Futures are all lower but already about 100bps higher than overnight lows with all eyes on geopolitical tension in the Middle East after Israel effectively started war with Iran, sending the VIX up to a 20-handle and Gold re-testing ATHs. As of 8:00am, SPX futures are down -90 bps, and trading just under 6,000; Nasdaq 100 futs are down 110 bps with all Mag 7 stocks trading lower (TSLA -2.8%, NVDA -2.0%, GOOG/L -2.0% lagging) and small caps -140 bps Global indices lower, though not dramatically so, with Asia market down ~75 bps overnight and Europe down 100-150 bps at the moment. Dubai/Abu Dhabi markets were down 3/4%. Overnight, the major headlines were Israel’s wide-ranging attack on Iran’s nuclear program and military leadership. Oil up sharply to ~$75 but also well off session highs as so far the initial Israeli attack has avoided energy targets, but Israel could extend over several days, with Iran vowing to retaliate. Also it is unclear if Iran will be allowed to continue smuggling oil to China after this escalation. Crude is up 7.8% from yesterday’s close having surged as high as 13% earlier - its biggest jump in 3 years - and with all CTAs still 100% short this may just be the start of the squeeze. Gold added +0.9%. Yields are mostly unchanged; USD is higher. US economic data slate includes June preliminary University of Michigan sentiment at 10am; Fed officials are in external communications blackout period ahead of June 18 rate decision.

In premarket trading, magnificent Seven stocks are lower as as investors rotate out of equities and into haven assets (Tesla -1.6%, Amazon -1.9%, Meta Platforms -1.5%, Nvidia -1.5%, Alphabet -2%, Microsoft -0.8%, Apple -0.2%). Energy and defense stocks rise after Israel’s airstrikes against Iran (Exxon Mobil +3.3%, Chevron +2.6%, Occidental Petroleum +5.5%; RTX +5.5%, Lockheed Martin +4.8%). Airline and travel stocks slide following Israel’s predawn attacks. Here are some other notable premarket movers:

It’s shaping up as an extremely busy Friday for traders assessing market risks going into the weekend. Stock futures are down and oil jumped the most in three years after Israel’s strikes on Iran. Havens, and especially gold, are in demand.

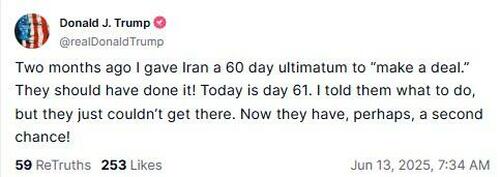

The airstrikes against Iran’s nuclear program and ballistic-missile sites renewed a standoff between two adversaries that risks spiraling into a wider conflict. While the reaction was strongest in crude oil, other pockets of the market suggested that investors are watching how long the tensions will last and whether the situation escalates. Netanyahu said the attacks targeted Tehran’s nuclear program and military, and would last until the threat was removed. Iran vowed to retaliate against Israel and, possibly, US assets in the Middle East even as Trump urged Iran to make a deal “before it is too late.”

The strikes follow repeated warnings by Israeli Prime Minister Benjamin Netanyahu to cripple Iran’s nuclear program. Iran had previously said it would inaugurate a new uranium-enrichment facility in response to censure by the UN atomic watchdog over its nuclear program.

"We are seeing behavior fully consistent with risk-off,” said Geoff Yu, FX and macro strategist at Bank of New York Mellon Corp. “This is probably the starting point for markets, but as we know correlations have been variable in recent weeks and much will depend on the reaction of Iran, the US and others.”

"Short term it will be used as an excuse or a catalyst by investors for some profit taking, after a very strong comeback of risk assets,” said Vincent Mortier, chief investment officer at Amundi SA. “Price reaction of historical safe havens has been minimal. We believe the events of last night will remain localized and will not degenerate into something more global.”

