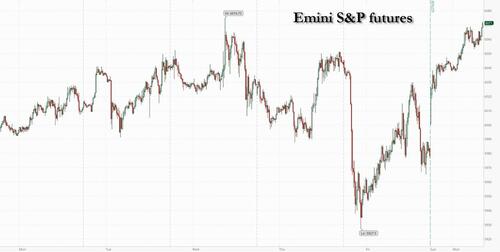

US equity futures are higher, oil is lower and multiple asset classes are displaying a risk on tone as markets shrug off the situation in the Middle East, potentially as Iranian oil exports have not been targeted. As of 8:00am, S&P futures are up 0.6% S&P 500 contracts up, rising some 70 points overnight to 6070 signaling a full rebound from Friday’s drop, with dip buyers coming back as the conflict between Israel and Iran remained contained over the weekend. Nasdaq 100 and Russell futures also rise 0.7% and 1.0% respectively, pointing to a recovery after cash equities fell on Friday. European and Asian stocks also advanced. Crude oil reverses early gains, with Brent now down 0.7% after spiking as much as 5.5% overnight following as attacks between Israel and Iran extended into a fourth day. Haven assets also retreat, with spot gold is down $15 to around $3,417/oz, and the Swiss franc and yen underperforming G-10 peers. Gold slipped 0.3% from an all-time high. Treasuries retreated on concerns that persistently higher energy prices could stoke inflation, with the 10-year yield rising five basis points to 4.45%. Trump said in an interview with ABC News on Sunday that it was “possible” the US could get involved in the conflict, though the US is “not at this moment involved"; he also said he hoped Iran/Israel can find an agreement but sometimes you have to “fight it out." Attention for this week is the G7 Summit (today/tomorrow – watch for commentary on bil-lateral trade deals), BoJ tomorrow, FOMC on Wednesday. and BoE on Thursday. Elsewhere, data from China was mixed with Retail Sales stronger while Industrial Production/Fixed Urban Assets worse. Reminder US mkts are closed Thursday for Juneteenth holiday.

In premarket trading, Mag 7 stocks are all higher (Tesla +1.7%, Meta +0.7%, Nvidia +0.7%, Apple +0.4%, Amazon +0.4%, Alphabet +0.5%, Microsoft +0.1%). Here are some other notable premarket movers:

The outbreak of hostilities between Israel and Iran on Friday disrupted the momentum that had driven the S&P 500 back near record levels and reversed April’s tariff-fueled losses. While markets initially adopted a cautious, risk-off stance to assess how the conflict might unfold, sentiment improved on Monday as investors grew more confident that the attacks were unlikely to draw in more parties.

"The situation in the Middle East is not making the market shake, and it’s likely it will stay that way as long as there is no major escalation,” said Enguerrand Artaz, a fund manager at La Financière de l’Echiquier. “Markets are riding strong momentum. The mood overall is still very much about buying the dip.”

"The market currently anticipates a limited conflict, though there is little indication that hostilities will end quickly,” said Jochen Stanzl, chief market analyst at CMC Markets. “It is expected that fighting will continue unabated this week, albeit on a limited scale.”

Some strategists were more circumspect and cautioned that the S&P 500 remained vulnerable, especially as valuations looked stretched. The broader the Middle East conflict becomes and the longer it lasts, the more negative it will be for US stocks, said RBC's Lori Calvasina. In a worst-case scenario, they see the S&P 500 returning to its April lows if the attacks drive up energy prices. And in a less severe case, the index may fall about 13%, the strategists said.

Federal Reserve Chair Jerome Powell will likely highlight increased uncertainty when policymakers meet this week about interest rates this week, noted Mohit Kumar, chief European strategist at Jefferies International.

“The tone would likely be that there is no hurry to cut rates, but the Fed will be ready to respond if economic conditions so warrant,” Kumar said.

Europe's Stoxx 600 is up 0.2% as investors wager that the Israel-Iran conflict would not have a widespread economic fallout beyond the Middle East. Advances for banks, oil companies and luxury goods stocks offset declines for pharmaceuticals and consumer goods. Among single stocks, Kering rallies on news the luxury-goods company will appoint the chief executive officer of Renault as its next CEO. Here are the most notable European movers:

Asian stocks advanced, helped by gains in technology firms, overcoming initial caution over hostilities between Israel and Iran. The MSCI Asia Pacific Index gained as much as 0.8% to head for its first advance in three sessions, settling after Friday’s drop as Israel launched surprise attacks on Iran. SK Hynix and Advantest were among the biggest boosts to the gauge’s climb. Benchmarks rose in South Korea, Japan and India. Chinese stocks were little changed as investors try to gauge the health of Asia’s largest economy. While May retail sales data came in stronger-than-expected, new-home prices fell by the most in seven months.

