Futures are tumbling this morning, hit by disappointing earnings and outllook from the largest US bank, JPMorgan whose stock is down around 3% in a soggy launch to Q1 earnings season, while growing fears of an imminent conflict between Israel and Iran have sent oil surging and futures sliding. As of 8:45am, S&P futures are down 0.7%, at session lows with Nasdaq also dumping after reports China has asked its telecom carriers to start phasing out foreign chips. The drop comes as we see safe having flows move capital into TSYs with bond yields sliding up to 10bps this morning. That said, the USD is higher again with the euro and cable sliding sharply. Commodities are mixed: oil and gold rally amid Middle East tension; base metals are lower amid lower-than-expected China exports (-7.5% vs. -1.9% survey vs. 5.6% prior), while the gold explosion documented last night continues, with gold futures trading just above $2,400 and spot trading just below. Today, the main focus will be banks earnings (C, JPM, WFC). We will also receive Univ. of Mich. Sentiment data.

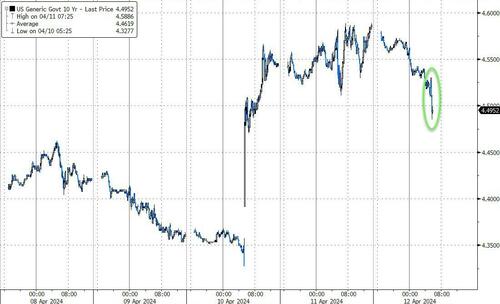

Bonds are bid also, 10Y -9bps...

In premarket trading, MegaCap tech are mostly lower: GOOG -45bp, TSLA -1.1%, while semis are lower amid headlines on China cutting American chip makers out of its telecoms systems (AMD -1.8%, INTC -1.7%, MU -94bp). Here are the most notable European movers:

The biggest highlight in premarket trading, however, was JPMorgan which dropped as much as 4.4% in premarket after its outlook for full-year net interest income missed expectations. Citigroup Inc. gained after its first-quarter profit topped estimates. Contracts for the S&P 500 fell 0.4%, while those on the Nasdaq 100 slid 0.5% after tech stocks jumped 1.7% Thursday. BlackRock rose in premarket after the world’s largest money manager reported a record $10.5 trillion in client assets. Wells Fargo shares retraced a slump after a miss on NII in its first-quarter report. State Street Corp. gained after its earnings beat estimates.

Separately, attention is also focused on the growing conflict between Iran and Israel where moments ago we got the following flashing red headline which hammered futures to session lows:

While there is nothing new there, we have heard that several times in the past few days, today the market is extra sensitive and it is sending oil surging, with WTI above $86 and Brent well into the $90.

European stocks were on course for their best day this month, with mining and energy shares leading gains amid a rally in oil and metals, however the gains have fizzled as geopol concerns emerge. The Stoxx 600 is up 0.6% after rising 1% earlier.

Earlier in the session, Asian equities slipped Friday with Hong Kong and South Korea leading the losses, as the region lacks positive momentum following a recent rebound. The MSCI Asia Pacific Index dropped as much as 0.2% in its third straight day of declines, the longest falling streak since early February. Chinese technology stocks including Alibaba and Tencent, as well as South Korea’s Samsung Electronics, were among the biggest contributors to the drop.Hong Kong markets underperformed, with the Hang Seng China Enterprises Index retreating after entering a so-called technical bull market earlier this week. Sentiment has turned cautious after Chinese price data released Thursday underscored deflationary pressures, putting a dampener on budding optimism that the economy is recovering.

In FX, the Bloomberg Dollar Index rises 0.4% while the euro sank to the weakest level against the dollar in five months as prospects grow that the European Central Bank will start cutting rates in June, well before the Federal Reserve can begin easing because of stubborn US inflation. Markets are pricing three rate cuts in the euro zone this year and fewer than two by the Fed. The Swedish krona is the worst performer among the G-10 currencies, falling 0.8% versus the greenback after CPI rose less than expected in March.

Treasuries rise after a steep two-day fall, with US 10-year yields dropping 8bps to 4.50% after surging 22 basis points in the previous two sessions. Data Thursday showed US producer prices in March increased less than forecast, sparking relief after consumer-price growth exceeded forecasts the previous day. German 10-year yields fall 9bps after ECB’s Stournaras said it is time for the ECB to diverge from the Fed. The 10-year Treasury yield dropped seven basis points. Strategists at Bank of America Corp. said a rare rally in both tech stocks and commodities, combined with a jump in bond yields, has echoes of periods when bubbles are forming. The unusual price moves are consistent with bets that interest rates will stay higher for longer while economic growth remains strong — a so-called no-landing scenario.