The attacks are coming at a time when equity markets had recovered from a slump in April that was caused by US President Donald Trump’s tariff war. An index of global stocks touched a record Thursday, gaining more than 20% from a low hit in April. Any persistent gain in oil prices could fuel inflation, adding to the challenges confronting the Fed and other central banks as policymakers also contend with the repercussions of Trump’s trade war. For now, changes in the prices of crude futures point to fears of a drawn-out conflict.

“This goes against what central banks were expecting for oil prices and could potentially change their scenario by heating up inflation and slowing growth,” said Alexandre Hezez, chief investment officer at Group Richelieu.

Meanwhile, US stock funds just suffered the biggest outflows in almost three months, according to data published by BofA's Michael Hartnett, citing EPFR Global data, another sign the rally may be stalling. About $9.8 billion was redeemed from US stocks in the week through Wednesday, the most in 11 weeks. Mideast conflict also risks upending the S&P’s quick-fire comeback from April’s tariff fallout. Bloomberg Intelligence wrote earlier that a return by the benchmark to its former peaks within the next few weeks would mark the fastest recovery from a decline of more than 15% since at least 1980.

European equities fall, with Israel’s military strikes against Iran’s nuclear program spurring big moves across energy and airline stocks, which are most sensitive to oil’s price jump. The Stoxx 600 falls 0.8%, with travel, auto and consumer products leading declines. Among single stocks, Novo Nordisk overtakes SAP to reclaim its position as Europe’s most valuable public company. Novo shares are lifted by its plans to advance an experimental weight management treatment amycretin into late-stage development. Here are the most notable movers:

Stocks in Asia dropped amid rising risk-off sentiment following Israel’s attacks on Iran’s military facilities, which can potentially spark a wider war in the Middle East. The MSCI Asia Pacific Index extended its loss to 1.2% in the afternoon session, the most in nearly two months. Most major markets were in the red, with Japan and Hong Kong leading the declines. TSMC, Alibaba and Samsung Electronics were among the stocks that weighed the most on the regional gauge. “This morning’s alarming escalation is a blow to risk sentiment and comes at a crucial time after macro and systematic funds have rebuilt long positions and investor sentiment has rebounded to bullish levels,” said Tony Sycamore, market analyst at IG Australia. “We are likely to see a further deterioration in risk sentiment as traders cut risk seeking positions ahead of the weekend.

In FX, the dollar rebounded 0.5% from Thursday’s three-year low as the Bloomberg Dollar Spot Index rises 0.4% as the greenback strengthens against all its G-10 peers. The haven yen and Swiss franc initially rise on news of the attack, only to reverse those gains in London trade; USD/JPY and USD/CHF both rise 0.3. Higher-risk currencies suffer the most, with the Australian and New Zealand dollars both falling roughly 1% versus the greenback. Knee-jerk reaction to risk-off news points to haven dynamics for the dollar, yet positioning and profit-taking on shorts ahead of the weekend need to be taken into account, as well as the boost to the greenback from higher oil prices

In rates, treasury futures turn lower into early US session, unwinding an overnight flight-to-quality bid after Israel launched airstrikes on Iran’s nuclear and ballistic missile programs, sending oil futures higher. Treasury yields higher by a couple of basis points across maturities with curve spreads little changed. 10-year is around 4.38% with UK counterpart cheaper by an additional 3.5bp, leading losses among European peers. Gilts underperform, along with most European bonds, after German and French CPI data. WTI crude futures remain more than 8% higher on the day.

In commodities, brent crude gained 7.6%, having earlier surged as much as 13% in the biggest intraday jump since March 2022. Gold rose 1% to the highest in more than a month.

Looking to the day ahead now, and data releases from the US include the University of Michigan’s preliminary consumer sentiment index for June, and in the Euro Area we’ll get industrial production for April. Central bank speakers include the ECB’s Escriva

Market Snapshot

Top Overnight News

Tariffs/Trade

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded lower and US equity futures were pressured amid the worsening geopolitical situation in the Middle East after Israel conducted pre-emptive strikes on Iranian nuclear and military targets, with the Israeli military said to have struck dozens of sites across Iran, while Israeli PM Netanyahu said the operation will last for as many days as it takes and Iran has warned that Israel and the US will pay a heavy price for the Israeli attack. ASX 200 was dragged lower by losses in cyclicals but with the downside stemmed as energy and gold miners benefitted from the geopolitical-fuelled upside in the respective underlying commodity prices. Nikkei 225 slipped beneath the 38,000 level after recent currency strength and heightened geopolitical tensions. Hang Seng and Shanghai Comp conformed to the negative mood as Israel's numerous strikes and Iran's retaliation threats dominated the headlines.

