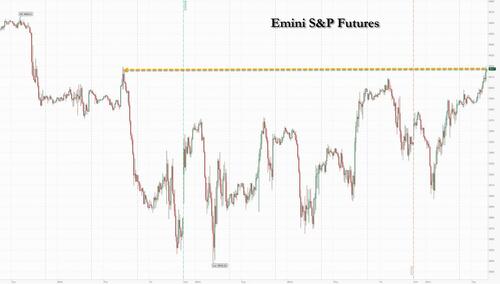

It's only appropriate that the day after the weekly dose of doom and gloom from Marko Kolanovic and Mike Wilson, that stocks soar to the highest level in almost two weeks. S&P futures spiked above 4,000 on Tuesday as fears about turmoil in the global banking sector subsided, following a Bloomberg report that the Biden admin was considering insuring all deposits (unclear exactly how they will credibly insure all $18 trillion in deposits, some 75% of US GDP but whatever) followed by an FT article this morning previewing Janet Yellen's speech at the American Bankers Association on Tuesday in which the Treasury Secretary will signal further US government backing for deposits at smaller American banks if needed, "a shift that seeks to protect parts of the country’s banking system struggling in the recent financial turmoil."

Contracts on the S&P 500 were up 0.8% by 7:45 a.m. ET paced by European shares with Estoxx50 +1.8% on the day as risk appetite has been stoked by report that US officials are studying ways to temporarily guarantee all bank deposits; Nasdaq 100 futures gained 0.7%. Both underlying indexes had risen on Monday. European and Asian markets were solidly in the green. As a result of the jump in risk sentiment, traders are also firming up bets on the Fed raising rates another 25bp on Wednesday with ~20bps currently priced in — versus less than 10bp at one stage on Monday.%. The Bloomberg Dollar Spot Index was down for the second day as treasury yields edged higher, mirroring moves in the UK and Europe. Gold fell and oil rose, while Bitcoin retreated for the first time in nearly a week.

Among notable movers in US premarket trading, First Republic Bank advanced more than 20%, rebounding from a slump to a record low as investors weighed a proposal from JPMorgan to help the struggling mid-size lender. Meta Platforms Inc. rose after Morgan Stanley raised its recommendation to overweight from equal-weight. Here are some of the other notable premarket movers:

Investors are tiptoeing back into riskier assets, reversing the knee-jerk selloff early Monday that followed a government-brokered takeover of Credit Suisse Group AG at the weekend by Swiss rival UBS Group AG. Banks’ Additional Tier 1 bonds rebounded in Europe and Asia after euro-zone and UK regulators gave reassurances on the risky debt category, which seized up after Credit Suisse shareholders took precedence over the holders of over $16 billion of the AT1s. Appetite for risk is also being fueled by expectations that the Federal Reserve may adopt a more cautious policy approach when it decides on interest rates on Wednesday.

"The resolution to the Credit Suisse situation has managed to calm markets down, though in the US, all eyes remain on First Republic Bank and whether it needs another show of support from major banks,” said Joachim Klement, head of strategy, accounting and sustainability at Liberum Capital. “If the Fed can calm markets down tomorrow, a longer-lasting rally in equity markets is on the cards.”

“About 10 days ago we had a series of risks emerge and now one by one, those tail risks are diminishing,” said Erick Muller, head of investment strategy at asset manager Muzinich & Co. Ltd. “It seems like everything has been put in place to resolve any liquidity issues — which is reassuring.”

The latest BofA fund manager survey showed investors now view a systemic credit event as the biggest tail risk to markets, followed by elevated inflation and hawkish central banks. Strategist Michael Hartnett recommended selling the S&P 500 above 4,100 to 4,200 points — between 3.8% and 6.3% higher than current levels.

Money markets are wagering on a hike of around a quarter-point as the cracks that emerged in the global banking industry discourage more aggressive tightening. Swap traders now see the Fed’s benchmark rate ending the year around 4%, while two weeks ago investors were betting on rates peaking close to 6%.

“It is possible that some central bankers will see recent events as policy finally getting some traction and tightening financial conditions via forcing markets to price in greater credit risk,” Mizuho International Plc strategists including Evelyne Gomez-Liechti wrote in a note. “This would allow central bankers to do a little less with policy rates.”

