For the third day in a row, futures have gone nowhere in the overnight session, and are flat as a pancake with yields also barely changed and holding on to their sharp move higher from the previous day when they surged 14bps; the USD was down, commodities are mixed with oil outperforming again, and crypto and gold staged a modest rebound. At 8:00am ET, emini S&P futures were unchanged at 4,275 while Nasdaq futs were just fractionally in the green after the index yesterday posted its worst decline since April; concern that central banks will keep driving interest rates higher sent tech stocks in Europe to one of the worst performances among industries, with ASML Holding NV as the biggest drag on the Stoxx 600.

In premarket trading, GameStop plunged 18% after firing its chief executive and reporting sales that fell short of estimates. Manchester United is set to extend gains, after rising as much as 5.6% in premarket trading, as Qatar’s Sheikh Jassim submitted his fifth takeover offer for Premier League team. Here are some other notable premarket movers:

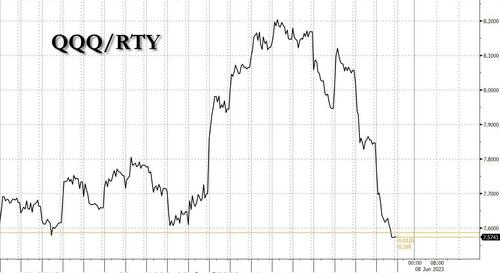

Yesterday, Russell 2000 was the clear standout as the +RTY/-NDX had another 3-sigma move (as discussed here), retracing the move since May 10.

Technology stocks, the most rate sensitive of all equities, have been feeling the pinch as investors consider the possibility that the Fed isn’t finished with its own tightening. Two major central banks this week — the Bank of Canada and the Reserve Bank of Australia — unexpectedly raised rates to bring inflation under control. Sure enough, the US yield curve reacted to the surprise Bank of Canada rate hike; the hike comes after skipping 2 meetings. The bond market is pricing ~80% chance of a 25bps hike by the July 26 meeting. Yields on two-year US Treasuries are hovering near 4.5%, the highest since March, although well below the 5.07% seen before banking turmoil gripped markets back then.

“The key thing to remember is that the fight against inflation isn’t over,” Helen Jewell, EMEA deputy CIO of BlackRock Fundamental Equities, said in an interview with Bloomberg Television. “We’re seeing the stickiness in inflation and concerns coming through from a rate hike perspective.”

Megacap tech companies have powered the S&P 500 to the brink of a bull market, before rate worries prompted Wednesday’s pullback. Policy decisions are due from the Fed and the ECB next week, with the Fed signaling it may pause rate hikes in June before resuming them later. The big question facing markets right now is whether the Fed decides to raise rates next Wednesday or holds after 10 straight increases, Deutsche Bank AG strategists including Jim Reid wrote in a note. Traders have boosted wagers on Fed rate increases, with swaps close to pricing in a quarter-point hike for the July meeting.

“While we still expect the Fed to skip the June meeting, this week’s policy decision which expressed more concern over persistent inflation risks makes us more wary,” said Lee Hardman, a strategist at MUFG Bank. “The hawkish policy updates from the RBA and BOC have injected fresh upward momentum into global yields.”

European tech stocks underperformed on concerns over the potential for central banks to keep raising interest rates. Stoxx 600 is steady with autos and banks outperforming. FTSE MIB outperforms peers, adding 0.7%; FTSE 100 lags, dropping 0.2%. Here are the most notable movers today:

Earlier in the session, Asian shares ticked lower as investors boost bets that the Federal Reserve may continue to raise interest rates and keep them at elevated levels for longer, while the yen strengthened after data showing Japan’s economy grew faster than expected in the first quarter. The MSCI Asia Pacific Index dropped as much as 0.8%, dragged by info tech and communication services shares. Tech stocks including TSMC, Tencent and Samsung Electronics were among the biggest contributors to the gauge’s decline. Most markets in the region traded lower with Taiwan being the worst performer. Benchmarks in the region dropped for a second day after the Bank of Canada unexpectedly resumed hiking its rates, stoking concerns for a further tightening by the Federal Reserve. The move comes after a surprising hike earlier in the week by Australia’s central bank. Meanwhile, Chinese equities in Hong Kong snapped a four-day winning streak following disappointing export data. This has raised hopes for more stimulus measures from the government.

