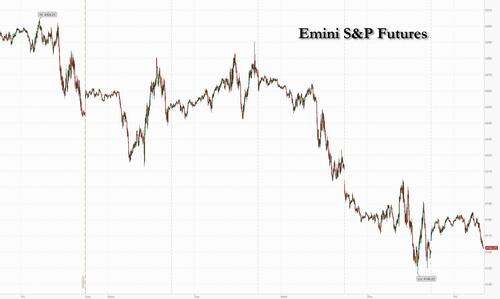

US futures were modestly higher - but well off session highs - at the end of a turbulent week after Amazon and Intel reported solid earnings. At 8:00am ET, S&P futures were up 0.3% while Nasdaq futures gained 0.6% after a selloff that drove the index to its lowest since May. The retreat also put the S&P 500 on the brink of a “correction,” with the gauge down nearly 10% from its July peak. The US outperformed Europe's Stoxx 600 which reversed earlier gains to trade at session lows, down 0.6% after French drugmaking giant Sanofi plunged 16% when it revealed a surprise forecast for lower profit. Crude oil rose 2% and back toward top of Thursday’s range as the US conducted strikes on Iran-linked facilities in Syria. Treasury yields resumed their tick higher as did the dollar.

In premarket trading, Chevron dropped 2.5% after the oil producer reported adjusted earnings per share for the third quarter that missed the average analyst estimate. Management cited lower upstream realization and lower margins. At the same time, it's bigger and more competent peer, Exxon was flat after it beat on revenue, reporter stronger cash flow and boosted dividends more than expected. Amazon rose 6.0% as the e-commerce and cloud computing giant posted robust sales and profit growth and indicated that its cloud unit is regaining momentum. Ford fell 3.6% after the automaker reported adjusted earnings per share for the third quarter that missed the average analyst estimate. Here are some other notable premarket movers:

The Q3 earnings season has proved a mixed bag so far, with investors punishing misses more severely than they are rewarding beats. In the US, 78% of companies reporting so far beat estimates, compared with 57% in Europe, according to JPMorgan. But more firms than usual are flagging lower consumer demand and a deteriorating economic environment, they said, even as data Thursday suggested price pressures continue to dissipate in the US despite solid economic growth.

“The better-than-expected results from Amazon last night are brightening the mood,” said Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown. “However, the overall concern is what the too-hot-to-touch US economic read will mean for the next interest rate decision. The higher-for-longer interest rate narrative will become louder and more apparent.”

Attention now turns to a barrage of reports today, including the Federal Reserve’s preferred inflation measure, the core PCE, which will cement bets the central bank will pause next week. Treasury yields ticked higher and the dollar dipped for the first time in four days. Swaps contracts are projecting a roughly one-in-three chance of another Fed hike in the current tightening cycle, according to data compiled by Bloomberg.

European stocks also tried to stage a rebound but failed, and were last trading 0.6% lower as gains for the energy sector helped offset a slump in Sanofi, NatWest Group Plc and Moncler SpA after disappointing earnings. The energy and chemicals sectors were the biggest gainers while the healthcare subindex lagged. Drugmaker Sanofi plunged 16% after a surprise forecast for lower profit next year overshadowed optimism about a plan to spin off the consumer health division. Among other single stocks, UK lender NatWest plummeted after it cut its margin guidance, while Italy’s Moncler became the latest luxury company to disappoint this season as analysts noted weaker trends into the latter part of the year. Drinks company Remy Cointreau SA also fell after cutting its annual sales guidnce. Here are the most notable European movers:

Earlier in the session, Asian stocks rebounded as the latest results from US tech majors and positive data on the China economy helped drive a rebound. The MSCI Asia Pacific Index rose as much as 1.2% Friday, with Alibaba, Toyota and TSMC among the biggest contributors. Shares in Hong Kong and Japan led the advances in Asia, while Australian and South Korean stocks were also in the green. Mainland Chinese shares edged higher after data on industrial companies’ profit showed growth, though slightly softer than in the prior period. China’s industrial profits in September rose 11.9% from a year earlier, marking the second-straight month of expansion, also helping boost risk appetite. Still, the Asian benchmark was on track for a second weekly loss with a 0.9% decline this week.

