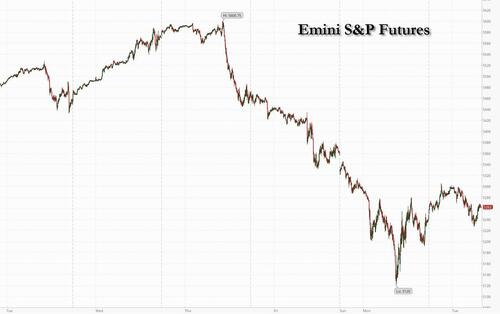

After Monday's historic selloff that capped a three-week, $6.4 trillion rout in global equities as a brutal unwind in the carry trade driven by last week's BOJ rate hike hammered most consensus trades, a dead cat bounce arrived as some investors looked for bargains and markets saw a hint of calm return on Tuesday, but the rebound has been decidedly more tepid than the rout, and doesn’t prove the meltdown is over. Futures on the S&P 500 and Nasdaq are poised to regain only a fraction of yesterday’s loss, while stocks in the UK and Europe gave up earlier gains to head lower. There were stronger moves in Japan, where the two key share gauges both jumped more than 9% at the close after tumbling 12% the day before. US futures higher in a volatile, shaky session, with small caps lagging the Nasdaq, as USD finds support and Japanese Equities rally 10% overnight, erasing much of Monday's loss. As of 7:45am, S&P futures were up 0.8%, off session highs, while Nasdaq futures rebounded 1.1% falling more than 7% over past three sessions. That said, much of the overnight gains were pared after JPM's co-head of FX Strategy Arindam Sandilya said that we may only be 50% - 60% through this carry trade unwind. Bond yields are 5-6bps higher as treasuries retreated, with the 10-year yield heading for the first increase in almost two weeks as traders curbed bets that the Federal Reserve will step in to support markets with early interest rate cuts. Commodities are weaker, with WTI and gold modestly in the green. For the remainder of the week, the macro catalysts are bond auctions and Fedspeak.

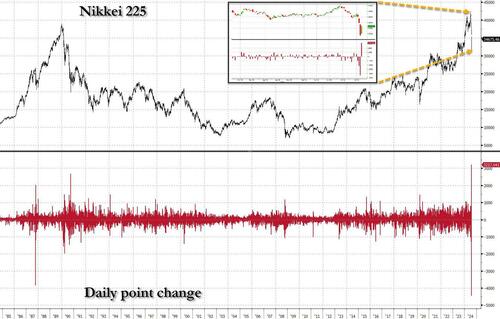

Overnight, the bulk of the action was once again in Japan, where the Nikkei 225 index surged 3,217.46 points on Tuesday - its largest single-day rise following the largest one-day drop in history - after US service sector data for July eased concerns of a recession. The average ended the day at 34,675.46, up 3,217.46 points, or 10.2%. The index's previous biggest single-day jump dates back to October 1990, when it gained 2,676.55 points. By percent, it was the biggest increase since 2008 and the fourth-largest rise ever.

A big reason for Japan's rebound is because of an emergency meeting between the BOJ and the MOF as Japan’s government and central bank sought to show a united front and restore calm to financial markets, after the biggest stocks plunge in more than three decades triggered criticism of monetary policy tightening and cast a shadow over efforts to get households to invest their assets. With some pointing fingers at the central bank’s decision to hike rates last week as part of the trigger for the market turmoil seen in the last few days, the government appears to be trying to show it’s standing with the BOJ remains unchanged, at least for now.

Anyway, back to the US, where in premarket trading, the Mag7 is higher with Semis up small. Alphabet (GOOGL US) edged 0.3% higher in premarket trading, as a global tech rebound allows the shares to look past Monday’s ruling by a US judge that Google illegally monopolized the search market through exclusive deals. Analysts say a modest stock move was expected, as Alphabet will appeal the verdict and the process will take time to resolve. Palantir shares are up 7.4%, after the data-analysis software company reported second-quarter results that beat expectations. It also raised its full-year forecast and touted the demand it is seeing from artificial intelligence software. Here are the other notable premarket movers:

Underscoring the broad market angst, investors are rushing to insure their portfolios against an extreme market crash. And Wall Street’s “fear gauge,” the VIX index, remains at the highest level in almost two years.

“We don’t expect a lull in the coming days,” said Christopher Dembik, senior investment adviser at Pictet Asset Management. The unraveling of the yen carry trade will continue to trigger margin calls and losses, while a sustained recovery in stocks hinges on central banks measures and big-tech earnings, he said. “I’m expecting the month of August to be red-tainted.”

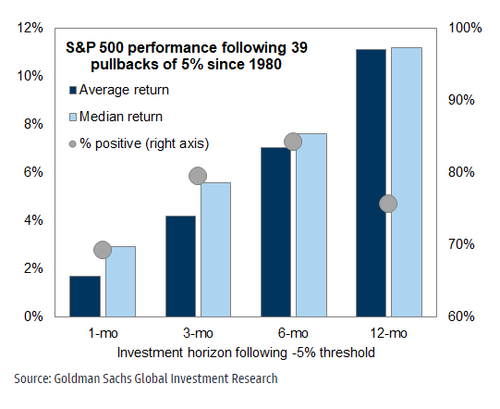

Even so, the small moves suggested some calm is returning to markets. In an attempt to awaken animal spirits, Goldman's David Kostin said that buying the S&P 500 after a decline of 5% has usually been profitable in the past four decades. According to Kostin, investors typically profit when buying the S&P 500 index following a 5% sell-off. Since 1980, an investor buying the S&P 500 index 5% below its recent high would have generated a median return of 6% over the subsequent 3 months, enjoying a positive return in 84% of episodes.

