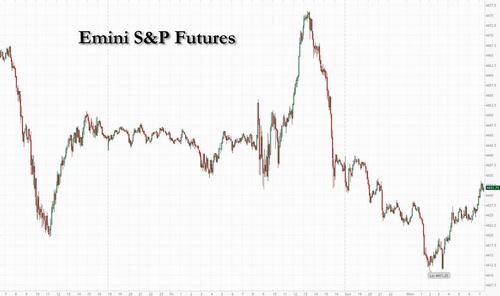

After Friday's downbeat market close, futures are again weaker to start the weak, if off the worst levels of the day, as we enter a heavy macro week highlighted by CPI, 8 Fed speakers, and the kick off of earnings season. Risk appetite also took a hit as focus turned to the threat of deflation in China: June CPI was flat - on the verge of deflation - while producer prices slumped 5.4% from a year earlier, the sharpest slide since December 2015.

As of 7:30am ET, S&P futures were down fractinally, erasing an earlier loss of 0.5%, with Nasdaq 100 futures lagging and down 0.2%. Bond yields are lower, the USD flat also erasing an earlier drop amid broad commodity weakness (as a reminder, the Black Sea Grain Initiative expires next week; keep an eye on Ags prices). Yellen's China trip attempted to thaw US/China relations and while dialogue remains open there are no actionable plans for further step.

In premarket trading, US-listed Chinese stocks fell giving back some of Friday’s gains after the latest economic data raised concerns about deflation risks as China’s recovery loses steam. Alibaba (BABA US) shares are down 1%, Baidu (BIDU US) -1.1%. Here are some other notable premarket movers:

- Rivian US) shares rise as much as 5.2% in premarket trading, on track to extend gains for a ninth consecutive session — their longest ever winning streak.

- Icahn Enterprises shares rise as much as 5.6% in premarket trading after a Wall Street Journal report said Carl Icahn finalized amended agreements with banks that untie his personal loans from the trading price of his company’s shares, increase his collateral and set up a plan to fully repay the borrowings in three years.

Global stocks have been on the back foot at the start of the second half amid concerns economies will buckle under high rates as central banks keep up the fight against rising prices. US Treasury Secretary Janet Yellen said at the weekend she wouldn’t rule out a US recession, noting inflation remains too high.

“Everyone is looking at inflation or has been looking at inflation for a long time,” Nicolo Bocchin, global head of fixed income at Azimut Group, said on Bloomberg Television. “Now it’s time to look at growth.”

Additionally, with second-quarter earnings season starting this week, investors should expect volatility to pick up in the weeks ahead, said Nigel Green, chief executive of DeVere Group.

“Markets are bracing for what could be the worst reporting season since the end of the pandemic,” Green said. “In the last quarterly earnings, there was a lot of negative guidance. We’re likely to see this having turned out to be correct amid the brewing of a perfect storm of several major economic headwinds.”

Traders will also assess US inflation numbers on Wednesday and producer prices a day later for signals on the Federal Reserve’s likely policy path and the rising risk of a recession. UK jobs data Tuesday will be crucial in determining the Bank of England’s next policy decision in August.

European stocks were quick to pare opening declines and now trade slightly higher while the dollar is off its best levels. The Stoxx Europe 600 index fluctuated after its biggest weekly drop since mid-March; the index was up 0.2% after earlier sliding as much as 0.5%; energy and banks led gains while miners were the leading decliners as iron ore and copper fell. Rio Tinto Group dropped more than 2% after its chairman warned of headwinds from China for raw materials. Bayer AG rose as much as 3.2% after a report it’s planning to spin off its agricultural chemicals business. Here are some of the most notable European movers:

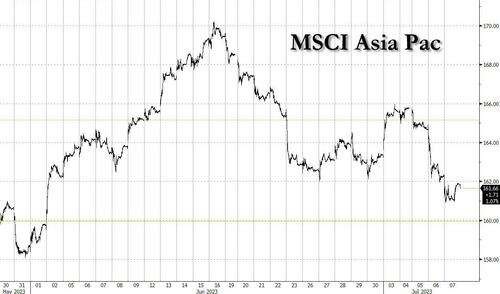

Earlier in the session, Asian stocks fell as Fed hike, China slowdown worries rattled investors. The MSCI Asia-Pacific Index was down 0.3% after erasing an earlier gain of as much as 0.5%, and heading for the lowest close in more than a month. Shares in Hong Kong and mainland China pared gains after Chinese data showed further declines in factory-gate prices while core inflation slowed. The offshore yuan swung to a loss after the data.

