Elon Musk's Department of Government Efficiency (DOGE) launched a precision strike against the "Deep State" by winding down USAID and rolling it into the State Department, with Secretary of State Marco Rubio now serving as the acting administrator of the once-rogue agency, which had functioned as an unlimited piggy bank for globalist Democrats. In a broader push for government efficiency, President Trump announced a freeze on all foreign assistance spending and has offered federal workers buyouts, including the entire workforce of the CIA and many other agencies.

A new era of government efficiency, led by Musk, a special government employee at DOGE, has unsettled investors in Government IT & Services and large-cap Defense companies.

Goldman Noah Poponak, Connor Dessert, and others updated clients on these two sectors, including commentary from various management teams, whispers from traders, and their take on market drivers.

"We are relatively cautious on Government IT given risk around customer budgets, and we have Sell ratings in Defense given top-line, margin, and valuation concerns," the analysts noted.

Here's their take on both sectors in the era of DOGE:

Government IT & Services:

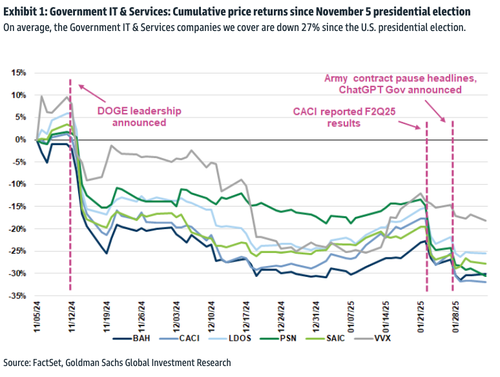

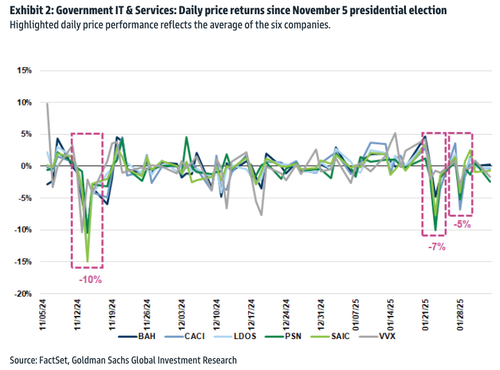

Proposed and effected government measures have driven uncertainty and de-risking activity across the group, with selloff activity appearing to be concentrated around three major events over the last three months: 1) commentary from the Trump administration cementing the formation of DOGE, 2) earnings results that either had slower bookings or pointed to a forward near-term risk of slower bookings, and 3) Federal agency change headlines, Army contracting headlines, and the introduction of OpenAI's ChatGPT Gov product. We reiterate our cautious Government IT & Services view.

Large-cap Defense:

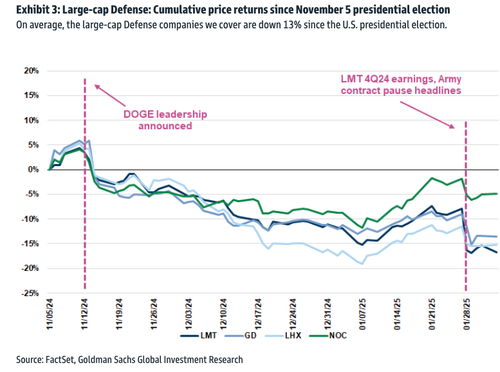

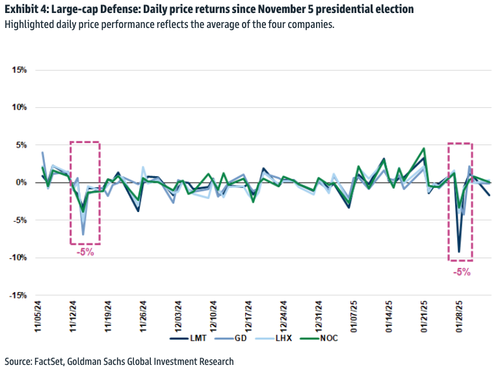

We think the Pentagon has shifted risk to companies via contract terms, and continue to see risk to both end-market growth and industry margins going forward. Defense managements are articulating the potential for positives from new government spending initiatives; but some also warned of slower bookings and revenue growth in the near-term. Lockheed took incremental write downs on programs where we believe contract terms differ from the past, while stating more fixed price in the industry was possible. We reiterate our cautious Defense view.

Focusing on more Government IT & Services, the analysts explained the sector is plagued with "uncertainty concerning the path of forward government spending" because of DOGE.

The analysts pointed out that since President Trump won in November, government IT & services stocks in their coverage have tumbled on average 27%. They noted that short-term uncertainty in any government leadership transition is expected. However, they warned that DOGE's agenda could upend budgets for the companies in their coverage and "reiterate a more cautious view of the sector into 2025."

Here are the major drivers pressuring Government IT & Services stocks lower over the last several months (all about DOGE & Trump):

In the defense sector, the analysts said their LMT, GD, NOC, and LHX coverage all reported earnings last week. They reiterated a cautious view on these companies because DOGE and the new administration will likely change contract terms and reduce spending.

Summary of their large-cap defense coverage:

The analysts ended the note with a comprehensive list of the Government IT & Services and large-cap defense companies in their coverage and included updated valuations, key risks, and strategic considerations as a new era of DOGE unfolds:

Welcome to the era of DOGE.