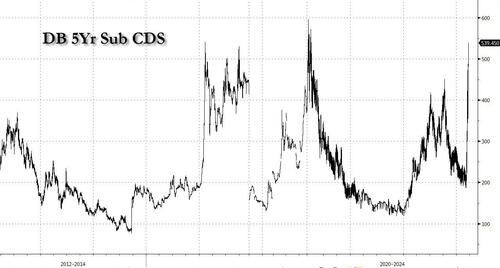

Yesterday, while attention was still focused on the US banking system and the ongoing botched response by the Fed and especially the Treasury's senile Secretary, who more than two weeks after SIVB collapsed, have still not been able to stabilize confidence in banks - thereby assuring the US is about to slam head first into a brutal recession, just as Biden ordered to contain inflation, as US consumer spending is now in freefall - we pointed out that something bad was taking place in Europe: the credit default swaps of perpetually semi-solvent banking giant Deutsche Bank were quietly blowing out to multi-year highs.

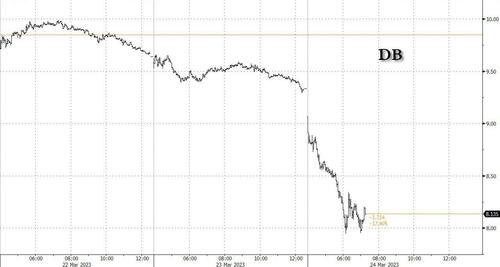

Well, we didn't have long to wait before everyone else also noticed and this morning it's official: the crisis has shifted to Germany's and Europe's largest TBTF bank, with even Bloomberg now writing that Deutsche Bank "has become the latest focus of the banking turmoil in Europe as ongoing concern about the industry sent its shares slumping the most in three years and the cost of insuring against default rising." The bank - which has staged a recovery in recent years after a series of crises that nearly brought it down - said Friday it will redeem a tier 2 subordinated bond early. And while such moves are usually intended to give investors confidence in the strength of the balance sheet, though the share price reaction suggests the message isn’t getting through, and the stock plunged 13% in German trading...

... while DB's CDS has exploded to level surpassing the bank's near-collapse in 2016, and is about to take out the covid wides.

“It is a clear case of the market selling first and asking questions later,” said Paul de la Baume, senior market strategist at FlowBank SA. “Traders do not have the risk appetite to hold positions through the weekend, given the banking risk and what happened last week with Credit Suisse and regulators.”

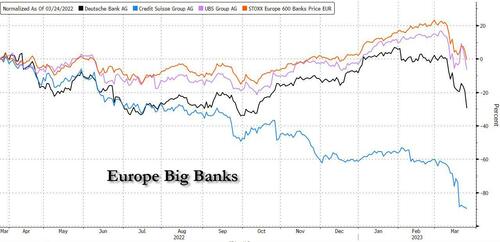

It wasn't just Deutsche Bank: UBS Group AG shares also dropped as Bloomberg reported that it’s one of the banks under scrutiny in a US Justice Department probe into whether finncial professionals helped Russian oligarchs evade sanctions, according to people familiar with the matter. In any case, the sudden, violent spike in DB default risk which quickly carried over to all big European banks, and which will not reverse until first the ECB then the Fed both cut rates...

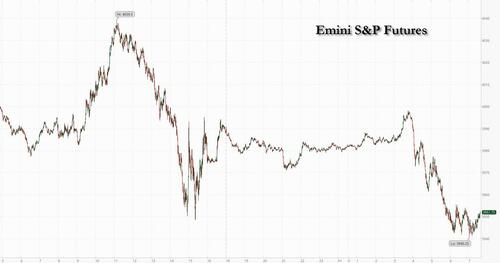

... sent broader risk sentiment reeling with S&P 500 futures at session lows, sliding 1% to 3940.

While there was no one big story setting off these moves. It could be a rush to havens heading into the weekend as traders wait for another shoe to drop — which has been a theme during recent weekends.

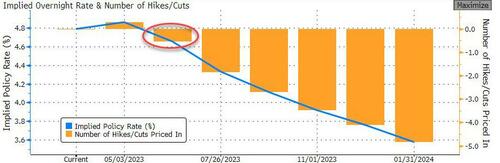

In any case, the latest global equity rout and bank crisis which is now spreading to TBTF banks has sent bond yields crashing with the 2-year US yield plumbing new session lows, breaking down as low as 3.55%, and the resulting shockwave has collapsed odds of another rate hike in May to just 28% while the odds of a rate cut in June have exploded to 83% as the Fed's pivot finally arrives just on time: with the Fed having again broken the global financial system.

