US equity index futures stormed higher to start the week as concerns about the bank crisis faded - if only for the time being - amid stronger risk appetite boosted by bank sector M&A, higher bond yields, a weaker USD and the prospect for further support from US authorities for the troubled regional banking sector. The stock of Friday's bank freakout - Deutsche Bank - rose and its CDS tightened, while in the US First Citizens Bank agreed to buy Silicon Valley Bank amid news that US authorities are considering expanding an emergency lending facility for banks in ways that would give First Republic Bank more time to shore up its balance sheet, BBG reported. Still, fears of a US slowdown damped investor sentiment after Minneapolis Fed President Neel Kashkari said recent bank turmoil has increased the risk of a US recession.

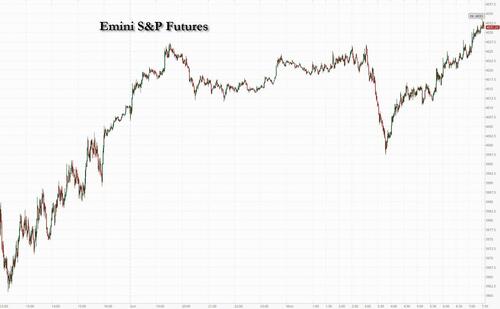

S&P 500 futures rose 0.7% to 4,030 at 7:45am ET while Nasdaq 100 futures gained 0.4%. The tech-heavy benchmark has rallied nearly 20% from its December lows as investors rotate into technology and shift out of banks, as expectations for rate cuts increase. The risk-on tone is evident elsewhere with bonds, gold and the Japanese yen all in the red. Oil rose while Bitcoin rose for a second day in a row.

In premarket trading, First Republic Bank led a rally across regional lenders in US premarket trading as sentiment improves following a Bloomberg report that US authorities are considering more support for banks. First Republic shares jump 27%, with peers Western Alliance +5.2%, PacWest Bancorp +9.1%. KeyCorp shares rise 7.4% after the lender is upgraded to buy from neutral at Citi along with peer M&T Bank (MTB US). Citi analysts stress-test regional banks following SVB’s demise, saying that the risk-reward for the pair looks “very appealing.” Here are some other notable movers:

Among the most recent developments for the banking sector, First Citizens BancShares agreed to buy Silicon Valley Bank which was seized by regulators following a run on the lender. Meanwhile, Bloomberg reported US authorities are considering expanding an emergency lending facility for banks in ways that would give First Republic Bank more time to shore up its balance sheet. Its shares soared over 25% in premarket trading.

Investors continue to monitor turmoil among US regional banks, while growing increasingly concerned over the possibility of a recession. Even the Fed's reformed permahawk, Minneapolis Fed President Neel Kashkari, admitted that risk has increased due to a credit crunch from the bank crisis, but said that it was too soon to judge what it means for the economy and monetary policy.

“We are in the camp that the economy is set to slow. We’ve been there since the start of the year and some of the pieces are falling into place,” said Manpreet Gill, Standard Chartered’s chief investment officer for Africa, the Middle East and Europe. “Clearly now is the tail end of what’s been a very rapid and sizable Fed hiking cycle, and naturally one would think that will lead to conditions that slow the economy,” he told Bloomberg Television.

“Volatility still remains high amid banking sector stress and the implications for the Fed and dollar rates,” said Marvin Chen, a strategist at Bloomberg Intelligence.

Meanwhile, Morgan Stanley’s undaunted permabear Michael Wilson said turmoil in the banking sector has left earnings guidance looking too high, putting sanguine stock markets at risk of sharp declines. The strategist said that’s partly due to the divergence in stock and bond market action this month.

European stocks rebounded from Friday's rout, led by Deutsche Bank: the German lender is up 4% as credit defaults swaps retreat, while the Stoxx 600 gains 1.0%. While banks recoup some recent losses, healthcare stocks lead gains as Novartis releases positive new drug results. Here are some of the biggest movers on Monday:

Earlier in the session, Asian stocks fell for a second day as traders continued to monitor the health of the global financial sector, while a slew of lackluster earnings dragged down Chinese technology firms. The MSCI Asia Pacific Index dropped as much as 0.6%, with Hong Kong leading the slump. A gauge of Chinese tech shares slid 2.8% after Meituan and Xiaomi’s earnings disappointed the market. Alibaba pared losses after founder Jack Ma returned to China. Onshore Chinese stocks also fell after official data showed profits at industrial firms plunged in the first two months of the year as factories had yet to fully recover from a Covid-induced slump. Shares in Japan and Australia rose. Investors took profits after Asia’s equity benchmark completed a 1.4% weekly advance amid US and European efforts to stabilize the banking sector. US authorities are considering expanding an emergency lending facility for banks in ways that would give First Republic Bank more time to shore up its balance sheet, according to people with knowledge of the situation. Still, fears of a US slowdown damped investor sentiment after Federal Reserve Bank of Minneapolis President Neel Kashkari said recent bank turmoil has increased the risk of a US recession. “Volatility still remains high amid banking sector stress and the implications for the Fed and dollar rates,” said Marvin Chen, a strategist at Bloomberg Intelligence.

Japanese stocks rose as investors weighed the risk of a US recession and the impact that could have on interest rates. The Topix rose 0.3% to close at 1,961.84, while the Nikkei advanced 0.3% to 27,476.87. Hitachi contributed the most to the Topix gain, increasing 2.1%. Out of 2,159 stocks in the index, 1,462 rose and 590 fell, while 107 were unchanged. Federal Reserve Bank of Minneapolis President Neel Kashkari said recent bank turmoil has increased the risk of a US recession but that it was too soon to judge what it means for the economy and monetary policy. “The Japanese market has calmed down as the uncertainty surrounding US financial institutions receded,” said Hitoshi Asaoka, strategist at Asset Management One. “Some traders are buying for the dividends, but market movement is limited amid strong yen and lingering worries over financials.”

Key stock gauges in India ended higher on Monday, outperforming most of their emerging market peers in Asia, as pharmaceutical and consumer goods companies advanced. The S&P BSE Sensex ended 0.2% higher to close at 57,653.86 in Mumbai, after rising as much as 0.9% following a strong open for European equities. The NSE Nifty 50 Index also advanced by a similar amount to finish at 16,985.70. The MSCI Asia-Pacific index fell 0.7%, while the MSCI Emerging Market Index declined 0.8%. The Indian equity market surrendered early gains as lingering uncertainties around the global banking system, the outlook for interest rates in developed economies and the rising threat of a US recession weighed on risk appetite. Mid- and small-sized companies saw heavy losses, with the Nifty Midcap 100 and Nifty Smallcap 100 gauges ending a volatile Monday, falling 0.5% and 1.6% respectively. Reliance Industries contributed the most to the Sensex’s gains, increasing 1.5%. Out of 30 shares in the index, 16 rose, while 14 fell

Australian stocks rose: the S&P/ASX 200 index edged 0.1% higher to close at 6,962.00, boosted by health care and real estate shares. Markets across Asia fluctuated in cautious trading as investors weighed the risk of recession and its impact on interest rates. Shares of Australian energy companies declined as the government is expected to win approval for its flagship climate policy after agreeing to rules that could limit development of new coal and gas projects. In New Zealand, the S&P/NZX 50 index rose 0.3% to 11,612.86.

In FX, the dollar rose 0.5% versus the yen, while the Bloomberg Dollar Spot Index was little changed after falling 0.8% last week. Investors focus on speeches by several Fed officials this week, which could provide more clues on the US interest rate trajectory.

“The resurgence in banking stress in Europe forces some softening of our bearish dollar view for the moment, at least until we can get more clarity on the stability of the EU banking sector,” ING strategists write, though they still see policy differencials between the Fed and the European Central Bank pointing to a higher EUR/USD. “We continue to see the Fed as mostly carrying downside risks for the greenback, as the lack of clear communication leaves the door open for dovish speculation as the US regional crisis remains unresolved and is keeping the monetary policy outlook in the US in stark contrast (for now) to that of most European central banks.”

In rates, treasuries extended losses into early US session with front-end leading the move lower, leaving 2-year yields cheaper by 16bp on the day, pulling away from a six-month low around 3.55% hit on Friday and paced by bear-flattening in core European rates. US 10-year yield around 3.47%, cheaper by ~10bp vs Friday’s close, with bunds and gilts trading 1.5bp and 3bp cheaper in the sector; front-end-led losses flatten 2s10s, 5s30s spreads by 8bp and 7bp on the day. Treasury auction cycle beings with 2-year note sale at 1pm New York time and 5- and 7-year sales Tuesday and Wednesday. WI 2-year yield around 3.88% is ~80bp richer than February’s stop-out and below auction stops since August.

In commodities, crude futures advance with WTI up 1.3% to trade back above $70. TotalEnergies said 33% of operational staff at its French refineries and depots were on strike on Sunday, according to a Co. spokesperson cited by Reuters. Spot gold is softer given the constructive European tone and as the USD retains an underlying bid with the DXY above 103.00, action which has pressured the yellow metal to a $1965/oz intraday low.

It's a quiet start to the week, with just the March Dallas Fed manufacturing activity at 10:30am on Monday's calendar; the US will sell $57 billion of 13-week and $48 billion of 26-week bills at 11:30 a.m., and $42 billion of two-year notes at 1 p.m. Fed Governor Philip Jefferson is due to speak at 5 p.m.; This week we get consumer confidence, final 4Q GDP revision, personal income and spending (with PCE deflators) and University of Michigan sentiment.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were mixed in mostly rangebound trade as markets took a breather from recent banking sector jitters and with risk appetite also restricted amid lingering geopolitical tensions and heading into quarter-end. ASX 200 eked slight gains with the index supported by strength in utilities and real estate although the upside was capped by weakness in the commodity-related sectors. Nikkei 225 reclaimed the 27,500 level but with further upside limited after firmer than expected Services PPI data from Japan and a fresh round of missile launches by North Korea. Hang Seng and Shanghai Comp. were pressured despite the PBoC's RRR cut taking effect today, as the attention turned to earnings releases with energy leading the downturn in Hong Kong following a decline in Sinopec’s profits and certain tech stocks also weakened after Xiaomi’s quarterly smartphone shipments fell 18.6% Q/Q, while the latest data showed that February YTD Industrial Profits declined by 22.9% Y/Y.

Top Asian News

European bourses are in the green across the board, Euro Stoxx 50 +0.9%, with banking names outperforming initially after the concerns at the tail-end of last week. Specifically, SX7P +1.0% with Deutsche Bank among the best performers as the weekend was devoid of any significantly negative developments with updates generally limited.

Stateside, futures are more tentative with the ES +0.4% firmer and back above 4k after it incrementally lost the figure in the European morning. FRC +24% is bolstered in the pre-market amid reports that the US is considering giving them more time, with banks generally under consideration for additional support from the US. China Commerce Ministries Wentao met with Apple (AAPL) CEO Cook; exchanged views on Cos progress in the region, stabilisation of industry and supply chains. Salesforce (CRM) and Elliott Investment Management issue joint statement; Elliott will not proceed with director nominations.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

Central Banks

DB's Jim Reid concludes the overnight wrap

Obviously matters in the banking sector will continue to set the pace this week. In an age of social media, misinformation can spread like wildfire so you're never sure where the next incredulous story is going to come from alongside the genuine issues. Investors in financials have had their confidence knocked by recent events which has allowed those betting against the sector a free run. If anything some rampant misinformation and fear on Friday morning allowed for an examination of the facts and fundamentals of the large banks and buyers stepped back in with European banks well off the lows by the end of Friday's session with the US bank index turning positive (+0.42%) just before the US close. With the worst of the irrational scare stories around European banks seemingly running out of momentum over the weekend, some reappraisals of the facts should continue this week. Indeed Euro Stoxx futures are up +1.1% in Asia trading with S&P and Nasdaq futures up around +0.5%.

One of our big themes of the last couple of weeks is that medium term corporates are more at risk than financials on the credit side as they are the more levered entities in this cycle. Indeed Steve Caprio in my team has just put out a piece (link here) where we overweight US banks against corporates. Today's $IG credit market is pricing substantial banking sector stress, with little negative spillover to leveraged corporates. On a relative value basis, $IG financials are trading at mid-2008 levels vs. $IG non-financials. The primary reason? Deposit outflows at small US banks. A secondary reason? Investor concerns over bank loan losses, particularly in commercial real estate.

While these dual fears have merit, they may be lacking the nuance needed to appropriately position $IG portfolios in today's environment. And they don't take into account that while banks are trading at 2008 levels vs. corporates, it is corporate leverage that is substantially higher this cycle. So see the piece for more.

Back to Asia, and Treasury yields are little changed with 10yr yields -0.7bps lower while 2yr yields (+1.4bps) are up a bit as we go to print. Asian equities are catching down with Friday's early DM losses with the Hang Seng (-1.25%), Shanghai Composite (-1.05%), the CSI (-0.96%) and KOSPI (-0.21%) trading in the red. Elsewhere, the Nikkei (+0.31%) is bucking the regional negative trend.

Early morning data showed that China’s industrial profits contracted -22.9% in the first two months of 2023 compared to a year ago indicating that factories are yet to fully come out of the Covid-induced slump. Revenues couldn't keep up with costs as the reopening trade emerged. For the whole of 2022, industrial profits declined -4%.

Looking forward, the banking sector will clearly set the scene this week as we approach month-end on Thursday. The data will be a bit secondary as it'll be too early to judge any impact from the mini crisis so far. However there are some important releases with the PCE in the US (Friday), CPIs for Germany (Thursday), the Eurozone and Tokyo (both Friday) keeping inflation data top of mind for investors this week. They’ll probably care a little less than they did before the banking crisis hit though. In addition, an array of consumer and business confidence indicators in the US and Europe are also due and China PMIs on Friday will be important. Perhaps more interesting with be hearing from a deluge of Fed officials as they were on blackout for the SVB crisis up until last week's FOMC. They are back in force this week and we'll therefore get a better idea of the deliberations around last week's 25bps hike and the future of this hiking cycle. See the day by day week ahead at the end for a list of the speaker and data highlights. We’ll expand on the main events below.

We’ll have to wait until the end of the week for the most important datapoint and that’s the Fed's preferred inflation gauge, the PCE, on Friday. Our economists see a +0.36% advance for the core PCE in February (+0.57% in January) and MoM declines for both income (-0.1% vs +0.6% in January) and consumption (-0.6% vs +1.8%). Earlier in the week, a pulse check on the US consumer will come from Conference Board's consumer confidence measure on Wednesday (DB estimates 102.1 vs 102.9 in February).

Over in Europe, all eyes will be on the preliminary inflation readings across the Eurozone. March data for Germany will be out on Thursday, followed by reports for the Eurozone and France on Friday, among others. In terms of forecasts, the team sees March headline at 7.1% (+1.1% MoM) and core at 5.8% (+1.4% MoM). As a reminder, the latest 5.6% core inflation reading is the highest on record. Our team don't expect it to peak until the 6.0% they expect in July.

Apart from the inflation data, there will be an array of sentiment indicators across the bloc as well, with potential preliminary impact of the banking turmoil in focus. Among the gauges are the Ifo survey (today) and consumer confidence (Wednesday) in Germany, as well as manufacturing (tomorrow) and consumer confidence (Wednesday) in France.