Top Asian news

European bourses are in the red, Euro Stoxx 50 -1.4%, given the dour risk sentiment, which has been triggered by events in the Middle East. Energy (+1.0%) is the only sector in the green, given the surge in benchmark prices. Defence names also faring well, the two together causing the FTSE 100 -0.3% to be the relative outperformer. Conversely, energy strength is weighing on Travel & Leisure (-2.5%) while Auto (-2.2%) names have been hit by Trump's comments on tariffs potentially going up.

Top European news

FX

Fixed Income

Commodities

Geopolitics

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

As we go to press, there’ve been huge developments in the Middle East overnight, as Israel has carried out air strikes against Iran’s nuclear and military facilities. We still await further details, but press reports have said that explosions were heard in Tehran and Natanz, which is where one of Iran’s nuclear plants is. Iranian state TV has reported that Hossein Salami, the head of the Revolutionary Guards, was killed, along with armed forces chief of staff Mohammad Bagheri. Israeli PM Netanyahu has said the operation “will continue for as many days as it takes to remove this threat”, although US Secretary of State Marco Rubio has said the US weren’t involved in the strikes.

The news has led to significant fears about an escalation and a wider regional conflict. For instance, Iran’s armed forces spokesperson said that Israel and the US will receive a “harsh blow” in response, and Iran’s Supreme Leader said Israel “should expect a severe punishment”. In turn, oil prices have surged on the news, with Brent crude up +9.00% this morning to $75.60/bbl. If sustained, that would be the biggest daily jump in oil prices since May 2020, as the global economy was recovering from the Covid lockdowns. And that’s slightly down from the overnight peak, when prices reached $78.50/bbl.

The effects of the attack have cascaded across global markets, with a strong risk-off move for several asset classes. Equities have slumped, with S&P 500 futures down -1.65% this morning, whilst those on the German DAX are down -1.65% as well. Meanwhile, gold prices have surged, moving up +1.26% to $3,428/oz. US Treasuries have also seen a fresh rally this morning, with the 10yr yield down another -1.4bps to 4.35%, its lowest in the last month. And the dollar index (+0.36%) has stabilised after closing at a 3-year low yesterday.

Looking forward, the focus is now shifting to what form Iran’s retaliation might take. It’s also unclear whether talks between the US and Iran over their nuclear programme will continue, although AFP reported that the US still wanted to hold talks this Sunday. We haven’t yet heard from President Trump directly, although his public schedule says he’ll be attending a National Security Council meeting in the Situation Room at 11am ET.

The reaction has been clear in Asian markets overnight as well, where all of the major indices have lost ground in response. That includes the Nikkei (-1.25%), the KOSPI (-1.29%), the Hang Seng (-0.70%), the CSI 300 (-0.76%) and the Shanghai Comp (-0.72%). Similarly, sovereign bonds have rallied, with Japan’s 10yr yield down -3.5bps, and Australia’s down -6.3bps.

Before the strikes, markets had put in a steady performance yesterday. Admittedly, there had been speculation about a strike, with Trump himself saying “Look, there’s a chance of massive conflict”, whilst ABC News reported that Israel was considering military action against Iran. However, there had been hopes that this could be a pressure tactic before planned US-Iran talks over the weekend, and US bonds and equities both advanced.

