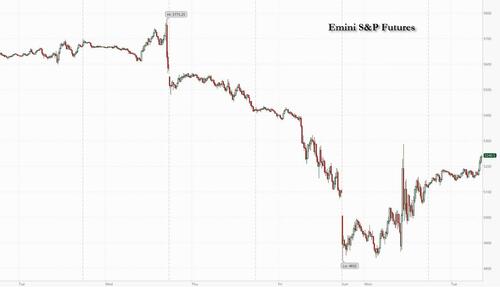

After three days of big losses and record-breaking volatility, equity futures are rebounding sharply following somewhat soothing comments from Treasury Secretary Bessent (although how long the relative calm lasts is anyone’s guess, given there’s little clarity about what Trump wants in exchange for cutting tariffs). As of 8:10am, S&P futures are 2.9% higher, a bounce which started around the time we informed readers that Goldman's head of risk of risk had turned bullish yesterday afternoon; Nasdaq futures are up 2.7%, with all Mag7 names higher with Semis and Cyclicals also outperforming. European and Asian markets are also broadly higher. The VIX is down 10 vols below 40, while Chinese ADRs are mixed. Bond yields have reversed earlier losses and are up 1bp to 4.22% with the USD dropping. Todays’ macro data focus is the Small Business Optimism report which saw sentiment tumble to 97.4 from 100.7 the lowest since the Trump election (Hiring Plans also slumped; these tend to have a lagged but positive correlation to NFP).

In premarket trading, Nvidia is leading the Magnificent Seven higher (Nvidia +4%, Amazon +3.3%, Meta +3%, Tesla +3.0%, Alphabet +2.5%, Apple +1.6%, Microsoft little changed). Health insurance stocks are rallying after the Centers for Medicare & Medicaid Services finalized a 5.06% average increase in payments to Medicare Advantage plans from 2025 to 2026, an increase from its earlier projection (Humana +14%, Alignment Healthcare +10%, CVS +8.8%, UnitedHealth +7.2%, Centene +4.9%). Here are some other notable premarket movers:

Traders are dipping back into risk assets after one of the most brutal selloffs in years, with some taking hints that President Donald Trump might be willing to ease his position on trade terms after Japan pushed ahead with talks. That sent the Nikkei 225 index to a 6% surge. Goldman traders are turning outright bullish anticipating a big bounce in stocks here, with many citing expectations that Trump will cut trade deals.

“The Trump administration is signaling his openness to trade deals,” said Elias Haddad, a strategist at Brown Brothers Harriman. “Regardless, the pervasive uncertainty created by continuously changing US tariff threats and the scope of potential retaliatory measures remain a major blow to the global economy. Bottom line: relief rallies in risk assets will likely be short-lived."

Trump made a string of comments Monday about his planned duties, yet he offered little clarity about what he is seeking in exchange for lowering levies — or whether he’s willing to offer relief at all. He rejected a European Union proposal to drop tariffs on all bilateral trade in industrial goods with the US, and threatened to slap China with an additional 50% import tax.

“The markets have come very far, very fast,” said Michael Kelly, global head of multi asset at PineBridge Investments. “It’s time for them to stabilize and figure out what the next turn of events is: up because the tariffs are coming down or down because the global economy is going down.”

Still, warnings are piling up on the bleak outlook for stocks. BlackRock strategists downgraded US equities on Monday to neutral from overweight, while a team at Goldman Sachs Group Inc. said the equity selloff could well turn into a longer-lasting cyclical bear market as recession risks mount.

UBS’s chief strategist said tariffs could hammer consumer demand, resulting in zero earnings growth for US companies this year. And Citadel founder and Republican mega-donor Ken Griffin said Trump’s tariffs amount to a hefty tax on families and are a “huge policy mistake.”

Amid the growing trade war, China stepped up efforts to support its market and vowed to “fight to the end” over tariffs — this could include levies on American farm goods and a ban on Hollywood movies, according to local bloggers.

“Markets have somewhat stabilized after a couple of dizzying trading days,” said Elias Haddad, senior markets strategist at Brown Brothers Harriman. “Regardless, the pervasive uncertainty created by continuously changing US tariff threats and the scope of potential retaliatory measures remain a major blow to the global economy. Bottom line: relief rallies in risk assets will likely be short-lived.”

Europe’s Stoxx 600 benchmark rose for the first time in five days, adding more than 2% even as President Trump rejected a European Union proposal to drop tariffs on all bilateral trade in industrial goods with the US. The travel and leisure and industrial sectors led the gains, while telecom shares were the biggest laggards. Here are the biggest movers Tuesday:

Earlier in the session, Asian stocks also rebounded from the worst selloff on record. Japanese shares surged on hopes of a tariff deal with the US, while equities in China rallied as authorities stepped in to support the market. The MSCI Asia Pacific Index rose 2.4% and is poised for its biggest gain since September, following an 8.7% slump on Monday amid fears of an intensifying US-China trade war. The gauge was boosted Tuesday by Japanese shares including Mitsubishi, Toyota, and Hitachi. Stocks in Indonesia and Thailand tumbled as traders rushed to exit after the countries reopened from a long holiday. Equities in Hong Kong and mainland China gained, while Taiwan’s benchmark extended a slide. The rebound’s sustainability will largely depend on further moves by the world’s two largest economies. US President Donald Trump’s threat to hit China with an additional 50% tariff was met by Beijing pledging a “fight to the end.”

