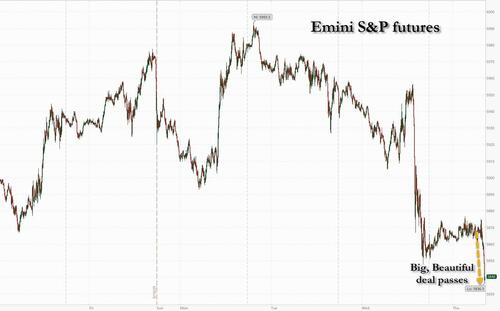

US stocks and treasuries sold off after President Trump’s signature tax bill passed the House by the narrowest of margins (214-215), sparking fears that the surging deficit - already at a nosebleed 6.5% of GDP - necessary to fund the bill will spark even higher rates at a time when foreign buyers are boycotting US Treasury purchases. As of 8:00am, S&P futures slumped by 0.5%, trading near session lows and reversing an earlier gain of about 0.3%. Nasdaq futures dropped 0.4%. Treasuries also slumped, extending days of losses in which the 30-year yield hit the highest since 2023: the 10Y was trading at session highs of 4.62%. The dollar ended a three-day losing run while Bitcoin pushed further into record territory. Commodities are weaker across all 3 complexes: oil slumped again after BBG reported that OPEC+ is considering another production hike at the June 1 meeting. SCMP reports that Mexico pledges neutrality between US/China in the Trade War; this follows a similar announcement from Indonesia last month. Today’s macro data focus is on Flash PMIs, weekly claims, existing home sales, and regional Fed activity indicators.

In premarket trading, Mag 7 stocks were mixed (Alphabet +1.2%, Nvidia +0.5%, Amazon +0.5%, Tesla -0.2%, Meta Platforms +0.3%, Microsoft +0.02%, Apple -0.1%). Solar stocks sink as US House Republicans’ new version of the tax and spending bill accelerates the end of incentives for clean electricity production (Sunrun -34%, Array Technologies -14%, First Solar -6%). Crypto-linked stocks gained in premarket trading after Bitcoin hit an all-time high. The world’s largest cryptocurrency reached a record price of $111,878 on Thursday amid growing optimism around the US stablecoin bill (Galaxy Digital (GLXY) +5%, Riot Platforms (RIOT) +3%, Mara Holdings (MARA) +3%). Here are some other notable premarket movers:

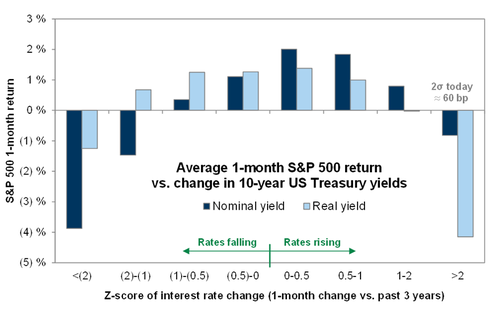

Just before 7am ET, after an all night session in the House, US lawmakers passed Trump's "big, beautiful bill", a sprawling multi-trillion dollar package that would avert a year-end tax increase at the expense of adding to the US debt burden. The move comes after a downgrade by Moody’s Ratings thrust concerns over the ballooning deficit into the spotlight. This has shown up in Treasuries, sapping sentiment after an equity rebound put the S&P 500 on the cusp of a bull market. Goldman calculated the yield at which stocks would crack: the bank notes that on May 1st, 10yr yield was 4.12%...we just touched 4.6% yesterday after the weak 20yr auction. At what level do yields start to put real pressure on the stock market? The easy big round number is 10yr @ 5%. The more nuanced answer is >4.7% (before the end of May) as velocity of move in rates matters much more than absolute levels (in regards to impacting stocks). When 10yr yield has moved higher by 2SD (60bps) within a one month period the stock market comes under pressure.

“Bond vigilantes are back,” Beata Manthey, a strategist at Citigroup Inc., told Bloomberg TV. “The market is worried about debt sustainability. It’s not very helpful, given how strong a rebound we’ve been seeing in equity markets.”

