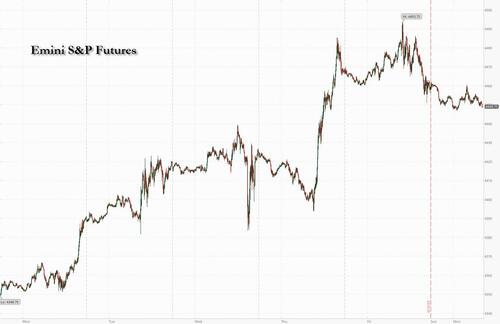

Global stocks fell on Monday after the recent powerful rally lost steam at the end of last week, while US equity futures were flat in thin trading celebrating the ("exploitative") Juneteenth holiday following Wall Street’s slight decline on Friday amid concern about the economic outlook. S&P 500 futures traded between modest gains and losses and at last check were down 0.1% as of 8:00am ET while Nasdaq 100 futures were flat. Global investors were also disappointed by the ongoing lack of more stimulus from China after its State Council stopped short of releasing any specific proposals for new support measures for the economy.

The S&P 500 has rallied for the past five weeks, the longest such streak since November 2021, as investors anticipate the end of the Fed's tightening cycle and that earnings will hold up better than expected. Several Fed officials, including Chair Powell, are slated to speak this holiday-shortened week. Investors will parse these statements for clues on the path of monetary policy and the direction of growth.

Despite the pressure of an $4.2 trillion options expiry at the end of last week, the S&P 500 index capped a fifth straight week of gains and is now higher than it was the day the Federal Reserve kicked off its campaign.

“We expect the US to head into a short, two-quarter, recession later this year,” said Joachim Klement, head of strategy, accounting and sustainability at Liberum Capital. That said, the “US recession is likely to be shallower and shorter than those in Europe and as a result, companies with a larger US revenue exposure will likely outperform companies with more exposure to Europe or the slowing Chinese consumer.”

Looking ahead, Fed Chair Jerome Powell will give his semi-annual report to Congress on Wednesday, while St. Louis Fed President James Bullard and his counterparts in New York and Chicago are among this week’s speakers.

As discussed previously, the S&P 500 index posted its mildest reaction on FOMC day in two years. Though it was the first in 11 meetings where policymakers held rates, they also lifted forecasts for higher borrowing costs of 5.6% in 2023, implying two additional quarter-point rate hikes or one half-point increase before the end of the year, although judging by the market reaction, few believed this particular forecast.

“Markets are still pricing in a lower path of interest rates compared to the Federal Reserve’s dot plot,” said Janet Mui, head of market analysis at RBC Brewin Dolphin. “While we are close to peak rates, it is uncertain how long rates will stay high. Markets have a more dovish lens on that.”

European stocks followed their Asian counterparts lower as investors were left disappointed by the lack of any fresh stimulus measures from China. Traders are also keeping an eye on details surrounding the meeting between Blinken and Xi in Beijing.

The Stoxx 600 is down 0.5% with with chemicals, construction and basic resources leading declines, while financials and insurance are the only sectors in the green. Among the biggest individual movers, Sartorius AG slumped 15% after issuing a bigger-than-expected profit warning. Here are some of the more notable movers:

Earlier in the session, Chinese tech companies dropped after China disappointed hopes for further stimulus. Asian stocks were mostly negative following last Friday's US losses while risk appetite was also contained as markets digested US-China talks and with US markets closed. Nonetheless, ASX 200 (+0.6%) bucked the trend with the index buoyed as strength in the defensive, financial and tech sectors made up for the losses in mining-related stocks. Nikkei 225 (-1.1%) was subdued and eventually breached through earlier support around the 33,500 level, after a torrid rally that helped send the index to the highest level since 1990.