“As far as US and China goes, we are well and truly into the game of chicken,” Peter S. Kim, an investment strategist at KB Securities, said in a Bloomberg TV interview. “Trump has made his move and China has retaliated rather than choosing the path of compromise. It’s now up to which country’s going to blink first, and that’s very dangerous.”

In FX, the Bloomberg Dollar Spot Index has pared an earlier fall to just 0.1%. The Aussie dollar is the best G-10 performer, rising 0.9% against the greenback. The Swiss franc, euro and pound underperform as they trade little changed. Currency fluctuations are at the highest in two years, and the VIX index of equity volatility has hit an eight-month high.

In rates, yields on 10-year US bonds reversed an earlier losses and rose 2 basis points to 4.22%, after a volatile start to the week that saw yields whip between gains and losses. German rates remained higher, while UK gilts recouped some gains after long-end yields surged on Monday by the most since former Prime Minister Liz Truss’ 2022 mini-budget. The relative lull came as a relief to traders after a fraught day of trading in the US. With little clarity on whether President Donald Trump is willing to offer relief on his tariffs, a gauge of Treasuries implied volatility has soared to its most extreme level since October 2023. Bunds underperform, with shorter-dated maturities under pressure as traders pare their ECB interest-rate cut bets. German two-year yields rise 7 bps. Short-end bonds outperform in the UK meanwhile as traders add to their BOE rate cut bets. UK two-year yields fall 4 bps.

Traders threw out a number of possible reasons for Monday’s yield whiplash: a market primed for a pullback after such a sharp rally; lurking concerns about tariffs stirring inflation or necessitating government stimulus; liquidations in favor of cash-like instruments; or even rumors that foreign owners, including China, were selling.

In commodities, oil prices are steady with WTI near $60.70 a barrel. Spot gold rises $13 although has slipped back below $3,000/oz in recent trading. Bitcoin is up near $80,000.

Looking at today's calendar, earnings due premarket include Walgreens Boots Alliance (WBA US) and two specialty chemicals companies — RPM International (RPM US) and WD-40 (WDFC US). For Walgreens, which is set to go private later this year, retail performance is the wild card as it is accelerating plans to close 500 stores in 2025. In economic data, NFIB small business optimism for March is released at 6am ET; the number tumbled to 97.4, below expectations of 99, easing from 100.7 the prior month. San Francisco Fed chief Daly is speaking at 2pm ET.

Market Snapshot

Top Overnight News

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly positive as markets regained some composure and bounced back from the recent tariff turmoil. ASX 200 advanced with tech and energy leading the broad-based gains across sectors which helped participants shrug off the weaker-than-previous consumer sentiment and business confidence surveys. Nikkei 225 surged at the open and reclaimed the 33,000 level after the recent aggressive selling and with Japan said to get priority in trade talks following a call between Japanese PM Ishiba and US President Trump. Hang Seng and Shanghai Comp conformed to the improved risk appetite as Chinese state-owned funds and regulators announced efforts to stabilise markets, although gains were capped after US President Trump threatened an additional 50% tariff on China if it doesn't withdraw its 34% tariff increase against the US by today.

Top Asian News

APAC Remarks

European bourses (STOXX 600 +1.5%) opened entirely in the green but some slight downward pressure has been seen in early morning trade with a couple of indices falling into negative territory. European sectors hold a strong positive bias, in-fitting with the risk tone. Industrials takes the top spot, followed closely by Travel & Leisure which continues to benefit from the lower oil prices and better risk appetite. Telecoms is lagging today; Banks and Real Estate also find themselves in the red.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

Top Overnight News

Central Bank Speakers

DB's Jim Reid concludes the overnight wrap

As we go to press this morning, the market selloff has shown some initial signs of stabilising after the incredible rout over recent days. For instance, the S&P 500 was “only” down -0.23% yesterday, and futures this morning are up +1.32%, which would be the first positive day since the reciprocal tariffs were announced. That pattern has been evident globally, and in Asia this morning, the Nikkei (+4.99%) is on course for its best day since the summer turmoil, surging back after Treasury Secretary Bessent said that “I would expect that Japan is going to get priority”. Other indices are recovering too, including the Shanghai Comp (+0.91%), the Hang Seng (+1.58%), and the S&P/ASX 200 (+1.73%), and in Europe, futures on the DAX (+1.93%) and the FTSE 100 (+1.77%) are also positive.