In FX, the Bloomberg Dollar Spot Index down by 0.1%, reversing a rally in the early hours. The Israeli shekel is the best-performing currency globally, clawing back some of the losses it saw last week versus the greenback.

In rates, treasuries are cheaper across the curve, lagging bunds and gilts as stock futures advance amid optimism that the hostilities between Israel and Iran will remain contained. Planned auction of 20-year bonds during US afternoon, two days earlier in the week than normal because of Wednesday’s Fed rate decision and Thursday’s holiday, also weighs. Treasury yields are 1.5bp-2bp cheaper across maturities with curve spreads steeper but still within 1bp of Friday’s closing levels. 10-year near 4.45% is ~5bps cheaper on the day with bunds and gilts outperforming by 2bp and 3bp in the sector. $13 billion 20-year bond reopening at 1pm New York time has WI yield around 4.945%, about 10bp richer than last month’s new-issue result; a $23 billion 5-year TIPS reopening Tuesday is this week’s only other coupon auction

In commodities, oil gave up another sharp gain on Monday as ongoing attacks have so far spared key export infrastructure. There’s also been no blockage of the vital Strait of Hormuz, the narrow waterway that handles roughly a fifth of the world’s daily crude shipments. Brent was down 0.7% after spiking as much as 5.5% overnight following as attacks between Israel and Iran extended into a fourth day. Haven assets also retreat, with spot gold is down $15 to around $3,417/oz, and the Swiss franc and yen underperforming G-10 peers.

Bitcoin edges higher and trades just shy of USD 107k; Ethereum also benefits from the risk tone and climbs past USD 2.6k.

Looking at today's calendar, US economic data slate includes June Empire manufacturing at 8:30am. Ahead this week are retail sales, industrial production, and S&P Global US PMIs

Market Snapshot

Top Overnight News

Tariffs/Trade

A more detailed look at global markets courtesy of Newsquawk

APAC stocks saw mixed trade with sentiment stabilising overnight despite the losses on Wall Street on Friday and the geopolitical escalations over the weekend. This came amid efforts to broker a ceasefire between Israel and Iran, with US President Trump posting on Truth suggesting many calls and meetings are taking place for a peace deal between Tehran and Tel Aviv. ASX 200 moved between modest gains and losses, whilst reports suggested Australian regulator ASIC and RBA have ongoing concerns over ASX’s ability to maintain stable, secure and resilient critical market infrastructure. Santos shares meanwhile jumped 15% at the open after ADNOC made a USD 18.7bln takeover offer for the Co. Nikkei 225 was bolstered by the weaker JPY despite the escalation on the Israel-Iran front. In trade-related headlines, Japan's top trade negotiator Akazawa and the US engaged in in-depth discussions and explored the possibility of a trade agreement. Traders now look ahead to the BoJ announcement on Tuesday. Hang Seng and Shanghai Comp were choppy whilst weekend reports suggested the US-China trade agreement in London did not resolve export restrictions linked to national security, according to Reuters. Chinese markets saw no notable reaction to Chinese activity data which saw Retail Sales surpass the most optimistic of analysts' forecasts, whilst Industrial Output slightly missed expectations.

Top Asian News

European bourses (STOXX 600 +0.2%) are firmer across the board, amid the constructive risk tone. The improving sentiment seemingly stems from efforts to broker a ceasefire between Israel/Iran (no progress yet). European sectors are mixed and with a fairly wide breadth today. Travel & Leisure is by far the clear outperformer today, with sentiment boosted by upside in Entain. The Co. upped its FY25 guidance. Healthcare is found right at the bottom of the pile, and is the clear underperformer today. US equity futures (ES +0.4% NQ +0.4% RTY +0.7%) are modestly firmer across the board, attempting to pare back some of the hefty Israel-Iran induced losses in the prior session; upside which also comes amid a broadly positive risk tone.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Israel-Iran War

US Event Calendar

DB's Jim Reid concludes the overnight wrap

This time last week it was all about US/China but that seems a long time ago now as 2025 continues to throw up new things for us to think about. So after the events of the last 3-4 days, events in the Middle East will overshadow the FOMC meeting on Wednesday which would have been the highlight in a week of several central bank meetings.

