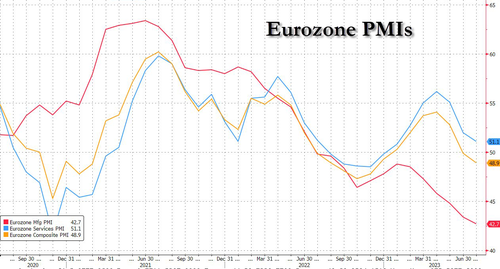

Futures rose as we enter a very heavy macro and earnings week highlighted by the Fed, ECB, BOJ, global PMIs and GDPs, US PCE, as well as earnings by GOOGL, MSFT and META. Global bond yields are lower after sharp declines in manufacturing and services gauges across Europe fanned concerns about economic growth. At 7:45am ET, S&P futures were 0.2% higher at 4,572 while Nasdasq 100 futures were up 0.3%. The USD was higher as cable slumped after a big miss in UK PMIs, commodities were in the green with gold, iron ore and oil prices all climbing. Today’s macro focus will be the US PMIs release (consensus expects 46.2 on mfg and 54.0 in services). Keep an eye on the price/inflation discussion in the detailed PMI report.

In premarket trading, megcap tech stocks including Nvida and Microsoft also rose. The Nasdaq special rebalancing is unlikely to solve the problem of high market concentration, and index will remain too concentrated to be considered an actively managed diversified fund, according to Goldman Sachs strategists. Mattel rose as much as much as 2.5% in premarket trading on Monday after Barbie became the top-grossing picture in US and Canadian cinemas, taking in $155 million in ticket sales. Warner Bros. Discovery the parent of the Hollywood studio that produced the movie, also advanced. Here are some other notable premarket movers:

Investors have been wary of making big equity at the start of a week packed with major central bank policy decisions and corporate earnings as some 48% of the S&P reports. In Europe, advance readings of the Purchasing Managers’ Indexes showed the private-sector economy contracted more than anticipated in July in the euro area and slowed sharply in Britain.

The data highlights the quandary for policy-setters, with traders positioning for the Federal Reserve and the European Central Bank to raise interest rates this week and to signal whether more hikes are likely after record tightening campaigns. Meanwhile, equity markets are looking into their busiest earnings week this season, with more than 500 major companies worldwide due to report quarterly results, including 48% of the S&P with such megacaps as Alphabet, and Meta Platforms on deck. The next few days will be crucial for investors, who will be watching to see if slowing economic momentum shows up on profit margins.

“Markets have entered a phase of anxious waiting, with two factors coming into play, central banks and earnings,” said Jeanne Asseraf-Bitton, head of research and strategy at BFT IM. “I’m not sure there will be a lot of surprises coming from the central banks so it’s really earnings that will be key. Valuations are expensive so earnings need to hold, margins need to hold.”

Later this week, the Bank of Japan is expected to stick to ultra-loose policy settings at its Friday meeting. The yen strengthened, however, with officials expected to consider sharply increasing their inflation forecast for this fiscal year.

In Europe, the Stoxx 600 index traded modestly firmer, though Spanish equities underperformed after an inconclusive outcome in the election on Sunday. Some European corporate results highlighted weakening consumer demand. Among movers, Philips plunged as much as 7.7% as analysts said the Dutch medical tech firm’s beat on 2Q earnings and FY guidance were expected, while a continued drop in order intake may put pressure on sales growth. Ryanair Holdings Plc fell after lowering its traffic prediction. Here are some other notable European movers:

