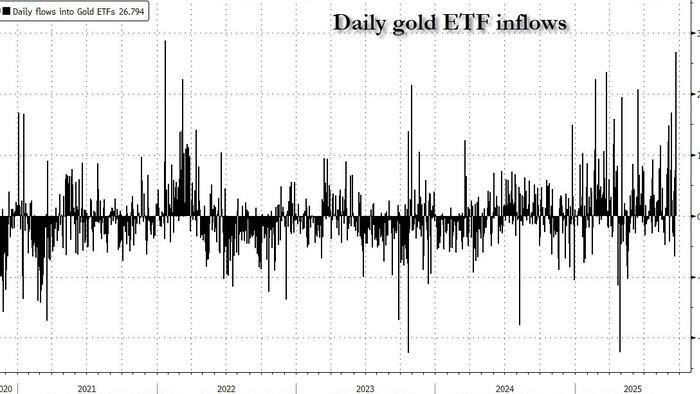

Three weeks ago, just as gold finally break out above its recent resistance level, we warned readers that we are about to see a far more powerful thrust higher once gold ETFs - which had been lagging badly - started chasing.

Fast forward to today when that's precisely what happened, and as Bloomberg writes this morning, gold has powered to a fresh record high "after flows into exchange-traded funds hit a three-year high, with investors betting that the Federal Reserve’s rate-cutting cycle has further to run." It wasn't just gold: silver also rose, with year-to-date gains topping 50%.

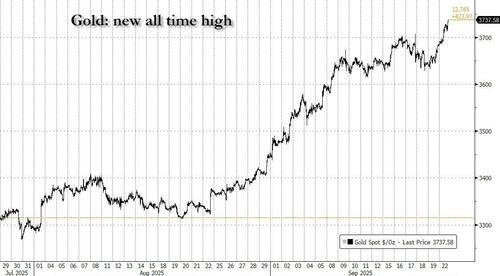

Gold was last trading at a new all time high of $3,737, building on a run of five weekly gains and extremely overbought, as the Fed cut rates and flagged further easing through to year-end.

On Friday, bullion-backed ETFs surged 0.9%, the most in percentage terms since 2022, according to data compiled by Bloomberg.

Gold - the year's best performing asset class - has been on a relentless tear higher amid a broad confluence of supportive factors, most notably the Fed's decision to restart policy easing. Additionally, central banks continuing to bolster their reserve holdings, and lingering geopolitical tensions, have provided a sustained bid for havens. Major banks including Goldman Sachs have flagged their expectations for further gains, with Deutsche Bank most recently lifting its gold forecast to $4000.

“Technicals are looking pretty strong, and expectations are rising for deeper rate cuts,” said Soni Kumari, commodity strategist at ANZ Group Holdings Ltd. In silver, “resistance at $43 an ounce was broken, while gold powered through $3,708 an ounce — suggesting prices will continue to push higher.”

“The gold price was overbought after climbing by more than 10% in the last five weeks,” analysts at Heraeus Precious Metals GmbH & Co KG said on Monday. “That raises the chance of a period of consolidation so the price could trade sideways to lower for a while.” Alas, gold decided it didn't need to consolidate and has instead moved straight up.

Silver rallied harder than gold on Monday, with some speculating that a gamma squeeze in silver options is starting to fomd. The daily volume of IShares Silver Trust options surged to 1.2 million on Friday - the highest since April 2024, with call options spiking.

In a note published this morning from UBS' S&T team, they write that "while it was technically New York Platinum week, gold took the gold as New York was flooded with market participants for every corner of the globe and one thing was clear, the bullish sentiment is here to stay. The demand is real and was confirmed when your strategist’s weeklong schedule fills up in a matter of hours and goes right until 17:00 New York on Friday, when in the past nobody wanted to meet on a Friday."

As UBS's Christine Gilfillan writes, "consensus is, gold has not seen the highs, proven yet again on Monday. There wasn't one meeting where someone was willing to short this market. In most meetings, the level of investment has not been reached and many continue to look for a pullback for entry. The majority are looking for $4000."

The UBS trades goes on to note that "shallow and short-lived pullbacks are frustrating during this climb higher, physical demand is absent and replaced with investor and retail demand while the Wealth Management community is actively exploring vaulting opportunities." Meanwhile, sellers or light profit-taking that may have been seen post the Fed have taken a step back, now allowing this bull market to march on. As for the white metals, consensus was favorable as well with silver taking the lead even with its recent positive performance.