In premarket trading, First Republic Bank swung between gains and losses as investors digested Treasury Secretary Janet Yellen’s comments about regulators being prepared to take additional steps to guard bank deposits if warranted. Fellow regional banks and bigger lenders decline, and after a volatile session on Thursday took the stock’s March slump to 90%. Block fell another 5%, extending Thursday’s 15% plunge as it announced potential legal action against short seller Hindenburg Research for its report on the payment processor. Here are some other notable premarket movers:

“Confidence is fragile, market volatility is likely to stay high, and policymakers may have to go further to make sure faith in the global financial system stays solid,” said Mark Haefele, chief investment officer at UBS Wealth Management. “Financial conditions are also likely to tighten, which increases the risk of a hard landing for the economy, even if central banks ease off on interest-rate hikes.”

“Credit and stock markets too greedy for rate cuts, not fearful enough of recession,” a team led by Michael Hartnett wrote in a note. The strategist, who was correctly bearish through last year, said investment-grade spreads and stocks will be taking a hit over the next three to six months. Global cash funds had inflows of nearly $143 billion, the largest since March 2020 in the week through Wednesday — adding up to more than $300 billion over the past four weeks, according to the note citing EPFR Global data.

European stocks are also plumbing lower, with European bank stocks sliding for a third day, and erasing weekly and yearly gains, as sentiment remains fragile on the sector. Deutsche Bank slumped nearly 15% as credit-default swaps surged amid wider concerns about the stability of the banking sector. The Stoxx 600 Banks Index is 5.3% lower as of 11:20am in London, erasing earlier weekly gains; the index is now -2.8% YTD. Meanwhile, UBS, which is not in the banking sector index, slumped as much as 8.4% as Jefferies cut its rating to hold from buy and it was among the banks under scrutiny in a US Justice Department probe into whether financial professionals helped Russian oligarchs evade sanctions. European oil stocks are also underperforming on Friday, dragging down the regional benchmark, as crude prices slump under pressure from a stronger dollar and concerns about the impact on growth of a fresh bout of stress facing the banking sector. The Energy sub-index slid as much as 4.3%, the most since March 15, while the Stoxx Europe 600 benchmark fell about 2%. Here are some other notable European movers:

Earlier in the session, Asia equities were set to snap a three-day rally as lingering concerns over the health of the banking sector pushed a gauge of the region’s financial shares lower. The MSCI Asia Pacific Index fell as much as 0.5% before trimming losses, with its 11 sectoral sub-gauges showing mixed moves. Most markets declined, led by Hong Kong’s Hang Seng Index, while Chinese tech shares extended their rally on the back of positive earnings. An index of Asian financial stocks dropped as much as 0.9%, tracking overnight declines in a measure of US financial heavyweights to the lowest since November 2020. Treasury Secretary Janet Yellen’s comments that authorities can take further steps to protect the banking system if needed failed to fully assuage concerns.

“The unease in the financial space will continue to weigh on the Asian financial sectors,” said Hebe Chen, an analyst at IG Markets Ltd. “The flip-flop in the market this week is seeing overwhelmed investors scratching their heads in the face of the mixed bag from Fed.” Even with Friday’s lackluster moves, the MSCI Asia benchmark was set to notch its best weekly performance in about two months. The shares rose earlier in the week thanks to assurances from regulators in the US and Europe over protecting the banking sector and the Federal Reserve’s dovish tilt. Meanwhile, a gauge of tech stocks in Hong Kong advanced for the fourth day close at its highest in a month. Lenovo led the gain, with JPMorgan lifting its recommendation on a bottoming of PC demand. “We like the internet sector, especially within China right now,” Marcella Chow, JPMorgan Asset Management’s global market strategist, said in an interview with Bloomberg TV. “China tech sector is attractive given improving regulatory outlook, leaner and more cost effective cost structure, improving margin.”

