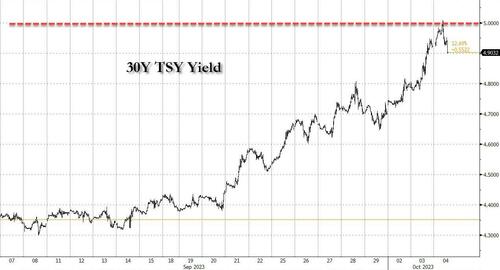

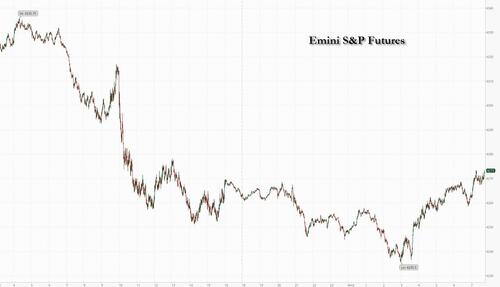

Global stocks and US futures were in freefall earlier this session, with spoos tumbling to a four month low of 4,235 and tracking the relentless drop in Treasuries tick for tick which briefly sent 30Y yields above 5.00% - the highest since Sept 2007 - around the time Europe opened...

... before a bout of buying kicked in and yields dropped sharply while futures reversed all losses and as of 7:45am, S&P futures were up 0.2% to 4,273 while Nasdaq futures were up 0.1% after slumping sharply earlier.

Europe was mixed as German 10-year yields reached the highest level since 2011 too as the Treasury moves rippled across markets. Investors are now focuing on term-premium and demanding greater compensation to hold onto long-dated debt with rates set to remain higher for longer, while concerns about the ridiculous pace of Treasury issuance - US debt rose by a whopping $275 billion on the first day of October - to address rising budget deficits are also weighing. Elsewhere, the dollar also dropped, as did oil, with WTI slipping further below the $90-per-barrel mark as an OPEC+ meeting is set to announce no changes to its policy.

In premarket trading, Apple fell 1%, after the stock was downgraded at KeyBanc Capital Markets, which said shares of the iPhone maker are trading near all-time high valuation levels, though its sales growth is likely to slow, while CEO Tim Cook sold $41 million in stock after taxes, his biggest sale in more than two years. Brooge Energy rose 21% after the company confirmed receipt of an acquisition offer from Gulf Navigation Holdings in a filing. Palantir gained 2% as the data analysis firm has emerges as the top pick for a contract to overhaul the UK’s National Health Service.

The latest leg of the bond selloff was fueled by Tuesday’s grotesquely manipulated and better-than-expected US job data, one which even Goldman mocked as being ridiculously adjusted, as well as a slew of hawkish comments from Federal Reserve officials. Data on U.S. private payrolls due later from the ADP Research Institute could fan more volatility, coming on the heels of Tuesday’s JOLTS survey.

“It’s fair to say there’s going to be a volatile environment until we have more clarity” on the direction of rates, Virginie Maisonneuve, global chief investment officer for equites at Allianz Global Investors, said in an interview with Bloomberg Television. “If you have a long-term time horizon find those stocks that have very strong structural backing for growth and have quality balance sheets.”

Meanwhile, there are signs that buyers are already emerging to take advantage of the stock swoon. The S&P 500 is officially in oversold territory based on its relative strength index of below 30. Francisco Simón, European head of strategy at Santander AM, is among those eyeing cheapened assets.

“The current weakness of equities would be an opportunity to enter those sectors and companies with high sensitivity to rates,” he said. “We hope they will do a catch-up again once rates stabilize. Current yields are already at very high levels for the expected inflation and growth in the medium and long term.”

European stocks managed to squeeze out marginal gains with the Stoxx 600 adding 0.2%. In individual stock moves Wednesday, airline SAS AB fell as much as 96% after the bankrupt Scandinavian flag carrier announced plans to be taken private. Tesco shares gain as much as 3.2%, the most since March 29, after the UK grocer increased its guidance for retail adjusted operating profit for the year. Here are the most notable European movers:

Earlier in the session, Asian stocks tumbled, with several local benchmarks tracking the key regional gauge toward a correction, as the risk-off mood intensified after strong US jobs data amplified concerns of higher-for-longer interest rates. The MSCI Asia Pacific Index fell 1.7%, pushing it down more than 10% from a July high. Tech stocks were the biggest drag as the 10-year Treasury yield climbed to a fresh 16-year high. South Korea’s Kospi and Japan’s Nikkei 225 were among the region’s worst performers Wednesday, also flirting with technical-correction territory. Markets had become complacent about macro concerns in recent months as excitement over artificial intelligence helped drive stocks higher globally. That rally has now all but faded in the wake of strong economic data that’s backed the case for the Federal Reserve to keep interest rates elevated.

