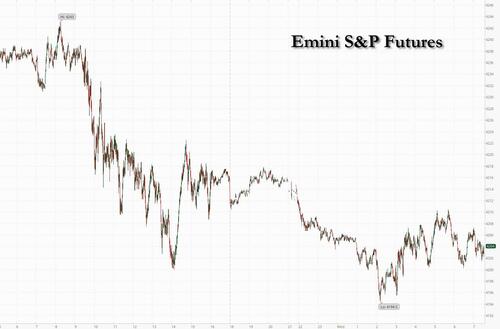

US equity futures are lower and flirting with 4,200 after another round of very ugly economic data out of China (where both mfg and service PMI missed) which dragged Asian markets lower (the HSEI entered a bear market) and slammed European stocks, while traders closely watched the debt ceiling situation after late last night the House Rule Committee advanced the bill which will now be submitted to a full vote in the House later today. That vote may not come until after market hours (~7pm) so headline risk remains.

At 7:30am ET, S&P futures were down 0.4% at 4,200 while Nasdaq futures dropped 0.2% as NVDA dipped back under $400 and exited the trillion dollar market cap club just as fast as it entered. Treasury yields slumped, dropping to 3.64%, down about 4bps, led by European rates as inflation came in weaker than expected in France and German states, prompting traders to trim bets on the path of future ECB rate hikes. The Bloomberg dollar index gained for the first time in four days whie oil extended losses with WTI crude oil futures dropping more than 2.5% after Tuesday's 4.4% drop; bitcoin got hammered in overnight trading as usual.

In premarket trading, Nvidia dropped back below $400 and is no longer in the $1TN market cap club after soaring 31% over the past three sessions on optimism surrounding artificial intelligence, a trend that contributed to a blowout revenue forecast for the chipmaker last week. Cryptocurrency-exposed stocks also fell in US premarket trading Wednesday as Bitcoin snapped its longest streak since March. The largest cryptocurrency slid along with US equity futures as China’s economic woes reverberated beyond the country’s domestic markets. Here are some other notable premarket movers:

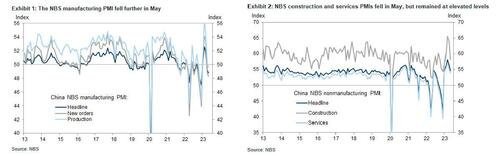

A major cause for the soggy trading sentiment overnight, was China's NBS manufacturing PMI which fell to a lower-than-expected 48.8 in May from 49.2 in April, below expectations of 49.5, with output sub-index falling the most followed by new orders sub-index. The NBS non-manufacturing PMI moderated to 54.5 in May from 56.4 in April, and also below the 55.2 median estimate, showing ongoing recovery in both the construction and services sectors but at a slower pace. Some more details:

China’s soft manufacturing data added to concerns about the outlook for global economic growth at a time when central banks are still in tightening mode. Meanwhile, weak price data from Europe on Wednesday prompted traders to curb bets on European Central Bank rate hikes, though worries remain about the region’s prospects as demand from its largest trading partner falters. Hawkish comments from Federal Reserve officials added mix of factors traders have to consider.

“We’re facing quite a lot of headwinds: firstly, the China growth story, clearly that’s been a major disappointment. On top of that, there’s a risk of a US recession, and for the euro region, there’s a likelihood that they’re facing stagnation,” Jane Foley, head of FX strategy at Rabobank, said on Bloomberg TV. “So you’ve got a pretty disappointing outlook for growth, not an environment where you really want to be piling en masse into high-risk assets, and therefore the dollar is likely to do well.” Meanwhile, Fedspeak remains hawkish with bonds pricing in a 66% chance for a hike at the June meeting.

In Europe, the Stoxx Europe 600 index headed for its lowest close since March, with China-exposed luxury-goods makers LVMH and Richemont among the biggest laggards, while Swedish landlord SBB plunged to an all-time low after its CEO said his holding company had deferred interest payments on a loan. Software and telecommunications stocks advanced, led by Capgemini SE after the Paris-based firm said it expanded a partnership with Google Cloud in data analytics and artificial intelligence. Here are some other notable European movers:

The euro slumped to a two-month through against the dollar after French inflation eased more than anticipated, reaching its lowest level in a year. Data from Germany’s states also signaled inflation may be falling more quickly than expected in the region’s biggest economy, prompting traders to trim bets on future European Central Bank interest-rate increases. European bonds rallied, with the German 10-year yield down about 9 basis points.

