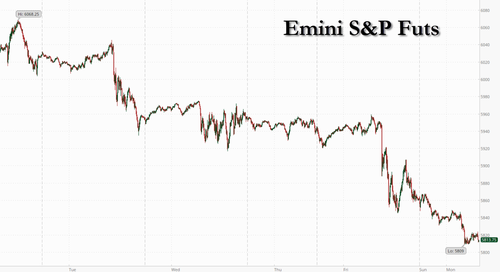

US equity futures tumbled to the lowest level since November as the global risk-off tone resumed amid a surge in oil prices pushing yields higher, with this Wednesday's CPI print the next global catalyst. Bond yields jumped (again) as the curve bear flattens and the USD resumes its move higher in what has now become a boring daily trade where the world is once again convinced the "exception" US can decouple form a world where Japan, China and Europe are all contracting and where the US can somehow keep growing (spoiler: it can't). As of 7:30am, S&P futures are down 0.8% to 5820, on pace for their 7th decline in the past 10 days, and approaching a level last seen in late-September; Nasdaq futures slump even more, down 1.1% with Mag7 names under pressure premarket with NVDA/TSLA the biggest losers. European shares dropped 0.9%, with technology names leading the declines. Credit ETFs are outperforming pre-mkt and may be an area of safety into CPI. Commodities are also stronger, led by Energy on news Biden hopes to blow up Trump's presidency by sending oil prices soaring thanks to additional US sanctions on Russian oil which may impact 1mm bpd. Today’s macro data focus is the NY Fed’s 1-yr inflation expectations.

In premarket trading, tech shares, including Tesla, Palantir and Nvidia were among the high-profile losers as a fresh rise in bond yields weighed on tech and growth stocks. Most other Mag Seven names were also broadly lower (Apple -1%, vidia -3.3%, Microsoft -0.9%, Alphabet -0.8%, Amazon -1.1%, Meta Platforms -0.9% and Tesla -2.8%). Here are some other notable premarket movers:

World markets, already in turmoil since the start of 2025, suffered a fresh setback on Friday from a blowout US jobs report - which will be revised sharply lower in a month or so - that prompted traders to slash their wagers on Fed rate cuts to less than 30 basis points for the whole of 2025. The figures sparked a selloff that wiped out the S&P 500’s year-to-date gain and sent Bloomberg’s dollar index to two-year highs. 10Y Treasury yields rose further to touch a 14-month high, up more than 15 basis points this year, and more than 100 bps higher since the Fed cut rates by 100 bps. Thirty-year borrowing costs hovered just below the psychologically key 5% threshold.

“As long as the US fixed-income market hasn’t stabilized, it will be difficult for the equity market to regain strength,” said Benjamin Melman, chief investment officer at Edmond de Rothschild Asset Management. “We need some stabilization, but as we are seeing this morning, it is not going to happen today.”

Yields jumped after a surprise wave of US sanctions by Biden on Russia - one week before the Trump inauguration - sent Brent crude futures to a five-month high above $81 a barrel. If the move reduces the global crude surplus, it could keep energy prices elevated, lifting price pressures as discussed earlier. The rise in Treasury yields and the dollar is affecting markets worldwide, raising borrowing costs across Asia and Europe. UK assets, which have been at the epicenter of the turmoil, continued to lose ground, with 10-year gilt yields holding near 2008 highs, and the pound extending last week’s 1.7% slump to trade at the weakest since November 2023. Rabobank analysts said that while the UK’s fiscal deficit was a major concern, “a large part of the move higher in UK long-term interest rates reflects the push higher in global rates, which is linked to a US-led rise in risk premia.”

Attention turns next to UK inflation data due Wednesday. The US also releases inflation figures on the same day, with economists forecasting the year-on-year print to have picked up to 2.9%. That could further reduce bets on Fed easing. Already Bank of America has moved to predicting no rate cuts at all this year, and in fact sees the risk of a hike, echoing what we said more than a month ago.

