Global stocks extended their rally to fresh record highs on the prospect of more trade deals with the US, easing fears of a drawn-out tariff war while US equity futures are also higher led by Tech with small caps lower after yesterday’s outperformance, as sentiment was boosted by Alphabet signaling strong demand for its AI products, while Tesla posted the biggest revenue decline in at least a decade. As of 8:00am, S&P futures are 0.1% higher and Nasdaq futs gain 0.3% with the AI theme driving Tech following GOOG earnings with $10 billlion capex boost helping lift other AI infrastructure stocks in premarket trading, including NVDA and AVGO. Tesla slumped 6% after Elon Musk warned of difficult times ahead after losing electric vehicle incentives in the US. Cyclicals are stronger pre-market led by Industrials. Bond yields are 1bp from 2s to 30s with USD seeing its first bid in 5 sessions. Commodities are also higher led by Ags/Energy with weakness in both Base and Precious metals. Today’s macro data focus is on Flash PMIs, Jobless Claims, Home Sales, and regional Fed activity indicators.

In premarket trading, Mag 7 stocks were mostly higher: Alphabet (GOOGL) rose 3.6% after after the Google parent reported second-quarter results that beat expectations. Tesla (TSLA) fell 6% after Elon Musk warned of a hard year ahead for the electric-vehicle maker. Elsewhere, Nvidia +1.1%, Amazon +0.7%, Meta +0.02%, Microsoft -0.02%, Apple -0.1%). Here are the other notable premarket movers:

As earnings season picks up pace, investors are keen for reassurance that the record-breaking US rally can continue and that lofty valuations are justified. Europe’s stocks climbed following reports the US is closing in on an agreement with the European Union to set a 15% tariff for most products.

“We still see some companies being able, especially in the US, to deliver very strong results and so probably valuations are less questionable now,” Claudia Panseri, chief investment officer for France at UBS Wealth Management, told Bloomberg TV. “People were expecting a lot of downside.”

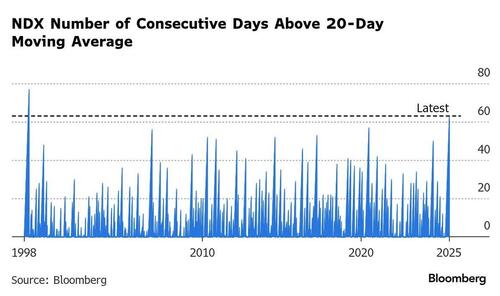

The Nasdaq posted its 63rd consecutive day above its 20-day moving average, the longest streak since 1999, suggesting investors are all-in on tech. Still, things have calmed down a bit on the meme stock front, with only Opendoor particularly active premarket.

As an Aug. 1 deadline on US trade tariffs nears, traders are watching the latest news on talks with countries around the world. Trump has suggested he won’t go below a rate of 15% as he sets so-called reciprocal tariff rates ahead of the cutoff date. Delegations from the US and China are also due to hold negotiations in Stockholm next week for their third round of trade talks. Meanwhile, the US and South Korea have discussed creating a fund to invest in American projects as part of a trade pact, similar to an agreement Japan struck Tuesday.

In Europe, the Stoxx 600 index was trading up 0.4% buoyed by upbeat earnings and reports that US and EU are near a deal to set a 15% tariff on most products. On one of the busiest days in the earnings season in Europe, Deutsche Bank shares jumped to the highest in a decade after the lender reported strong trading results. Meanwhile, BNP Paribas SA rose 3% after posting a better-than forecast profit. Luxury firm LVMH is due to report after the close. Telecoms, personal care and banks are the strongest-performing sectors. Later Thursday, the European Central Bank is set to leave interest rates untouched for the first time in more than a year as it awaits clarity on the impact of President Donald Trump’s trade levies on inflation. Data showed the euro area’s private sector grew at the quickest pace since last August. Here are the biggest movers Thursday:

Earlier in the session, Asian stocks also added to their strong gains from Wednesday as investors bet that progress in trade deals will help clear the uncertainty that’s clouded the economic outlook for months. The MSCI Asia Pacific Index rose as much as 1.1%, with cyclical sectors — industrials and financials — leading gains. Chip and tech-related shares also climbed after Alphabet reported strong second-quarter revenue growth and raised its 2025 capital expenditure plan, and South Korea’s SK Hynix outlined plans to speed up spending on advanced memory chip production capacity after reporting record earnings. Japanese stocks once again led gains in the region, extending Wednesday’s rally sparked by the announcement of a trade deal that set a 15% levy on Japanese exports to the US. The Topix climbed to an all-time high. The MSCI Asia gauge rose more than 2% on Wednesday to reach its highest close since June 2021. The regional benchmark is on course for a sixth straight day of gains, which would mark its longest winning streak since January. A gauge of global equities is at a record. Here are the most notable Asian movers:

In FX, the pound fell to a session low versus the dollar, underperforming G-10 peers, after PMIs showed the economy struggled to grow. The Bloomberg dollar spot index rose 0.1%, pulling the euro 0.2% down ahead of the ECB meeting later. The central bank is expected to hold rates steady for the first time in over a year as policymakers assess the fallout from Trump’s trade policies. Separately, Thailand’s baht fell from the strongest level in more than three years after the government said Thai fighter jets attacked two Cambodian army posts.

In rates, yields are near session highs with the 10-year higher by more than 2bp at about 4.40%, near its 50-day average level which it’s been below since Monday. Gilts outperformed peers across the curve. The UK 10-year yield fell one basis point, while comparable Treasury yields climbed a basis point, and the German 10-year rates rose 2.5bps. Treasury sells $21 billion 10-year TIPS new issue at 1pm; auction faces an array of challenges ranging from its record size to weaker-than-expected demand for most of the six annual auctions of the tenor over the past two years

In commodities, Brent rose 1.1% near $69.25. Most base metals traded in the green. Spot gold fell roughly $23 to trade near $3,365/oz.

Looking to the day ahead now, the main highlight will be the ECB’s latest policy decision, along with President Lagarde’s subsequent press conference. Otherwise, data releases include weekly initial jobless claims, and new home sales for June. Earnings releases include Intel.

Market Snapshot

Top Overnight News

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks mostly extended on gains following the positive handover from Wall St and as recent trade developments continued to underpin risk sentiment. ASX 200 lacked conviction and lagged behind regional peers with heavy losses seen in gold miners after a drop in the precious metal, while participants also digested several quarterly production updates. Nikkei 225 continued its rally and briefly breached the 42,000 level to the upside as the euphoria from the US-Japan trade agreement lingered and with the electrical equipment manufacturers leading the advances, although the index has since pulled back from today's best levels. Hang Seng and Shanghai Comp were higher with little fresh catalysts to derail the recent positive momentum and following some optimistic comments from US Treasury Secretary Bessent ahead of next week's US-China talks in Sweden in which he stated that they are in a very good place with China right now and are back on track with China negotiations, while he also seemingly suggested they could do a rolling 90-day deadline when asked about the tariff deadline with China.

Top Asian News

European bourses (STOXX 600 +0.5%) opened stronger across the board, with positive trade developments continuing to boost sentiment. However, as the morning progressed, indices have dipped off earlier highs but still reside firmer across the board. Sentiment boosted today thanks to an FT report which suggested that the US and the EU were closing in on a trade deal with a 15% tariff rate, albeit this is yet to be officially confirmed. European sectors hold a strong positive bias, with the industry compilation today largely dictated by post-earning movers. Optimised Personal Care tops the pile, largely driven by Reckitt which soars after the Co. reported a Q2 sales beat, lifted its annual guidance and plans a GBP 1bln share buyback. Banks take second spot, lifted by post-earning strength in Deutsche Bank and BNP Paribas. Food Beverage and Tobacco underperforms alongside Real Estate today; the former has been pressured by heavyweight Nestle, after its results. (details all below).