Mohit Kumar, chief economist for Europe at Jefferies, echoed Kostin's sentiment saying that "the violent market moves over the last few sessions, in our view, present a buying opportunity."

European stocks started off well in the green, but the buying waned with most European bourses now flat or lower; a paring which has occurred without a fresh fundamental driver. The Stoxx 600 was down -0.2% near session lows. Tech outperforms as it rebounds with Deutsche Bank also upgrading the European sector while Banks come in a close second place as they trim recent rate-driven downside. Here are the most notable European movers:

Earlier, Asian equities rose, helped by bargain hunting after concerns over a hard landing in the US drove a regional benchmark to its worst single-day drop since 2008. The MSCI Asia Pacific Index jumped as much as 4.2%, heading for its best day since November 2022, following a rout of more than 6% on Monday. Japan led the rebound as the yen eased following steep gains against the dollar that drove the nation’s stocks into a bear market. The Topix index closed with a 9.3% gain, the biggest single-day rally since 2008. Regional equities came under the kosh in the previous two sessions as investors fretted over a possible US recession in addition to overheating of the artificial intelligence rally. Meanwhile, the rapid surge in the yen triggered unwinding of carry trades across the globe, weighing on technology stocks.

“The market reaction was a bit extreme yesterday and hence we see this sharp rebound today,” said Rupal Agarwal, Asia quantitative strategist at Sanford C. Bernstein. “I would expect markets to remain volatile and hence would stick to looking for late-cycle defensive exposure through quality or dividend yielding names.”

In addition to Japan, stocks bounced back Tuesday in technology-heavy South Korea and Taiwan. Chinese stocks were mixed even as local brokerages talked up the prospects of the market in the face of a global selloff.

In FX, the yen dropped after rising to its highest level in seven months, taking a breather from the rally stoked by wagers on further Bank of Japan policy tightening. USD/JPY rose as much as 1.5%, after falling to as low as 141.70 on Monday, the lowest since Jan. 2. Leveraged clients who had previously sold spot higher up bought back, according to an Asia-based FX trader. Bloomberg Dollar Spot Index rose 0.3%. The BOJ’s monetary policy tightening last week has triggered a wave of criticism after it helped set off a historic plunge in Japanese stocks and contributed to global market turmoil — likely putting any plans for further interest-rate hikes on ice.

“Volatile financial market conditions, especially rapid JPY appreciation, are lowering the probability of an October-rate hike” by the BOJ, according to an ING note. “The short-term market volatility won’t change the course of the BOJ’s policy normalization, but the pace may be slower than we expect if it continues.”

In rates, US Treasuries fell as the strong demand for haven assets that marked the start of the week waned globally. Treasuries were cheaper by 3bp to 6bp across the curve in a bear-flattening move with intermediates leading the weakness on the day. The 10-year yield is around 3.86% about 7bp cheaper on the day, trailing bunds in the sector by 8bp, gilts by 4bp; belly-led losses flatten 5s30s spread by nearly 4bp while 2s10s is little changed at around -14bp following Monday’s brief disinversion. Investors pivot from haven demand to supply pressure, with first of this week’s three coupon auctions ahead at 1pm New York when the Treasury will hold a 3-Year, $58BN note auction to be followed by 10- and 30-year sales Wednesday and Thursday. WI 3-year yield ~3.81% is roughly 60bp richer than last month’s, which stopped through by 0.8bp.

In commodities, oil held near a seven-month low as a halt in production at Libya’s biggest field refocused attention on the Middle East. Gold steadied after being pulled into Monday’s global rout, when it slumped as some traders cut holdings to cover potential margin calls.

Looking at today's market calendar, the US economic data slate includes June trade balance at 8:30am. No Fed speakers are scheduled

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly positive as the region rebounded from the recent market turmoil - Nikkei futures saw an upside circuit breaker triggered, while the Korea Exchange activated sidecars for the Kospi and Kosdaq after early surges. ASX 200 traded higher albeit within a confined range as participants awaited the latest RBA policy announcement, while the central bank provided no major surprises as it kept rates unchanged and maintained its hawkish tone. Nikkei 225 bounced back aggressively following its largest-ever daily point drop and reclaimed the 34,000 status. Hang Seng and Shanghai Comp. were somewhat lacklustre with the Hong Kong benchmark gave up initial gains, while the mainland lagged after a substantial daily net liquidity drain.

Top Asian News

Markets found some reprieve following yesterday's hefty selling, Euro Stoxx 50 U/C; action which was led by a substantial rebound in APAC trade that saw the Nikkei 225 close with gains of over 10%, though not quite paring all of Monday's record move lower. However, across the European session this strength has waned with European bourses now flat/lower; a paring which has occurred without a fresh fundamental driver. Sectors were primarily in the green, but are becoming increasingly mixed; Tech outperforms as it rebounds with Deutsche Bank also upgrading the European sector while Banks come in a close second place as they trim recent rate-driven downside. FTSE 100 -0.3% is the relative laggard, hit by pressure in defensive large-caps and as the housing sector slumps after housebuilder updates, remains afloat overall due to its banking exposure. Stateside, futures in the green (ES +0.5%, NQ +0.6%) with the narrative the same as the above after the better-than-expected ISM Services began a rebound which looks set to continue. Numerous key earnings ahead incl. Caterpillar, Uber & more.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar