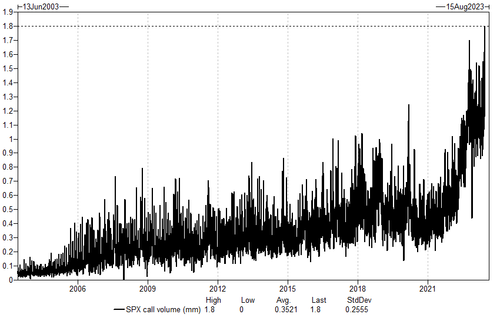

Following the largest ever S&P call-buying day in history...

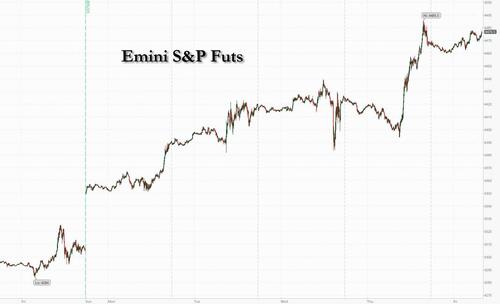

... which sparked a marketwide gamma-squeeze that pushed the market higher for the 6th consecutive day to the highest level since April 2022, US equity futures and global stocks were headed for the best week in more than two months, buoyed by bets on Chinese stimulus and exuberance surrounding artificial intelligence firms. After closing above 4,400 on Thursday, S&P futures were up 0.1% at 7:40m ET, recovering from an earlier dip and trading near session highs. The MSCI World Index has climbed 3% this week, the most since the end of March. Asian stocks staged a broad rally on Friday and European equities climbed. Treasury yields climbed across the curve, most steeply at the shorter end on recession fears. The Bloomberg dollar index reversed earlier gains while gold prices rose. Oil prices were flat, while iron ore is also edging lower today despite being poised to climb this week.

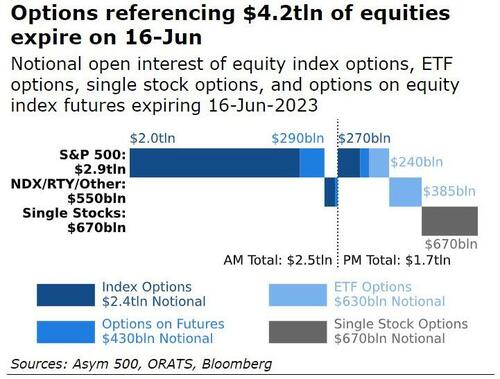

Whether the US rally extends to a 7th day will depend on how the market reacts to today's sizable $4.2 trillion triple-witching opex. According to Asym 500 founder and former Goldman derivatives strategist Rocky Fishman, today's OpEx, which is broken down into $2.5 trillion in options expiring in the morning and another $1.7 trillion at the close, is 20% more than a year ago.

The opex will lead to a sharp drop in the "call wall", resulting in a so-called unclenched market,which could lead to a spike in volatility as gamma gravity is reduced and the market is free to move more aggressively. To Matthew Tym, the head of equity derivatives trading at Cantor Fitzgerald LP, traders are likely to roll out their call positions, particularly those that are still out of the money. But the overall event’s impact on the broader market is hard to predict. Speaking to Bloomberg, he said that “people are under-invested and need to get exposure,” adding that "there is a tremendous amount of options coming off tomorrow. However, I don’t have a good feel for what that does to the market.” We'll just have to wait and see.

In premarket trading, Adobe shares rose as much as 3.9% in premarket trading after the software company reported second-quarter results that beat expectations and raised its full-year forecast. Analysts are positive on the report, seeing strong net-new digital media annualized recurring revenue as a highlight. There is also optimism about the company’s potential with artificial intelligence. Apple neared a record $3 trillion market capitalization. Here are some other notable premarket movers:

The week's powerful rally was sparked by rising bets that the Fed will end its tightening cycle sooner rather than later after this week’s pause in interest-rate hikes, while expectations are also growing that China’s government will boost spending. That helped lift mining, energy and some luxury stocks in Europe trade Friday.

“Theres a lot of cash on sidelines and we should not underestimate investors’ willingness to step in,” said Georgios Leontaris, chief investment officer for Switzerland and EMEA at HSBC Global Private Banking and Wealth.

The tech-led rally has upended countless bearish analyst calls. Bank of America’s Michael Hartnett said he was wrong in the first half because the US economy has avoided a recession and a credit crunch, and called the AI-driven tech rally an “unanticipated event.” Still, he drew parallels to 2000 or 2008, warning of a “big rally before big collapse.”

In Europe, the Stoxx 600 rose 0.4% with utilities and consumer outperforming. Construction and mining names fall. LVMH contributed the most to the advance in the Stoxx 600 Index. Asos Plc rose as much as 7.8% after the fashion retailer’s sales update showed turnaround progress. Here are the biggest European movers:

Asian stocks also rose as markets in China, Hong Kong Australia and South Korea climbed. Japanese shares rose while the yen fell, after the Bank of Japan kept is negative rate and yield curve control program unchanged. “The decision should not have been a surprise,” said John Vail, chief global strategist at Nikko Asset Management. “Anyone who shorts the yen versus the dollar must realize that the authorities will likely intervene with little warning if it gets much weaker.”

In FX, the Bloomberg dollar index faded earlier gains following a 0.7% drop on Thursday after ECB President Christine Lagarde said a further hike in July is “very likely.” The euro was little changed after rallying the most since April on Thursday following the European Central Bank’s decision to lift interest rates by another quarter-point. The yen declined as much as 0.8%, paring its rebound from a seven-month low against the dollar touched in the previous session; the BOJ left its negative interest rate and yield curve control program unchanged at the end of a two-day gathering. The central bank expects inflation will slow in the middle of the financial year and won’t hesitate to ease further if needed.

“There’s no option but to see the yen weakening,” said Kengo Suzuki, senior market strategist at Mizuho Bank Ltd. “Divergence is quite big with the BOJ saying it will add easing if necessary” compared with the Fed and ECB which are more hawkish, he said.

“The euro area has more of an inflation problem than the US and therefore the ECB will continue to hike, at least to 4%,” Christian Kopf, head of fixed income and FX for Union Investment Privatfonds GmbH said in an interview with Bloomberg Television.

In rates, treasury yields rose across the curve as the front-end underperformed with 2-year yields cheaper by about 4bp on the day, pushing 2s10s spread through Thursday’s low. There was some outperformance by longer-dated US yields flattens 2s10s by ~3bp, 5s30s spreads by ~2bp on the day. 10-year at 3.73% is higher by ~1bp, trailing bunds and gilts in the sector by 4bp and 3bp. According to Bloomberg, there was no apparent catalyst for bear-flattening beyond rate-hike premium creeping back into swaps for July Fed policy meeting. Core European rates outperform following Thursday’s ECB rate decision.

Looking at today's calendar, we have a few Fed speakers to listean to: Waller at 7:45 a.m., then Barkin at 9:00 a.m. That’s followed with US June University of Michigan Consumer Sentiment at 10:00 a.m. and the Baker Hughes US rig count at 1:00 p.m.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded higher following the gains on Wall St where the major indices were lifted alongside a weaker dollar and softer yields as participants digested a hawkish ECB and the rise in US jobless claims. ASX 200 was positive with the gains led by early strength in energy and utilities after AGL Energy flagged a jump in FY24 underlying profit and with some households facing electricity tariff increases of up to 51% for the winter season. Nikkei 225 initially declined amid cautiousness heading into the BoJ policy decision but then recovered after the BoJ refrained from any hawkish surprises and maintained its ultra-easy policy settings. Hang Seng and Shanghai Comp. were underpinned amid anticipation of further support measures from China but with gains capped in the mainland amid lingering frictions with the EU to ban Huawei and ZTE equipment from internal Commission networks and after the US tempered expectations of a breakthrough in relations ahead of US Secretary of State Blinken’s visit to China.

Top Asian News

European bourses are firmer across the board, Euro Stoxx 50 +0.4%, though action has at times been somewhat choppy in the likes of the FTSE 100 +0.3% despite a lack of fresh specific drivers since the Cash Open. Note, Goldman Sachs lifted its end-2023 year-end target for the Stoxx 600 to 500 from 475. Sectors are primarily in the green with some of the more defensively biased names leading such as Utilities and Healthcare while Basic Resources lags slightly after recent upside. Stateside, futures are firmer though only modestly so with newsflow limited thus far as we await a number of Fed speakers lter in the session.

Top European News

FX

Commodities

Fixed Income

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Today is the day that a passionate group within 1% of the world's population get extraordinarily excited about something that the other 99% of the globe ranges from being completely unaware of, to being completely apathetic towards. Yes, one of the oldest international sporting rivalries in the world kicks off here in England as we take on Australia at cricket for The Ashes. The home series are every 4 years, and I can soundtrack my life to these battles. Hopefully 2023 will go down as one of the best. So if you're one of the 99% spare a thought for the small number of obsessed nervous wrecks within the 1% of us today.

Risk assets are exhibiting few nerves at the moment and have continued their relentless advance over the last 24 hours, with the S&P 500 (+1.22%) rising for a 6th consecutive session for the first time since November 2021. It marked a big turnaround from earlier in the day, when there’d been a significant rates selloff, particularly after the ECB hiked rates and raised their inflation forecasts once again. But just 15 minutes later, the mood completely turned after the US weekly jobless claims unexpectedly remained at last week’s level of 262k, which is the highest they’ve been since October 2021. And in turn, that meant investors grew more doubtful about whether the Fed would end up delivering the two further hikes they indicated for this year, which supported a multi-asset rally across equities, bonds and commodities.

Ironically, the rest of the US data from yesterday had been perfectly respectable, with the retail sales numbers even posting a mild beat. But markets are overweighting the weekly claims data at the moment, since they’re one of the most timely indicators we get, and would therefore be one of the first to show if the labour market is beginning to crack. So when the 262k reading came in well above the 245k consensus expectation, that prompted a sizeable reaction, particularly given the negative surprise from last week as well. For instance, yields on 10yr US Treasuries had stood at 3.83% just after the ECB delivered their hike, before tumbling down to 3.716% by the end of the session.