Turning to Asia, this week will be a busy one for Japan as well, with one of the key releases being the Tokyo CPI on Friday. Elsewhere in the region, markets will be closely following China's PMI releases on Friday to assess the speed and magnitude of economic recovery. Current median estimates on Bloomberg are pointing to a slight deceleration in both manufacturing (51.8 vs 52.6 in February) and non-manufacturing (54.3 vs 56.3) indicators.

Looking back on last week now, US and European markets diverged on Friday as the US market continued normalising as sentiment improved in the latter half of the week. Meanwhile renewed jitters concerning the stability of the banking sector in Europe gripped markets on Friday. Friday also saw the release of the March flash PMIs for both the US and Europe. The US composite PMI beat expectations at 53.3 (vs 49.5 expected) to land well into expansionary territory, as both manufacturing (49.3 vs 47 expected) and services (53.8 vs 50.3 expected) surpassed forecasts. For the Euro Area, the March composite PMI likewise beat expectations at 54.1 (vs 52 expected). While manufacturing remained in contraction (47.1 vs 49 expected), services demonstrated strength (55.6 vs 52.5 expected) as the energy shock that developed through autumn last year continued to ease.

Despite the strong beats implying latitude for further rate hikes, markets are more focused on the strains from the banking sector and what it might imply for overall economic health. Therefore fed futures ended last week just pricing in a 1 in 4 chance of a +25bps rate hike at the Fed’s May meeting, with the implied rate hike falling -3.9bps on Friday to 6.1bps. For the final Fed meeting of the year in December, the expected rate fell -9.4bps to 3.91% on Friday (+7.8bps on the week) as markets are pricing in over -88bps of rate cuts by year-end.

Against this backdrop, US equity markets once again whipsawed between gains and losses last week, and continued to demonstrate a significant level of dispersion. The S&P 500 closed up +1.39% on the week overall, after ending Friday up +0.56%. Regional banks recovered on Friday led by recent laggards Western Alliance Bancorp (+5.7%), KeyCorp (+5.2%), and Zion Bancorp (+4.1%), while large-cap banks like JPMorgan (-1.5%) and Wells Fargo (-1.0%) fell. Embattled First Republic (-1.4% Friday) closed down -46% on the week, just off its Monday lows, and is now down nearly -90% MTD. Overall in weekly terms, the KBW bank index fell -0.52% (+0.42% on Friday). The testimony of TikTok CEO Shou Zi before the US Congress last week saw the US information technology sector outperform. For example, Meta moved up +5.32% (+0.85% on Friday) and Pinterest up +4.17% (-0.51% on Friday) in weekly terms.

While US assets ended the week with a risk-on tone, European equity markets closed lower as weakness in European banks weighed on sentiment overall. The STOXX 600 was down -1.37% Friday (+0.87% on the week), with the retreat in the banking sector on concerns about financial stability, causing European banks to close down -4.61% (-1.08% in weekly terms). The CAC and DAX also fell back on Friday by -1.74% and -1.66%, but on the week finished up +1.30% and +1.28% respectively.

Sovereign bonds on both sides of the Atlantic outperformed on Friday. 10yr Treasury yields fell -5.0bps on Friday, and down -5.2bps on the week, slipping to their lowest levels since January. Yields on US 2yrs were at their lowest levels since September after falling -7.1bps last week (-6.6bps on Friday). 10yr bund yields similarly retreated on Friday, having fallen -6.6bps, but were up modestly by +2.1bps in week-on-week terms. German 2yrs outperformed on Friday, as yields fell -13.3bps to 2.39% but closed the five days just higher than unchanged (+0.5bps).

Turning to commodity markets, WTI Crude contracts were up +2.77% last week to $69.26/bbl (-1.00% on Friday) and Brent crude up +2.77% to $74.99/bbl (-1.21% on Friday). Copper also had a strong week, up +4.80% (-1.07% on Friday). Finally, the prevailing risk-aversion sentiment failed to penetrate crypto markets, as Bitcoin strongly outperformed, closing up +30.25% on the week (-2.52% on Friday).