While that narrative is “correctly in vogue,” there’s also a risk of higher inflation and an increased cost of capital, the strategists led by Michael Hartnett wrote. The price action is “typical of bubbly markets,” according to Hartnett, who makes a comparison with the pre-tech bubble period of 1999.

In commodities, WTI rises 2% to trade near $87 a barrel; spot gold rises 0.9% having earlier topped $2,400/oz for the first time while copper rises 2.3% to the highest since June 2022. Iron ore headed for its best week in two years on speculation that China’s economy may be on the mend, buoying the outlook for demand. A rally in industrial metals strengthened, with zinc rising to a one-year high on increased risks to supply.

To the day ahead now, and the Bank of England will release the Bernanke review on forecasting. Central bank speakers include the BoE’s Greene, the ECB’s Elderson, and the Fed’s Collins, Schmid, Bostic and Daly. Data releases include the UK GDP reading for February, and in the US there’s the University of Michigan’s preliminary consumer sentiment index for April. Finally, earnings releases include JPMorgan, Citigroup, Wells Fargo and BlackRock.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed despite the gains on Wall St where softer-than-expected PPI eased some inflationary fears, while participants in the region were also cautious as they awaited the latest Chinese trade data. ASX 200 marginally declined as weakness in consumer-related sectors overshadowed the gains in gold miners. Nikkei 225 was underpinned on the back of a weaker currency and despite the selling pressure in Fast Retailing. Hang Seng and Shanghai Comp. were somewhat varied with underperformance in Hong Kong amid broad selling after the local benchmark index pulled back from the 17,000 level, while the mainland struggled for direction leading into the Chinese trade data.

Top Asian News

European bourses, Stoxx600 (+1.1%), jumped higher at the open and continued to make session highs as the morning progressed, though upward momentum has slowed in recent trade as we await US bank earnings. European sectors are firmer across the board; Once again Basic Resources and Energy top the pile, lifted by gains in the commodities complex. Optimised Personal Care is found at the foot of the pile. US Equity Futures (ES U/C, NQ -0.1%, RTY U/C) are trading on either side of the unchanged mark, seemingly taking a breather following strong Stateside performance in the prior session; Intel (-1.8%) and AMD (-1.9%) pressured in the pre-market on China-related reports via the WSJ.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

Central Bank Speakers

DB's Jim Reid concludes the overnight wrap

It’s been a volatile 24 hours in markets, with bonds continuing to struggle thanks to concerns about inflation, whilst equities saw a tech-led rebound that meant the NASDAQ (+1.68%) closed at an all-time high. To be fair, front-end yields did stabilise after Wednesday’s dramatic selloff, as the US PPI release was softer than many feared, and the ECB added to the signals that they might cut rates at the next meeting. But ultimately, the big picture is that inflation is still proving more resilient than expected, whilst the chance of a Fed rate cut in H1 is seen as increasingly remote. Alongside that, several geopolitical concerns remain in the background, and gold prices (+1.65%) closed at a record high yesterday of $2,372/oz.

With that in mind, yesterday brought another bond selloff on both sides of the Atlantic, and 10yr yields across several countries hit their highest level since late-2023. In the US, the 10yr yield was up +4.3bps to 4.59%, which is its highest level since November, although overnight there’s been a -1.6bps pullback to 4.57%. This was driven by a fresh rise in real yields, with the 10yr real yield (+4.8bps) also up to a post-November high of 2.18%. Meanwhile at the front end, yesterday saw a modest decline in the 2yr yield (-1.2bps) to 4.96%, but that comes in the context of a +23bps increase the previous day, leaving it up by more than +20bps relative to its pre-CPI levels.

That pullback in front-end yields was in large part down to the PPI inflation print for March, with the 2yr yield having momentarily traded at 5% immediately before the release. That showed headline PPI at +0.2% on a monthly basis (vs. +0.3% expected), which meant the year-on-year measure rose to +2.1% (vs. +2.2% expected). Although it was only slightly beneath expectations, monthly moves in PPI components that feed into core PCE inflation came in on the weaker side, including airfares (-1.8%) and healthcare services (0.0%). So a big relief to investors after the upside surprise in CPI the previous day. It also meant futures raised the chance the Fed would still cut rates by July, which moved up from a 50% to a 56% chance after yesterday’s session, with a further rise this morning to 58%.

