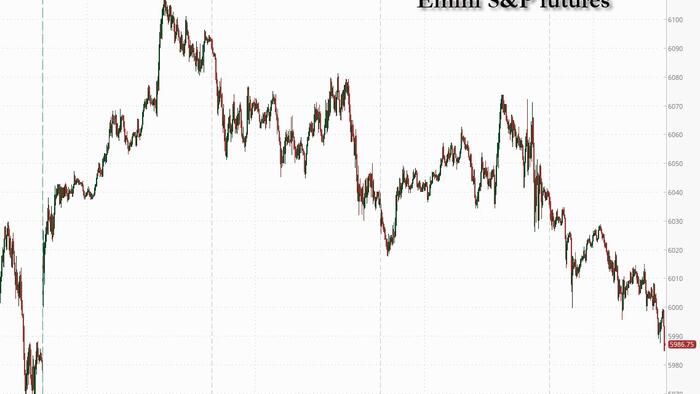

US equity futures tumbled amid mounting speculation the US will join Israel's war against Iran some time this weekend, fueling uncertainty and concerns about the inflationary impact of higher crude prices. S&P and Nasdaq 100 futures tumbled 0.8% on a day when cash trading in US stocks and Treasuries is closed for a public holiday. Europe’s Stoxx 600 gauge declined 0.4%, setting the index on course for a third day of losses. Asian shares dropped more than 1%.

Brent crude neared $78 a barrel, approaching last week's post war high and extending gains in a week where market reaction to the Middle East conflict has been most concentrated in oil. The dollar edged higher against a basket of currencies.

Traders’ sentiment sank after a late Wednesday report from Bloomberg that senior US officials are preparing for a possible strike on Iran in the coming days, pointing to potential plans for a weekend strike. Fed Chair Jerome Powell’s signaling of imminent tariff impact on consumer prices also added to risk-off sentiment.

“If the US does strike, you’re going to see a big knee-jerk reaction,” said Neil Wilson, investor strategist at Saxo UK. “No one will be wanting to make big long bets.”

Trump has for days publicly mused about calling for a strike on Iran. He told reporters at the White House Wednesday that he prefers to make the “final decision one second before it’s due” because the situation is fluid.

The odds for the US to become involved are “quite high at this moment in time,” said Anna Rosenberg, head of geopolitics at Amundi Investment Institute.

“For the US, this is a moment to take out a big geopolitical headache, which is Iran potentially developing a nuclear weapon,” Rosenberg told Bloomberg TV. “Having said that, acting comes with a lot of consequences too. Trump will have to make a really difficult decision.”

Elsewhere, among the barrage of monetary policy decisions in Europe, the Bank of England kept its benchmark rate on hold at 4.25%. While the outcome was in line with economists’ expectations, more committee members than anticipated had voted for a cut. The pound fell before erasing the loss. Earlier, the Swiss National Bank cut its interest rate to zero as policymakers sought to deter investors from pushing up the franc, which has gained almost 10% against the dollar this year. In Norway, officials surprised with the central bank’s first post-pandemic reduction of borrowing costs.

European equities fell Thursday with consumer products and travel and leisure shares leading declines, while energy and telecommunications stocks advanced. Stoxx 600 falls 0.5% to 537.69 with 482 members down, 100 up, and 18 little changed. here are the top European movers:

Earlier in the session, Asian equities were caught in a broad selloff on Thursday, with Hong Kong-listed Chinese stocks leading the losses, as investors feared the possibility of the US entering the conflict in the Middle East. The MSCI Asia Pacific Index slid as much as 1.4%, its biggest intraday slump since April 16. Technology names like TSMC, Tencent and Alibaba were the biggest drags on the regional benchmark. A gauge of Chinese stocks listed in Hong Kong slumped 2.1%, marking its third session of retreat. Thailand’s equity benchmark also lost more than 2% to head for its lowest close since March 2020 after the government’s second-largest party quit the ruling coalition. Stock benchmarks in Indonesia and Taiwan were other major losers in Asia, while equities in South Korea, Philippines and Vietnam rose. The US market will be shut today for a holiday.

While trading in cash treasuries was closed, the 10Y yield as implied by Treasury futures was about 1bp lower vs the Thursday close.

Market Wrap

Top Overnight News

Tariffs/Trade

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded subdued following the mixed close on Wall Street, where traders juggled the FOMC alongside geopolitics, with markets apprehensive as US President Trump keeps participants in the dark about his touted move on Iran. ASX 200 saw its losses cushioned by a recovery in gold miners. The index came off highs after employment surprisingly contracted. Nikkei 225 marginally underperformed with USD/JPY briefly dipping under 145.00 and a trade deal with the US proving elusive. Hang Seng and Shanghai Comp were subdued in tandem with the broader risk tone, with China-specific newsflow once again taking a back seat to geopolitics. US equity futures were subdued following the choppiness seen during the Fed, with attention overnight on geopolitics. Futures saw some weakness on reports via ABC that US President Trump was getting comfortable with the idea of taking out Iran's Fordow nuclear facility with multiple strikes. Another leg lower was seen as Bloomberg reported that the US was reportedly eyeing this weekend as a possibility for an Iran attack and was preparing for a possible strike in the coming days. European equity futures are indicative of a slightly softer open with the Euro Stoxx 50 -0.2% after cash closed down -0.4% on Wednesday.

Top Asian news

European equities fell Thursday with consumer products and travel and leisure shares leading declines, while energy and telecommunications stocks advanced. Stoxx 600 falls 0.5% to 537.69 with 482 members down, 100 up, and 18 little changed.

Top European News

FX

Fixed Income

Commodities

d

FOMC: STATEMENT

FOMC: PRESS CONFERENCE

FOMC: REACTION