European markets rise for a second day as concerns around the health of the banking sector ease and investors look ahead to this week’s central-bank rate decisions while the demise of Credit Suisse appears to be in the rear-view mirror for investors who have piled back into European bank stocks. The Stoxx Banks Index is up 4.5% as most lenders saw their AT1 notes rebound from Monday’s sharp sell off. The Stoxx 600 is up 1.5%, with banks and insurance stocks leading gains, while consumer staples trail. Here are some of the biggest European movers:

Earlier in the session, Asian stocks gained as concerns of an escalation in the banking crisis eased, with lenders helping drive the day’s advance. The MSCI Asia Pacific excluding Japan Index climbed as much as 1%, with Tencent, TSMC and AIA Group providing the biggest boosts among individual stocks. Japan was closed for a holiday. Financial stocks lent the most support among sub-indexes to the regional benchmark, which traded close to its 200-day moving average. Sentiment was helped by a rebound in riskier Additional Tier 1 bonds sold by banks in the region, along with news that US officials are studying ways to temporarily guarantee all bank deposits if the turmoil expands.

“Whenever there is bad news on individual banks, governments and big global banks are responding immediately, helping markets find a bottom,” analysts at Shinhan Investment Corp. wrote in a note. Benchmarks in Hong Kong and China advanced more than 1% to lead a regional rebound. The Hang Seng Tech Index gained 2.5% as Tencent climbed ahead of its earnings release. Korean stock gauges rose after China approved more foreign online game titles, fueling a rally among related stocks. Investors are waiting for the Fed’s monetary policy decision, due early Thursday in Asian hours, with expectations that the US central bank will refrain from an aggressive interest rate increase. Pershing Square’s Bill Ackman said the Fed shouldn’t raise its benchmark rate.

In Australia, the S&P/ASX 200 index rose 0.8% to close at 6,955.40, buoyed by a rebound in banks and mining shares. The rise comes following gains on Wall Street as immediate concerns over the global financial system dissipated. Australia’s central bank will consider pausing its policy tightening cycle next month, given that interest-rate settings are already restrictive and the economic outlook is uncertain, minutes of its March meeting showed. In New Zealand, the S&P/NZX 50 index fell 0.3% to 11,531.30.

Stocks in India rose, helped by a recovery in lenders who posted their biggest gains in two weeks as investors chose to look beyond the ongoing banking crisis and chase pockets of value. Tata Consultancy Services, the country’s biggest software exporter, slumped for a ninth straight session. This was the stock’s longest losing streak since November 2007, triggered by a surprise change in its top leadership. Meanwhile, the turmoil in US and European banks continued to dent the appeal for information technology service providers. The S&P BSE Sensex Index rose 0.8% to 58,074.68 in Mumbai, while the NSE Nifty 50 Index advanced 0.7%. The gauges have now risen for three of the last four sessions but slipped more than 4% over the last one month as global equities remained under pressure on concerns of slowing growth and higher rates. The 50-stock Nifty gauge is now trading at 17.3 times its members’ estimated earnings for the next 12 months - the lowest in one year - and near its 10-year average, according to data compiled by Bloomberg.

In FX, the Dollar Index is flat after a three-day fall. The New Zealand dollar is the weakest among G-10 currencies, followed by the Japanese yen. The euro advanced to the strongest level in five weeks and short-end German bonds extended a drop as concerns about contagion in the European banking sector eased further following the rescue deal of Credit Suisse Group AG over the weekend. EUR/USD rose as much as 0.5% to 1.0770, the highest since Feb. 14.

In rates, the improving market sentiment dented government bonds and treasuries extend declines led by the short-end as US stock futures gain and money markets add to Fed tightening wagers ahead of Wednesday’s policy decision. Losses across the curve are led by an aggressive bear-flattening move in bunds, with 2-year German yields nearly 21bp higher on the day to 2.57% as traders also bet the ECB will raise rates again in May. The US 2-year yield rises 11bps to 4.09% while its 10-year peer climbs 5bps to 3.54%, flattening the 2s10s curve 6bps to -56bps. Traders bet on 20bps of Fed hikes this week and add as much as 17bps to tightening expectations this year. The US session includes 20-year bond auction reopening at 1pm, while a $15b 10-year TIPS sale is slated for Thursday. WI 20-year yield near 3.875% is around 10bp richer than last month’s, which tailed by 0.2bp. Cash trading was closed in Tokyo for a Japanese holiday.