Japanese stocks Inched lower as worries linger over the financial sector while investors assess statements made by US Treasury Secretary Janet Yellen. The Topix Index fell 0.1% to 1,955.32 as of market close Tokyo time, while the Nikkei declined 0.1% to 27,385.25. Mitsubishi UFJ Financial Group Inc. contributed the most to the Topix Index decline, decreasing 1.1%. Out of 2,159 stocks in the index, 976 rose and 1,039 fell, while 144 were unchanged. “Assuming that the fallout from the US financial sector woes doesn’t spread significantly, Japanese stocks will likely stop its decline and pick up as the earnings period starts next month,” said Takeru Ogihara, a chief strategist at Asset Management One

Australian stocks slumped to post a seventh week of losses; the S&P/ASX 200 index fell 0.2% to close at 6,955.20, with financials the biggest drag, as the malaise hanging over the global banking sector continued to damp sentiment. The benchmark erased 0.6% for the week, the seventh straight decline, maintaining the longest losing streak since 2008. In New Zealand, the S&P/NZX 50 index fell 0.1% to 11,580.82.

Indian stocks declined for a third straight week in the longest losing streak since December spurred by a late selloff in key gauges amid risk-off sentiment in global equities. The Nifty 50 index ended just shy of entering a so-called technical correction given the index’s near 10% drop from its December peak. For the week, the Nifty 50 fell 0.9% while the Sensex declined 0.8%. The S&P BSE Sensex fell 0.7% to 57,527.10 as of 3:30 p.m. in Mumbai, while the NSE Nifty 50 Index declined 0.8% to 16,945.05. The selloff in small and mid cap counters contributed to the broader losses, with the Nifty Mid cap 100 and Nifty Small Cap 100 indexes ending nearly 2% lower each. Stocks of asset management companies were hammered after the government dropped the benefit of long-term capital gains tax for debt mutual funds in order to ensure parity in tax treatment with other such products. Shares of HDFC AMC dropped 4.1%, Aditya Birla AMC -2%, UTI AMC -4.8% and Nippon Life India AMC -1.2%. Reliance Industries contributed the most to the index decline, decreasing 2%. Out of 30 shares in the Sensex index, six rose and 24 fell

In FX, the dollar’s recent weakness, which had supported the outlook for the region’s currencies and other assets, also took a breather on Friday. The Bloomberg dollar index rose 0.3% after a six-day run of declines. The yen rallies to the highest in six weeks amid demand for haven assets due to concerns over the health of the global banking sector. The yen was the biggest gainer versus the greenback among the Group-of-10 currencies. Treasury yields continued to decline reflecting expectations for Federal Reserve rate cuts this year

“JPY’s strong performance we believe is driven by the return of its safe haven appeal, especially given that we see that Japanese banks are in a relatively better standing,” said Alan Lau, a strategist at Malayan Banking Bhd in Singapore. “Falling UST yields have also given the JPY support recently. Overall, we are positive on the yen and see the spot being on a downward trend this year with our year-end forecast at 122”

In rates, Treasuries front-end adds to Thursday’s gains, with 2-year yields richer by over 20bp on the day, as the yield continues to plumb new session lows, breaking as low as 3.55%, dropping below th 2023 lows, and steepening the curve as traders continue to price out rate-hike premium for the May meeting and start pricing for cuts as early as June. Yields were near lows of the day while rest of the curve is richer by 17bp across belly to 9bp out to long-end; front-end led gains steepens 2s10s, 5s30s by 10bp and 8bp on the day. SOFR white-pack futures surge higher, with gains led by Dec23 contract which rallied 27bp vs. Thursday close; Fed-dated OIS shows just 4bp of rate hike premium for the May policy meeting with almost a full cut then priced into the June policy meeting — around 120bp of rate hikes are then priced into year-end

In commodities, oil slipped the most in over a week, with Brent below $75, tracking a slide in equity markets and feeling the effects of a stronger dollar. Aluminum and copper headed toward their biggest weekly gains in more than two months on increasing demand in China and bets on looser Federal Reserve policy. Uranium Energy is among the most active resources stocks in premarket trading, falling about 9%. Gold traded just shy of $2000 and is about to break solidly higher.

To the day ahead now, and data releases include the March flash PMIs from Europe and the US, along with UK retail sales for February, and the preliminary US durable goods orders for February. Otherwise from central banks, we’ll hear from the ECB’s De Cos, Nagel and Centeno, the Fed’s Bullard and the BoE’s Mann.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly subdued after the recent bout of central bank rate hikes and choppy performance stateside where Wall Street just about closed higher amid a dovish market repricing of Fed rate expectations. ASX 200 was lower with risk appetite sapped by weak PMI data which returned to contraction territory. Nikkei 225 lacked conviction after the latest inflation data printed mostly in line with estimates. Hang Seng and Shanghai Comp. retreated after the central bank drained liquidity and as participants digest earnings releases, while it was also reported that the US added 14 Chinese entities to the red flag list.

