US stock futures and global markets are higher led by Tech with the Mag7 and semis higher pre-mkt while small-caps underperform ahead of two key central bank decisions - by the Fed, BOJ and BOE - while Nvidia has two key events this week which may be even more market-moving. As of 8:00am, S&P futures were 0.73% higher while Nasdaq futures gained 1.1%. Tech was boosted by news from Bloomberg that Apple may use Google's woke AI chatbot Gemini to power the iPhone's AI features. Bond yields and USD are flat, while commodity strength is seen in both Ags and Energy, where oil hit a fresh four-month high as macro-economic data from China came in ahead of expectations, and Ukrainian attacks on Russian refineries heightened geopolitical risks. According to JPM's weekly preview, this is a catalyst-heavy week as the markets may be approaching an inflection point with Mag7 appearing extended, positioning getting stretched, and the potential for bond yields to reprice higher as economic growth is elevated amid above-target inflation. Today's US data calendar is light and keeps focus on Tuesday’s Bank of Japan meeting, where first rate hike in 17 years is expected, as well as Wednesday’s Fed policy announcement.

In premarket trading, Google parent company Alphabet rallied almost 4% in premarket trading after Bloomberg reported that Apple is in talks to build Google’s Gemini artificial intelligence engine into the iPhone; Nvidia and Tesla added more than 2%. Here are some other notable premarket movers:

The Federal Reserve’s meeting on Wednesday is set to dictate the direction of global stocks for the next quarter, with policymakers likely to stick to forecasts for three interest-rate cuts in 2024. Meanwhile, the Bank of Japan is widely expected to hike interest rates tomorrow, potentially ending the world’s last negative interest rate regime. In the US, the main focus comes Wednesday, when Fed policy makers gather for a meeting that has the potential to set the tone for global stocks for the next quarter. While Fed Chairman Jerome Powell indicated the central bank was close to having the confidence to cut, bond traders appear to have painfully surrendered to a higher-for-longer reality. The 10-year Treasury yield held near a three-week high on Monday, having risen more than 20 basis points last week. A gauge of the dollar was steady.

“The recent market repricing has put policy expectations essentially at Fed estimates,” said Anthi Tsouvali, multi asset strategist at State Street Global Markets. The decision will likely provide “another signal that easing of economic conditions is coming, pushing equity markets higher,” Tsouvali said.

European stocks hover near record levels ahead of rate decisions from the US Federal Reserve and Bank of England later this week. The Stoxx 600 Index was largely unchanged, with autos, real estate and the energy sector among top gainers. Among individual stocks, Haleon falls after Pfizer said it plans to sell about £2 billion of its shares. Here are some of the biggest movers Monday:

Earlier in the session, Asian stocks climbed, led by Japan and China, as investors brace for an event-heavy week that includes monetary policy outcomes in Japan and the US. The MSCI Asia Pacific Index gained as much as 0.8%, the most since March 8, with technology and industrial stocks contributing the most. In Japan, the Nikkei 225 index climbed the most in a month and the yen traded weaker against the dollar, amid signs markets have priced in the potential for an interest-rate increase. “Japanese stocks are rising, driven by weakness of the yen, and expectations that the currency won’t strengthen even if the central bank hikes,” said Charu Chanana, a strategist at Saxo Capital Markets based in Singapore.

“The weaker yen from widening US-Japan rates and reduced uncertainty for the BOJ meeting should push Japanese stocks higher today,” said Shoji Hirakawa, chief global strategist at Tokai Tokyo Intelligence Laboratory. US yields have been gaining amid bets on fewer rate cuts this year. “Defensives are likely to rise, including electric power and gas, land transportation, materials, non-ferrous metals and steel.”

Mainland China pared early gains as data released on Monday pointed to continued troubles for the property sector and weakness consumer spending. Property development investments slid 9% from last year in February, while retail sales missed expectations.

In FX, the Bloomberg Dollar Spot Index is also little changed. The yen falls 0.1% even as speculation mounts the Bank of Japan will raise interest rates on Tuesday.

In rates, treasuries are steady ahead of the Fed decision on Wednesday. US 10-year yields are flat at 4.3% with front-end outperforming, steepening the curve. US front-end yields richer by 1.3bp on the day with intermediate and long-end little changed, steepening 2s10s and 5s30s by 1bp-2bp; Bunds are underperforming by 2bp in the sector. Germany’s bond market sees bigger bear-steepening move, with long-end around 3bp cheaper on the day after erasing gains. Treasury auctions this week include $13b 20-year bond reopening Tuesday and $16b 10-year TIPS reopening Thursday.