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

The risk-on tone has continued over the last 24 hours, with the S&P 500 (+0.78%) at a fresh record thanks to growing optimism that more trade deals would be reached before August 1. The initial catalyst was the US-Japan deal we woke up to this time yesterday, with both European and US risk assets rallying as they caught up to the news. But around the time that European markets were going home, an FT headline said that the EU and the US were closing in on a similar deal that would also put 15% tariffs in place. So that would be the same rate as the Japan deal, and only half the 30% rate that Trump had threatened in his previous letter. Indeed, if a 15% total rate inclusive of existing tariffs is agreed as suggested, this would mark only a marginal increase compared to the 10% additional tariffs that EU exports to the US have faced since Liberation Day but with certainty about the future.

This optimism was clear on several fronts yesterday, and aside from the press reports, the noises from the negotiators were sounding much more positive. For instance, Treasury Secretary Bessent had said earlier that “We are making good progress with the EU.” Later on, Trump said the US is in “serious negotiations” with the EU and that ““we will let them pay a lower tariff” if the EU opens up to American businesses. Meanwhile on China, Bessent said that “we’re in a very good place with China” ahead of the two sides meeting next week. And on the 90-day tariff reduction that expires on August 12, he said “I think that we could roll it forward, maybe in a 90-day increment.” So when it comes to the major economies, there’s now a deal with Japan, headlines pointing to one with the EU, and Bessent signalling a roll-over of the tariff reduction with China. And Trump announced a deal with Indonesia as well yesterday.

All this created a very strong backdrop, and European equities rallied in particular as hopes for a deal mounted. Equity markets there closed just before the FT headline on the trade deal came through, but even before that news, the STOXX 600 (+1.08%) had already recovered after three days of losses. And notably, the STOXX Automobiles and Parts index (+3.76%) surged following the news that Japan had managed to get a lower tariff on automobiles. Euro futures are climbing this morning with the STOXX 50 and DAX futures trading +1.19% and +1.18% higher respectively.

US equities also had a strong day thanks to the trade headlines, with the S&P 500 (+0.78%) up to a fresh record. But whilst it was trade that drove the gains, after the close we then heard from Tesla and Alphabet, who are the first of the Mag 7 to report this quarter. Alphabet’s shares gained in after-hours trading as the company delivered a decent revenue beat, which it said was boosted by demand for AI products. The search giant also boosted its 2025 capex plan from $75bn to $85bn to meet AI-related cloud demand. This spending increase initially worried investors and shared dipped after the results but ultimately bounced back in the after hours trading period.

By contrast, Tesla’s shares fell by -4.4% post-market as the company missed revenue and profit estimates, with Q2 sales falling -12% year-on-year and CEO Musk warning of a few “rough quarters” ahead. Next week we’ve got four more of the Mag 7 announcing, including Meta and Microsoft on Wednesday, and then Apple and Amazon on Thursday.

Whilst equities were rallying, sovereign bonds put in a weaker performance given the risk-on tone. For example, Treasury yields moved higher across the curve, with the 2yr yield up +4.7bps to 3.88%, whilst the 10yr yield was up +3.7bps to 4.38%. The losses for Treasuries largely held despite a solid $13bn 20yr auction. We also had a fresh bout of criticism at Fed Chair Powell from President Trump, who said that “Housing in our Country is lagging because Jerome “Too Late” Powell refuses to lower Interest Rates.” He also called for rates to be “three points lower”, so that kept up the drumbeat of pressure from the administration, although markets have mostly taken out the extra risk premium they assigned to Powell’s removal last week. Trump is visiting the Fed today at 4pm local time so there's possibilities for extra headlines from that visit.

Related to the central bank theme, Peter Sidorov yesterday published a note (link here) looking at key themes in global monetary and credit conditions, and his key takeaway for the US economy is that while its rate-sensitive sectors such as housing are lagging, aggregate US credit conditions are consistent with a Fed stance that is only modestly restrictive. See his report for more, including on the credit cycles in Europe and China.