Israel and Iran have continued to exchange strikes over the weekend. Israel has attacked Iran’s energy infrastructure, including oil storage as well as a plant at its largest gas field, but so far has shied away from targeting oil production and shipping facilities. While both sides have traded retaliatory blows, they have so far avoided the most extreme escalatory steps. In Iran’s case, they have so far avoided targeting US facilities in the region, which would very likely trigger direct US involvement. Reuters reported that Trump discouraged Israel from trying to kill Iran’s Supreme Leader Ayatollah Ali Khamenei when an opportunity presented itself. So diplomacy may be on a knife-edge in the region.

Middle Eastern markets have obviously been badly hit, with the Egyptian market down -4.6% yesterday (-7.7% at the lows). S&P 500 (+0.13%) and Nasdaq (+0.18%) futures have edged up this morning with the weekend developments not as bad as they could have been.

Oil is up another +1.3% this morning (+5.5% at the morning peak) after climbing around +7% on Friday. In terms of what’s next for Oil, on Friday DB’s Michael Hsueh outlined some scenarios. He highlights that in the most negative scenario of a complete disruption to Iranian oil supply and a closure of the strait of Hormuz, oil could rise to above $120pbbl. Under a more restrained scenario of a 50% reduction in Iranian exports without broader disruption, the oil price spike would be limited to around current levels, implying that this is the scenario that is currently priced by the market. They see closing the strait, which sees around 20% of global oil pass through it daily, as a last resort piece of leverage from Iran, rather than something immediately likely.

As geopolitical shocks are becoming more frequent it seems its now at least a yearly occurrence that we refer to our equity strategists work on the impact of such shocks and how long it takes for the market to recover from them. Our strategists Parag and Binky reminded us of the work on Friday night and highlighted that the typical pattern is for the S&P 500 to pull back about -6% in 3 weeks after the shock but then rally all the way back in another 3. They believe this incident will likely be milder than this unless we get notable escalation as they highlight that equity positioning is already underweight (-0.33sd, 28th percentile), and a -6% selloff would need it to fall all the way to the bottom of its usual range. See their report here for more and the table of geopolitical shocks over the last 80 years and how it impacts equities. I may use it in my CoTD later.

Outside of the Middle East, geopolitics will continue to be in the spotlight with the G7 Leader's Summit in Canada that started yesterday through to tomorrow. Any headlines from trade in this meeting will also be of note but progress doesn't look likely from seeing the headlines going into the summit. The meeting also takes place ahead of the NATO summit on June 24-25. So a lot bubbling up and next week will be fascinating to see how the US operates in terms of pressure on its fellow NATO members and what European countries commit to.

Ahead of that, the FOMC will attract the most attention this week outside of events in the Middle East. See our economists' preview here. As is widely expected, they expect the Fed to be on hold and maintain their existing biases in the statement, the Summary of Economic Projections (SEP) and Chair Powell's press conference. Having said that, the SEP will likely show weaker growth, higher inflation, and could show a softer labour market. With these adjustments, their baseline is that the median dot only shows one rate cut this year, though they admit it is a close call between that and the existing two. Beyond 2025 they expect only modest adjustments to the SEP, with the 2026 median fed funds rate moving 25bps higher, in part supported by a small increase in the long-run dot.

Powell's press conference is likely to emphasise uncertainty and a wait and see approach. The recent spike in oil will just add to all of this even if recent inflation data has been better than expected. Future price increases from tariffs loom in the background even if their initial impact has taken a bit longer to show up than expected. So it's a meeting where we could learn very little, partly as the Fed really don’t know which way the world is evolving and feeling that they have flexibility at current policy settings.

Prior to that, the BoJ meeting arrives tomorrow before we go to print. Our Chief Japanese economist previews the meeting here and expects the target for the short-term policy rate to be maintained. There’s also the interim assessment of the JGB purchase plan to look forward to. Our economists expect no change to the schedule up to Q1 2026 and then to be reduced thereafter. The report has all the details. They still expect a July hike but there are a number of conditions they go through in the note for that to materialise.