Angst over the lack of policy support in China is growing, forcing some investors to look at alternatives such as South Korea and India. Even then, key gauges in Hong Kong and on the mainland were among the best performers in the region Monday. Weaker-than-expected producer price data and muted retail inflation for June led traders to speculate on further easing by the central bank, while gains in technology stocks also helped. A rally in Alibaba, which ended 3.2% higher in Hong Kong, spurred gains in other technology stocks as investors perceived China’s imposition of more than $1 billion in fines on unit Ant Group, and Tencent as the end of the regulatory purge on the sector. “China is cheap,” and its current transition to lower growth “is well understood by the market,” Shaun Cochran, head of research at CLSA, said in a Bloomberg Television interview. “China can deliver reasonable returns. It doesn’t have to lead the cycle. The next cycle is about transition. India can pick up the baton.” Japanese stocks fell tracking the USDJPY tick for tick, with the Nikkei 225 registering worst string of daily losses this year after a blockbuster rally in the first six months of 2023. The blue-chip gauge fell 0.6%, extending its losing run to a fifth day, the longest since December. Australia's ASX 200 gave back early gains with price action rangebound as the gains in the commodity-related sectors are offset by losses in industrials, real estate and consumer stocks.

In FX, the Bloomberg Dollar Spot Index steadied as weak Chinese inflation data saw a risk-off trading session. AUD/USD and NZD/USD led declines, while USD/NOK fell as much as 0.8% on hotter than expected Norwegian inflation data.

In rates, the treasury curve continues to steepen with front-end and belly yields richer by around 3.5bp on the day into early US session, while long-end is slightly cheaper vs Friday close as the curve bear steepened with traders brushing off Friday’s non-farm payrolls print in anticipation of further Federal Reserve tightening. Treasury 10-year yields marginally richer on the day at around ~4.05% with bunds and gilts trading cheaper by ~2.5bp in the sector; front-end- and belly-led gains steepen 2s10s, 5s30s spreads by 3bp and 4.5bp on the day. US 2s10s spread has widened as much as 26bp from last Monday’s lows, with positioning flows suggesting flattener fatigue. Dollar IG issuance slate includes JBIC 5Y SOFR; as much as $25 billion in new bond offerings is on tap for the week. US session includes a handful of Fed speakers, with June CPI report ahead Wednesday. “Friday’s report does not support another pause in July,” wrote Mizuho rates strategists in a note, forecasting a 25 basis point hike. “We expect front-end UST yields to remain around current ranges (4.85-5.10% for 2Y).” Money-markets continue to fully price one more hike from the Federal Reserve with a 92% chance it comes at the next meeting

In commodities, crude futures decline, with WTI falling 0.8%. Spot gold is little changed. Bitcoin drops 0.2%.

Bitcoin is under modest pressure from the stronger USD, though with action relatively contained and BTC is currently holding above the USD 30k mark after a brief loss of the level earlier to a USD 29.96k trough. Upside was seemingly spurred by the Standard Chartered call for Bitcoin to rise to circa. $50K by end-2023 and possibly to USD 120k by end-2024.

It's a quiet start to a busy week, with just Wholesale inventories/sales and Consumer Credit data on deck.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Nwsquawk

APAC stocks were mostly positive albeit with gains capped for many of the regional bourses as participants digested softer-than-expected inflation data from China. ASX 200 gave back early gains with price action rangebound as the gains in the commodity-related sectors are offset by losses in industrials, real estate and consumer stocks. Nikkei 225 spent most of the session extending on last week’s slump before rebounding in late trade. Hang Seng and Shanghai Comp traded higher with the Hong Kong benchmark boosted by the tech sector amid hopes that China could be nearing the end of the tech crackdown. Conversely, the gains in the mainland were capped after the latest Chinese inflation data missed estimates with zero consumer inflation in the mainland and a deeper contraction in factory gate prices, while there were recent comments from Treasury Secretary Yellen that they made some progress during her trip to Beijing and that ties were put on a super footing, although expectations had been pre-set at a low level.

Top Asian News

European bourses are modestly firmer, with specific catalysts limited but the action diverges with US futures with a number of potential factors in play, Euro Stoxx 50 +0.4%. Stateside, futures by contrast are softer across the board, ES -0.2%, with fresh fundamentals light after numerous weekend developments. In terms of the divergence between Europe and the US, this could be spurred by any one of a number of factors which include: US-China talks, Citi note, upcoming data (US CPI) and the commencement of Q2 earnings season, among others.