Hang Seng (-0.8%) and Shanghai Comp. (-0.5%) were lower amid ongoing China growth concerns with the likes of Goldman Sachs, Nomura and UBS all cutting their Chinese GDP forecasts for 2023, while participants also digested the meeting between US Secretary of State Blinken and Chinese Foreign Minister Qin in Beijing which was said to be candid, substantive and constructive although lacked any major breakthroughs aside from agreeing to schedule a reciprocal visit at a suitable time.

Reports covering China’s State Council meeting on Friday, chaired by Premier Li Qiang, were light on details about any potential stimulus or timing. The lack of tangible evidence for support adds to worries over a slowing economy, unnerving investors who had bid up Chinese equities last week in the hope of a sweeping package.

Treasury futures are lower with cash markets closed for to the Juneteenth holiday in the US. Bunds and gilts are also in the red.

In Fx, the Bloomberg Dollar Spot Index is up 0.1%. The Norwegian krone is the weakest of the G10 currencies, falling 0.4% versus the greenback. The offshore yuan is down 0.4%.

In commodities crude futures decline with WTI falling 0.4% to trade near $71.50. Spot gold is little changed around $1,956

There is nothing on today's US calendar.

A more detailed look at global markets courtesy of Newsquawk

Asia-Pacific stocks were mostly negative following last Friday's losses on Wall St, while risk appetite was also contained as markets digested US-China talks and with US markets closed on Monday for Juneteenth. ASX 200 bucked the trend with the index buoyed as strength in the defensive, financial and tech sectors made up for the losses in mining-related stocks. Nikkei 225 was subdued and eventually slipped below earlier support around the 33,500 level. Hang Seng and Shanghai Comp. were lower amid ongoing China growth concerns with the likes of Goldman Sachs, Nomura and UBS all cutting their Chinese GDP forecasts, while participants also digested the meeting between US Secretary of State Blinken and Chinese Foreign Minister Qin in Beijing which was said to be candid, substantive and constructive although lacked any breakthroughs aside from agreeing to schedule a reciprocal visit at a suitable time. US equity futures were uneventful after Friday's retreat and approaching holiday lull. European equity futures are indicative of a lower open with the Euro Stoxx 50 -0.7% after the cash market closed up 0.7% on Friday.

Top Asian News

European equity futures are indicative of a lower open with the Euro Stoxx 50 -0.7% after the cash market closed up 0.7% on Friday.

Top European News

FX

Fixed Income

Commodities

Crypto

Geopolitics

US Event Calendar

DB's Jim Ried concludes the overnight wrap

It's not easy to find the main highlight this week with a number of events that could be meaningful but could also pass without incident. Powell's semi-annual testimony to the House and the Senate on Wednesday and Thursday, respectively, should be the key event but coming so soon after the FOMC it's hard to know what he can say that will be particularly new. Around this there is plenty of Fed and ECB speak as you can see in the day-by-day calendar at the end. They will I'm sure give their nuances to the policy meetings last week.

Given an increasing global focus on rising UK rates of late, then UK CPI (Wednesday) and the expected 25bps hike on Thursday, and associated commentary, could have a big impact on Gilts and with it global bonds. There was lots in the weekend papers about the upcoming mortgage refi wave over the next couple of years if rates stay close to current levels. So this is becoming a big topic.

Staying with rates and yields, given how much US yields rallied for a period last week after jobless claims stayed surprisingly high, this Thursday's release could be one of the data highlights of the week. The recent rise has an element of the fraudulent filings the market discovered a few weeks back, but it’s got slightly more broad-based since so this could be the first area where we see any genuine cracks in the labour markets. So all eyes on this.

Elsewhere, Global flash PMIs on Friday are always a big focus. Back in the US we have a slew of housing data including the NAHB housing market index today, housing starts and building permits tomorrow and existing home sales on Thursday. Housing is still very weak but many are seeing green shoots starting to emerge. The other key highlights are Japanese inflation on Friday and UK retail sales the same day and PPI in Germany tomorrow. In China, markets will focus on domestic banks' loan prime rates fixings tomorrow following last week's PBoC reverse repo and MLF rate cuts as well as a round of disappointing economic data amid the broader talk about the need for stimulus to support the waning recovery. The rest of the day-by-day week ahead is at the end as usual.

