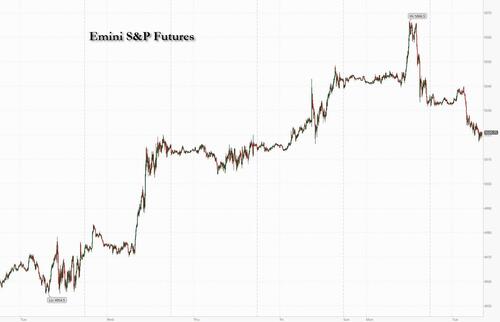

US equity futures and European bourses slumped before the release of closely watched CPI data that could set the stage for the timing of the Federal Reserve move to interest-rate cuts. Contracts on the Nasdaq 100 slid 0.6% while those on the S&P 500 fell 0.4%, extending Monday’s decline in the main US stock gauge from a high of near 5,050. Nvidia dropped 1% in premarket trading with all Mag 7 stocks down. Bond yields are down 3bps, the dollar fell and bitcoin traded around $50,000, the highest in over two years. Commodities are higher pre-mkt led by both Energy and Metals. CPI is the key macro focus for today but we also receive Small Business Optimism; full CPI preview and scenario analysis is below.

In premarket trading, all Mag7 names were lower pre-mkt as it is becoming increasingly clear that someone has been gaming a gamma squeeze (most likely SoftBank in names like Arm Holdings).

Here are some other notable premarket movers:

Investors are taking a breather from the torrid meltup after optimism about corporate earnings - driven by what Bloomberg calls a combination of resilient US growth and expected interest-rate cuts - helped push the market to extremely overbought territory. The latest BofA Fund Managers Survey found that allocation to US equities has risen, with exposure to the tech industry at the highest since August 2020.

Today's inflation report (which we previewed in depth here), which is expected to show the first reading below 3% on year-over-year headline inflation since March 2021, may not be enough to justify a more rapid shift to monetary easing. Employment (as much as that number is not completely made up), manufacturing and economic growth in the US have surprised on the upside, proving resilient to the fastest rate increases in a generation.

“Despite expecting CPI to print below 3% later, we still think the market is over-exuberant when it comes to when that first cut comes in,” Grace Peters, head of global investment strategy at JPMorgan Private Bank, said in an interview with Bloomberg TV.

Policy makers, meanwhile, are driving home the message that rate-cut bets have become overblown. Federal Reserve Bank of Richmond President Thomas Barkin Monday warned US businesses accustomed to raising prices in recent years may continue to fan inflation. The market is overlooking the risk of rate increases following the easing cycle, strategists at Citigroup Inc. warned Monday.

Derivatives markets point to the first fully-priced quarter-point rate cut in June, with three more to follow in 2024, taking the Fed Funds Rate lower by 1 percentage point by December, according to data compiled by Bloomberg.

European stocks and US futures are on the back foot as investors look ahead to the release of US consumer price data. The Stoxx 600 fell 0.3% led lower by technology names which fell from Monday’s highest close since December 2000, as chip stocks pulled back after wafer maker Siltronic gave full-year guidance that was much weaker than expected; healthcare and auto stocks advanced. ASML lost over 7% at the open before recovering, with some traders blaming a “fat finger.” Here are the key European movers:

Earlier in the session, Asian stocks advanced, boosted by a rally in semiconductor and technology stocks that lifted markets like Korea and Japan. The MSCI Asia Pacific Index rose as much as 0.8%, with Tokyo Electron, Toyota Motor and Tokio Marine contributing the most. Japanese stocks surged the most in a month after trading resumed following Monday’s holiday, driven by gains in chipmakers, exporters and ARM-rigging Softbank. Stocks in China, Vietnam, Taiwan and Hong Kong remained closed on account of Lunar New Year holidays. A Bloomberg gauge of semiconductor stocks in Asia was on pace for its highest close in nearly two years, propelled by Tokyo Electron’s strong earnings forecast and a rally in Nvidia shares overnight. The gains also helped Korea, which was on verge of erasing its year-to-date losses. Australia's ASX 200 was choppy as gains in mining, utilities and financials were offset by weakness in healthcare, telecoms and tech, while data showed an improvement in Westpac Consumer Sentiment but NAB Business Confidence and Conditions were mixed.

In FX, the Bloomberg Dollar Spot Index is also little changed. Gilts are in the red after UK wage growth slowed less than expected in the fourth quarter. The data also pushed the pound to the top of the G-10 FX pile - cable is up 0.3%.