Yet despite this morning’s recovery, markets are hardly in a good place right now, with an incredible amount of volatility still happening across different asset classes. Bear in mind that the S&P 500 is now down -10.73% since the tariff announcements, making it the worst 3-day performance since March 2020 at the height of the pandemic turmoil. And what was particularly striking yesterday was that sovereign bonds also witnessed a heavy selloff, with the 30yr Treasury yield (+21.0bps) posting its biggest daily spike since March 2020. That marked a big shift with recent sessions, when investors had moved into sovereign bonds amidst the risk-off move, and it spoke to broader concerns about the safety of US assets and their capacity to act as a haven in times of market stress.

All that came as President Trump showed no sign of reversing course on the reciprocal tariffs, which are still due to take effect from tomorrow. If anything, Trump’s rhetoric pointed towards further escalation, and he said yesterday that “if China does not withdraw its 34% increase above their already long term trading abuses by tomorrow, April 8th, 2025, the United States will impose ADDITIONAL Tariffs on China of 50%, effective April 9th.” He also added that meetings with China would be “terminated”. So that led to a fresh risk-off move, and later on the Chinese Ministry of Commerce said in a statement that “If the US insists on its own way, China will fight to the end.”

Admittedly, Trump did sound open to reaching deals with other countries, saying in his message on China tariffs that “Negotiations with other countries, which have also requested meetings, will begin taking place immediately.” Later on, he also said that “There can be permanent tariffs and there can also be negotiations because there are things that we need beyond tariffs”. But administration officials have struck quite different tones on this issue, with White House adviser Peter Navarro writing “This is not a negotiation” in an FT op-ed, while Treasury Secretary Bessent said that “everything is on the table” when asked about the possibility of tariffs being lowered.

Although markets are facing incredibly stressed conditions right now, one of the most interesting features of yesterday’s session was a brief surge of more than +5% intraday for the S&P 500, shortly after the US open. That followed a headline suggesting that Kevin Hassett, the Director of the National Economic Council, had said that President Trump was considering a 90-day pause in the tariffs for all countries except China. But as questions arose about where this headline had come from, with no source available, the market quickly gave up most of those gains again, with the S&P 500 reversing back into negative territory. So it was a clear indication that markets are very sensitive to any policy shifts here, given that even an unsubstantiated headline was capable of driving a huge market reaction.

When it came to the market moves, global equities continued to lose ground across the world yesterday. While the S&P 500 recovered from -4.71% shortly after the open to only close -0.23% lower, the wild swings still saw the VIX index of volatility (+1.67pts) up to 46.98pts by the close, marking its highest closing level since the pandemic turmoil. Meanwhile in Europe, the slump was much more aggressive, with the STOXX 600 (-4.50%) having now shed -15.83% since its all-time high in early March. More broadly, financial conditions continued to tighten, with US HY spreads widening another +22bps yesterday to 449bps. So that means HY spreads have widened by more than +100bps over the last 3 sessions, making it the fastest spread widening since March 2020. Meanwhile US IG spreads were up +7bps yesterday and +23bps in the last 3 sessions, the fastest spread widening since the regional bank turmoil of March 2023.

But even as risk assets remained under pressure, it was notable that sovereign bonds were also selling off at the same time. For instance, the 10yr Treasury yield (+18.9bps) rebounded to 4.19% yesterday, which was its biggest jump since September 2022, during the global selloff after the UK’s mini-budget under PM Liz Truss. The 10yr yield had traded as low as 3.88% early in the European session so it was a huge intraday move. The losses were particularly clear at the long end of the curve, but they happened across the board, and even the 2yr yield (+11.1bps) moved up to 3.77%. And it was also notable that real rates drove the rise in yields, with the 10yr real rate (+17.9bps) posting its biggest daily rise since September 2022, moving back up to 1.98%.

That shift came as investors dialled back their expectations for rate cuts this year, with 93bps priced in by the December meeting, down -6.5bps on the day. So it was interesting that despite a broad risk-off move, investors are concerned that the Fed might not be able to cut aggressively in this environment, not least because of the threat of inflation rising even further above target. Indeed, Fed speakers haven’t sounded as though they’re in a hurry to cut rates, and Governor Kugler said yesterday that “We want to keep inflation expectations well anchored”, and that “It should be a priority to make sure inflation doesn’t move up and doesn’t move up in a very negative way.”

Over in Europe, there was also an aggressive bond selloff, with UK gilts particularly affected. In fact, the 30yr gilt yield (+20.4bps) saw its biggest daily jump since October 2022, back when Liz Truss was still Prime Minister, taking it back up to 5.24%. Other parts of the curve were also affected, with the 10yr gilt yield (+16.3bps) also seeing its biggest daily jump in over a year. And elsewhere in Europe, there was also a decent move higher for yields, with those on 10yr bunds (+3.5bps), OATs (+6.6bps) and BTPs (+9.8bps) all rising on the day. That also pushed the Franco-German 10yr spread back up to 78.7bps, its widest level since mid-January.

To the day ahead now, and US data releases include the NFIB’s small business optimism index. Meanwhile from central banks, we’ll hear from the Fed’s Daly, ECB Vice President de Guindos, the ECB’s Holzmann and Cipollone, and the BoE’s Lombardelli.