Asian equity markets are largely struggling at the start of the week, tracking Friday’s fall in US stocks. As I check my screens, the Hang Seng (-1.57%) is the biggest underperformer across the region with the CSI (-0.84%), the Shanghai Composite (-0.54%) and the KOSPI (-0.86%) also trading in the red. The Nikkei (-1.11%) is also down after 10 straight weeks of gains. Elsewhere, the S&P/ASX 200 (+0.66%) is bucking the wider sell off in the region.

On a positive note, US Secretary of State Antony Blinken met Qin Gang, China’s top foreign policy official in Beijing, to stabilise strained ties between the world’s biggest economies with a meeting with Xi Jinping potentially in the works.

Looking back at last week, in terms of data releases, on Friday we had the University of Michigan survey results, in which year-ahead inflation expectations receded for the second consecutive month, falling from 4.2% to 3.3% (vs 4.1% expected), its lowest level since March 2021. The downshift was much more modest for the 5-year period, falling from 3.1% to 3.0%, as expected by consensus. However, it was in consumer sentiment that we saw the most significant move, which rose from 59.2 in May to 63.9 in June (vs 60.0 expected). This is its highest level in four months as inflation continues to come down, though it is still below pre-SVB levels at the start of the year, and at historically low levels.

Despite the above slowing in inflation expectations, hawkish messaging from Fed governors saw the rate priced in for the July meeting move up +1.0bp on Friday to 5.258%. However, in weekly terms, this was down -3.5bps after the Fed skipped at the June meeting and also with earlier data releases hinting at rising slack in the US labour market. The largest move over the week was in the rate priced in for December, with the implied rate up +14.5bps to 5.206% (and +2.0bps on Friday), heavily influenced by the Fed dot plot showing two further hikes for this year.

With markets trimming back expectations of the timing and extent of rate cuts, US 2yr Treasury yields jumped +7.2bps on Friday, and +11.9bps week-on-week, reaching their highest level since early March. 10yr yields rose +4.5bps on Friday, and up +2.2bps on the week. The 2s10s slope thus inverted further to -95.3bps, its most negative weekly close in over 40 years, with just three lower daily values in early March 2023. Over in Europe, 10yr bunds sold off over the week, as yields climbed +9.7bps (despite a -3.0bps rally on Friday), whilst 2yr yields climbed +20.7bps in their largest up move since mid-April (-0.3bps on Friday), helped by a hawkish ECB.

Now turning to equities, the S&P 500 rally finally ran out of steam on Friday, down -0.37% after 6 consecutive days of gains. This still marked a +2.58% rise on the week to the highest weekly close since April 2022. At the sector level, the S&P reversal was led by the tech sector (-0.83%) as semiconductor manufacturer Micron Technology announced about half of its China customer revenue was at risk. This followed on from China’s bar on purchases of Micron chip products in late May amid elevated geopolitical tensions. Tech underperformance was reflected in the decline of NASDAQ (-0.68%) and the FANG+ (-1.27%) indices on Friday, though they were still up by +3.25% and +4.03%, respectively, on a weekly basis. The FANG+ Index is now 3% from its all-time highs in November 2021. With the US equities sell-off coming in the latter half of the day, in Europe the STOXX 600 climbed +0.53% on Friday before the US dip (and +1.48% week-on-week).

Lastly, in commodities, oil finished up the week strong off the back of optimism over China demand. This followed a Bloomberg report that the Chinese State Council was considering a sweep of stimulus proposals to boost consumption, as well as support for sectors including property. WTI crude gained +2.29% week-on-week bringing it to $71.78/bbl (+1.64% on Friday), and Brent crude gained +2.43% to $76.61/bbl (+1.24% on Friday). The news from China also lifted copper, which climbed +2.64% in weekly terms (but down a modest -0.31% on Friday), reaching its highest level for over a month.