In rates, treasuries were slightly richer across the curve amid outperformance by bunds during European morning. US 10-year at 4.165% trails bunds in the sector by 0.5bp. US intermediate to long-end yields richer by as much as 1.5bp; front-end lags, flattening 2s10s spread by less than 1bp toward middle of Monday’s range. Gilts lag by 2.5bps, with 10-year yields reaching highest level since Dec. 5 after UK December earnings data. Ahead of US CPI data, Fed-dated swaps price in around 3bp of easing for the March policy meeting and 16bp for May; further out, around 112bp of cuts are priced in for the year. Dollar issuance slate includes EBRD 4Y FRN; seven companies combined to price $11.3b on Monday as issuers paid about 6bps in new-issue concessions, driven by order books that were just under three times covered. US economic data calendar includes only January CPI at 8:30am.

In commodities, oil prices advanced again, with WTI rising 1.2%, to trade near $77.80 while Brent briefly topped $83. Spot gold adds 0.3%.

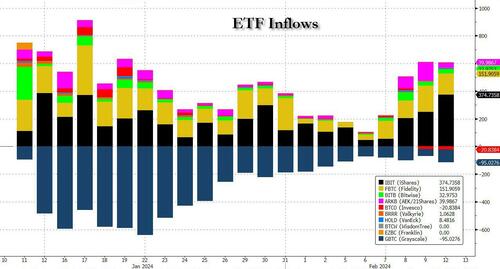

Bitcoin continues to hold above the USD 50k mark and Ethereum (+1.2%) plays catch-up. The aggressive flood of retail flows into bitcoin ETFs continues.

Looking to the day ahead now, data releases include the US January CPI, NFIB small business optimism, UK January jobless claims, December average weekly earnings, Germany and Eurozone February Zew survey, Germany December current account balance and the French Q4 ilo unemployment rate. Finally, we will have earnings releases from Coca-Cola, Shopify, Airbnb, Zoetis, Marriott, Biogen, and Restaurant Brands.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed albeit with a positive bias as several markets reopened from the extended weekend. ASX 200 was choppy as gains in mining, utilities and financials were offset by weakness in healthcare, telecoms and tech, while data showed an improvement in Westpac Consumer Sentiment but NAB Business Confidence and Conditions were mixed. Nikkei 225 outperformed and extended on its highest levels since February 1990 as the earnings deluge resumed.

Top Asian News

European bourses, Stoxx600 (-0.3%), initially opened on a mixed footing before dipping into the red as sentiment waned throughout the early hours. The Eurostoxx50 (-0.7%) is dragged down by Tech names Infineon (-2.3%), SAP (-2.3%) and ASML (-3.8%), after Siltronic (-8.1%) issued a profit warning. European sectors are generally lower, though the overall breadth of the market is fairly narrow (ex-Tech). Tech is the clear laggard, after Siltronic announced poor guidance. Healthcare marginally outperforms after GSK (+1.1%) received a broker upgrade at Citi. US Equity Futures (ES -0.3%, NQ -0.6%, RTY -0.4%) are softer across the board, with price action generally following that seen in European trade. The docket for today sees US CPI where expectations are for the headline to cool to 0.2% (prev. revised 0.3%).

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Welcome to inflation Tuesday as US CPI today will be a very important staging post for any Fed cuts this year. Before we preview this, this morning I’ve just published a new chart book with my colleague Galina Pozdnyakova for macro generalists on the Magnificent Seven. This group has become so big that they are effectively countries and not just companies now in scale. They have already impacted global risk sentiment in recent years and especially in recent months and no market participant can ignore them in whatever asset they look at. Their size has left the S&P 500 at its most concentrated since the 1929 bubble but in the pack we show how these companies are already as profitable as the entire stock market in many countries. We show a number of long term charts that explain how they arrived at this level of dominance and also highlight what happened to all the top 5 S&P 500 stocks over the last 60 years. It was a fun and fascinating pack to put together so hopefully you’ll find it useful in framing the discussion of their future. You can see it here.

Yesterday was one of the rarer sessions where the Magnificent Seven (-0.83%) clearly underperformed, with the pullback in tech sentiment leading the S&P 500 to a marginal decline (-0.09%). But it was also a day when a more prevalent theme this year of differentiation within the mega caps was evident. The reversal was led by a -2.81% decline for Tesla, which is now the second worst performer in the S&P 500 so far in 2024 (-24.3%). By contrast, Nvidia, which eked out a new all-time high yesterday (+0.16%), has been the best performing S&P 500 stock year-to-date, having already risen by +45.9%, adding $561bn in market cap. Just to hammer home the message from the chart book that you can’t ignore these stocks, this six-week gain for Nvidia is larger than the entire market cap of the largest company in Europe (Novo Nordisk at $540bn). Indeed, Nvidia briefly surpassed Amazon to be the 4th largest fully listed company in the world yesterday, rising more than 3% earlier in the session as chipmaker sentiment benefited from dramatic gains for ARM Holdings (+29.3% yesterday and +93.4% over the past three sessions) after its results last week. SoftBank is +6.3% higher overnight given its large stake in the chipmaker.

