The S&P 500 has not had a nine-day win-streak since 2004 and it appears Kamu-nism was enough to stop stocks doing it again today as Harris unveiled her cunning plan, including 28% corporate tax, price-controls, 44.6% capital-gains tax, and last but not least, a tax on unrealized gains.

Small Caps were the ugliest horse in the glue factory today as the algos tried their hardest to maintain the win-streak.

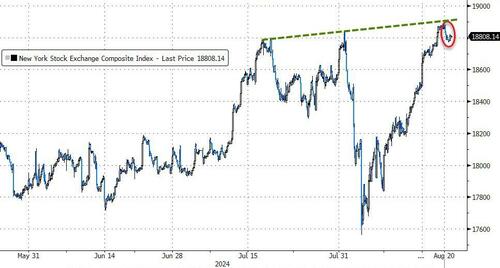

The NYSE Composite Index did make a new record high at this morning's open, but then faded back...

Source: Bloomberg

The Mag7 basket managed another day of (marginal) gains (but we do note that it stalled intraday at a key resistance level)...

Source: Bloomberg

But 'most shorted' stocks were puked out of the gate...

Source: Bloomberg

And this occurred as growth-surprise data slumped back to multi-year lows (not helped by the crash in Philly Fed's survey today)...

Source: Bloomberg

...which lifted rate-cut expectations modestly...

Source: Bloomberg

Are we back in Goldilocks-land - just enough growth-scare to enable the Fed doves support for stocks but not enough growth-scare to terrify investors' guesses at future earnings.

The dollar doesn't care - it's riding the dovish path lower no matter what...

Source: Bloomberg

And despite the best efforts of Benoit and his BIS buddies to tamp down enthusiasm for alternatives, gold surged to a new record high today...

Source: Bloomberg

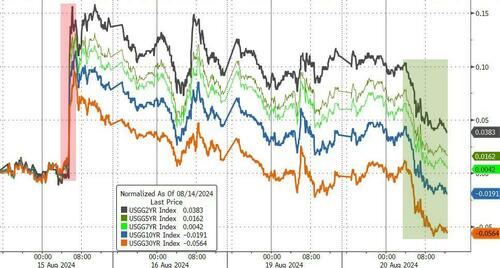

But, we do note that Treasury yields did plunge today (6-7bps across the curve) - a little more growth-scare than equity bulls might have liked to see...

Source: Bloomberg

As the chart above shows, the long-end (10Y and 30Y) has erased all of the CPI-spike from last week.

Most notably, the 2Y yield tumbled back below 4.00% (after CPI sent yields back up to pre-payrolls levels)...

Source: Bloomberg

Oil prices limped lower once again (5th day of the last 6) as growth-scares weighed on commods...

Source: Bloomberg

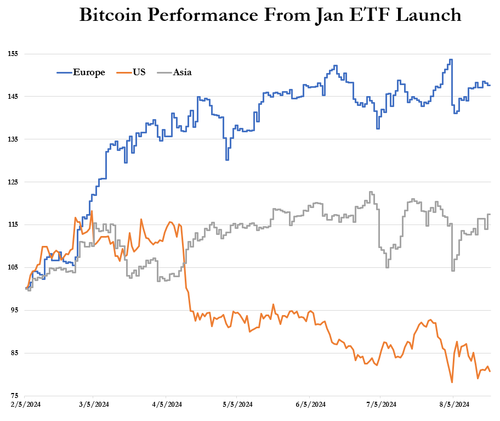

Bitcoin ripped up above $61,000 overnight during the Asia session, then was punched lower during the US session...

Source: Bloomberg

Bear in mind, that pattern of trading should come as no surprise at all...

Finally, while markets have recovered, Deutsche Bank warned this morning in a note to clients that catalysts behind the retreat haven't necessarily evaporated. The firm outlined five key risks that remain that investors should watch:

And under the hood, options markets are still pricing in the potential for short-term chaos amid a heavy calendar of risk catalysts including Powell's address at Jackson Hole, NVDA earnings, NFP, CPI, and OpEx...

Source: Bloomberg

As VIX rose notably on the day and VVIX rejected the Maginot Line at 100...

Source: Bloomberg

Was today's dip a sign that the momo-chase is over... for now?