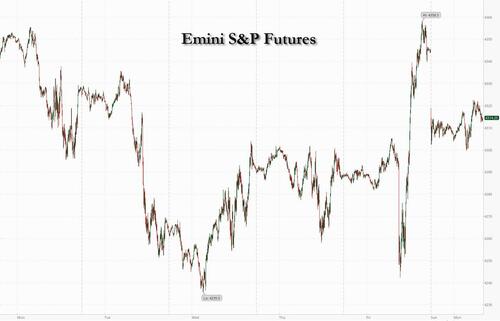

US equity futures, Asian and European stock markets and bond yields all dropped while oil prices and the dollar jumped in a global rush for safety after the sudden war between Israel and Hamas raised fears of a wider conflict. Investors avoided traditionally risky assets such as stocks and instead bought gold, bonds and the dollar. As of 7:45am,S&P futures dropped 0.6% to 4314, after earlier trading as low as 4,300 and reversing much of Friday's brutal squeeze higher, while Europe's Stoxx 600 slipped 0.2%, having traded between gains and losses. West Texas Intermediate jumped 4% to almost $86 a barrel, after earlier surging more than 5%, spurring a rally among European energy producers while Defense stocks such as BAE Systems and Saab AB also rose. Gold climbed 1% and index of dollar strength added 0.3%.

After 10Y TSY yields surged to the highest since 2007 on Friday, rising as high as 4.88%, cash trading in Treasurys is closed Monday due to Columbus Day holiday, however Treasury futures were open and indicated a drop in yields back down to 4.72%.

In premarket trading, equities related to oil and gold rose. Shares of US-listed Israeli companies also fell ahead of the open. Shares of US-listed Israeli companies fell: Inmode (INMD US) -7.7%, Gilat Satellite Networks (GILT US) -5.5%, Elbit Systems (ESLT US) -4.8%. Here are some other notable premarket movers:

The Israeli shekel weakened 2%, touching the lowest in seven years, even after the Bank of Israel unveiled an unprecedented program to support markets. The central bank plans to sell as much as $30 billion in foreign exchange, and extend up to $15 billion through swap mechanisms to support markets.

Israel’s benchmark TA-35 stock index rose 0.2% after recouping a loss of as much as 1.3% earlier Monday. The measure plunged 6.5% on Sunday. Stock markets across the Middle East fell amid concerns the war might escalate into a broader conflict, with Dubai’s benchmark gauge losing 2.9%.

“Our measures of risk appetite have been already signaling a high degree of risk aversion from institutional investors, which is likely to only get worse,” said Marija Veitmane, senior multi-asset strategist for State Street Global Markets. “Markets are likely to particularly worry about higher oil prices as a further supply squeeze is likely.”

While the latest events aren’t an immediate threat to oil flows, traders are concerned the conflict may become a proxy war. The US said it was dispatching warships and the Wall Street Journal reported that Iranian security officials helped plan the strike. Iran is both a major oil producer and supporter of Hamas. Any retaliation against Tehran may endanger the passage of vessels through the Strait of Hormuz, a vital conduit that Iran has previously threatened to close.

European stocks traded between gains and losses, last trading about 0.2% lower with energy and utilities stocks outperforming, while investors monitored the risk of escalation following Hamas’s surprise attack on Israel. FTSE 100 outperformed peers, adding 0.3%. Energy outperforms, while retailers, travel and consumer products underperform in Europe. Metro Bank Holdings Plc’s riskiest bonds gained the most on record on Monday after the troubled UK lender clinched a £925 million ($1.1 billion) financing package, a deal that will impose a 40% haircut on some bondholders and see Colombian financier Jaime Gilinski take a controlling interest. Here are the most notable European movers:

Earlier in the session, Asian stocks were mostly lower amid a flight to safety which underpinned T-note futures and gold although the biggest moves were seen in oil prices which jumped amid the heightened geopolitical risk.

In FX, haven demand lifted the yen, dollar and gold as investors assess implications of conflict in the Middle East. As noted above, the Israeli shekel weakened 2%, touching the lowest in seven years, even after the Bank of Israel unveiled an unprecedented program to support markets. The central bank plans to sell as much as $30 billion in foreign exchange, and extend up to $15 billion through swap mechanisms to support markets.

In rates, German and UK bond yields all drop across the curve, led by the 10-year. Bund 10-year bond yields outperform comparable gilts by a basis point. Cash treasuries are closed for a US holiday. Treasury futures pare some earlier gains over inflation resurgence concerns.