The elevated claims number was a little more broad based than the surprise last week when two states made up the overwhelming bulk of the increase. So last week there was slightly more reason to be suspicious of the increase than this week. Ironically the first reaction to the perception of a weaker labour market was positive through the Fed effect. However be careful what you wish for. Even more attention will be on next week’s numbers now.

This release distracted markets from what was an eventful ECB meeting in its own right. The main headline was another 25bp hike as expected, which took the deposit rate up to 3.5% and its highest level since 2001. But what caused a big reaction was the upgrade to their inflation forecasts, which signalled that more action was needed to get inflation back to their 2% target. For example, headline inflation was revised up by a tenth across each of 2023-25, and they’re now expecting it to only come down to 3.0% in 2024 and 2.2% in 2025. In addition, the core inflation forecast that excludes food and energy saw even bigger upgrades, with both 2023 and 2024 revised up half a point to 5.1% and 3.0% respectively. And even in 2025, core inflation was still seen at 2.3%, so the ECB are signalling they still expect headline and core inflation to be above their target in two years’ time.

President Lagarde then offered some further hawkish comments in her press conference, saying that “barring a material change to our baseline, it is very likely the case that we will continue to increase rates in July.” That helped remove any doubt about whether the ECB were finished hiking yet, and investors moved to fully price in a further 25bp move to 3.75% at the next meeting. Looking further out, investors also began to consider it more-likely-than-not that the ECB would deliver yet another hike beyond that in September, which if realised would take the deposit rate all the way up to 4%. Following the meeting, our European economists have maintained their view of a 3.75% terminal rate but continue to see upside risks. However they did note some dovish counterbalancing comments from the ECB. See their reaction note here for more.

All this meant European rates were torn between the generally hawkish ECB and the weak claims data, but ultimately the ECB won out. By the close, yields on 10yr bunds (+5.2bps), OATs (+4.5bps) and BTPs (+4.2bps) had all risen, and the 2yr German yield (+11.0bps) hit a post-SVB high. It was a similar story for equities, with the STOXX 600 (-0.13%) underperforming its US counterparts, despite paring back its losses later in the session.

In the US it was a very different story however, since the claims data took centre stage. That meant Treasuries rallied across the curve, with yields on 10yr Treasuries closing -7.0bps lower at 3.716%. Furthermore, the 2s10s curve inverted further to -93.4bps, which is the most inverted its been since SVB, and just demonstrates how recessionary indicators are continuing to flash with growing alarm. This morning 2yr and 10yr yields are are back up +3bps and +1.7bps respectively with the curve thus inverting a touch more.

For equities, there was a similarly buoyant tone, and the S&P 500 (+1.22%) closed above the 4400 mark for the first time since April 2022. 88% of index constituents were higher on the day with all but two industry groups gaining. For once, tech stocks slightly underperformed the broader S&P, but there was still a decent advance as software companies rose +2.7% to pace the S&P 500 industry groups. Elsewhere the FANG+ index (+1.09%) rose for the 10th time in the last 11 sessions, bringing its YTD gains beyond +76%.

Asian equity markets are also mostly trading higher tracking overnight gains on Wall Street alongside hopes of fresh stimulus from China. As I check my screens, the Hang Seng (+0.68%), the CSI (+0.44%), the Shanghai Composite (+0.37%) and the KOSPI (+0.69%) are all moving higher. Elsewhere, the Nikkei (-0.10%) is trimming its losses but continues to remain in the red after the Bank of Japan (BOJ) maintained its ultra-easy monetary policy despite stronger-than-expected inflation (more below). Outside of Asia, US equity futures are indicating a slight pull back with those on the S&P 500 (-0.18%) and NASDAQ 100 (-0.22%) printing mild losses on what is triple witching day, with huge option expiries going through later.

Overnight, the run of central bank meetings has continued, with the BoJ maintaining its current pace of yield curve control in line with market expectations as the central bank waits to ensure Japan sustainably achieves 2% inflation. While warning about risks to the global outlook, the central bank’s policy statement indicated that it won’t hesitate to ease further if necessary. Following the substantially dovish decision, the Japanese yen declined -0.35% against the US dollar to around 140.775.

Finally, yesterday brought several other data releases from the US aside from jobless claims. Retail sales surprised on the upside with +0.3% growth (vs. -0.2% expected) even if retail control (that goes directly into GDP) was inline at 0.2%. Furthermore, the Empire State manufacturing survey for June rebounded to 6.6 (vs. -15.1 expected). That said, industrial production unexpectedly fell by -0.2% in May (vs. +0.1% expected).

To the day ahead now, and data releases include the University of Michigan’s (UoM) preliminary consumer sentiment index for June, along with the final Euro Area CPI reading for May. Watch out for the inflation expectations in the UoM report as the long-term ones have been edging up of late. Otherwise, central bank speakers include the Fed’s Bullard, Waller and Barkin, along with the ECB’s Holzmann, Rehn, Villeroy and Centeno.