“If there are pressures that are too negative in the domestic economy, I really believe the government will come in with support measures but in a much more, I would say, delicate way” than what was seen earlier, Virginie Maisonneuve, global chief investment officer for equities at Allianz Global Investors, said in an interview with Bloomberg Television. Investors are also awaiting data on foreign buying of Japanese stocks due later this afternoon, given the recent market strength in the world’s third-largest economy

In FX, the Bloomberg dollar spot index fell 0.2%. SEK and CHF are the weakest performers in G-10 FX, NZD and AUD outperform. The Turkish lira continued its merry disintegration.

In rates, Treasuries are slightly cheaper across the curve. US yields cheaper by 1bp-2bp across the curve with 7-year sector underperforming, widening 5s7s10s fly by 1.5bp on the day; 10- year yields around 3.81%, cheaper by 1.5bp on the day with gilts underperforming by 3bp in the sector. Gilts underperform bunds and Treasuries, and lead core European rates lower with 30-year UK cheaper by more than 5bp on the day, while euro money markets cement bets on a 25bp ECB rate hike next week. US session includes weekly jobless claims data.

In commodities, WTI trades within Wednesday’s range, falling 0.4% to near $72.21. Spot gold rises roughly $8 to trade near $1,948/oz

To the day ahead now, it’s an incredibly quiet one on the calendar, with one of the few highlights being the US weekly initial jobless claims.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were mostly subdued following the mixed handover from Wall St where tech underperformed as global yields climbed after the surprise BoC rate hike. ASX 200 traded rangebound as gains in the commodity-related sectors were offset by underperformance in property and tech, while softer trade data from Australia added to the non-committal mood. Nikkei 225 was initially choppy but eventually retreated firmly beneath the 32,000 level despite the stronger-than-expected upward revisions to Japan's Q1 GDP. Hang Seng and Shanghai Comp. were lacklustre amid the ongoing growth concerns surrounding the world’s second- largest economy although the losses stemmed after China's Big 4 banks reduced their deposit rates following calls from the government to help bolster the economy.

Top Asian News

European bourses are mixed/flat with newsflow limited and the region alongside broader assets largely struggling for direction into a sparse docket. Sectors are mixed overall; Basic Resources outperform as metals lift slightly and on a Rio Tinto upgrade while Tech and Healthcare names lag. Stateside, futures paint a similar picture but feature incremental underperformance in the NQ and outperformance in RTY which continues its recent strength amid a rotation into small caps. Tesla (TSLA) is asking several Chinese supply chain companies to build factories in Mexico to replicate a Giga Shanghai and its supply chain system there, according to a report cited by CnEVPost. Meta (META) voluntary child protection appears not to work, according to EU's Bretton via a Reuters exclusive; calls on CEO to explain and take immediate action.

Top European News

FX

Fixed Income

Commodities

Crypto

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

With less than a week to go until the Fed’s next decision, yesterday offered another hawkish surprise for markets after the Bank of Canada delivered an unexpected 25bp rate hike. Now that might be just one central bank, but it comes on the back of a similar surprise hike from the Reserve Bank of Australia the previous day, so investors are starting to see a pattern emerging here and there was a significant bond selloff as a result. The latest developments have also run against the prevailing narrative that central banks are on the verge of pausing their rate hikes, particularly given Canada was one of the first to formally signal a pause back in January. The big question now is whether the Fed might follow up with a hike of their own next Wednesday, or whether they’ll finally keep rates on hold after 10 consecutive increases.

When it came to the Bank of Canada, they announced they were taking their overnight rate up to a post-2001 high of 4.75%, and their statement said that that “excess demand in the economy looks to be more persistent than anticipated”. In light of this, they wrote that “concerns have increased that CPI inflation could get stuck materially above the 2% target”, and they said they were hiking since “monetary policy was not sufficiently restrictive to bring supply and demand back into balance and return inflation sustainably to the 2% target.” Looking forward, they didn’t provide too much of a steer on future policy, but markets then moved to price in a further hike in July as the most likely outcome.