Rothschild’s Melman considers the data to be crucial, given Trump’s pledge to implement policies that are widely seen as inflationary. “If we have confirmation that the disinflation process stalled even before Donald Trump’s re-election, it could provide some more tension for US fixed income,” he said.

European shares dropped 0.9%, with technology names leading the declines. Major markets are all lower with regional indices down at least one std dev as bond yields move higher. The technology sector underperformed, with suppliers to Apple dropping the most after an analyst predicted that iPhone shipments will miss Wall Street estimates this year. Commodityh-related Equities are higher with the move higher in oil. The moves in bonds are attracting buyers. Value is leading, Cyclicals are lagging. UKX -0.4%, SX5E -0.9%, SXXP -0.7%, DAX -0.7%. Here are some of the biggest movers on Monday:

Earlier in the session, Asian stocks fell for a fourth session as sentiment remained downbeat, weighed by reduced expectations of the Federal Reserve’s interest-rate cuts and an ongoing selloff in Chinese shares. The MSCI Asia Pacific excluding Japan Index dropped as much as 1.7% to touch its lowest level since August last year. TSMC, Samsung Electronics and Hon Hai were among the largest contributors to its fall. Benchmarks in Taiwan and Philippines led declines in the region, while stocks in India sank as the rupee hit a new low. Japanese markets were closed for a holiday. Downward pressure on Asian markets has intensified after stronger-than-expected US jobs data triggered a recalibration on Fed cut expectations for this year. Sentiment has been particularly weak for Chinese stocks, with concern over increased trade tensions under Donald Trump pushing the MSCI China Index into a bear market last week. TGhe Hang Seng fell more than 1% and Shanghai Composite slips 0.4%. The ASX 200 drops 1.2% and Taiex slumps 2.3%. Japanese markets are closed for a holiday.

China has been another source of pressure for market sentiment, with shares extending losses even after data showed record exports last year, which however was driven by a rush to buy Chinese goods ahead of Trump's tariffs. The offshore-traded yuan dropped close to a record low against the dollar, forcing authorities to ramp up support for the currency and tweak capital curbs.

In FX, the dollar climbed against most majors. The pound weakens 0.6% amid UK fiscal woes and euro falls 0.3%. Offshore yuan ticks higher after PBOC boosts support for the currency.

In rates, treasuries are extending Friday’s slide with front-end yields cheaper by about 3bp, as investors further reduce expectations for Fed rate cuts based on strong December jobs data. Additional rise in oil prices compounds upside pressure on Treasury yield, with WTI crude futures up 2% after gaining 3.6% Friday. This week’s corporate new-issue calendar is expected to be front-loaded ahead of the December CPI report Wednesday. 10-year yields around 4.78% are ~2bp cheaper on the day with bunds and gilts keeping pace. Bear-flattening leaves 2s10s, 5s30s spreads tighter by 1bp and 2.5bp on the day, extending Friday’s move. Fed-dated OIS prices in only about 4bp of Fe easing over the next two policy meetings and just 23bp by the end of the year. Corporate new-issue slate already includes several items; $40 billion to $45 billion of offerings are anticipated this week, most before the midweek release of December CPI. Treasury auctions resume Jan. 22 with 20-year bond reopening

In commodities, crude oil extended Friday’s rally on sweeping US sanctions on Russian energy industry. WTI crude futures jump almost 2% to a three-month high around $78-handle. Gold dips to near $2,685. Bitcoin is steady around $94,500.