Later on Thursday, S&P Global will issue its preliminary May survey of manufacturing and service providers. Based on economists’ projections, industrial weakness probably continued while growth in services activity may have picked up slightly. Weekly jobless claims data is also due.

Meanwhile, the doom and gloom from Jamie Dimon continued, after the JPMorgan CEO said he can’t rule out the US economy will fall into stagflation as the country faces huge risks from both geopolitics, deficits and price pressures. “I don’t agree that we’re in a sweet spot,” Dimon told Bloomberg TV in Shanghai.

With everything else being sold, traders turned to non-fiat alternatives: Bitcoin surpassed $111,000 for the first time with traders increasingly bullish on the prospects of the cryptocurrency., gold traded back over $3,300.

“Bitcoin, and the crypto market in general, have largely decoupled from equities over the last few days,” said Richard Galvin, co-founder of hedge fund DACM. “Bitcoin continues to benefit from its market position as a non-system, store of value.”

European stocks fall as worries over rising bond yields curbed investor appetite for risky assets. The Estoxx index slumped 1%, with the yield-sensitive technology sector is among the biggest laggards. Among individual stocks, EasyJet Plc falls after the low-cost airline reported bigger-than-expected losses, while Johnson Matthey rises on a major sale of its technology business. Here are some of the biggest movers:

Asian equities dropped the most in two weeks, driven by losses in technology stocks after Treasury yields jumped overnight on concerns about the US budget deficit. The MSCI Asia Pacific Index fell as much as 0.8%, the biggest decline since May 8, with Alibaba, TSMC and Samsung contributing the most to the losses. South Korea’s Kospi retreated over 1%, while benchmark gauges in Hong Kong, Japan and India also lost ground. Philippine stocks weakened after President Ferdinand Marcos Jr. ordered his cabinet to resign.

In FX, the Bloomberg Dollar Spot Index rebounded to rise 0.1% after three straight days of losses. EUR/USD fell 0.2% to 1.131 after data showed private-sector activity in the euro area unexpectedly shrank in May. USD/JPY slumped as much as 0.6% to 142.81, the lowest level in two weeks, before paring the move to trade 0.2% lower. Despite the latest drop, the Hang Seng China Enterprises Index remains on track to cap a sixth straight week of gains. JPMorgan Chase is committed to long-term investment in China, despite tensions with the US, Chief Executive Officer Jamie Dimon said in a Bloomberg TV interview.

In rates, the yield for 10-year Treasuries advanced two basis points to 4.62% on Thursday. The worry in debt markets is that the tax bill would add trillions of dollars to an already bulging deficit at a time when investors’ appetite is US assets is slumping. The 30-year yield reaching new multimonth highs of 5.15% while short-end tenors richen, pivoting around a little-changed 7-year sector. 5s30s spread near 97bp is widest since May 1. European sovereign curves are also steeper. The Treasury will sell $18 billion of 10-year TIPS in a reopening at 1pm New York; Wednesday’s 20-year new-issue auction tailed by about 1bp, spurring long-end yields higher. Focal points include House Republicans narrowly passing President Trump’s tax bill shortly before 7am, PMI and jobless claims data, a 10-year TIPS auction and comments by NY Fed President Williams.

Looking at today's calendar, US economic data includes April Chicago Fed national activity index and weekly jobless claims (8:30am), May preliminary S&P Global US PMIs (9:45am), April existing home sales (10am) and May Kansas City Fed manufacturing activity (11am). Fed speaker slate includes Richmond Fed President Barkin (8am) and Williams (2pm).

Market Snapshot

Top Overnight News

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were on the back foot following the sell-off on Wall St where stocks, treasuries and the dollar were pressured amid deficit concerns and a weak 20-year auction. ASX 200 retreated with energy and tech front-running the declines, although continued strength in gold producers atoned for some of the losses. Nikkei 225 gapped beneath the 37,000 level amid a firmer currency and proceeded in a somewhat choppy fashion as participants also digested data releases, including a surprise surge in Japanese Machinery Orders and mixed PMI figures. Hang Seng and Shanghai Comp conformed to the downbeat sentiment in the absence of any fresh bullish catalysts and after recent earnings results failed to inspire, while the mainland initially showed resilience in early trade before succumbing to the broad risk-off mood.