That surprise rate hike sparked a big selloff among sovereign bonds. Unsurprisingly, Canada was at the epicentre of this, and their 10yr government bond yield was up +16.3bps on the day to their highest level since early March. That was echoed among US Treasuries, where the 10yr yield (+13.5bps) rose to 3.80%, and the 2yr yield (+7.8bps) hit a post-SVB high of 4.56%. There was a strong rise in real yields too, with the 2yr real yield (+9.2bps) closing at a post-GFC high yesterday of 2.49%, and the 10yr real yield (+11.7bps) closing at a post-SVB high of 1.59%. So it’s clear that investors are pricing in the prospect of higher rates for longer.

When it comes to next week’s Fed decision, it’s hard to get a firm steer on things given that officials are now in their blackout period ahead of the meeting. Nevertheless, the decision from the Bank of Canada meant that futures moved to price in a 35% chance of a hike, up from 19% as of close on Tuesday. At the same time, investors also grew more sceptical that the Fed would end up cutting rates this year at all, with the rate priced in by the December meeting up to a post-SVB high at 5.03%. Bear in mind that after the Fed’s last meeting in May, that rate expected in December was priced at 4.18%. So in just over a month, we’ve had around 85bps of expected cuts for this year taken out of market pricing.

This selloff was evident in Europe as well, with yields on 10yr bunds (+8.3bps), OATs (+9.4bps) and BTPs (+15.1bps) all moving higher. That came as ECB speakers continued to signal another rate hike next week. For instance, Isabel Schnabel of the Executive Board said that “we have more ground to cover” in an interview with De Tijd that was conducted last week but released yesterday. Along these lines, Ireland’s Makhlouf said that “more work is needed from monetary policy in the short run” and the Netherlands’ Knot said that he was “not yet convinced that the current tightening is sufficient”. All this meant markets priced in more rate hikes over the rest of the year, with the rate priced in for the December meeting up +4.0bps on the day.

This backdrop meant that equities struggled, and the S&P 500 (-0.38%) saw a pullback that took it further away from bull market territory. For once, tech stocks actually underperformed, and the NASDAQ (-1.29%) came off its one-year high from the previous day, whilst the FANG+ index (-2.91%) saw even larger declines. On the other hand, energy stocks were the biggest outperformer, having been aided by a rebound in commodity prices over recent days. Indeed, Brent Crude closed up +0.87% to $76.95/bbl, marking its highest level in 8 trading sessions. Otherwise in Europe it was much the same story, and the STOXX 600 (-0.19%) posted a small decline.

Broadly speaking, this pattern has continued overnight in Asia, with some fresh momentum after data revisions showed that Japan’s Q1 GDP growth was faster than initially thought. Specifically, growth was revised up to an annualised rate of +2.7%, which was above the initial +1.6% estimate, as well as economists’ expectations of a +1.9% reading. That’s meant that bonds have continued to lose ground across the region, and yields on 10yr Australian (+15.0bps) and New Zealand (+12.1bps) government debt have seen some strong increases this morning. The major equity indices have experienced losses too, with the Nikkei (-0.96%), the KOSPI (-0.64%), the Hang Seng (-0.39%) and the Shanghai Comp (-0.12%) all falling back. The main exception is the CSI 300 (+0.09%) which has posted modest gains. Looking forward, US and European equities futures are pointing towards more losses today as well, with those on the S&P 500 currently down -0.18%.

There was little in the way of economic data yesterday. German industrial production saw a small rebound in April (+0.3% mom vs +0.6% expected) but with the March decline revised upward (from -3.4% to -2.1%). The OECD published their latest economic outlook, with a view that global growth would come in at 2.7% this year, before picking up slightly to 2.9% in 2024.

To the day ahead now, it’s an incredibly quiet one on the calendar, with one of the few highlights being the US weekly initial jobless claims.