In FX, the Bloomberg Dollar Spot Index falls 0.2%. USD/JPY drops 0.3% to ~150. The Swiss franc is the weakest of the G-10 currencies, falling 0.1% versus the greenback. The Dollar Index “appears to be in a holding pattern ahead of tonight’s release of the US PCE deflator data,” said Philip Wee, a senior currency economist at DBS Bank in Singapore. “The potential for unexpected announcements from the Fed remains a factor to consider in the upcoming FOMC meeting.” The yen was up first day in four as data showed consumer price growth in Tokyo unexpectedly quickened for the first time in four months in October USD/JPY slipped 0.2% to 150.15, edging closer to the 150 handle where $4.35 billion worth of options expire.

In rates, treasuries are cheaper across the curve, with the long-end leading losses on the day. US yields cheaper by up to 2bp across long-end of the curve with 2s10s, 5s30s spreads steeper by 1bp and 2bp on the day; 10-year yields around 4.87%, cheaper by 2bps vs. Thursday close with bunds and gilts outperforming by 4bp and 5bp in the sector. Treasuries lag price action in core European rates after a release of Brandenburg inflation figures for October came in below median estimates for the national figure, which will be released on Monday. The US session will focus on data including personal income and spending along with PCE deflator. Friday's dollar IG issuance slate empty so far; M&T Bank was the only issuer to sell IG bonds Thursday, the fourth one-deal session this week as primary issuance has ground to a halt.

In commodities, oil rallied as traders monitored the Israel-Gaza conflict ahead of the weekend. WTI rose 2.5% to trade near $85.30. Spot gold adds 0.1%.

Bitcoin was unchanged on the session, trading in close proximity to $34k. Action that is much steadier than that seen across the week as a whole where ETF optimism has driven BTC from a $29.67k base to a $35.18k peak.

Looking to today's event calendar, we have US September personal spending, personal income, PCE deflator (8:30am), October University of Michigan sentiment (10am) and Kansas City Fed services activity (11am); we also get the Italian September hourly wages, October economic sentiment, consumer, manufacturing confidence, August industrial sales, and French October consumer confidence. We will also have earnings releases from Exxon Mobil, Chevron, AbbVie, Charter Communications, and Colgate-Palmolive.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks eventually traded firmer across the board as the well-received earnings from Amazon and Intel pushed sentiment into the positive after the mostly lower close on Wall Street. ASX 200 supported by its Consumer Staples sector, while an uptick in M/M PPI had kept the Industrial Sector’s gains capped, and Tech had resided as the laggard. Nikkei 225 saw its gains driven by its Industrial sectors, potentially following the US GDP metrics, while the Pharma sector lagged as Takeda shares slumped over 7% following their earnings. Hang Seng and Shanghai Comp opened mixed with the former firmer as its earnings season picked up and as the Hang Seng Tech index rose over 2%. Sentiment for the Mainland was initially muted but improved, while reports via China’s Securities Journal suggested China was likely to reduce the reserve requirement ratio in Q4 to support government bond issuance.

Top Asian News

European bourses are modestly firmer on the session, DAX 40 +0.5%, but pronounced post-earning stock movements are resulting in marked divergence across some bourses; namely, the post-results/spin-off downside of 15% in Sanofi is weighing on the Euro Stoxx 50 +0.1% and CAC 40 -0.4% where the stock has respective 3.5% and 7.1% weightings. Sectors are mixed with Energy echoing benchmarks and outperforming while Health Care lags given Sanofi, Media pressured post-UMG and Food, Beverage & Alcohol names hit on Remy Cointreau. Banks reside in the green as NatWest's marked downside is offset by Danske Bank, Caixabank & Sabadell. Stateside, futures are in the green, ES +0.5%, with the NQ +0.9% outperforming following AMZN (+6.1% pre-mkt) and INTC (+7.8% pre-mkt) earnings after hours. Ahead, US PCE dominates the schedule.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US-IRAN