Top Asian News

European bourses (STOXX 600 -0.7%) opened lower across the board, in a continuation of the pressure seen on Wall St/APAC trade and have traded at subdued levels throughout the morning. European sectors hold a strong negative bias, with only Basic Resources and Chemicals marginally holding in positive territory. Consumer Products is underperforming after LVMH’s (-1.5%) cautious comments on the Luxury sector. Chemicals names are faring better vs peers, with Bayer (+1.7%) doing much of the heavy lifting. The Co. benefits from a WSJ report which suggests the US HHS Secretary's move will “go easier than expected on pesticides in farming”.

Top European News

Eurozone PMIs

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Morning from Holland where I’ve just been told I’m now a BA Gold Card holder for life after my latest trip tipped me over the landmark. Annoyingly in my first 10 plus years of my career I didn’t collect tier points as I couldn’t be bothered to fill in the forms. So what could have been. I’ll make sure that on my way back home today I’ll have a celebratory decaf latte in the lounge.

If you collected air miles for issuing government debt then many DM countries would have been in the first class lounge many years ago and over the last 24 hours concerns have continued to mount about debt sustainability. We should put it into some perspective as sensible people have been worried about debt sustainability for years. Indeed if you'd have told anyone 10-20 years ago that the US could comfortably fund 7% mid-cycle deficits in recent years then most would have been incredulous at the prospect. So we could have sustainability fears for years to come before an inevitable accident or event happens. However it's fair to say that events in 2025 have brought forward any day of reckoning.

Yesterday saw the 30yr Treasury yield (+12.3bps to 5.09%) close above 5% for the first time since October 2023, and only 2bps away from its highest level since 2007. Even during the inflation peak at 9.1% in 2022, 30 year US yields didn't climb above 4.40% that year. The only time they've been briefly above 5% since 2007 was at the peak of the Treasury sell off in autumn 2023, when yields rose by over 100bps in under three months following an increase in the supply of long-dated bonds and delay of Fed rate cut expectations. It took a change in issuance duration from the Treasury to calm the long-end.

While Treasury yields were already trading around 5bps higher midway through yesterday’s session, they took another major step higher after a soft 20yr auction, which saw $16bn of bonds issued at 5.05%, +1.2bps above the pre-sale yield. This ended a pattern seen in the previous two sessions of an early Treasury sell-off reversing during US trading hours. Real yields led the move higher, with 30yr real yields rising +11.2bps to 2.78%, their highest level since 2008. Elsewhere along the curve, the 10yr yield (+11.2bps) rose to 4.60% and even the front-end wasn’t immune to the selloff, as the 2yr yield (+4.7bps) also moved back up to 4.02%. And in a repeat of concerns over US ability to attract foreign investors to fund its twin deficits, the rise in yields came while the dollar index (-0.56%) lost ground for a third session running. This morning US Treasuries are quieter, trading 1-2bps lower across the curve.

The soft 20yr auction was also a trigger for a broader market slump, with the S&P 500 falling from -0.2% on the day to -1.61% by the close, its worst day in the past month. This was a very broad-based decline with only 18 advancers in the whole index and the equal-weighted version of the S&P down -2.15%. The Mag-7 (-1.03%) saw a relative outperformance, mostly thanks to a +2.79% advance for Alphabet. Over in Europe, markets had closed before the US sell-off, with the STOXX 600 (-0.04%) little changed, while Germany’s DAX (+0.36%) reached another record high that took its YTD gains to +21.16%. European futures are around two-thirds of a percent lower as I type.