Earlier, the MSCI Asia Pacific Index nudged modestly higher as equities regain composure following last week’s selloff. Japanese stocks lead winners with Nikkei about 1.4% stronger; it was underpinned after reports on Friday that the BoJ is leaning towards keeping its yield curve control policy unchanged at the upcoming meeting and sees little need to act on YCC for now. Hang Seng and Shanghai Comp were mixed with Hong Kong pressured by weakness in the property sector and tech, while the mainland was indecisive as the NDRC’s notice to promote high-quality development of private investment counterbalanced the reduced hopes for aggressive stimulus from China’s politburo meeting where the top officials will review the economic performance for H1. Australia's ASX 200 was rangebound as outperformance in the energy sector was offset by losses in mining names and with sentiment also clouded after Australian flash PMIs all printed in contraction territory. Indian stocks declined for a second consecutive session, a first for this month, after hitting record after hitting record after relentless record, as earnings of heavyweight companies disappoint and due to a late sell off in ITC. The S&P BSE Sensex fell 0.5% to 66,384.81 in Mumbai, while the NSE Nifty 50 Index declined 0.4%. Indian stocks underperformed the regional index MSCI Asia Pacific, which was little changed for the day.

Emerging-market stocks extended losses to a sixth day and most currencies slid amid a contraction in euro-area manufacturing and services and darkening gloom for Chinese stocks despite the country’s latest support pledge.

In FX, a gauge of the dollar traded in a narrow range after last week’s 1.1% jump, its biggest gain since February. EUR/USD falls 0.5% to day’s low of 1.1066, while EUR/GBP slips 0.4% to 0.8619 low. The pound fell and gilts extended a rally after S&P Global Market Intelligence said its index tracking sentiment among purchasing managers fell to 50.7 in July. That compares to a consensus estimate of 52.3. GBP/USD slips 0.2% to 1.2835, trimming earlier fall of 0.4%. USD/JPY down 0.5% to 141 after climbing for four days. Trading in China’s yuan was muted even after the country’s leaders signaled they will ease property policies.

In rates, treasury yields were lower by as much as 3.5bps on the 5-year, trailing steeper declines for UK and euro-zone yields spurred by weaker-than-expected PMI readings; the yield on German 10-year notes slid as much as seven basis points. UK yields fell 8 basis points, while Treasury yields also edged lower. Yields remain inside last week’s ranges, the 10-TSY yield was around 3.80%, holding above 50-day average level breached last week for the first time since May; Treasury curve flattened last week as swaps fully priced in a Fed rate hike on July 26 while auctions of 20-year bonds and 10-year TIPS drew strong demand (the inverted 2s10s curve is slightly flatter on the day at around -103bp; Thursday’s low -105bp was deepest inversion since July 6). The yield on Germany’s 10-year debt slipped as much as 7bps to 2.40% after the country’s manufacturing and services data flashed a warning sign over the health of the economy. Today's $42BN 2-year note auction at 1pm New York time will draw the highest yield since 2007, with WI trading around 4.77%; cycle also includes $43b 5-year notes Tuesday and $35b 7-year notes Thursday, with a gap for the Fed decision. S&P Global’s July preliminary US PMIs follow during US morning. 2-year sector underperforms ahead of Treasury auction cycle beginning Monday with sale of that tenor. Fed swaps continue to fully price in a 25bp rate hike for this week’s policy meeting, with decision to be announced Wednesday at 2pm in Washington, and about a third of an additional quarter-point hike this year. Dollar IG issuance slate is blank so far, though syndicate desks expect $20b-$25b of supply this week. Australian curve a touch steeper with 3-year yield down 2bps. JGB futures trim opening gains but remain higher after Friday’s sharp rally

In commodities, crude futures advanced with WTI rising 0.4% to trade near $77.40. Spot gold is up 0.2%.

Bitcoin spent the first half of the morning with a negative bias but relatively steady; however, more recently we have seen a bout of pressure in the space with Bitcoin moving to just below its 50-DMA at USD 29.02k. Currently, BTC is holding just above the level. Binance says it will list Worldcoin (WDC), a Cryptocurrency project founded by OpenAI CEO Sam Altman.