ISRAEL-HAMAS

US Event Calendar

DB's Jim Reid concludes the overnight wrap

So I braved 3 hours and 26 minutes of the new Martin Scorsese film "Killers of the Flower Moon" last night. It was a pretty good film but probably around 1 hour 45 minutes too long. It could have done with a good edit. After reading the below I hope you won't say the same thing about today's EMR.

However concise we try to be, there's no getting away from spending yet more time on the zig-zagging nature of bond yields with the volatility continuing yesterday. 10y Treasury yields were down -11.1bps to 4.85%, outperforming a decent rally for 2yrs (-8.1bps) and 30yr (-10.0bps) yields. Most of the gains happened before a firm 7yr auction but this did help flatten the curve late in the day.

This rally came even as Q3 US GDP was strong yesterday with the PCE deflator having more influence as it came in a tenth below expectations. Meanwhile, US equities suffered, led by the tech sector with the Magnificent Seven down -2.98%. All this overshadowed a relatively dull ECB meeting as they paused for breath after 10 successive hikes.

The tech sector got a reprieve after the bell last night, as Amazon beat revenue and earnings estimates for Q3, and offered encouraging guidance on the outlook for its key cloud computing business. Together with positive results for Intel, the news helped Nasdaq futures +0.74% higher overnight as I type with S&P futures up +0.50%.

Prior to this overnight rebound, Meta dropped -3.73% after results the night before highlighted an uncertain revenue outlook for the following year. Alphabet and Microsoft also fell -2.65% and -3.75%, respectively. As a result, the tech heavy NASDAQ was dragged down -1.76%, the Magnificent Seven -2.98%, and the FANG+ index -2.66%. The Magnificent Seven are now down -11.7% in the past 15 days, with two more members left to report. Apple and Nvidia will report next Thursday (2 November) and on 21 November, respectively.

The underperformance of big tech weighed on the S&P 500, which fell -1.18%. Earnings reports from other key corporates failed to bring much relief, as UPS, which is often interpreted as a measure of economic activity, cut its profit target yesterday, falling -5.93% on the day. Mastercard declined -5.62% as the revenue outlook came in below expectations. Having said all that, even though the tech sector slumped, taking the index with it, 48% of S&P 500 constituents were actually up on the day, with non-tech interest-sensitive sectors (utilities, real estate) and banks outperforming. So outside of those seven big stocks it was a fairly neutral day for US equities, with the equal weight S&P 500 down a modest -0.17% and the Russell 2000 small cap index actually up +0.34%. However, those seven stocks made it feel like a bad day in the opposite way to how they made many ordinary days very good for the index in the first 7 months of the year.

Over in Europe, the STOXX 600 slid -0.48% after weak earnings reports from top European firms such as Mercedes-Benz (-5.77%), and Volkswagen (-3.08%), as well as confirmation from Siemens Energy (-35.49%) that it was speaking with the German Government and former parent Siemens (-4.54%) due to its struggling wind energy arm.

Turning back to the US data, core PCE for Q3 came in below expectations at 2.4% quarter-on-quarter (vs 2.5% expected), down from 3.7%. This brings the measure to its slowest pace since 2020, a promising sign for the Fed. We have the September PCE data today, which will bring further colour to the pace of falling inflation. Yesterday’s quarterly data suggests a touch of downside risk to our US economists’ projection for a +0.3% month-on-month core PCE deflator print today.