In FX, the Bloomberg Dollar Spot Index falls 0.1%. The kiwi underperforms after the RBNZ left rates on hold, falling 0.2% versus the greenback. USDJPY is down to 148.88 after Japanese officials declined to comment on speculation they intervened in the currency market on Tuesday when the pair briefly rose above 150.

In rates, Treasury yields reversed an earlier spike which extended Tuesday’s bond market rout during London trading. 10-year reached 4.76% and keeping pace with bunds, gilts in the sector,while 30-year yields briefly exceeded 5% but were down to 4.88% last. As conviction grew that US interest rates could rise further from current 22-year highs, 30-year yields touched 5% for the first time since 2007. Markets are pricing a one-in-three chance of a November. US yields from belly to long-end are little changed with front-end yields marginally richer on the day; 2s5s10s fly cheaper by ~3bp on the day as belly underperforms. Recent activity in Treasury options sees traders positioning for 10-year yield above 5%. The Dollar IG issuance slate includes Kommuninvest 2Y; all companies considering deals Tuesday stood down Tuesday

In commodities, crude futures decline, with WTI falling almost 2% to trade around $88, at the lowest level in three weeks.

Looking to the day ahead now, the US session has heavy economic data slate, starting with ADP employment change at 8:15am New York time; it will also include the ISM services index along with factory orders for August. Elsewhere, there’s the final services and composite PMIs for September from around the world, and in the Euro Area there’s retail sales and PPI for August. Central bank speakers include ECB President Lagarde, Vice President de Guindos, and the ECB’s Centeno and Panetta, along with the Fed’s Bowman and Goolsbee.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks declined following the losses on Wall Street where stocks and bonds resumed their slide. ASX 200 was dragged lower by underperformance in tech, real estate and the top-weighted financial sector with headwinds amid the continued upside in yields. Nikkei 225 extended on losses beneath the 31,000 level amid wide speculation of FX intervention and with Japanese officials out in force but refusing to confirm or deny whether they intervened. KOSPI underperformed on return from the extended holiday despite encouraging Industrial Production data which showed a surprise expansion. Hang Seng conformed to the downbeat mood amid the continued absence of mainland participants and with pressure on tech, energy and casino stocks.

Top Asian News

European bourses are now mostly but modestly firmer after trimming the losses seen at the cash open. Futures were initially pressured alongside yet another pick-up in yields which saw the German 10yr hit 3% for the first time since 2011, however, equities were able to claw back some lost ground as moves in the fixed income space began to stabilise. Sectors in Europe are now mostly firmer with Utilities, Optimised Personal Care Drug & Groceries, Real Estate, and Media as the current top performers, while Energy, Travel & Leisure, Autos & Parts, and Retail sit as the laggards at time of writing. US futures scaled back earlier losses to hover around neutral levels, with the ES back above 4,250.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

Central Bank speakers

DB's Jim Reid concludes the overnight wrap

We’re at risk of repeating ourselves on a daily basis now, but the last 24 hours saw the relentless bond sell-off continue, with yields rising to fresh multi-year highs on both sides of the Atlantic.That included the 10yr Treasury yield (+11.7bps), which closed at a post-2007 high of 4.80% (4.838% this morning), whilst the 10yr real yield (+10.9bps) also hit a post-GFC high of 2.44%. But unlike some previous days, the sell-off was evident across several asset classes, with sizeable losses across equities and credit as well. In fact, the S&P 500 (-1.37%) closed at a 4-month low, and the index has now lost nearly 8% since its recent peak in late-July. That makes this now the biggest sell-off so far this year, having now surpassed the scale of the losses in February and March at the time of SVB’s collapse. Meanwhile, the Stoxx 600 is back to levels it first breached in 2023 on January 6th. US CDX HY widened +20bps to the widest since May and now wider than where we started 2023. So this is starting to be a significant correction. I struggle to see how the recent yield moves don't increase the risk of an accident somewhere in the financial system given the relatively abrupt end over recent quarters of a near decade and a half where the authorities did everything they could to control yields. So risky times. If all that wasn't enough, the US House speaker Kevin McCarthy was ousted late last night leaving a leadership vacuum with large uncertainty as to how this will be filled ahead of the next government shutdown deadline of November 17th .

We dig deeper into some of these issues below but first the main factor behind yesterday’s declines was the JOLTS report of job openings for August, which showed the US labour market was proving more resilient than expected. The big headline was that job openings unexpectedly rose to 9.610m (vs. 8.815m expected), taking them up from their two-year low in July. So that made a big change from the narrative in the last report, when job openings hit a two-year low and there was a growing sense that the tight labour market was beginning to ease. And it comes on top of some strong readings in other data recently, including the ISM manufacturing print on Monday, as well as the last couple of weekly jobless claims. There were maybe parts of the JOLTS report that weren't as buoyant as the headline number (e.g., a stable quits rate and the hiring rate at its lowest since the first Covid wave) but that was not a nuance that was relevant yesterday.