It's an extremely busy week but it starts off rather modestly with just the Chicago Fed PMI and US S&P prints n deck.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly positive but with gains capped ahead of upcoming key risk events including the FOMC, ECB and BoJ monetary policy meetings, as well as several big tech earnings results. ASX 200 was rangebound as outperformance in the energy sector was offset by losses in mining names and with sentiment also clouded after Australian flash PMIs all printed in contraction territory. Nikkei 225 was underpinned after reports on Friday that the BoJ is leaning towards keeping its yield curve control policy unchanged at the upcoming meeting and sees little need to act on YCC for now. Hang Seng and Shanghai Comp were mixed with Hong Kong pressured by weakness in the property sector and tech, while the mainland was indecisive as the NDRC’s notice to promote high-quality development of private investment counterbalanced the reduced hopes for aggressive stimulus from China’s politburo meeting where the top officials will review the economic performance for H1.

Top Asian News

European bourses are mixed with Flash PMIs flagging increased recession risks, Euro Stoxx 50 -0.2%; Spain lags following a political stalemate in Sunday's elections, IBEX 35 -0.7%. Sectors are also mixed but with a negative tilt given the above. Telecom names outperform after strong Vodafone results while Travel & Leisure lags given PMIs, Ryanair earnings and the European heatwave causing disruptions. Stateside, futures are modestly firmer and picked up to incremental highs following the Politburo readout, ES +0.2%; today's docket is headlined by PMIs alongside a front-loaded supply schedule given Wednesday's FOMC. NQ in-fitting ahead of the special rebalancing taking place.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

I spent most of the weekend downloading new weather apps until I found one with a forecast that suited me. First for my own golf on Saturday and then for the Ashes cricket. Alas, even as I found one that suggested a decent break in the rain for both, the eventual outcome was 4 hours of constant rain for my own round of golf on Saturday and a weekend of mostly heavy rain for the cricket which robbed England of a glorious chance to level the Ashes at 2-2. A through gritted teeth congratulations to our Australian readers for retaining the Ashes.

Hopefully I won't be searching through financial markets this week until I find a forecast that fits my market view. As I’m sure you’re all fully aware, the big event will be the 11th, and possibly final, Fed hike of this cycle on Wednesday. However the ECB (Thursday) and BoJ (Friday) meetings are also big events. In a busy week, some other highlights include the global flash PMIs today, the ECB bank lending survey (tomorrow), US Q2 GDP (Thursday), US core PCE, US ECI alongside German and French CPI (all Friday).

In terms of earnings, big tech, oil majors and notable semiconductor firms will be the highlights with 165 S&P 500 and 200 Stoxx 600 companies reporting this week. Watch out for Microsoft, Alphabet (tomorrow) and Meta (Wednesday) after some slightly disappointing tech earnings last week.

Going through the three big central bank meetings and other highlights in more detail now. The Fed will almost certainly hike +25bps on Wednesday which we and the market expect to be the final hike in the cycle. A September hike is priced at 33%, albeit up from 22% the previous week. With two CPIs and payrolls to come before then there is plenty of incoming data to confirm or dispute that assumption. The key for this meeting is if and how much the Fed messaging changes given recent softer inflation data. Our economists in their preview here, suggest that there is little downside at this stage for the Fed to do anything other than maintain a hawkish bias even if they acknowledge the progress. You can listen and watch Matt Luzzetti and rates strategist Matt Raskin, alongside our US rates traders, today at 830am ET / 130pm London for their latest thoughts ahead of the FOMC. Register here. In additions, various heads of DB research teams and trading desks will have a call on broader global markets at 2pm London time tomorrow. Click here to register.

Over in Europe, the ECB will also decide on rates on Thursday. Our European economists expect the ECB to deliver a +25bps hike, taking the deposit rate to what they see as a terminal level of 3.75%, even if they see a hike in September as a genuine possibility. Their preview here looks at this potential hike in more detail. Aside from the ECB meeting, the Eurozone bank lending survey tomorrow is important in order to see how lending standards have moved from what are currently tight and restrictive levels. The Fed’s SLOOS equivalent is out next week and is also very important. These are key pillars in the recession argument and if they stay tight risks continue to build. A surprise big improvement will put a dent in the argument.

