Global stocks are soaring after China pledged fiscal stimulus even as traders raised their bets on interest-rate cuts by major central banks (the two are contradictory but who cares). Futures on the S&P 500 climbed 0.8% as US-listed China stocks soared and Micron surged in premarket trading after the company reported stronger than expected earnings and guided higher. As of 8:00am ET, Nasdaq 100 futs jumped 1.5% and the Stoxx 600 index in Europe headed for a record close on the back of what is just shy of China's "whatever it takes" moment. Treasury yields and the dollar edged lower while oil tumbled for a second day on a report from the FT (which is now doing Reuters' price manipulation for it) according to which Saudi Arabia was reported to be weighing increasing output, and factions in Libya reached a deal that opens the way to the return of some crude production. Gold soared more than 1% to new all time highs as it prices in all the massive fiscal and monetary stimulus that are coming.

US-listed Chinese stocks jumped again in premarket trading after China’s top leaders pledged fiscal spending and measures to stabilize the property sector, showing more urgency to boost the economy. Alibaba +6%, Baidu +5%. Memory maker Micron surged 16% after giving surprisingly strong sales and profit forecasts, helped by demand for artificial intelligence gear. Here are some other notable premarket movers:

The promises by China’s Politburo, alongside growing expectations that the Fed and ECB will push ahead with more easing, buoyed markets on Thursday. Traders are waiting for a pre-recorded address by Federal Reserve Chair Jerome Powell and jobs data later Thursday, even as GDP is expected to be revised sharply lower.

"The message, over the last 10 days or so, from monetary and fiscal policymakers across the globe, has been clear and undeniable — the policy ‘put’ is well and truly back,” said Michael Brown, a strategist at Pepperstone Group Ltd. “The path of least resistance is likely to continue to lead to the upside, over both the short- and medium-term.”

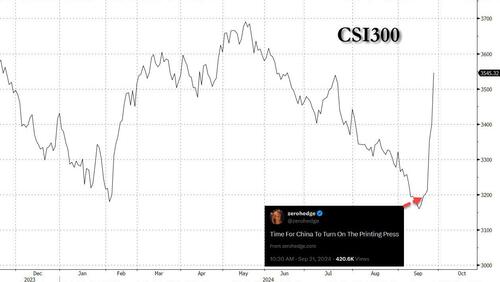

The bid to revive growth by China’s top leaders on Thursday added to a slew of measures from Beijing this week that have supercharged local assets. The CSI 300 Index is headed for its biggest weekly gain in almost a decade. But questions remain over the long-term impact of the measures.

“I wouldn’t be surprised if tomorrow we are going to see a bit of a pullback,” Helen Jewell, chief investment officer at BlackRock Fundamental Equities EMEA, told Bloomberg TV. “This is what is happening in the markets right now — you end up risk on one day, risk off the next day. The Chinese economy is still very fragile.”

Back to the US, where money markets have flipped to favor a half-point cut by the Fed in November, and traders are now pricing almost 39 basis points of reductions after lackluster US consumer data earlier in the week. The US central bank’s preferred price metric and a snapshot of consumer demand will give more clues on the economy’s health on Friday. “The Federal Reserve is more concerned about growth than they let on,” said Vanguard Chief Economist Joe Davis on Bloomberg TV. “Our view is they are going to be more aggressive in the near term.”

Elsewhere, the Swiss National Bank made a 25 basis-point interest rate cut in an effort to contain the strength of the Swiss franc, which has had the strongest rally in nearly a decade.

European stocks soared on the back of China's rally, tracking sizable gains in Asia after China’s top leaders ramped up urgent efforts to revive growth with pledges to support fiscal spending. The Stoxx 600 rose more than 1%, as hopes of fresh stimulus in China buoyed shares across several sectors, including mining, luxury and automotive. The energy sector is the only significant faller in early Tuesday trading, tracking a fall in oil prices. Here are the biggest movers Thursday:

Earlier in the session, Asian stocks jumped amid renewed enthusiasm in the tech sector and further policy support from China.