GDP growth for Q3 came in at 4.9% annualised quarter-on-quarter, an upside surprise from the 4.5% expected, and the fastest pace in nearly two years. The strength was largely driven by consumer spending, with the personal consumption index at 4.0% (as expected), from 0.8% in Q2. Government spending was also strong at 4.6% annualised, with some questioning whether the government and consumer can continue to propel growth ever higher from here, especially as private non-residential investment saw zero growth in Q3. In other data, durable goods orders for September were also strong, at 4.7% (vs 1.9% expected), a rise from 0.1% from the previous release. Weekly continuing claims saw a larger-than-expected increase to 1,790k (vs 1,740k expected), though initial jobless claims were largely benign at 210k (vs 207k expected).

Taken together, yesterday’s data reaffirmed the likelihood of a Fed pause next week, and the Fed rate priced in by fed fund futures for the final meeting of 2023 in December fell -1.7bps, which equates to a 19% likelihood of a hike before we move into 2024 .

In the eurozone, as widely expected, the ECB kept rates unchanged at 4.00%. The central bank retained its data dependent approach and guidance that “rates will be set at sufficiently restrictive levels for as long as necessary”. There were some dovish tilts, with Lagarde noting in prepared remarks that “inflation dropped markedly in September” while yields “had risen markedly since our last meeting”. She also struck a cautious tone on the near-term growth outlook. Nonetheless, Lagarde was emphatic that any discussion of rate cuts was “absolutely premature” and would not rule out the possibility of another hike. Our economists continue to expect a prolonged pause but see the softer data, and ECB’s greater acknowledgement of it yesterday, as skewing risks to an earlier cut than their September 2024 baseline. See their reaction piece here.

Following the meeting, markets moved to price in an increased likelihood of ECB rate cuts next year, with Jun-24 OIS futures (-6.1bps) now fully pricing in a 25bp cut. On the back of this European bonds saw a steepening rally, with 2yr bund yields down -5.0bps, while 10yr bund yields ended the day -2.8bps lower at 2.86% .

Looking beyond the rates decision, there was nothing new on the balance sheet front from the ECB, with Lagarde saying that changes to PEPP reinvestments or minimum reserves were not discussed. Around the market close, Reuters reported that the ECB policymakers agreed to discuss QT early next year. The lack of any signal towards a faster unwind of the ECB’s bond portfolio was moderately beneficial for Italian BTPs, with 10yr yields falling -4.5bps, and the spread to 10yr Bund yields tightening -1.7bps. It briefly dipped below 200bps in intraday trading before closing at 201bps, 5.5bps below its recent wides.

Switching to the commodities space, oil more than reversed its gains of the previous day to close at its lowest level in two weeks, with Brent crude down -2.44% to $87.93/bbl and WTI down -2.55% to $83.21/bbl. By contrast, gold was up +0.31% to $1,984/oz, its highest since May .

Asian equity markets are trading higher this morning shrugging off overnight weakness on Wall Street although most of the region’s markets are still heading for weekly losses. The Nikkei (+1.54%) is the best performer across the region after sharply rebounding from previous session losses while the Hang Seng (+0.94%), the CSI (+0.50%), the Shanghai Composite (+0.35%) and the KOSPI (+0.40%) are also trading in positive territory as US Treasury yields eased.

Early morning data showed that Tokyo’s headline inflation rate came in at +3.3% y/y for October (v/s +2.8% expected), compared with an increase of +2.8% seen in September. At the same time, consumer prices excluding fresh food rose +2.7% y/y in October, edging up from +2.5% in September, thus putting the Bank of Japan (BOJ) in spotlight amid signs of broadening price pressures as the central bank prepares to set policy next week. Moving to China, industrial profits dropped -9.0% in the first nine months narrowing from a -11.7% contraction in the first eight months indicating that the world’s second biggest economy is stabilizing helped by the authorities policy support.

Looking ahead to today. In terms of data, we have US September personal spending, personal income, PCE deflator, October Kansas City Fed services activity, the Italian September hourly wages, October economic sentiment, consumer, manufacturing confidence, August industrial sales, and French October consumer confidence. We will also have earnings releases from Exxon Mobil, Chevron, AbbVie, Charter Communications, and Colgate-Palmolive.