Then the BoE round outs the G7 policy meetings for the week on Thursday. Our UK economist previews the meeting here. He sees the Bank Rate staying unchanged at 4.25% and expects the MPC to open the door to an August rate cut. There will be other European central bank policy meeting this week, Sweden's Riksbank on Wednesday, and Norway's Norges bank and Switzerland's SNB on Thursday. The SNB are expected to cut rates back down to zero which will be a landmark moment after three years of positive rates following 7-8 years of negative rates. There is some risk that they cut into negative rate territory.

In terms of the rest of the week the day-by-day calendar is at the end as usual but the main highlights are; the US Empire manufacturing index and a 20yr UST auction today; US retail sales, industrial production and Germany's ZEW tomorrow; US housing starts/permits, jobless claims and UK inflation on Wednesday; a US holiday (Juneteenth) on Thursday; and the US Phili Fed, UK retail sales, Japanese CPI, German PPI and French retail sales on Friday.

Coming back to Asia, there is a small relief rally as developments in the Middle East haven't yet escalated out of control. The Nikkei (+1.21%) is outperforming its peers with the KOSPI (+1.08%) building on its previous gains, trading close to a 3-½ year high this morning. Elsewhere, Chinese equities are struggling to gain traction amid mixed economic readings. As I check my screens, the Hang Seng (-0.12%) is seeing minor losses while the Shanghai Composite (+0.05%) is broadly flat.

Chinese retail sales did grow at their fastest rate since late 2023, jumping +6.4% y/y in May, comfortably beating market estimates for +4.9% growth and accelerating from the +5.1% growth the previous month in part helped by the extended Labor Day and Dragon Boat holidays. On the other hand, growth in industrial output slowed to +5.8% year on year in May (v/s +6.0% expected) from +6.1% the prior month. Additionally, Fixed-asset investment has expanded +3.7% this year as of May from a year earlier, undershooting the market forecast for a +4.0% increase and slowing from +4.0% growth in the first four months. China’s new home prices fell in May, extending a two-year long stagnation. Prices fell -0.22% m/m, the most in seven months in May after sliding -0.12% the previous month, suggesting that the nation’s property sector remains stagnant despite several rounds of policy support measures.

Recapping last week now and the most significant story came early on Friday morning, after Israel carried out air strikes against Iran’s nuclear and military facilities. This triggered a market-wide sell-off, and while equities initially saw some recovery, news of Iran’s retaliatory missile strikes late in the session left the S&P 500 -0.39% lower on the week (-1.13% Friday). The Stoxx 600 declined -1.57% (-0.89% Friday). Initially, after the news broke, oil saw its biggest jump since May 2020, with Brent trading as high as $78.5/bbl, before coming down to $74.23/bbl, but still up +11.67% on the week (+7.02% on Friday).

Prior to Friday's news, markets performed reasonably well amidst positive headlines from US-China talks, as well as softer than expected US inflation data. That led to more aggressive pricing for Fed cuts this year. Specifically, US headline CPI was up +0.08% on the month in May (vs. +0.2% expected), and core CPI up +0.13% (vs. +0.3% expected), with the latter beneath every economist’s estimate on Bloomberg. The PPI print then consolidated this narrative, with the monthly headline reading up just +0.1% in May (vs. +0.2% expected), and core PPI up only +0.1% as well (vs. +0.3% expected). Markets also feared a slowing labour market as the weekly jobless claims and continuing claims were higher than expected at 248k (vs 242k expected), and 1.956m (vs. 1.910m expected) respectively. How much is due to the recent seasonal trend of increased summer claims is not clear at the moment.

In light of all that, Fed futures are pricing 50bps of cuts by the December meeting, which is a weekly increase of +6.2bps (-1.7bps Friday), and having been as high as 58bps on Friday morning. This led to a rally in government bonds, with the 10yr Treasury yield -10.7bps tighter on the week to 4.40%, though it rose +4.0bps on Friday as the impact of higher oil prices outweighed initial safe-haven flows. In Europe, the 10yr Bund yield came down -4.0bps to 2.53% (+5.8bps Friday). With the earlier narrowing in sovereign spreads running out of steam, 10yr OAT yields rose slightly by +1.2bps to 3.25% (+7.2bps Friday), and while 10yr BTP was -0.4bps lower at 3.48% (+7.9bps Friday).

In FX markets, the dollar index reached a 3-year low on Thursday, ending the week -1.01% lower despite a +0.27% recovery on Friday amid the geopolitical risk-off mood. The euro broke through $1.15 against the dollar, moving +1.33% higher on the week to $1.1549 (-0.30% on Friday after the attacks), its highest weekly close since 2021.