The US economic data calendar includes December New York Fed 1-year inflation expectations (11am) and federal budget balance (2pm). Ahead this week are PPI, CPI, retail sales, housing starts and industrial production. Fed speaker slate empty for the session. Schmid, Williams, Barkin, Kashkari and Goolsbee are slated later in the week

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly negative in reaction to the hot NFP jobs report and subsequent rise in yields as Fed rate cut bets were unwound, while risk sentiment was also not helped by the holiday closure in Japan and failed to benefit from Chinese trade data. ASX 200 was lower with underperformance in tech, financials and consumer discretionary sectors, while energy bucked the trend owing to a surge in oil prices. Hang Seng and Shanghai Comp were pressured at the open as participants awaited the latest Chinese trade data but pared some of the losses following comments from PBoC Governor Pan that they have the confidence and means to overcome difficulties in the economy and will use interest rate and RRR tools to keep liquidity ample, while sentiment then remained subdued amid the broad risk-aversion and failed to benefit from the better-than-expected Chinese trade figures.

Top Asian News

European bourses began the week entirely in the red and have gradually edged lower as the morning progressed; as it stands, indices reside at worst levels with downside in excess of 1.0% for the Euro Stoxx 50. European sectors hold a strong negative bias, with only a handful of industries residing in positive territory. Energy is by far the clear outperformer today, buoyed by the strength in oil prices. Tech is the underperformer today, swept away by the risk-off sentiment and as traders digest comments from Apple watcher Ming-Chi Kuo, who said the iPhone maker is facing challenges in 2025, including stagnant iPhone growth and declining Chinese market share. US equity futures are entirely in the red, in a continuation of the downside seen following the strong NFP report; NQ -1.4% the underperformer given the broad tone, yield advances and specific Tech pressure. Barclays European Equity Strategy: Cuts UK FTSE 250 to Neutral from Overweight.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

It's hard to determine what's icier at the moment, global bond markets or the weather across much of Northern Europe and even New York where sub zero temperatures have been the norm in recent days. The good news is that the icy ground added 70 yards to my drives on the golf course yesterday. The bad news is that they were invariable bouncing into the rough, a bunker or a ditch!

As the weather warms up a bit, whether the deep freeze in bond markets continues may be determined by how US CPI on Wednesday materialises after Friday's blockbuster payrolls report. Elsewhere in the US the main highlights are the New York Fed 1-yr inflation expectations (today), PPI (tomorrow), retail sales (Thursday), building starts and permits and industrial production (Friday), and the unofficial start of earnings season on Wednesday with a selection of big banks reporting.

Outside of the US, the key events are UK CPI and European Industrial production (Wednesday), UK monthly GDP and the ECB account of the December meeting (Thursday) and China GDP on Friday. The full calendar of events, including central bank speakers, is at the end as usual but lets now go through the main highlights in more details.

There’s nowhere else to start other than Wednesday’s US CPI that occurs after 10yr UST yields climbed +16.1bps last week to close Friday at their highest since October 2023.

Our economists expect headline (+0.40% mom forecast vs. +0.31% last month) to be impacted by strong food and energy and eclipse a tamer core (+0.23% vs. 0.31%). This would ensure a YoY rate of 2.9% (+0.2pp) and 3.3% (unch) respectively. The core rate’s steady decline from late 2022 petered in the second half of 2024 around current levels and that’s before Trump’s policies take effect. See our economists’ preview here with a registration link to their webinar immediate after the release. Amongst other things they discuss how rents will boost this month’s release but with signs of rental disinflation ahead. The curve ball going forward will of course be policy.

For US PPI on Tuesday, headline (+0.4% vs. +0.4%) and core (+0.2% vs. +0.2%) will likely be similar in magnitude to CPI but as ever we will be most focused on the PPI categories that feed into the core PCE deflator namely, health care services, airfares and portfolio management. Elsewhere Thursday's retail sales is likely to be strong given holiday spending trends in December with headline (+0.6% vs. +0.7%), ex auto (+0.5% vs. +0.2%), and retail control (+0.3% + 0.4%) all firm.

In terms of earnings, the kick-off on Wednesday sees JPMorgan, Goldman Sachs and BlackRock report. Bank of America and Morgan Stanley will follow on Thursday, when investors will be also closely watching the Taiwanese semiconductor company TSMC. Our US equity strategists preview the upcoming earnings season here and expect S&P 500 earnings growth near 13% in Q4, similar to the low double-digit growth seen in recent quarters.