“There’s a fairly consistent line with the euro-area CPI numbers: it is coming down,” Paul Donovan, chief economist at UBS Global Wealth Management, said on Bloomberg TV. “This whole idea of stickiness, of inflation sticking around, is really being blown out of the water. Interestingly, we’re also getting this confirmed in the regional data in the US.”

Earlier in the session, Asian equities fell, led by shares listed in Hong Kong, as weaker-than-expected manufacturing data showed the Chinese economy continues to struggle. The MSCI Asia Pacific Index dropped as much as 1.4%, set for its biggest decline since March 14, with a gauge of Chinese stocks in Hong Kong as well as the city’s benchmark index headed for bear markets. Data Wednesday showed China’s manufacturing activity contracted for a second month in May, offering the latest proof that the post-Covid recovery is stalling. Broad weakness also pulled Korean stocks lower, after they briefly headed for a bull market amid foreign demand for the nation’s chipmakers.

“Cyclically, the recovery in China is on a much weaker footing,” Timothy Moe, chief Asia Pacific equity strategist at Goldman Sachs, told Bloomberg Television. For Korea, investors are looking past the earnings trough expected this year to a rebound in the chip sector in 2024, he said. Declines were broad-based, with gauges in Japan, Australia and Thailand also falling. An energy sub-gauge dropped the most as crude prices fell. The broader MSCI Asia gauge is down about 7% from a peak in January as China’s faltering economic recovery and worries about a recession in the US damp sentiment.

In FX, the Bloomberg Dollar Spot Index rises 0.3% with the largest gains for the greenback seen against the Norwegian krone and kiwi. EUR/USD fell as much as 0.7% to 1.0662, the lowest since March 20, as euro-area bond yields dropped; German two- and five-year bond yields fell as much as 10 basis points before paring the move; 10-year yield is down 9bps to 2.25%.

In rates, treasuries extended this week’s gains, with yields richer by ~4bp across the curve, led by bunds: the German 10-year yields are down 9bps after regional prints point to soft German CPI due at 8am New York time, while French inflation slowed more than expected. US session includes four Fed speakers and JOLTS job openings. Treasury gains are led by belly of the curve, tightening 2s5s30s fly by 1.5bp on the day after almost 6bp of tightening Tuesday; 10-year yields around 3.65% with bunds outperforming and trading 5bp richer in the sector. IG issuance slate includes Hong Kong 3Y/5Y/10Y; five deals priced $11.3b Tuesday, with final order books said to be more than four times covered. US economic data slate includes May MNI Chicago PMI (9:45am), April JOLTS job openings (10am) and May Dallas Fed services activity (10:30am)

In commodities, crude futures decline with WTI falling 1.2% to trade below $69. Spot gold is little changed around $1,958. Bitcoin drops 2.4%, sliding below $27,000.

Looking to the day ahead now, and data releases include the May CPI releases from Germany, France and Italy, along with German unemployment for May. In the US there’s also the JOLTS job openings for April, as well as the MNI Chicago PMI for May. From central banks, we’ll hear from the Fed’s Collins, Bowman, Harker and Jefferson, the ECB’s Villeroy and Visco, and the BoE’s Mann. In addition, the Fed will release their Beige Book, and the ECB will release their Financial Stability Review.