In commodities, oil hit a fresh four-month high as macro-economic data from China came in ahead of expectations, and Ukrainian attacks on Russian refineries heightened geopolitical risks. Morgan Stanley increased its Brent crude price forecast to $90 a barrel by 3Q, citing tightening supply-demand balances. Over the weekend, BHP is reported to have stood down around a quarter of the workers constructing its West Musgrave nickel and copper project in Western Australia, according to the Australian Financial Review. Spot gold is unchanged at $2,156/oz.

Bitcoin holds just above $68k after volatile price action over the weekend; Ethereum is also lower trading around $3,500.

The US economic data calendar includes March New York Fed services business activity (8:30am) and NAHB housing market index (10am); later this week are housing starts/building permits, manufacturing PMI and new home sales. Nvidia CEO Huang is set to speak on AI at 4pm ET. There are no Fed speakers scheduled before March 20 policy decision.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were somewhat mixed after quiet weekend newsflow and as participants brace for this week's busy slate of central bank announcements including tomorrow's crucial BoJ decision, while better-than-expected Chinese activity data had little lasting effect. ASX 200 traded cautiously with the index contained by underperformance in real estate and energy. Nikkei 225 outperformed despite weak Machinery Orders and with many anticipating a policy shift at tomorrow's BoJ announcement, while momentum in the index was helped by currency weakness and softer yields. Hang Seng and Shanghai Comp. were both ultimately positive after the Hang Seng pared earlier losses with the help of tech strength but with gains capped by weakness in property, while the mainland was gradually underpinned following better-than-expected Chinese Industrial Production and Retail Sales data.

Top Asian News

European bourses are mostly firmer, though with clear underperformance in the SMI (-0.6%), which is hampered by losses in Logitech (-7.5%). European sectors are mixed; Real Estate takes the top spot, whilst Telecoms is found at the foot of the pile. US equity futures (ES +0.3%, NQ +0.6%, RTY +0.2%) are entirely in the green, with clear outperformance in the NQ; Google (+2.5%) benefits from Apple/Gemini related news and Nvidia (+2.1%) gains ahead of its GTC

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

OTHER

US Event Calendar

DB's Jim Reid concludes the overnight wrap

This could be a landmark week in markets as the last global holdout on negative rates looks set to be removed as the BoJ likely hikes rates from -0.1% tomorrow. That could slightly overshadow the FOMC that concludes on Wednesday that will have its own signalling intrigue given recent strong inflation. We also have the RBA meeting tomorrow (DB preview here) and the SNB and BoE (DB preview here) meetings on Thursday to close out a big week for global central bankers with many EM countries also deciding on policy. We’ll preview the main meetings in more depth below but outside of this we have the global flash PMIs on Thursday as well as inflation reports in Japan (Thursday) and the UK (Wednesday). US housing data also permeates through the week as you'll see in the full global day-by-day week ahead at the end as usual.

Let’s go into detail now, starting with the BoJ tomorrow. We’ve had negative base rates now for 8 years which if I have my history correct is the longest run ever seen for any country in the history of mankind. In fact I doubt pre-historic man was as generous as to charge negative interest rates on lending money prior to this! It also might be one of the longest global runs without any interest rate hikes given the 17 year run that could end tomorrow. So a landmark event.

Our Chief Japan economist previews the meeting here and e xpects the central bank to revise its policy and abandon both NIRP and the multi-tiered current account structure and set rates on all excess reserves at 0.1%. He also sees both the yield curve control (YCC) and the inflation-overshooting commitment ending, replaced by a benchmark for the pace of the bank’s JGB purchasing activity. Our house view forecast of 50bps of hikes through 2025 is more hawkish than the market but risks are still tilted to the upside. On Friday, the Japan Trade Union Confederation (Rengo) announced the first tally of the results of this year's shunto spring wage negotiation. The wage increase rate, including the seniority-based wage hike, is 5.28%, which was significantly higher than expected. This year will probably see the highest wage settlements since 1991 which given Japan’s recent history is an incredible turnaround. This wage data news has firmed up expectations for tomorrow. See our economists’ piece on it here.

With regards to the FOMC which concludes on Wednesday, our economists (see their preview here) expect only minor revisions to the meeting statement that saw an overhaul last meeting. With regards to the SEP, the growth and unemployment forecasts are unlikely to change but the 2024 inflation forecasts potentially could. DB expect the Fed to revise up their 2024 core PCE inflation forecast by a tenth to 2.5%, although they see meaningful risks that it gets revised up even higher to 2.6%. In our economists' view, a 2.5% core PCE reading would allow just enough wiggle room to keep the 2024 fed funds rate at 4.6% (75bps of cuts). However, if core PCE inflation were revised up to 2.6%, it would likely entail the Fed moving their base case back to 50bps of cuts, as this would essentially reflect the same forecasts as the September 2023 SEP.