There are also a few political points of interest this week with Senate confirmation hearings for Trump's cabinet nominees including Secretary of Defense, Secretary of State and Attorney General among others. In France, the new Prime Minister Bayrou will deliver his General Policy Statement tomorrow (see our European economists' preview of France's 2025 budget here) which will likely be followed by a vote of no confidence which at this stage he will likely win due to abstentions from the far right and the socialist party. The note from our French economist provides an up to date state of play in French politics and answers some questions as to what is likely to happen next.

Overnight in Asia, markets are catching down to Friday's falls despite stronger than expected Chinese exports data this morning (YoY growth of 10.7% vs 7.5% expected). The CSI 300 is down -0.52%, with the Hang Seng declining even more (-1.20%). Elsewhere in the region, the Kospi has dropped by -1.04% so far with Japanese markets closed for a holiday. Meanwhile, US equity futures show continued risk-off sentiment with the S&P 500 losing -0.44% and the Nasdaq 100 down by -0.60% as we go to print. As you'll see below a further spike in Oil isn't helping.

Recapping last week now and the main story for markets was the relentless bond selloff, with long-end borrowing costs pushing higher across the world. Several data releases pushed that selloff forward, with the main ones being the ISM services index on Tuesday and the US jobs report on Friday, which showed that nonfarm payrolls were up by +256k in December (vs. +165k expected). On top of that, the unemployment rate fell a tenth to 4.1%. And the moves got even more support after the University of Michigan’s 5-10yr inflation expectations ticked up to 3.3% in January, the highest since 2008.

All that reignited concerns that the Fed and other central banks would have to keep rates higher for longer. In fact by the weekend, markets were only pricing 29bps of cuts by the Fed’s December meeting, down from 39bps at the start of the week. And in turn, that pushed the 10yr Treasury yield up +16.1bps (+7.0bps Friday) to 4.76%, which is its highest closing level since October 2023. That momentum was clear in Europe too, where yields on 10yr bunds moved up +17.0bps (+2.8bps Friday) to 2.59%, their highest since July. It also marked a 6th consecutive weekly increase for the 10yr bund, which is the first time that’s happened since 2022, back when the ECB were hiking by 75bps per meeting.

One of the worst affected countries was the UK last week, which came under intense market pressure. For instance, their 10yr gilt yield was up +24.5bps (+2.7bps Friday) to 4.84%, which was its biggest weekly jump in the last year. Moreover, it pushed the 10yr yield up to its highest level since 2008, adding to the risk that the government could break its fiscal rules unless they announced another round of fiscal consolidation. That pressure was also evident on the pound sterling, which was the worst-performing G10 currency last week, weakening by -1.74% (-0.76% Friday) against the US Dollar to $1.2207, its lowest closing level since November 2023.

Those bond moves weren’t helped by fresh rises in commodity prices, which added to fears about inflationary pressures. Brent crude oil saw its highest weekly close since July at $79.76/bbl, with a +3.69% jump on Friday after the outgoing Biden administration announced a new broad set of sanctions against the Russian oil industry. Brent crude futures are up another +1.88% this morning. In addition, copper posted its biggest weekly gain since September, with a +5.66% rise (-0.13% Friday), whilst gold was up +1.88% (-0.89% Friday).

Finally, equities put in a divergent performance around the world. In the US, the S&P 500 fell for a second week running with a -1.94% decline (-1.54% Friday). Similarly in Asia, Japan’s Nikkei fell -1.77% (-1.05% Friday), and China’s Shanghai Comp was down -1.34% (-1.33% Friday). However, European equities put in a much stronger performance, with the STOXX 600 up for a third consecutive week with a +0.65% gain (-0.84% Friday), whilst the DAX was up +1.55% (-0.50% Friday). Impressive outperformance.