Copper futures on the London Metal Exchange are near record highs as traders weighed supply disruptions at major mines, the Federal Reserve's interest rate outlook, the ongoing U.S. government shutdown, and demand outlooks tied to power grid upgrades and AI-related growth.

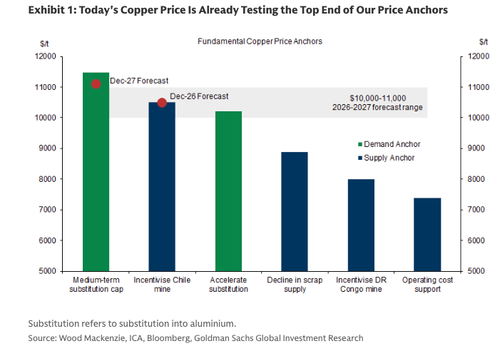

Focusing on copper prices, a team of Goldman analysts led by Eoin Dinsmore told clients on Monday that the industrial metal is entering a new structural price range of $10,000 to $11,000 per ton.

Dinsmore's thesis is clear:

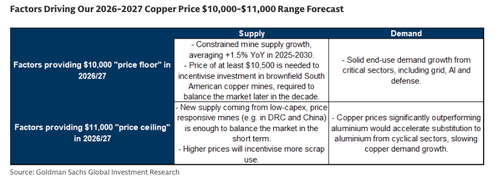

We believe that the copper price is resetting in a new range of $10,000-$11,000/t - a range copper has never held for longer than two months - as resource constraints and structural demand growth from critical sectors set a new price floor from 2026 onward. We lift our 2026 copper price forecast to $10,500/t (from $10,000) following the Grasberg outage, also supported by U.S. Fed rate cuts and further U.S. dollar depreciation, and maintain our $10,750/t 2027 forecast.

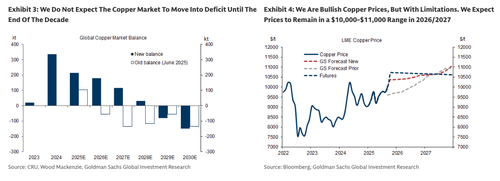

While we are bullish on copper prices vs. historical averages and the 2027 forwards, we believe that there is a ceiling at $11,000 for the coming two years. The copper market is currently in a modest surplus, which we expect to be maintained in 2026, even after a significant drop in global refined output following recent mine disruptions. We do not see a deficit materialising until the end of the decade.

The commodity analyst outlined three reasons why copper should trade in the $10,000 to $11,000 range through 2027:

Mine supply is constrained, but enough to meet demand for now: Multiple recent mine incidents highlight the growing structural challenges in copper mining as copper mines get deeper, grades get lower and ore gets harder, requiring greater investment. This caps our mine supply growth forecast at an annual average of +1.5% YoY in 2025-30. While high copper prices are already delivering investment in China, DR Congo, Russia, and Uzbekistan, which we believe will be enough to meet demand over the next two years, a price above $10,500 is needed to incentivise investment in brownfield South American mines, required to balance the market later in the decade. Meanwhile, we expect a pick up in copper scrap use to help delay any deficit in the copper market until later in the decade, likely limiting copper price upside beyond $11,000/t in 2026/27.

Structural demand growth from critical sectors moderated by accelerated substitution in cyclical sectors: We forecast global refined copper demand growth to moderate from +2.8% YoY in 2025 to an average of +2.1% YoY in 2026-2030. We continue to see grid and power infrastructure driving over 60% of the growth in our forecasts, with additional direct boosts from defense, electric vehicles, wind and datacenters. Importantly, we see investment in aging Western power grids as a national security priority, due to its critical role in AI, defense and energy security. However, we also forecast accelerated copper to aluminium substitution in cyclical sectors, which slows copper demand growth and keeps the market in small surplus. This substitution contributes to copper pricing into a higher range, rather than an open-ended rally.

Strategic Stockpiling: Given copper's dual nature of constrained resources and essential use in critical sectors, it is a compelling commodity to strategically stockpile. This means that even as our balance implies that the market will remain in a small surplus over the coming years (vs our leaning towards a small deficit previously), this inventory build is likely to be at least partly absorbed by strategic stockpiles, limiting the visible stockbuild and downward pressure on exchange prices.

Dinsmore expects prices to remain above $10,000 for the remainder of this year, primarily due to Freeport-McMoRan's force majeure declaration on contracted supplies from its giant Grasberg mine in Indonesia, the second-largest source of the metal, following a mudslide last month.

At the time, Goldman's commodity specialist, James McGeoch, called the event a "black swan event" (see the report)...

Dinsmore noted, "The global copper market to move into deficit by the end of the decade."

Copper Price Already Near Top End of Goldman's Price Anchors

When to Expect the Deficit

The note includes tons of charts and an in-depth analysis of global copper markets, outlining what to expect through the end of the decade. ZeroHedge Pro Subs can read the full report in the usual place.