Beyond 2024, DB expect officials to build in less policy easing due to a higher r-star. If two of the eight officials currently at 2.5% move up by 25bps, then the long-run median forecast would edge up to 2.6%. This could be justified by a one-tenth upgrade to the long-run growth forecast. After all this information is released the presser from Powell will of course be heavily scrutinised, especially on how Powell sees recent inflation data. Powell should also provide an update on discussions around QT but it is unlikely they are ready yet to release updated guidance.

One additional global highlight this week might be a big fall in UK inflation on Wednesday with our economists' preview here suggesting that headline CPI will slow to 3.4% (vs 4% in January) and core to 4.5% (5.1%). Elsewhere there is plenty of ECB speaker appearances including President Lagarde on Wednesday. They are all highlighted in the day-by-day guide at the end.

Asian equity markets are climbing this morning with the Nikkei (+2.13%) rising sharply ahead of what could be the first baby step towards normalising policy tomorrow. Elsewhere, the CSI (+0.51%) and Shanghai Composite (+0.49%) are also moving higher after data showed that the world’s second biggest economy kicked off the year on a stronger note (more below). Meanwhile, the KOSPI (+0.60%) is also up while the Hang Seng is struggling to gain traction this morning. S&P 500 (+0.26%) and Nasdaq (+0.45%) futures are higher. US Treasury yields are fairly stable. .

Coming back to China, industrial production grew +7.0% in the first two months of 2024, well above Bloomberg’s forecast of +5.2% with businesses continuing to engage in strong capital spending as fixed asset investment grew +4.2% in the two-month period, more than the +3.2% expected. Meanwhile, retail sales advanced +5.5% YTD y/y, v/s +5.2% expected, indicating that the Chinese economy is performing better than expected helped by extra demand during the Lunar New Year period.

Elsewhere, in one of the more predictable electoral events of 2024, Vladimir Putin secured another term as Russia’s president. Peter Sidorov has published a short reaction on the result and on things to watch in its aftermath, here.

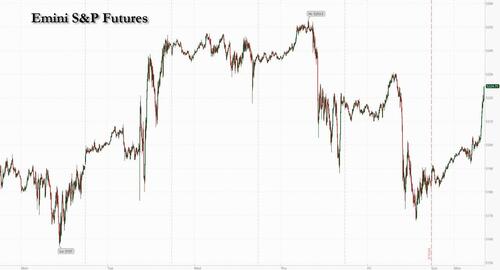

Recapping last week now, concerns about stubborn inflation proved to be at the forefront of investors’ minds. The main drivers of these renewed inflation worries were the stronger than expected US CPI and PPI reports, which showed that both consumer and producer prices were rising faster than expected. And markets found little relief in Friday’s data, with the University of Michigan’s preliminary consumer sentiment index falling to 76.5 in March (vs 77.1 expected), while the 5-10yr inflation expectations were unchanged at 2.9% as expected. Adding to the inflation fears, oil prices surged last week. Brent crude rose +3.97% (-0.09% on Friday) to $85.34/bbl, its highest weekly close since late October, and WTI crude jumped +3.88% ( -0.27% on Friday) to $81.04/bbl.

Off the back of this, markets revisited their expected timing of Fed cuts. For example, futures are now pricing only a 61% chance that the Fed will cut by June. At the start of March, markets had seen a 96% chance of a cut by June. The number of cuts expected by the December meeting were dialled back by -23.1bps last week (and -4.8bps on Friday), with just 72bps of cuts priced in for the year, the lowest this has been in four months.

The prospect of fewer rate cuts led to a strong upward move in global yields. US 2yr Treasury yields surged +25.3bps last week (and +3.4bps on Friday). Longer dated Treasuries also jumped. For example, 10yr yields rose +23.1bps to 4.31% (+1.6bps on Friday), bringing them back to their February levels. European fixed income was far from immune to these moves, as 10yr bunds gained +17.5bps (and +1.6bps on Friday). Increasing expectations that the BoJ was looking to cut at this week’s meeting also added to this upward pressure on global yields, with 10yr Japanese bond yields up +5.1bps (and +0.9bps on Friday).

The equity reaction was not as negative but they also struggled after last week’s hot inflation prints, as well as with the softer US retail data. The S&P 500 was down -0.13% last week, and fell -0.65% on Friday against a risk-off backdrop. The small cap Russell 2000 struggled the most, down -2.08% over the week, despite a +0.40% rise on Friday. Technology also underperformed on the week, as the NASDAQ fell -0.70% (and -0.96% on Friday). The Magnificent 7 were down -1.04% on Friday (-0.30% on the week), though Nvidia (+0.35% on the week) managed to narrowly secure 10 weeks of consecutive gains. Equity markets were more optimistic in Europe, with the STOXX 600 up +0.31% (-0.32% on Friday). The German DAX and French CAC outperformed, up +0.69% and +1.70% on the week, respectively.