In commodities, oil prices rallied, with some taking the view that an escalation could threaten supply. Brent rises 2.8% near $86.97. Spot gold rises roughly $16 to trade near $1,849/oz. Bitcoin is subdued under $28,000 as prices gradually waned from highs throughout the European morning before seeing another leg lower.

Looking at today's event calendar, there are no economic events on the docket due to the Columbus Day holiday. Fed's Barr, Logan and Jefferson speak, ECB's Centeno speaks, BoE's Mann speaks

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly lower in holiday-quietened conditions and US equity futures were pressured amid geopolitical concerns after a surprise multi-front attack by Hamas on Israel which resulted in at least 700 Israeli deaths and prompted Israel to declare war on Hamas with air strikes conducted on Gaza where 400 have been killed. This spurred a flight to safety which underpinned T-note futures and gold although the biggest moves were seen in oil prices which jumped amid the heightened geopolitical risk as a report also claimed that Iranian security officials helped Hamas plan the attack. ASX 200 kept afloat with gains led by strength in the energy and mining-related sectors as underlying commodity prices were lifted owing to the conflict in the Middle East and the return of Chinese buyers to the market. Shanghai Comp. was pressured as participants returned from the Mid-Autumn Festival and National Day Golden Week holidays, while Hong Kong trade was delayed for most of the day due to a typhoon no. 8 signal and black rainstorm warning which further added to the already thinned markets caused by holiday closures in Japan, South Korea and Taiwan.

Top Asian News

European bourses have mostly kicked the week off on the backfoot as geopolitical concerns grip the market narrative following a surprise multi-front attack by Hamas on Israel. Sectors in Europe are mostly softer with Energy names the clear outperformer to the upside amid the geopolitically-inspired upside in crude prices, which subsequently weighs on airliners alongside the scrapping of routes via Israel. Given the use of military forces in the Israel-Palestine conflict, European Defence names are also firmer intraday. US futures are trading lower as global geopolitical tensions keep traders in a risk-off mood, while participants also gear up for the start of Q3 earnings season later this week.

Top European News

FX

Fixed Income

Crude

Geopolitics

US Event Calendar

Central Bank speakers

DB's Jim Ried concludes the overnight wrap

Markets will spend a fair amount of time in the early part of this week trying to understand the implications of the most serious cross-border attack on Israel in decades early on Saturday morning. It was 50 years ago on Friday that the Yom Kippur War started after a surprise attack on Israel so there are some parallels. This war cast a shadow over the rest of the 1970s so although we're a long way from that, it's a reminder that geopolitical risk is elevated at the moment with the Ukraine conflict, the US/China tensions and now those resurfacing in the Middle East. How Saudi Arabia, Iran, and the US get drawn into this will be key. Geopolitical risk doesn't tend to linger long in markets but there are many second order impacts that could come through in the weeks, months and years ahead from this weekends' developments. Our regional strategists and economists have published a note overnight (link here) with some thoughts on the implications and some background for those not familiar with the events.

So far this morning Brent oil is +3.68%, having been around +5% a little earlier in the session. To put this in some context it was down over -11% last week. Israel's stock market was down -6.5% yesterday. With the US bond market closed for Columbus Day it's not going to be the most liquid day of trading.

S&P 500 (-0.75%) and NASDAQ 100 (-0.74%) futures are lower with Asian equity markets mixed as Chinese markets reopen after a week-long Golden week holiday. In terms of index moves, the CSI (-0.50%) and the Shanghai Composite (-0.69%) are trading lower while the S&P/ASX 200 (+0.38%) is seeing gains in early trading. Hong Kong’s morning session has been cancelled due to a storm. Elsewhere, markets in Japan and South Korea are closed for a holiday. The dollar index is up +0.3%, while gold prices (+1.07%) are also higher on safe haven bids .

Moving on to some political news, Germany’s opposition conservative bloc is set to retain control in both the states of Bavaria and Hesse according to exit polls by state broadcaster ARD. The Christian Democratic Union (CDU) won 35.5% of the vote in Hesse, while in Bavaria, the Christian Social Union (CSU) - a sister party to the CDU took 37%. The results are a blow for all three parties in Chancellor Olaf Scholz' left-wing-led national coalition as it lost support in both states. The far right AfD came second in both regions seeing their support increase around 4pp from 2018 to mid- to high-teens levels.

