Authored by Mike Shedlock via MishTalk.com,

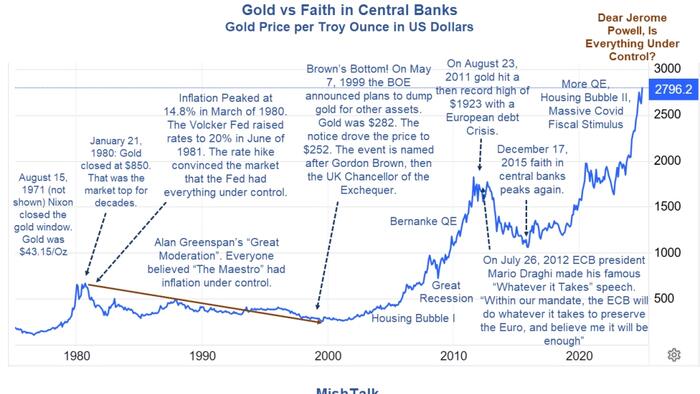

Gold does not believe the Fed has things under control and neither do I.

Image from Trading Economics, Annotations by Mish.

Reuters reports Gold hits record high on safe-haven demand amid tariff threats

Gold prices rose to hit a lifetime high on Thursday, sparked by safe-haven demand due to U.S. tariff threats, while the focus was also on a crucial inflation report for clues on the Federal Reserve’s policy path.

“We are seeing keener uncertainty and anxiety about the Trump administration’s new policies on trade and foreign policy … fresh technical buying coming in as prices are trending higher now in both gold and silver,” said Jim Wyckoff, a senior market analyst at Kitco Metals.

Earlier this week, the White House said U.S. President Donald Trump planned to hit Mexico and Canada with steep tariffs on Saturday and was also considering some on China.

The U.S. gold market has been trading at a premium since the recent presidential election, the London Bullion Market Association said on Thursday, adding that the association has been closely liaising with the CME Group and U.S. authorities to monitor this trend.

At the beginning of 2021, the US dollar index was 89. The US dollar index is now 108.

The price of gold advanced from $1962 to nearly $2900. It’s now about $2850.

Yet, people still believe moves in the dollar determine moves in the price of gold.

I suggest the price of gold moves in accordance with long-term inflation and faith in the Fed.

From 1980 to 2000 there was inflation every step of the way, but gold fell from $850 to $250. There was inflation from 2011 to 2015 when gold fell from $1923 to $1045.

People thought Greenspan was “The Great Maestro” and Mario Draghi saved the Euro.

Gold tends to do very poorly in such times and in periods of disinflation.

A friend of mine emailed some thoughts on what’s changed.

In 1971, when Nixon closed the gold window, a 400 oz. bar of gold had a value of approximately $17,260.

Today, in 2025, that same 400 oz. bar has a value of approximately $1,140,000.

Did the gold bar add new and improved features?

Nope.

Did the gold bar become substantially more efficient somehow?

Nope.

Nothing changed whatsoever about the gold bar. It is exactly the same as it was in 1971.

What’s changed is persistent Fed and government-sponsored inflation.

Is the Fed suddenly going to get things under control?

Will DOGE cut $2 trillion or even $1 trillion in government expenses?

Is Trump going to magically reduce the deficit via tariffs or any other means?

Gold acts like money. And central banks hold gold, not silver.

Silver sometimes acts like a monetary metal and sometimes acts like an industrial commodity.

But gold’s primary use is that of a monetary metal. Only a miniscule amount is used in industrial purposes.

On Wednesday, Fed Chair Jerome Powell said the Fed would not budge from its two percent inflation goal which it ridiculously defines as “price stability”.

Bonus Q: Does the lead chart look like price stability?

A: No, but it does look like periodic misguided faith in central banks.