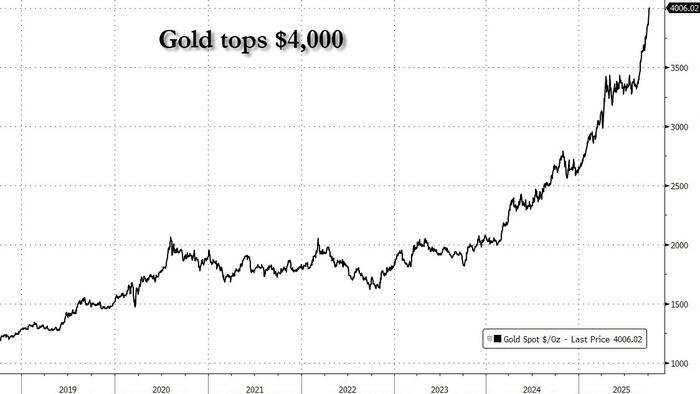

Gold has just topped the $4,000/oz level for the first time ever, cementing its status as the year’s best performing asset and most intriguing story in global commodities, not to mention the most important themes across broader financial markets - one of accelerating and relentless fiat destruction coupled with what Rabobank earlier today called passing the global fiscal event horizon (read letting inflation run amok in hopes of inflating away the $330 trillion in global debt).

Spot bullion climbed as much as 1% to $4,014 an ounce...

... in a milestone moment for the metal that traded below $2,000 just two years ago, with returns that now well outstrip those for equities this century.

Much of that upside has taken place in 2025 when gold soared more than 50% in the face of continued paper currency debasement and uncertainties over global trade and fiscal stability in the US (people also like adding "Fed independence" here but only idiots believe the Fed was actually independent, ever). At the same time, geopolitical tensions have boosted demand for haven assets, while central banks have continued to buy gold at an elevated pace

The recent re-start of the Fed’s rate cutting cycle has also been a boon for gold, which benefits any time the Fed injects liquidity into the system like now. Investors have responded by piling into exchange-traded funds, with bullion-backed ETFs seeing their biggest monthly inflow in more than three years in September according to Bloomberg, something we predicted well ahead of time.

As Bloomberg notes, jumps in the price of gold typically track broader economic and political stresses. The metal breached $1,000 an ounce in the aftermath of the financial crisis, $2,000 during the Covid pandemic, and $3,000 as the Trump administration’s tariff plans washed over global markets in March.

“Gold breaking $4,000 isn’t just about fear — it’s about reallocation,” said Charu Chanana, a strategist at Saxo Capital Markets Pte. “With economic data on pause and rate cuts on the horizon, real yields are easing, while AI-heavy equities look stretched. Central banks built the base for this rally, but retail and ETFs are now driving the next leg.”

Gold’s rally is on pace for its best annual performance since the 1970s, a decade when soaring inflation and the end of the gold standard sparked a 15-fold rally of the precious metal. At that time, Richard Nixon pressured the Fed to lower rates. The central bank under then-chair Arthur Burns was clearly not independent and some speculate that a similar suppression of monetary policy may emerge in the next year when Powell is gone and replaced with a Fed chair of Trump's choosing.

Ahead of the historic breakout, Goldman this morning raised its 2026E gold price forecast from 4,300 to 4,900, a move which the bank believes will still be supported by:

Elevated central bank buying is a “structural shift in reserve management behavior, and we do not expect a near-term reversal,” Lina Thomas, Goldman commodities strategist wrote in a September note. “Our base case assumes that the current trend in [central bank] accumulation continues for another three years."

We have been hammering the table for years on gold's disconnect and relentless meltup ever since the Biden admin weaponized the dollar after the Ukraine war, which we now know was meant to cover up the local crimes of the Biden crime family.

Goldman also sees risks skewed to the upside, as private sector diversification may boost ETF holdings above our rates-implied estimate.

As a result, Goldman's trading desk has proposed a trade to take advantage of the coming meltup with 10x leverage.

How To Trade (from GS Sales & Trading)

Buy a 6m XAU Binary call with 10x Payoff (indic 4700 strike, off spot 3960)

Goldman's full gold report available here for pro subs.