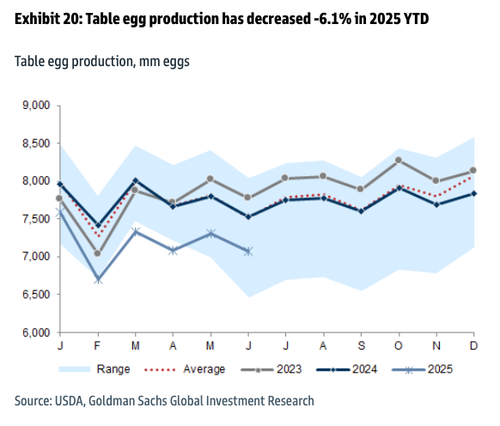

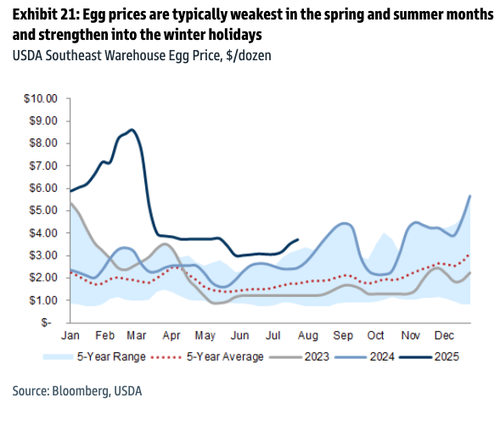

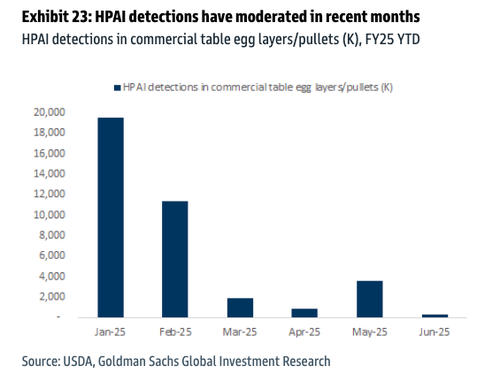

Supply/demand likely normalizes from here: Over the last decade, supply and demand for eggs have grown relatively in line. However, outbreaks of HPAI (highly pathogenic avian influenza, aka bird flu) have impacted flocks and constrained supply more recently, resulting in elevated egg prices (and historically high profitability for CALM, as its footprint has been more insulated to this issue). Specifically, CALM's egg production operation is primarily focused in the South, Southeast, and mid-Atlantic regions (along with a small footprint in Utah), while recent outbreaks have been predominately in the Midwest. In summary, HPAI led to a depopulation of 36.3mm birds YTD and a reduction in eggs produced by ~7%, although detections of the disease have moderated recently (in part supported by seasonality). As pullet placements sequentially improve and HPAI incidences remain low, we expect egg supply to accelerate in 2H25 given the relatively short lifecycle for hatching type layers (pullet placement is done around 16-17 weeks, with the onset of egg production occurring around 18-22 weeks). As a result, we expect egg prices to continue to normalize (with typical seasonality, noting relative strength in 4Q).

Chartpack in visualizing the egg industry:

Egg production process

Hatchery cycle

Nation's egg-laying flock still well below average but recovering.

Egg production is still low.

Egg prices cratered after Trump moved to counter the crisis between February and March.

What happened to avian flu?

Even as the egg market stabilizes after recent supply shocks, it's still wise to have a backyard chicken coop and take part of your food supply into your own hands.

. . .