In commodities, crude futures rose for a second day with WTI rising 1.3% to trade near $68.50 after swinging in a $3-plus range on Monday. Traders are starting to return to risk markets after authorities stepped in to shore up the financial system. US officials are also studying ways they might temporarily expand protection for all deposits. Spot gold falls 0.6% to around $1,697. Bitcoin gains 0.4%.

To the day ahead now, we get the US existing home sales for February and the latest Philly Fed non-mfg survey. From central banks, we’ll hear from the ECB’s Lagarde and Villeroy, whilst the two-day FOMC meeting will be getting underway ahead of tomorrow’s decision. Lastly, earnings releases include Nike.

Market Snapshot

Top Overnight News

A more detailed look at global markets

Asia-Pac stocks mostly tracked the gains on Wall St where some of the banking sector jitters dissipated following the Credit Suisse rescue and amid hopes FDIC’s deposit insurance amount could be increased. ASX 200 was led by outperformance in energy, financials and the mining-related sectors, while the RBA Minutes from the March meeting noted that the Board agreed to reconsider the case for pausing at the April meeting. Nikkei 225 was closed as Japanese participants observed the Vernal Equinox holiday. Hang Seng and Shanghai Comp. gained as Hong Kong benefitted from strength in consumer stocks and the mainland was buoyed by the PBoC’s liquidity injection albeit with upside capped on higher money market rates.

Top Asian News

European bourses are firmer on the session, Euro Stoxx 50 +1.7%, as the region continues the positive APAC handover with specific banking-sector updates slim. Sectors are all in the green with Banking names the outperformer, SX7P +3.5%, and back at Friday's best levels; albeit, the index has someway to go to recoup the pressure of recent days/weeks. Stateside, futures are similarly in the green though magnitudes are much more contained as participants await updates to First Republic (FRC) and the FDIC ahead of Wednesday's FOMC, ES +0.6%.

Top European News

Bank headlines

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Morning from what promises to be a very sunny warm day in Lisbon which makes a nice change from the rain in London as I left yesterday as we hit the first official day of spring. Like the seasons, it did feel like a new beginning for markets as they finally saw some positivity in the UBS-Credit Suisse deal after an open that felt like we might be in an ice age rather than starting to see green seasonal shoots.

It's worth looking at how bad the open was yesterday and why it turned around. The STOXX 600 fell by almost -2% within 20 minutes of the opening bell, whilst UBS was down almost -16% with European bank AT1s down around 10-15%. It was a similar story on the rates side too, since the 10yr Treasury yield hit its lowest intraday level in over 6 months, at just 3.286% (-14.3bps at that point).

It all turned when we got a statement from the European Banking Authority that explicitly set out that the EU’s practice was that “common equity instruments are the first ones to absorb losses”, and that “only after their full use would Additional Tier One be required to be written down”. A similar statement was then issued by the Bank of England, which said that the UK’s bank resolution framework “has a clear statutory order” as used in the case of SVB UK, which prioritised AT1 ahead of CET1. With that reassurance, AT1s recovered somewhat over the session and we saw a broader boost in bank stocks across the board.

In more detail, Euro Sub-Financial CDS was as much as +46bps wider on the open yesterday before closing -13bps tighter overall, while the senior index was +18bps wider just after the open before finishing -12bps tighter by the end of trading. The STOXX Banks index advanced +1.97% (from -6.61% at the early lows), as all 19 of the 23 members moved higher on the day.

This was an extremely important announcement as most financial investors felt very uncomfortable with the details of the Swiss merger and what it did for AT1 bondholders rights in the resolution pecking order. The EU/UK clarity was a very good move and net net probably helps the European economy longer-term as to permanently increase the cost of bank capital would be counterproductive. As we've shown for the last few days, CS was massively decoupled from the rest of the European banking sector in CDS terms over the last several months, so whilst harder times are to come economically, this announcement and the prior fairly stable European banking system outside of CS, should cut off contagion risks.

US banks have a few more issues to deal with still though and although the KBW Banks index was up +0.79% on the day, they were as much as +2.4% higher before selling off steadily after Europe went home.