The MSCI Asia Pacific Index rose as much as 2.1%, with chipmakers Samsung Electronics and Taiwan Semiconductor Manufacturing Co. among the top contributors to the advance following Micron Technology’s surprisingly strong forecast. Japanese benchmarks gain more than 2% as the yen edged lower. Hong Kong and mainland China shares surged after the nation’s top leaders delivered a forceful pledge to increase fiscal support and stabilize the property sector to revive growth. Consumer shares outperformed after China said it will give one-off cash handouts to people in extreme poverty before a weeklong holiday, while financial stocks were supported by news of a possible capital injection into state banks. “Asian markets are soaking in an ocean of optimism thanks to China’s unusual and all-in determination to gear up momentum into the Golden Week and the year-end,” said Hebe Chen, an analyst at IG Markets Ltd. “The region, having broadly built up the risk-on sentiment following Fed’s rate cut last week, is clearly staging a striking relief rally.”

In FX, the Bloomberg Dollar Spot Index falls 0.2%. The Swiss franc rises 0.2% even as the Swiss National Bank cut borrowing costs by 25 bps and warned of more to come if needed.

In rates, treasuries are richer across the curve with yields lower by around 2bp vs Wednesday’s close, following wider gains in bunds with the German curve bull-steepening. US 10-year yield at around 3.75% is ~4bp richer on the day with bunds in the sector outperforming by around 1bp; curve spreads are little changed. Focal points of US session include jobless claims and 2Q GDP revision, $44 billion 7-year note auction and packed slate of Fed speakers, several at regulators’ annual US Treasury Market Conference. Bunds also rallied as traders boost bets on the ECB cutting interest rates next month. German 10-year yields fall 3bps to 2.15%.

In commodities, oil prices dropped sharply, with WTI down ~2% on the prospect of more Saudi and Libyan crude supplies. Spot gold rises $11, soaring to a new all time high.

Looking at the US economic data calendar includes 2Q final GDP revision, August durable goods orders and weekly jobless claims (8:30am), August pending home sales (10am) and September Kansas City Fed manufacturing activity (11am). Fed speakers scheduled include Collins (9:10am), Bowman (9:15am), Powell (9:20am), Williams (9:25am), Barr and Cook (10:30am) and Kashkari (1pm)

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

Top Asian News

European bourses, Stoxx600 (+1.2%) are entirely in the green, with sentiment lifted from further Chinese stimulus efforts. Price action today has only really moved upwards, initially opening on a strong footing and gradually edging higher as the morning progressed. European sectors hold a strong positive bias; Consumer Products tops the pile, benefiting from significant strength in the Luxury sector amid further Chinese stimulus efforts; Basic Resources and Tech also gain. Energy is by far the clear underperformer, dragged down by losses in the crude complex. US Equity Futures (ES +0.8%, NQ +1.4%, RTY +0.9%) are entirely in the green, taking impetus from a strong European session, with sentiment lifted by further Chinese stimulus efforts; the tech-heavy NQ outperforms, owing to very strong Micron (+15% pre-market) results where it beat on top- and bottom-lines and provided solid guidance.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

Central Bank Speakers

DB's Jim Reid concludes the overnight wrap

Investor risk appetite has maintained its momentum over the last 24 hours, aided by strong earnings from Micron Technology after the US close last night. It’s true the S&P 500 (-0.19%) saw a slight pullback from its record high the previous day, but since that earnings release, futures on the index are up another +0.46% this morning, and those on the NASDAQ 100 are up by an even stronger +0.84%. Moreover, the major equity indices in Asia have posted fresh gains as well, with the Nikkei (+2.35%) currently on track to close at its highest level since late-July, before the market turmoil began in earnest over early August. And that advance has been seen across the board, with gains for the Hang Seng (+2.32%), the CSI 300 (+0.71%), the Shanghai Comp (+0.64%) and the KOSPI (+2.07%) as well.

One trend that’s been helping sentiment is growing optimism about the economic outlook, particularly given the Fed’s 50bp rate cut last week, and yesterday brought fresh evidence that lower rates were already having a stimulative effect on the US housing market. So the hope is that given the lags of monetary policy, we’ll see further good news and data improvements over the coming months, especially as we’re now seeing a globally synchronised cycle of rate cuts.

In terms of that data, yesterday’s release from the Mortgage Bankers Association showed that the contract rate for a 30yr fixed mortgage was down to a two-year low of 6.13% over the week ending September 20. Moreover, housing market activity was picking up a bit as well, with their purchase index reaching its highest level since early February. Elsewhere, another effect of lower rates has been the ongoing rise in gold prices, as it’s seen as a classic inflation hedge that tends to benefit from falling interest rates, given it doesn’t pay any interest itself. Indeed, this morning it’s currently trading at $2,662/oz, and with just a few days of Q3 remaining, it’s currently on track for its best quarterly performance since Q1 2016.