Elsewhere, small-caps out-performed, with a +1.75% gain for the Russell 2000 yesterday moving the index back into the black year-to-date (+0.90%). Banks also gained, with the S&P 500 banks group (+1.06%) seeing its strongest day since the New York Community Bancorp results two weeks ago, while the KBW index of regional banks was up +1.83%. This easing of banking sector concerns came even as NYCB itself ended the day near flat despite trading up by more than +12% early on. On this, Luke Templeman and Galina Pozdnyakova (she was busy yesterday) published their latest private capital monitor (link here) with a special look at the CRE market. In short private investors don’t seem to be too concerned. Over in Europe equities saw a solid rally, with the STOXX 600 +0.54%, DAX (+0.65%) and CAC (+0.55%) all higher – a similar gain to the equal-weighted version of the S&P 500 (+0.63%).

Supporting the risk on mood outside of tech was the NY Fed inflation expectation report, which showed that 3-year inflation expectations fell to 2.35% (from 2.62%), its lowest level since 2013. 1-year inflation expectations were largely unchanged at 3.00% (previously 3.01%). With today’s US CPI report, given that seasonally adjusted gas prices were down almost 2.5% in January from December, our US economists expect headline CPI to come in at +0.15% (vs. +0.23% previously, consensus +0.2%), with core more elevated at +0.27% (vs. +0.28% previously, consensus +0.3%). This would see core YoY CPI falling two-tenths to 3.7%, and headline down by four-tenths to 2.9%, both in line with consensus. Chair Powell shifted his attention in the January Fed press conference from the three- and six-month annualised rates to year-on-year rates so we expect the market to refocus on these numbers. See our economists preview here.

Talking of the Fed, the speakers yesterday continued to caution regarding Fed cuts, albeit largely reiterating their recent comments. A known hawk, Fed Governor Bowman stated it is still “too soon to project when, how much the Fed will cut rates”, as “many risks remain for the Fed’s inflation fight”. Richmond Fed President Barkin noted that while the Fed was closing in on its inflation target, it was not there yet as there was “a real risk that there will be continued inflationary pressure”.

Against this backdrop, market expectations of Fed rate cuts saw little change, with a slightly less than one in five chance priced in that the Fed cuts by 25bps at the March meeting and an unchanged 112bps of cuts priced by December. Treasury yields were flat on the day, with the 10yr up +0.4bps while 2yr yields fell -0.6bps.

On the other hand, in Europe, the ECB’s Wunsch commented that there was “no big risk in waiting or not for data” in terms of deciding when to cut, as markets have already priced in future rate cuts which provide some easing for financial conditions even before a cutting cycle begins. Expanding, he suggested there was not a “huge difference” whether to start rates cuts earlier and proceed gradually or “wait a bit more and then go faster”. Market expectations of ECB rate cuts saw a moderate rise, with chances of a cut by April up to 60% from a three-month low of 52% on Friday. And the amount of cuts expected by the December meeting rose by +6.2bps on the day to 120bps. 10yr bund yields fell -2.0bps, with a stronger rally in OATs (-2.9bps) and BTPs (-5.7bps).

Talking of Europe and in light of the weekend NATO comments on the US election campaign trail, our German economists yesterday put out a note on potential catalysts for a fiscal regime change in Germany (including uncertainty around NATO post the US election) and then present three potential scenarios for the 2025 budget. See it here.

Asian equity markets are higher but with many still on holiday. As I check my screens, the Nikkei (+2.57%) is sharply higher sustaining its previous gains and making fresh 34-year highs with the KOSPI (+1.01%) also starting the day on a positive note. Chinese markets will remain closed for the week but the Hang Seng will resume trading tomorrow. S&P 500 (-0.17%) and NASDAQ 100 (-0.20%) futures are ticking lower. Treasury yields are flat.

In other notable market moves yesterday, Bitcoin (+3.23%) broke through the $50,000 level for the first time since December 2021, supported by the recent spot Bitcoin ETF by the SEC (more on that here), though it retreated to a touch below this level at the close and as I type.

To the day ahead now, data releases include the US January CPI, NFIB small business optimism, UK January jobless claims, December average weekly earnings, Germany and Eurozone February Zew survey, Germany December current account balance and the French Q4 ilo unemployment rate. Finally, we will have earnings releases from Coca-Cola, Shopify, Airbnb, Zoetis, Marriott, Biogen, and Restaurant Brands.