For markets, it meant another rate hike from the Fed was kept firmly on the table. Indeed, futures suggested that the likelihood of another hike by December was up to 52%, having reached 57%, its highest since August, intra-day. And in turn, yields on 6-month T-bills hit a post-2001 high of 5.58%. Moreover, the sense that rates would remain higher for longer was cemented by Atlanta Fed President Bostic, who said the Fed should “hold for a long time ”. Later on, Cleveland Fed President Mester then said she would support a November hike if the economy “looks the way it did at the next meeting similar to the way it looked at our recent meeting”.

All that meant the bond sell-off continued apace, with lots of new milestones around the world. As discussed at the top, for the 10yr Treasury yield, there was another +11.7bps jump up to 4.80%. Furthermore, the 30yr yield (+13.5bps) moved above its intraday peak from 2010, reaching levels last seen in 2007. From a financial conditions perspective, it was notable how real yields led the sell-off once again, with the 10yr real yield (+10.9bps) up to a post-2008 high of 2.44%. This dramatic rise in long-dated borrowing costs has also led to a major curve steepening in recent weeks, with the 2s10s curve steepening another +6.9bps yesterday to -35.9bps (-31.9bps overnight). Given its role as a leading indicator of recessions, there has been some excitement about a soft landing because of those moves. But as Henry pointed out yesterday (here) most cycles normally see a curve steepening in the months just before the recession begins. So we’re some way from sounding the all clear just yet.

Over in Europe, there was also a sharp sell-off for sovereign bonds. Among others, we saw yields on 10yr bunds (+4.5bps) hit a post-2011 high of 2.96%, yields on 10yr OATs (+5.6bps) at a post-2011 high of 3.53%, and yields on 10yr BTPs (+13.3bps) at a post-2012 high of 4.93%. The 10yr BTP-Bund spread thus reached its highest level since March at +197bps. As in the US, there was a sharp rise in European real yields, with the German 10yr real yield up +4.9bps to 0.62%. And here in the UK, the 30yr gilt yield (+3.8bps) reached its highest closing level since 2002, at 5.05%.

With nominal and real rates rising around the world, it was a very bad day for risk assets, with the S&P 500 slumping -1.37% to a 4-month low. That leaves its YTD advance at just +10.16%, and on an equal-weighted basis the index is now -2.06% lower since the start of the year. Indeed, 273 of its constituents are now down YTD, with only 230 stocks higher. In a reversal of the past few days, tech stocks underperformed with the Nasdaq down -1.87% and the Magnificent Seven mega caps down -2.12%. The VIX volatility index traded above 20 for the first time since May, before closing up +2.17pts at 19.78. Over in Europe, the STOXX 600 (-1.10%) fell to a 6-month low, having now shed -6.58% since its peak in late-July. It’s true that the index is still up +3.72% YTD, but that’s mainly because the index had such a strong January, and we actually passed these current levels as soon as January 6th. So we've effectively gone sideways since.

Overnight in Asia, the sell-off continues. As I type, the Nikkei is down -2.03%, the Hang Seng -1.04% and the Kospi -2.30% after returning from 2 days of holidays. Markets in China are closed all week. Taking a quick look at Japan, the global fixed income sell-off saw yields on Japan’s five-year government bonds rise to their highest level since 2013. The yen weakened to 149.21 against the dollar after speculation that price action in Tuesday’s session was driven by official intervention. Officials remained quiet this morning, as the top currency official Masato Kanda declined to comment whether any intervention had been conducted but did state that they “will respond as always to excessive FX moves”. In other news, the Reserve Bank of New Zealand decided to keep rates on hold at 5.5%. We continue to think the central bank has now reached its terminal rate. See our economist’s reaction here.

In US political news, after the US closed, the House of Representatives voted to remove Speaker Kevin McCarthy, the first time in US history the Speaker has been ousted from their post. The move was led by a small group of conservative Republicans with Democrats joining in on a 216-210 vote. Votes on a new Speaker might begin on October 11th, according to reports, but uncertainty may linger (it took 15 rounds of voting for McCarthy to get the job back in January). From a market perspective, this brings extra uncertainty on the ability of Congress to pass a new spending bill after the latest stopgap measure expires on November 17th. With conservative Republicans having opposed McCarthy’s deal last weekend, his ouster may raise the risk that we will get a government shutdown in November, or that the Senate is forced to accept spending cuts demanded by House Republicans to avoid a shutdown. So a fiscal risk to keep in mind for later in Q4. Taking the temperature of the day ahead, S&P 500 and NASDAQ futures are slightly lower this morning (both around -0.2%) but off their overnight lows.

To the day ahead now, and data releases from the US will include the ISM services index and the ADP’s report of private payrolls for September, along with factory orders for August. Elsewhere, there’s the final services and composite PMIs for September from around the world, and in the Euro Area there’s retail sales and PPI for August. Central bank speakers include ECB President Lagarde, Vice President de Guindos, and the ECB’s Centeno and Panetta, along with the Fed’s Bowman and Goolsbee.