All those moves came amid an increased focus on the fiscal implication of the US tax bill going through the House of Representatives, which includes tax cuts that would increase the deficit over the years ahead. Initially, it had looked as though we might get a vote on the bill yesterday, which Speaker Johnson said he was planning on. But the chances diminished as the day went on, as various Republican members were still signalling their opposition. As a reminder, they only have a 220-212 margin in the House, so it only requires a handful of votes against (along with the Democrats) to vote down any bill.

In terms of the latest on the budget bill, some of the main issues appeared to be overcome yesterday with the House Republican leadership releasing an revised version late last night US time. That included raising the proposed state and local tax (SALT) deduction up to $40,000, from $10,000 at present, as several Republicans from higher-tax states had threatened to vote against a bill that didn’t see a big enough increase in the SALT limit. And to placate fiscal conservatives, the updated bill would speed up the implementation of Medicaid work requirements and a reduction in Biden-era clean energy tax breaks. As I write this, it still remains to be seen if the revised bill will pass the House, though reporting last night suggested that Trump and Speaker Johnson had assuaged the opposition from the right-wing House Freedom Caucus.

Turning to the global moves, the bond selloff also wasn’t helped by an upside surprise in the UK CPI print. That showed headline CPI rising more than expected to +3.5% in April (vs. +3.3% expected), whilst core inflation also rose to +3.8% (vs. +3.6% expected). In absolute terms, it was also the fastest headline inflation rate since January 2024, so that led investors to dial back their expectations for rate cuts from the Bank of England. For example, the amount of cuts priced by December came down -3.2bps on the day to 38bps. And in turn, gilts underperformed their counterparts elsewhere, with the 10yr yield up +5.4bps to 4.76%. But sovereign bonds also sold off across Europe, with yields on 10yr bunds (+3.9ps), OATs (+4.9bps) and BTPs (+4.0bps) all moving higher.

In trade news, Bloomberg reported yesterday that the EU has shared a revised trade proposal with Washington, which includes steps such as gradually reducing tariffs to zero on non-sensitive agricultural products and industrial goods, as it aims to build new momentum for transatlantic talks.

Looking forward, the main highlight today will be the flash PMIs for May from around the world. Those will be interesting, as they’re one of the first indications we have for how the global economy has performed this month, particularly given not all of the Liberation Day impact would have been immediately clear in April. Overnight, we’ve already had the numbers from Japan and Australia. Data showed that Australia's manufacturing sector has maintained its expansion for the fifth consecutive month, with the S&P Global manufacturing PMI holding steady at 51.7 in May. The services PMI decreased to 50.5 from 51.0 previously, while the composite fell to 50.6 in May from 51.0 in the prior month.

Japan's manufacturing sector continued its decline in May, marking the 11th consecutive month below 50, coming in at 49.0 in May, showing a slight improvement from the previous month's level of 48.7. On a more positive note, services remained in expansion at 50.8 in May, although it slowed from April's 52.4. The composite declined to 49.8 in May from 51.2 in April.

Asian equity markets are following on from Wall Street's late decline. The KOSPI (-1.16%) is leading the way, primarily due to losses in technology stocks. It is followed by the Nikkei (-1.12%), Hang Seng (-0.55%) and the S&P/ASX 200 (-0.54%). Mainland Chinese markets are relatively flat amid increasing optimism that Beijing will introduce additional stimulus measures to bolster the economy.

Meanwhile Bitcoin is fast approaching $112,000 and trading at a new record as hopes increase that Stablecoin regulation will soon pass after the advancement of legislation yesterday. The US debt instability has probably helped too.

To the day ahead now, and the main data highlight will be the flash PMIs from Europe and the US. Otherwise, we’ll get the US weekly initial jobless claims and existing home sales for April, whilst in Germany there’s the Ifo’s business climate indicator for May. From central banks, we’ll hear from ECB Vice President de Guindos, the ECB’s Holzmann, Vujcic, Nagel, Elderson and Escriva, the Fed’s Barkin and Williams, and the BoE’s Breeden, Dhingra and Pill. We’ll also get the ECB’s account of their April meeting.