Top Asian News

Equities are back under marked pressure as banking sector concern re-intensifies within Europe, Euro Stoxx 50 -2.3% & ES -0.8%. Specifically, the European banking index SX7P -5.0% is the standout laggard amid broad-based pressure in banking names as CDS' for the stocks continue to rise alongside focus on the redemption of notes by Deutsche Bank and Lloyds; currently, Deutsche Bank -12% is the Stoxx 600 laggard. Stateside, futures are pressured in tandem with the above price action though with the magnitude less pronounced ahead of the arrival of US players and as we await potential updates to the regions own banking names. Apple (AAPL) supplier Pegatron (4982 TW) is reportedly looking to open a second factory within India, to construct the latest iPhone models, via Reuters citing sources.

Top European News

Bank headlines

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

There's a bad bout of conjunctivitis going round the school at the moment and every member of the family has now had it with the last hold out being me until yesterday. So my eyes are a bit blurry this morning looking at screens. One of the twins believes he has conjunctiv"eye-test" as he thinks it's called. If he hadn't given it to me I'd think he was quite sweet.

As I was looking at screens last night through weepy eyes, markets looked like they were trying to normalise. However late weakness in financials again was a big drag on the last couple of hours of US trading. Just after the European close, the S&P 500 was up over +1.2% and looked set to reverse a good portion of the previous day’s losses. However by the end of the session, further weakness in banks and cyclicals more broadly left the index only +0.30%, but having been down nearly half a percent with 30 minutes left in trading. The VIX, which intraday was near its lowest level (20.18) since the SVB issues became prominent, ended the day 0.35pts higher at 22.6. Today we'll see if the flash PMIs around the world are impacted by the early part of the mini banking crisis we've seen in the last two weeks. So watch the European and US numbers carefully.

The renewed weakness in banks yesterday actually started in Europe with the STOXX Banks index down -2.27%. The STOXX 600 recovered from an intraday low of almost -1.0% to finish -0.21% lower overall. CDS markets highlighted the stress in European financials as the Subordinated Financial CDS index widened (+20bps) for the first time since last Friday – before the CS-UBS merger news – while the Senior CDS index was +9bps wider. In the US, the Regional bank ETF, KRE, was down -2.78% yesterday whilst the broader KBW Bank index was -1.73% lower as liquidity concerns of the smaller banks continue to permeate.

Staying with bank liquidity, after the US close last night, the Fed’s weekly balance sheet data showed that the use of the Fed’s discount window was down from $153bn to $110bn, while the credit deployed to SVB and Signature was up from 143bn to 180bn, and lastly the new emergency bank lending facility (BTFP) was up from $12bn to $54bn. So net of the two failed banks there was little change, indicating that banks were not finding it necessary to access cheap capital. The market should look favourably on that from a contagion standpoint. Overnight S&P and Nasdaq futures are both up around +0.2% and 2 and 10yr UST yields are both around -4.5bps lower as we go to press.

Far before that balance sheet data came out the S&P 500 opened much stronger, up +1.8% and stayed buoyant through the first three hours of trading, before the weakness in regional banks weighed on overall sentiment throughout the US afternoon. This was most pronounced with a bout of selling just before Treasury Secretary Yellen spoke in front of a House of Representatives subcommittee an hour or so before the US close. The selling might have been nervousness ahead of her remarks, given the negative market reaction to her comments before the Senate on Wednesday. Regardless, the S&P actually saw a +1.0% whipsaw move when Yellen said that the US government was “prepared for additional deposit action if warranted.” This was quickly faded, with the index continuing to trade between smaller gains and losses until it ended the day +0.30% higher.

Despite the weakness in banks and Energy (-1.4%) on the back of lower oil prices, the S&P finished in the green thanks to Tech stocks outperforming on the lower rate outlook. The FANG+ index surged by +2.53%, whilst the NASDAQ 100’s gains (+1.19%) mean it’s now up nearly 20% from its lows at the end of December, almost meeting the traditional definition of a bull market.