The bond rally was driven by a dovish batch of US data, including a softer-than-expected PPI reading. So that added to investors’ confidence that the Fed would still cut rates this year, which pushed Treasury yields lower, and meant the dollar index (-0.72%) hit a three-year low. Geopolitical concerns added to the bond rally, but risk assets put in a decent session too, aided by the prospect of rate cuts and the fact that lower yields helped to ease fears around the fiscal situation. So the S&P 500 (+0.38%) still reached a three-month high, closing just -1.61% beneath its all-time peak from mid-February.

The US PPI reading for May was the main driver of yesterday’s rally, as it added to the view that the tariff passthrough was smaller than expected, and wasn’t creating a big spike in inflation. Now, we should add the caveat that we wouldn’t expect the full tariff impact to be evident in the May data, and plenty of tariffs have since risen further (like on steel and aluminium). But the fact that inflation has been pretty soft so far is adding to investor confidence that the inflationary impact won’t be as big as feared. For example, monthly headline PPI was up just +0.1% in May (vs. +0.2% expected), whilst core PPI only rose +0.1% as well (vs. +0.3% expected).

That soft inflation print led to mounting anticipation that the Fed would cut rates in the months ahead, not least given the lower-than-expected CPI number the previous day. Moreover, the weekly jobless claims were also higher-than-expected yesterday, so that created a bit of nervousness about the state of the labour market, and helped to support the rate cut narrative. In fact, the continuing jobless claims moved up to their highest level since late-2021, at 1.956m in the week ending May 31 (vs. 1.910m expected). The initial claims have also been moving higher in recent weeks, and the 4-week average now stands at 240.25k for the week ending June 7, the highest since August 2023.

Given all that, futures priced in more rate cuts from the Fed yesterday, with 52bps of cuts now expected by the December meeting, up +2.9bps on the day. The overnight news has seen that move further, with 55bps priced in this morning. So that led to a significant rally for Treasuries as well yesterday, with the 10yr yield (-6.1bps) falling to 4.36%, whilst the 30yr yield (-7.6bps) hit a one-month low of 4.84%. Matters were helped by a solid 30yr auction, which went smoothly despite recent concern about demand for long-end bonds. And in turn, the decline in yields meant the dollar index hit a three-year low yesterday, whilst the Euro moved above $1.16 intraday for the first time since 2021.

Other notable news yesterday included Trump repeating his criticism of Fed Chair Powell, adding that he may “have to force something” if the Fed does not lower rates. In comments at the White House, Trump also said he might want to raise auto tariffs further from their 25% level “in the not too distant future”. Auto stocks struggled following the comment, with Ford (-1.22%), GM (-1.22%) and Stellantis (-1.84%) all falling back. And in other trade news, Bessent commented that the EU had been “very intractable” in talks.

Despite the geopolitical fears and the softer data, US equities had managed to put in a decent performance yesterday as the decline in yields proved supportive. For instance, the S&P 500 (+0.38%) posted a moderate advance, as did the NASDAQ (+0.24%). The Mag-7 (-0.005%) saw mixed moves, with Tesla (-2.24%) falling back but Nvidia outperforming (+1.52%) and Microsoft (+1.32%) reaching a new record high. The mood for AI-linked stocks was helped by Oracle (+13.31%) projecting very strong growth in its cloud infrastructure business. However, it wasn’t all good news, with the small-cap Russell 2000 (-0.38%) falling back.

Earlier in Europe, markets put in a much weaker performance, with the STOXX 600 (-0.33%) posting a 4th consecutive decline. Matters weren’t helped by some weak growth data in the UK, with monthly GDP contracting by -0.3% in April (vs. -0.1% expected). There was also a clear tariff impact, as the export of goods to the US fell by £2.0bn in April. The weak growth figures meant investors priced in more rate cuts from the Bank of England, and gilts outperformed their counterparts elsewhere, with the 10yr yield down -7.6bps on the day. But bonds still rallied across the continent, with yields on 10yr bunds (-6.1bps), OATs (-4.5ps) and BTPs (-4.1bps) all moving lower.

To the day ahead now, and data releases from the US include the University of Michigan’s preliminary consumer sentiment index for June, and in the Euro Area we’ll get industrial production for April. Central bank speakers include the ECB’s Escriva