The BoJ will close out the busy week for central banks with a decision on Friday and will also release their quarterly Outlook Report. Our Chief Japan economist previews the meeting here and sees some policy revision as a c.40% probability event, but continues to expect no change in monetary stance as his baseline. For the Outlook Report, he expects the BoJ to increase the inflation outlook for FY2023 but lower it for FY 2024, continuing to emphasise downside risks, but with no changes to the growth outlook.

Turning to the week's economic indicators, several important gauges will be out in the US. This includes the preliminary Q2 GDP reading on Thursday as well as the employment cost index and personal income and spending on Friday along with the all important monthly core PCE. Other data in focus will include Conference Board's consumer confidence gauge (tomorrow), new home sales (Wednesday) and durable goods orders (Thursday).

Outside of the global flash PMIs today, a number of sentiment gauges will also be out in Europe, including the Ifo survey for Germany (tomorrow) and consumer confidence for France (Wednesday) and Germany (Thursday).

Germany and France publish preliminary CPI releases for July on Friday. Q2 GDP for France will be due that day as well. Our European economists' inflation chartbook looks at the recent trends in data here, highlighting uncertainty regarding the speed of normalisation and persistence of the core measure as some of the key themes, emphasising ECB's focus on stickiness of domestic services inflation. The team expects the headline gauge for the Eurozone to come in at 5.3% YoY (vs 5.5% YoY in June) and core at 5.4% (5.5%).

Corporate earnings releases will also compete for investors' attention with key big tech players, oil majors, semiconductor companies as well as some large European corporates, including those in healthcare and luxury, all reporting this week. The highlight will be big US tech, with Microsoft, Alphabet (tomorrow) and Meta (Wednesday). The three companies make up almost $5tn in market cap, or c.12% of S&P 500, and have enjoyed YTD gains ranging from around 36% for Alphabet to c 145% for Meta, helping propel the Nasdaq 100 to +41% YTD. Elsewhere in tech, Samsung, NXP semiconductors, Intel, Lam Research and SK Hynix will be among the companies reporting. Our US equity analysts preview the earnings season for semiconductors here, cautioning on the AI optimism.

Another notable group to release earnings will be the big oil firms. The list of companies reporting includes Exxon and Chevron on Friday in the US as well as Shell, TotalEnergies on Thursday and Eni on Friday in Europe. Elsewhere, Rio Tinto, Anglo American and Vale will be on investors' radars.

In terms of Consumer stocks, results are due from Coca-Cola, P&G, Mondelez and McDonald's, among others. Automakers releasing earnings include GM and Ford in the US and Porsche, Mercedes-Benz and Volkswagen in Europe. Otherwise, Raytheon, GE and Honeywell will be among notable industrials firms reporting.

Other European corporates reporting include healthcare firms AstraZeneca, Roche and Sanofi as well as a number of key European luxury firms such as LVMH tomorrow. Nestle and BASF will also report. The earnings and data highlights are in the day-by-day calendar at the end as usual. It’s certainly a busy week all round.

Asian equity markets have started the week with what has become a common China versus the rest of the region divide. The Hang Seng (-1.47%) is sharply lower with the CSI (-0.28%) also losing ground while the Shanghai Composite (+0.08%) is struggling to gain traction as concerns over the Chinese economy continue to dampen sentiment. Elsewhere, the Nikkei (+1.23%) is seeing gains after a report late on Friday suggesting the BoJ see little urgency to change their YCC policy. The KOSPI (+0.73%) is also higher. S&P 500 (-0.03%) and NASDAQ 100 (+0.06%) future are fairly flat ahead of a bumper week of earnings.

Early morning data showed that the manufacturing sector in Japan continued to slightly contract in July as the Jibun bank’s preliminary manufacturing PMI declined to 49.4 from June’s reading of 49.8. Meanwhile, the flash estimate of the services PMI dipped slightly to 53.9 in July from 54.0 in June with the Composite PMI, indicative of the overall health of the economy, remaining unchanged at 52.1.

Elsewhere, service sector activity in Australia shrank for the first time since March as the Judo Bank’s flash estimate of services PMI came in at 48.0 in July down from 50.1 in June. In contrast, manufacturing activity recorded a softer contraction at 49.6 in July against 48.2 in June.