Meanwhile in Europe, sovereign bonds did see a very late turnaround, as the FT headline on the US-EU trade deal came out in the brief period between the equity and the bond close. So that saw yields immediately move 3-4bps higher across the board, particularly as investors viewed the news as hawkish from the ECB’s standpoint. Indeed, the probability on another ECB rate cut by the September meeting came down from 51% the previous day to only 40% by the close last night. So that pushed yields higher, and those on 10yr bunds (+4.9bps), OATs (+3.6bps) and BTPs (+2.8bps) all moved up on the day after being relatively flat before the headlines.

Across other asset classes, the risk-on tone saw gold retreat by -1.29% from Tuesday’s record high, while the dollar index (-0.18%) lost ground for a fourth consecutive day.

Looking forward, the focus will be on the ECB today, with their latest policy decision at 13:15 London time. They’re widely expected to pause the current cycle of rate cuts, which would be the first decision to hold rates since their July 2024 meeting. However, markets don’t think they’re done cutting yet and, as our European economists note, the bigger question is whether this is a short pause until the subsequent meeting in September, or whether this is the start of a longer period on hold. Their view is that the ECB will want to leave their options open and have no incentive to make significant changes to their messaging this time. After all, uncertainty remains high, particularly around the August 1 tariff deadline and any potential retaliation by the EU. Yesterday's news will perhaps help crystalise the ECB's thinking a bit more but until a deal is confirmed they are unlikely to factor anything in. See here for our economists' full preview. Also watch out for the flash European PMIs this morning for trends ultimately influencing the ECB.

Overnight in Asia, the MSCI Asia-Pacific index has been trading higher for the sixth consecutive day, marking its longest streak since January. Specifically, Japanese markets are approaching record highs, with the Nikkei rising by +1.53% and the Topix increasing by +1.62%, both benefiting from sustained optimism regarding a US trade agreement. Elsewhere, the Hang Seng has increased by +0.59%, the Shanghai Composite by +0.48%, and the KOSPI by +0.26%. S&P 500 (+0.11%) and NASDAQ 100 futures (+0.30%) are being helped by Google and 10yr USTs are up just over a basis point.

Overnight the S&P Global Japan services PMI rose to 53.5 in July from 51.7 in June, driven by growth in new business. Conversely, the manufacturing PMI fell to 48.8 in July from June's final reading of 50.1, that had marked the first time in 13 months that the index had exceeded 50.0. This month's fall obviously covered the period before the trade deal was announced. When combining both service and manufacturing activities, the composite PMI remained steady at 51.5, indicating four consecutive months of expansion.

Turning to Australia, S&P Global reported that the composite PMI increased to 53.6 in July, up from 51.6 previously, reaching its highest level since April 2022 and marking the tenth consecutive month of expansion. Furthermore, the services PMI rose to 53.8 in July from the previous reading of 51.8, achieving its fastest growth rate in 16 months. Meanwhile, the manufacturing PMI registered at 51.6 in July compared to 50.6 previously. New orders for manufactured goods have rebounded, resulting in the strongest overall growth in new business in over three years.

In FX, the Japanese yen (+0.30%) is gaining ground for the fourth consecutive session trading at 146.07 against the dollar on speculation that the Japan-US trade agreement has made it easier for the BOJ to raise interest rates.

Finally, there wasn’t much economic data yesterday, although US existing home sales fell a bit more than expected in June, down to an annualised rate of 3.93m (vs. 4m expected), which was their lowest in 9 months. Separately, the European Commission’s preliminary consumer confidence indicator ticked up to a 4-month high of -14.7 in the Euro Area (vs. -15.0 expected).

To the day ahead now, and the main highlight will be the ECB’s latest policy decision, along with President Lagarde’s subsequent press conference. Otherwise, data releases include the July flash PMIs from the US and Europe, the US weekly initial jobless claims, and new home sales for June. Earnings releases include Intel.