Top European News

FX

Fixed Income

Commodities

US Event Calendar

Central Banks

DB's Jim Reid concludes the overnight wrap

Welcome to a big US CPI week. Since you last heard from me on Friday I’ve played 3 rounds of golf, watched a glorious England’s men win at cricket, an impressive women’s cricket win, saw England’s men footballers lift the U21 European championship trophy, and watched the Women’s Golf Open at Pebble Beach. If you think I’m exaggerating, feel free to grill me on any of the details on the above!! Over this time, I put no annoying kids to bed. That’s all over tonight as a tired, hungry, emotional family come back from a long weekend away in Scotland and I’ll lose my temporary bachelor status. Good news (I think!).

Watching and playing sport all weekend has given me a chance to reflect on markets. Last week was a fascinating one as US 10yr yields closed the week above pre-SVB levels for the first time since that major accident and 2yr yields traded briefly above for the first time too, albeit retracing in the latter half of the week. It does make you wonder where we would be if SVB hadn’t happened. Our view before SVB was that we were waiting for the lag of monetary policy to bite and that something would happen to trigger a US recession by the end of the year. However, as a thought experiment it's possible that SVB and the other regional bank problems have actually helped delay further pain and the recession as it caused a major rally in rates and rate expectations whilst simultaneously seeing the Fed add various liquidity schemes to help prevent a wider problem.

Indeed, with a -130bps rally in 2yr yields to the lows after SVB, a -65bps rally in 10yr and a stunning -185bps rally in the Dec 2023 Fed Funds contract, the fear trade quickly moved onto to a “Fed will soon cut aggressively” trade and with it the soft-landing narrative slowly gained more and more traction. However, as we stand here today, we’re pretty much back to where we were pre-SVB in rates (plus or minus) and with equities notably higher. I still think we’re at the earlier end of the full impact period from the lag of what has been fairly aggressive monetary tightening over the last 12-15 months. Remember that a year ago the ECB rate was still negative with QE only having just ended.

With US/Euro central bank rate expectations now elevated again and with longer end rates higher, it is going to be harder to avoid stress and/or weaker economic activity than if rates were still nearer their post-SVB lows.

The direction of travel over the next several weeks could be set by US CPI on Wednesday and will take something remarkable elsewhere for it not be the most important event this week. There is plenty of Fed speak before and after the release so their response to it and to payrolls last Friday will be very closely watched too. The other highlights in the US include the Beige Book (Wednesday), PPI, jobless claims (both Thursday), and the University of Michigan survey (Friday) which includes the important inflation expectations series. In addition, Friday sees JPMorgan, Citigroup and BlackRock report as Q2 earnings season slowly starts this week.

Over in Europe, notable economic indicators include the Euro and German ZEW survey (tomorrow), UK's labour stats (tomorrow), and the UK monthly GDP report (Thursday). The ECB account of their June meeting (Thursday) will be another interesting release given the increased pricing of a September hike in markets of late.

Staying with central banks, the Bank of Canada decision on Wednesday will also be of note. Markets are expecting a 25bps hike now after strong Canadian payrolls on Friday.

Going through a few points in more detail now. For US CPI, our economists preview it in full here but in brief they expect a +0.20% mom gain for headline CPI (vs. +0.12% previously, consensus +0.3%) and a +0.28% increase for core (vs. +0.44%, consensus +0.3%) which would have the YoY rate for the former dropping by a full percentage point to 3.1%, while that for the latter would drop by 30bps to 5.0%, both in line with consensus. This would leave the three- (4.6% vs. 5.0%) and six-month annualised (4.8% vs. 5.1%) core rates still well above the Fed’s target.

Another piece of the inflation puzzle will come from the University of Michigan's consumer sentiment survey on Friday. The focus will likely be on whether the drop in 12-month inflation expectations will prove sustainable, after the latest reading of 3.3% was the lowest since March 2021 (consensus 3.1% this month) and now converging back to the long-term series which is at 3% at the moment.

In the UK, the labour market stats tomorrow (including the crucial wages number) will be important given recent big Gilt moves.

There will be a few events to watch in geopolitics as well this week, starting with US President Biden's current trip to Europe from yesterday to Thursday. It will also include NATO's annual summit in Vilnius held tomorrow and Wednesday, where Ukraine's potential membership path will be a key point to watch. The G20 finance ministers and central bankers meeting will take place in Gandhinagar on July 14-18.