Moving on to this week, we have another US CPI (Thursday) to look forward to alongside PPI (Wednesday) as the dress rehearsal. China inflation (Friday) is also interesting as last month the country came out of deflation again. Elsewhere, the FOMC minutes (Wednesday) and the ECB account (Thursday) from their September meetings will be of note. German industrial production (today) and UK monthly GDP (Thursday) are other key highlights and on Friday US Q3 earnings season unofficially starts with a few big US banks reporting. US 10yr and 30yr auctions on Wednesday and Thursday could also be market-moving events for yields depending on how well they are covered. You can see the full day-by-day calendar, including another busy week for central bank speakers, at the end as usual but we'll review the main highlights below and also discuss a blow-out payrolls report from Friday.

With regards to payrolls, t he huge beat in the headline (336k vs. 170k expected) was a notable development as were the +119k of revisions over the last 2 months. Prior to Friday's report, every month had been revised down this year so this was a change in momentum as was the 3m moving average that has moved up to +266k from +150k at last month's release. So it's fair to say this data has been all over the place of late but for now it's looking up again. There were some grumbles about the household survey only adding +86k and that part-time jobs led the way, with full-time employment looking less rosy, but there are always things to find if you dig enough. See our economists chart book based around the report and associated labour market stats here for more.

For US PPI on Wednesday, our economists expect the headline (+0.3% forecast vs. +0.6% previously) to slightly outperform the core (+0.2% vs. +0.2%) but the healthcare and airlines components will be the most closely watched as they feed through into core PCE. The latter component has been more buoyant recently than in the CPI which is partly why PCE core services excluding housing inflation has been significantly stronger than that of the CPI core services excluding rent and medical care services. So although this is a bit in the weeds, it will matter for the Fed.

For Thursday's CPI our economists note that with seasonally adjusted gas prices up almost 3% from August, they expect headline CPI (+0.26% vs. +0.63% last month) to slightly outpace core (+0.24% vs. +0.28%). This would allow core YoY CPI to drop from 4.4% to 4.0%, and headline to fall from 3.7% to 3.5%. Core goods should be soft led by used cars but this could pick up again by year-end if our models are correct.

Earnings season will kick off with results from several US banks/financials on Friday, including JPMorgan, Citi, BlackRock, and Wells Fargo . See our equity team's preview of earnings season here. In short, they think we'll see a fresh high for S&P 500 earnings. They also note that 80% of time the market rallies during earnings season, and by an average of 2%. The extent of this typically depends on performance and positioning going into it. Going into this season, we've had a notable pull-back and investors are now underweight (see their positioning report here) which leaves our strategists fairly optimistic. We will see if the macro world supports that view in the next few weeks.

Now turning to review last week. Yields moved sharply higher on the payroll report with the 10yr Treasury yield spiking by 15bps shortly after the release to reach 4.885% at its peak, before reversing around half their rise by the close. At the front-end, Fed funds futures moved to price a near-even likelihood of another Fed hike by year-end at 48% (from 37% the day before), while the end-24 futures rose +7.9bps on Friday (and +2.3bps in weekly terms) to 4.64% .

Looking at the fixed income sell-off in more detail, US 10yr Treasury yields closed +8.3bps higher on Friday to 4.801%, a new post-2007 high. They also saw their largest weekly up move since July (+23.1bps), extending the sell-off into a fifth consecutive week. 30yr yields saw their largest weekly increase since the end of 2022 (+26.8bps, and +7.7bps on Friday). With the long-end leading the sell-off, the 2s10s curve steepened +19.2bps last week (+2.1bps on Friday) to its smallest inversion since last October (-27.6bps). In Europe, the rates sell-off was more moderate, with 10yr German bund yields up +4.5bps on the week (and +0.7bps on Friday).

Equity markets initially reacted negatively to the payrolls print, but rallied for the rest of the day. The S&P 500 gained +1.18% on Friday, its largest daily rise since August and helping post its first weekly rise (+0.48%) in five weeks. US technology stocks outperformed as the NASDAQ gained +1.60% on Friday (also +1.60% on the week). Large-cap tech stocks powered ahead, with the FANG+ index rising +3.53% on the week (and +2.48% on Friday). European equity underperformed, with the STOXX 600 down -1.17% over the week, although the index pared its losses after gaining +0.82% on Friday.

In commodities, oil massively fell back last week amid growing demand fears and a spike in US gasoline inventories. Brent Crude dropped -11.26% to $84.58/bbl, its worst weekly performance since March. This brought prices to their lowest level since mid-July, although prices did steady on Friday (+0.61%). WTI also slipped, down -8.81% last week to $82.79/bbl, but likewise recovered on Friday (+0.58%). Clearly news from the Middle East will change things again in the early part of this week. Lastly, copper also had a tough week, falling -2.94%, even though it trimmed its losses on Friday (+2.13%) .