With rapid rate cuts being priced in for the months ahead, that also helped to drive a fresh round of curve steepening on both sides of the Atlantic yesterday. 2yr Treasury yields (+2.1bps) rose modestly to 3.56%, up from the two-year low the previous day, while the 10yr yields rose by +5.7bps to 3.78%, their sixth increase in seven sessions. That meant the 2s10s curve in the US steepened for a 6th consecutive session, moving up to 22bps, which is the steepest it’s been since June 2022. Obviously that’s good news for those viewing a steeper curve as a signal of economic strength, but we also know that the last four US recessions only began after the inversion had finished, once the curve was back in positive territory again. So depending on the context, a steeper curve has been a bit of a mixed signal historically.

Today we’ll get some more US data that should help shape perceptions on the outlook, including the weekly initial jobless claims. They’ve been improving over recent weeks, and last week saw the 4-week average fall to its lowest since early June, so that’s helped to reassure investors about the current state of the US labour market. The other report of interest today will be the annual revisions to the US national economic accounts, which will cover 2019 through to Q1 2024. Last year that saw the growth rate for 2022 revised down by two-tenths, alongside revisions to previous years. So it’ll be interesting to see how that affects our understanding of recent economic history.

In the meantime, US equities lost some ground in yesterday’s quiet session, with the S&P 500 down -0.19%. Energy stocks (1.90%) led the decline, pulled down by a decline in oil prices, with Brent crude down -2.27% to $73.46/bbl. But the softness was broad-based, with both the equal-weighted S&P 500 (-0.65%) and the small cap Russell 2000 (-1.19%) underperforming. On the other hand, the tech mega caps outperformed, with Magnificent 7 (+0.44%) reaching a two-month high as it posted a third consecutive advance.

The equity tone was also negative in Europe, with growing fears about the outlook given the weak data of recent days, including from the flash PMIs. In turn, that meant the major equity indices fell across the continent, with losses for the STOXX 600 (-0.11%), the DAX (-0.41%) and the CAC 40 (-0.50%).

Staying on Europe, sovereign bonds saw a similar sell off to the US. Yields on 10yr bunds (+2.6bps) moved higher, whilst OATs (+5.0bps) underperformed to push the Franco-German 10yr spread up to 79.3bps, just 0.2bps from where it stood on August 5, at the height of the recent market turmoil after the US jobs report. This came as French budget minister Laurent Saint-Martin said to the National Assembly’s finance committee that “in 2024 the public deficit risks exceeding 6% of gross domestic product, according to the latest estimates we have.”

One difference compared to the US was the more marginal curve steepening in Europe, though the German 2s10s curve did inch up to its steepest since November 2022, at 4.9bps. This came as markets slightly dialled back their expectations for ECB rate cuts for this year, with the amount expected by December’s meeting down -1.1bps to 47bps, after rising by nearly 12bps over the previous four sessions. On this topic, our European economists published an update of their ECB view overnight. They think the latest data might not yet be quite weak enough to trigger an October ECB cut, but now expect a more rapid easing cycle with back-to-back 25bp cuts from December through to mid-2025, and they do not rule out a 50bp cut in December.

Elsewhere in Europe, the trend towards rate cuts continued yesterday, and the Riksbank delivered a 25bp cut in their policy rate to 3.25% as expected. That marks their third rate cut this year, and they also signalled that further reductions were ahead, with their forecast for the average policy rate in Q4 at 3.11%, with a further decline to 2.38% in Q2 2025. Back in June, their policy rate forecast stood at 2.94% in Q2 2025, so that’s a noticeably more dovish path relative to last quarter.

To the day ahead, and US data releases include the third reading of Q2 GDP, the preliminary August reading for durable goods orders, the weekly initial jobless claims, and pending home sales for August. Meanwhile in the Euro Area, we’ll get the M3 money supply for August. From central banks, we’ll hear from Fed Chair Powell, the Fed’s Collins, Kugler, Bowman, Williams, Barr, Cook and Kashkari, along with ECB President Lagarde, Vice President de Guindos and the ECB’s Schnabel.