This morning in Asia, equity markets are mostly higher with Chinese equities leading gains across the region supported by a rally in tech stocks. However, they are off their highs after weak Chinese inflation data has brought a word into play that we haven't heard for a while. Deflation. Annual producer prices dipped -5.4% YoY (v/s -5.0% expected) in June, its lowest level since December 2015 and compared with the -4.6% decline in May. Meanwhile, consumer price inflation was flat YoY in June, versus Bloomberg expectations for a +0.2% rise and down from +0.2% growth in May. The calls for fresh stimulus will grow.

As I check my screens, the CSI (+0.68%), the Hang Seng (+0.65%), and the Shanghai Composite (+0.18%) are off their earlier highs that were fuelled by hopes that Beijing’s long running tech regulatory crackdown is coming to an end. Elsewhere, the KOSPI (+0.23) is higher whilst the Nikkei (-0.66%) is extending losses for the fifth consecutive session after dipping more than -1% on Friday. Outside of Asia, US stock futures are edging lower with those on the S&P 500 (-0.23%) and NASDAQ 100 (-0.37%) a bit weaker. Meanwhile, yields on 10yr USTs (+1.2 bps) are trading at 4.07% with the 2s10s curve (+2.0 bps) slightly steepening to -87.0 bps as we go to print.

Now, looking back on last week, on Friday we had the June US nonfarm payrolls data release. The headline payrolls number came in softer than anticipated at +209k (vs +230k expected, and with -110k of downward revisions for the previous two months). This was the first miss in 15 months versus expectations on the day. However, the overall report was still firm. The unemployment rate came down from 3.7% in May to 3.6%, as expected, and average hourly earnings rose to 4.4% year-on-year (vs 4.2% expected), up from 4.3%. Average weekly hours for all employees also climbed to 34.4 (vs 34.3 expected). Overall, the dampening of payrolls is consistent with a labour market deceleration. However, the low unemployment rate and the strength in average hourly earnings highlight that there is a way to go to bring enough heat out of the labour market in order to meet the Fed’s objectives. This something-for-everyone print led to a mixed day for rates and equities, with a weaker US dollar being the clearest market theme on Friday.

Payrolls did nothing to dislodge market expectations of an additional 25bps hike by the Fed this month, with the pricing of a July hike staying at 89% on Friday. However, the data saw 10yr US Treasuries whipsaw, first dropping around -5bps to below 4.00% on the release, before closing +3.6bps higher on the day at 4.06%. Week-on-week, yields were up +22.8bps, reaching their highest level since November last year. With investors trimming some of their expectations for the Fed beyond the July meeting, US 2yr yields fell -3.7bps, partially erasing gains earlier in the week (up +4.8bps in weekly terms). Off the back of this, the US 2s10s curve steepened by +7.3bps on Friday, and +18.0bps week-on-week. It had hit -110.5bps on Monday but closed the week at -88bps.

In Europe, markets similarly priced in further rate hikes by the ECB over the course of last week despite a retreat on Friday. By December 2023, the market is now pricing +51.2bps of additional hikes (so just over two 25bp hikes), up from 47.8bps a week earlier (but down -3.7bp on Friday). Against this backdrop, the 2yr bund yield fell by -4.6bp on Friday (+5.7bp on the week) but 10yr bund yields rose by another +1.0bps to bring the weekly increase to +24.4bps, the largest weekly move up since mid-April.

Equity markets in the US initially rallied on Friday after the payrolls release but retreated later in the day, with S&P 500 closing -0.29% lower (and down -1.16% in weekly terms). It was a similar story for the NASDAQ, down -0.13% on Friday, and -0.92% week-on-week. It was European equities that saw the larger losses over the course of the week, with the STOXX 600 falling back -3.09% in its largest weekly move down since the SVB crisis (despite a marginal +0.10% recovery on Friday).

Looking to commodities, oil prices were the main outperformer. Brent crude gained +4.77% week-on-week (and +2.55% on Friday) to $78.47/bbl, its largest weekly move up since the first week of April. WTI crude, gained +4.56% last week (and +2.87% on Friday) to $73.86/bbl. On Friday, commodities outperformance was boosted by a weaker dollar, with the US dollar index down -0.87%, its sharpest daily decline since the banking stress in mid-March.