In political news, Spain appears to be heading for a hung parliament after national elections on Sunday showed no clear winner emerging in a nail-biting finish. As per media reports, incumbent Pedro Sánchez is slated to remain the Spanish prime minister as a consequence of inconclusive national election in which the center-right Popular Party (PP) won 136 seats against the ruling Socialist Workers party (PSOE’s) tally of 122. Both parties were short of the 176 seats needed to control the Spanish parliament but Sánchez's coalition can potentially muster 172 seats with the right wing block only 170, after being slated to be able to get to 180 in the last polls before the blackout early last week. So at this stage it feels like a Sánchez controlled hung parliament with fresh elections later in the year perhaps.

Looking back on last week now. On Friday, markets struggled for direction, though the earlier better-than-expected economic data resulted in risk-on moves for the week as a whole. Expectations for an additional 25bp hike following this weeks’ 25bps near certain rise were dialled back marginally on Friday, down from 35% to 33%, but were up from 22% a week earlier. Expectations for rates for the December 2024 meeting were up +0.5bp on Friday to 4.035%, a gain of +10.7bps in weekly terms.

US 10yr Treasuries rallied by -1.4bps on Friday, leaving yields up +0.5bps week-on-week. Real yields and breakevens saw contrasting moves, with the 10yr real yield down -10.7bp on the week, while the 10yr breakeven rose +11.2bp to 2.35% (+3.2bps on Friday), its highest level since the SVB crisis. So the strengthening of the soft landing narrative has added to perceptions of firmer long-term inflation. In contrast, the interest-rate sensitive US 2yr yield gained +7.4bps week-on-week (-0.15bps on Friday). Resultingly, the 2s10s curve flattened -7.3bps over the course of the week (and -2.3bps on Friday) to -101.5bps. Every time it resteepens, the flattening trade seems to make a comeback pretty soon after at the moment.

While US markets priced in a greater chance of an additional rate hike after July last week, European markets reduced their expectations of another 25bps rate hike by the ECB largely after hawkish governor Knot suggested that September’s meeting wasn’t a foregone conclusion. Terminal rate pricing for December 2023 fell -4.2bps week-on-week (-1.4bps Friday), with 47bp of hikes now priced until year-end. German 10yr bund yields thus declined -1.8bps on Friday (-4.4bps in weekly terms) to 2.47%, with the rally more pronounced for the 2yr (-3.0bp on Friday and -11.7bp on the week).

In equities, the S&P 500 was near flat (+0.03%) on Friday after losses on Thursday and ended the week up +0.69%, closing off its second consecutive week of gains. A similar Friday performance for the Dow (+0.01%) saw the index rise for the 10th session in a row, only the fourth such run of gains since 2000. The megacap-driven tech underperformance continued on Friday, with the NASDAQ down -0.22% on the day and down -0.57% in weekly terms. The index was dragged down after underperformance from big tech players like Netflix (-2.27% on Friday and -3.26% week-on-week) and Tesla (-1.10% on Friday and -7.59% week-on-week) following worse-than-expected earnings. Over in Europe, the STOXX 600 gained +0.99% last week (and +0.32% on Friday).

Oil gained last week against a backdrop of tight supply, as Russia’s crude shipments fell to a six-month low in the four weeks to mid-July. Brent crude rose +1.50% week-on-week to $81.07/bbl (and +1.80% on Friday). WTI crude outperformed, up +2.19% in weekly terms to $77.07/bbl (and +1.90% on Friday). Both closed up for their fourth consecutive week.

Finally, geopolitical tensions resurfaced via the grain market. Wheat prices grappled with the collapse of the Black Sea grain deal and growing concern that Ukraine’s ability to substitute shipments via the Danube has been compromised by central Europe’s heatwave. There was some relief in the market on Friday after confirmation of the size of the world’s wheat stockpiles and other avenues for Ukraine grain exports, with grain prices falling -4.06%. However, this was not sufficient to erase earlier price increases. Overall, wheat prices were up +8.73% week-on-week.