When it came to Fed officials themselves, their remarks yesterday signalled they weren’t in a hurry to cut rates. For instance, New York Fed President Williams said “There’s no clear need to adjust policy in the very near term”. Meanwhile, Boston Fed President Collins said that the recent data “implies that less easing of policy this year than previously thought may be warranted.” And Richmond Fed President Barkin said that “We’re not yet where we want to be” when it came to inflation.

In light of recent developments, DB’s US economists have now materially adjusted their Fed view for this year. They now only expect one rate cut at the December FOMC meeting, followed by modest further reductions in 2025. Beyond that, they expect the Fed to guide the policy rate back towards a neutral level, that is likely just below 4% by the end of 2026. And although a rate cut in July is still possible, their view is that it would need a string of more favourable inflation prints than they forecast, as well as some softening in the labour market and tightening in financial conditions. See the report here for more details on their latest forecast.

Speaking of central banks, we had the latest ECB decision earlier in the day, who left their deposit rate at 4% as expected. However, their statement suggested that they were moving closer to rate cuts, as it said “If the Governing Council’s updated assessment of the inflation outlook, the dynamics of underlying inflation and the strength of monetary policy transmission were to further increase its confidence that inflation is converging to the target in a sustained manner, it would be appropriate to reduce the current level of monetary policy restriction.” So a clear signpost that rate cuts could be near, and investors raised the chance of a cut by the June meeting from 82% to 87% by the close. Our European economists see the ECB as having a clear but conditional baseline of a June cut, while keeping its options open beyond this. They note that Lagarde’s expression of a “dialling down cycle” may be more consistent with gradual rate cuts. See their reaction note here for more.

The ECB’s decision helped to bring down 2yr yields on German (-0.4bps) and French (-0.6bps) government bonds. However, at the long end it was a different story, and yields moved noticeably higher across the continent, including on 10yr bunds (+2.8bps), OATs (+3.6bps) and BTPs (+6.8bps). Meanwhile for gilts, the 10yr yield (+5.5bps) closed at a post-November high of 4.20%. That came as investors continued to dial back the chance of a Bank of England rate cut by June, with overnight index swaps lowering the probability from 56% to 41% by the close. That followed comments from the BoE’s Greene in the FT we mentioned yesterday, who said that UK rate cuts “should still be a way off”.

Although bonds continued to sell off, a renewed tech rally saw equities recover in the latter half of the US session ahead of the earnings season kicking off in full today. The S&P 500 advanced +0.74%, with the NASDAQ (+1.68%) and the Magnificent 7 (+2.25%) strongly outperforming and closing at new all-time highs. All of the Magnificent 7 posted gains, with Apple (+4.33%) leading the way amid news that it plans to overhaul its line of Macs with new AI-focused chips. However, equity gains were limited outside tech, with more than half of S&P 500 constituents actually down on the day. And earlier in the day Europe saw fresh losses, with the STOXX 600 (-0.40%), the DAX (-0.79%) and the CAC 40 (-0.27%) all falling back. That came as European natural gas futures (+8.40%) rose following Russian attacks on energy facilities in Ukraine, including those for natural gas storage.

Overnight in Asia, most of the major equity indices have lost ground this morning, with losses for the Hang Seng (-1.73%), the CSI 300 (-0.28%), the Shanghai Comp (-0.04%) and the KOSPI (-0.80%). Japanese equities have been the main exception however, where the Nikkei is up +0.33%. And looking forward, US equity futures are slightly higher, with those on the S&P 500 up +0.05%. Elsewhere in Asia, the Bank of Korea kept its policy rate unchanged at 3.5%, marking its 10th consecutive decision to hold since it last hiked in January 2023.

To the day ahead now, and the Bank of England will release the Bernanke review on forecasting. Central bank speakers include the BoE’s Greene, the ECB’s Elderson, and the Fed’s Collins, Schmid, Bostic and Daly. Data releases include the UK GDP reading for February, and in the US there’s the University of Michigan’s preliminary consumer sentiment index for April. Finally, earnings releases include JPMorgan, Citigroup, Wells Fargo and BlackRock.