This came as concerns continue to percolate regarding US bank First Republic, even after last week’s move by other US banks to deposit $30bn. S&P cut their credit rating to B+ from BB+ over the weekend and yesterday saw their shares end the day down -47.08%, which builds on a decline of more than -80% already over the previous two weeks. There was a short intraday rally after the Wall Street Journal reported that JPMorgan CEO Jamie Dimon was leading discussions with other CEOs to stabilise First Republic, which could involve some or all of the $30bn in deposits being converted into a capital infusion. Despite these headlines, the stock reverted lower to finish near the lows of the day.

Overnight, it was reported that US officials at the Treasury Department and FDIC were studying ways to temporarily expand their deposit coverages in case the current situation expands into a full-blown crisis of confidence. The White House was looking into whether federal regulators would be able to increase the $250k cap without an act of Congress as headlines suggest Republicans would oppose the move.

Aside from the First Republic issues, the more positive shift in sentiment saw investors put growing weight on the probability of the Fed hiking rates tomorrow. For instance, shortly after the European open when everything had slumped, just 9bps worth of hikes were being priced in by futures. But that bounced back over the rest of the session, and by the close a 17.8bps hike was priced in, which is equivalent to a 71.2% probability. So for the time being at least (and clearly things are subject to change in these conditions), it would still be a surprise relative to expectations if the Fed didn’t go ahead.

Last night, our own US economists published their preview of tomorrow’s Fed meeting (link here), and they agree with the view that the Fed will opt for 25bps. Our economists expect the Fed to follow the ECB’s lead and raise rates in line with expectations, do away with forward guidance, but signal a continued tightening bias. They do not expect much change to the dot plot or the SEP from December, and Powell will also likely emphasise the heightened uncertainty surrounding those forecasts in his press conference.

Those expectations of a Fed hike meant that yields posted a small increase yesterday, with the 10yr Treasury yield ending the day up +5.6bps at 3.485%. As with bank stocks though, that only came after a big turnaround earlier in the session, having recovered by nearly +20bps from their intraday low of 3.286%. It was much the same story in Europe too, with the 10yr bund yield up from a low of 1.91% after the open before closing at 2.125%, leaving it up by a net +1.7bps over the day.

For equities it was also a positive session, at least once we got past the European morning. By the close, the STOXX 600 had advanced +0.98%, capping off a turnaround of almost +3% on an intraday basis from the initial lows. And over in the US, the S&P 500 was up +0.89%, which now leaves it down by just -1.01% since its close on March 8 before the concerns about SVB really took hold. Tech stocks were the main underperformer yesterday, with Software (-0.8%) the worst-performing industry, but even so the NASDAQ still gained +0.39%.

This morning in Asia a cautious rally continues. As I check my screens, the Hang Seng (+0.33%), the KOSPI (+0.30%), the CSI (+0.42%) and the Shanghai Composite (+0.15%) are trading in positive territory. Elsewhere, markets in Japan are closed for a holiday with Treasuries not trading overnight.

In central bank news, the minutes from the Reserve Bank of Australia’s recent meeting were less hawkish as the central bank indicated a near-term pause in interest rate increases at its upcoming policy meeting scheduled on April 4th, as uncertainty surrounding the economic outlook persists. In response to the RBA meeting minutes, the Australian dollar rose to a high of 0.6726 versus the US dollar before settling at $0.6687 as we go to press. Meanwhile, 10yr government bonds rallied with yields dropping -4bps to 3.20% as I type.

Amidst all the financial news, one more positive story in the background for consumers (albeit for negative return reasons) has been the continued decline in commodity prices. For instance, European natural gas futures (-8.24%) closed at a 19-month low of €39.325 per megawatt-hour yesterday, which brings their decline over March so far to -15.73%. Oil prices were under pressure for most of the day before a late rally in the US left Brent crude up +1.12% to $73.79/bbl and WTI contracts were up +1.35% to $67.64/bbl. Both contracts reached their lowest level since December 2021 intraday. Overall the recent drop in energy prices will benefit consumers, as well as central banks since it’ll offer them a helpful tailwind on the inflation side. On the other hand, it’s worth noting that much of the decline is thanks to growing concerns about a recession, with oil traditionally being a more cyclical commodity in those circumstances.

To the day ahead now, and data releases include the German ZEW survey for March, Canada’s CPI for February, and US existing home sales for February. From central banks, we’ll hear from the ECB’s Lagarde and Villeroy, whilst the two-day FOMC meeting will be getting underway ahead of tomorrow’s decision. Lastly, earnings releases include Nike.