On the rates side, 10yr Treasury yields held up for the most part, with the 10yr yield -0.08bps to 3.427%. Short-dated rates were another story, with 2yr yields -10.4bps lower to 3.833% fully on the back of lower inflation expectations (-13.3bps), while 5yr rates were -7.2bps lower. This saw the 2s10s yield curve normalise a further +9.4bps yesterday to -41.3bps, which is the least inverted the curve has been in over 5 months. This drop in yields led by inflation expectations was also borne out in fed future pricing, where the market now only sees a 40% chance of a 25bp hike during the May meeting.

In Europe there was a sharp decline in longer dated yields that accelerated later in the session, with yields on 10yr bunds (-13.3bps), OATs (-12.3bps) and BTPs (-10.4bps) all moving lower. Furthermore, those moves came in spite of some of the ECB’s hawks calling for further tightening. For example, Austria’s Holzmann said that the ECB would “probably have to add” to its rate hikes at the next meeting in May. And the Netherlands’ Knot said that “I still think that we need to make another step in May, but I don’t know the size of that”.

Speaking of central banks, we had the Bank of England’s latest decision yesterday, who hiked rates by 25bps as expected. That takes the Bank Rate up to a post-2008 high of 4.25%, and 7 of the 9 MPC members were in support, with the other 2 preferring to remain on hold. Looking forward, the BoE said that they still expected inflation “to fall significantly” in Q2, aided by falling energy prices and the government’s move to extend the Energy Price Guarantee in last week’s budget. And when it comes to inflationary pressures, they said that if “there were to be evidence of more persistent pressures, then further tightening in monetary policy would be required.”

In his review (link here), our UK economist writes that while he sees some upside to growth and pay, there are downsides to services CPI and credit conditions, making the next meeting in May a difficult decision to call. On balance, he sees more downside risks than upside, and holds onto his call for the Bank Rate to remain where it is at 4.25%, with the risks tilted to one further hike.

Whilst we’re on central banks, yesterday also saw the Swiss National Bank hike rates by 50bps, taking the policy rate up to 1.5%. There were a number of hawkish-leaning details, including an upgrade in their inflation forecast relative to December, and their statement said that inflation was “still clearly above the range the SNB equates with price stability.” In the meantime, SNB President Jordan said that a “Credit Suisse bankruptcy would have had serious consequences for national and international financial stability and for the Swiss economy” and that “taking this risk would have been irresponsible.”

This morning in Asia equity markets are lower with the KOSPI (-0.72%) the biggest underperformer with the Nikkei (-0.41%), the Shanghai Composite (-0.54%), the CSI (-0.27%) and the Hang Seng (-0.21%) trading in negative territory.

Data from Japan has shown that consumer price inflation (+3.3% y/y) slowed in line with forecasts but for the first time in 13 months in February, compared to a +4.3% increase in January, mainly due to the effect of government’s energy subsidy program. At the same time, core-core CPI (excluding both fresh food and fuel costs) advanced further to +3.5% y/y in February (v/s +3.4% expected), notching the fastest y-o-y gain since January 1982. It followed a +3.2% increase in January highlighting the underlying inflationary pressures. Staying with Japan, the preliminary estimate for manufacturing PMI showed that sector activity remained in contraction for the fifth consecutive month in March after the reading came in at 48.6, albeit up from the previous month’s final reading of 47.7 as output and new orders remained under pressure. On the contrary, activity in the services sector expanded for the seventh straight month in March as the PMI edged up to 54.2, recording the fastest pace since October 2013, against prior month's reading of 54.0.

Elsewhere, manufacturing as well as services in Australia slipped into contractionary territory as the manufacturing PMI fell to 48.7 in March from 50.5 in February with the services PMI deteriorating to 48.2 from the prior print of 50.7.

When it came to yesterday’s data, the US weekly initial jobless claims came in at a 3-week low of 191k over the week ending March 18 (vs. 197k expected), pointing to continued strength in the labour market. Continuing claims saw a small increase to 1694k (1690k expected) and remains in a slight up-trend but not at a concerning level yet. Meanwhile, the new home sales data for February showed a modest rise to an annualised rate of 640k (vs. 650k expected), taking them up to a 6-month high. Over in the Euro Area, the European Commission’s preliminary consumer confidence data for March showed a decline to -19.2 (vs. -18.2 expected), marking a reduction after 5 consecutive monthly improvements.

To the day ahead now, and data releases include the March flash PMIs from Europe and the US, along with UK retail sales for February, and the preliminary US durable goods orders for February. Otherwise from central banks, we’ll hear from the ECB’s De Cos, Nagel and Centeno, the Fed’s Bullard and the BoE’s Mann.