Market Snapshot

Top Overnight News from Bloomberg

A more detailed look at global markets corutesy of Newsquawk

APAC stocks were mostly lower following the mixed handover from Wall St where sentiment was clouded as hardliners voiced opposition to the debt ceiling bill, while risk appetite was subdued overnight as participants digested a slew of data releases heading into month-end including disappointing Chinese official PMIs. ASX 200 was led lower by underperformance in the commodity-related sectors with energy the worst hit after oil prices slumped by more than 4% yesterday and with the mood not helped by firmer-than-expected monthly CPI. Nikkei 225 was pressured by data releases in which Industrial Production printed a surprise contraction and Retail Sales missed forecasts, with early jitters also from North Korea’s failed satellite launch. Hang Seng and Shanghai Comp. declined with Hong Kong dragged lower by notable weakness in the local blue-chip tech stocks and following disappointing Manufacturing and Non-Manufacturing PMI data in which the former printed at a second consecutive month in contraction territory and its weakest reading YTD.

Top Asian News

European bourses are mostly in the red, Euro Stoxx 50 -0.4%, following the soft APAC handover and despite the generally softer inflation data from European nations thus far. Sectors are lower across the board, with Luxury names lagging after the weak Chinese PMI figures. Stateside, futures are all in the red though only modestly so, ES -0.1%, with the NQ in-line with broader action today and NVIDIA pulling back a touch from its recent upside, -1.5% in the pre-market.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

The AI hype continued to help push the NASDAQ (+0.32%) to another YTD high yesterday, even if the mood was more subdued elsewhere. For instance, a sizeable majority (296/502) of the S&P 500 (unchanged) actually fell on the day, with the index only treading water thanks to tech. Nvidia climbed +2.99% to a market cap of $991bn, tantalisingly close to the trillion mark which it's crossed intraday. Otherwise, the weak economic backdrop meant commodity aggregates fell to their lowest levels in nearly two years. And on top of that, sovereign bonds staged a big rally as concern about the outlook resurfaced as the debt ceiling distortions started to wane. So despite some of the headline gains, the last 24 hours have seen several warning lights under the surface, including multiple recession indicators that are flashing with growing alarm. The highlight today might be German, French and Italian CPI after Spain's surprise fall yesterday (see below).

As a minimum this will be the highlight until the debt ceiling votes comes through. We’re expecting that the House of Representatives to be voting on the deal agreed by President Biden and Speaker McCarthy tonight. That deal is formally called the Fiscal Responsibility Act, and yesterday saw it pass through the House Rules Committee despite the opposition of two Republican members and all Democrats to pass 7-6, meaning it can now be voted on by the full chamber today.

In terms of the prospects for today, investors seem relatively relaxed that this is going to pass. There has been reports overnight that over 150 GOP members would vote to approve the bill, with the balance needed to pass the House coming from Democrats. So things seem on track. Indeed, one of the good news stories from yesterday was that T-bill yields around the X-date fell back to more normal levels again, with the bill expiring June 8th seeing yields fall -75bps to 5.05, after having briefly traded with a 7 handle last week. Also the 1M US Treasury yield is trading at the same level of swaps for the first time since early May, and at the same time 5yr CDS spreads for the US dropped back to their lowest level since March, which shows how fears of default have continued to ebb over recent days. Bear in mind that this deal has the backing of the Biden Administration as well as the Republican leadership in the House and Senate, even if a minority of members have already said they’ll vote against it.

Of course, the event that’s still scars a lot of people is what happened with the first TARP vote in September 2008, which for younger readers was the $700bn bailout package proposed by the Bush Administration at the height of the GFC. Much like today’s deal, it also had the support of leaders in both parties, but it was rejected in the House on its first vote by a 228-205 margin, sparking what was then the biggest one-day decline in the S&P 500 (-8.79%) since Black Monday in 1987. Now clearly we’re not at the height of a once-in-a-generation financial crisis today, but markets have been taken by surprise on these votes before, even if all might look OK for the time being.

Against that backdrop, there was a big rally among sovereign bonds yesterday, with yields on 10yr Treasuries falling -10.8bps to 3.69% (3.68% in Asia). And similarly in Europe, yields on 10yr bunds (-9.2bps), OATs (-9.8bps) and BTPs (-12.6bps) all moved notably lower for a second day. One factor supporting that was good news on the inflation side, since the Spanish CPI print for May came in at just +2.9% using the EU-harmonised measure (vs. +3.3% expected), which was the slowest it’s been since July 2021. Now of course that’s just one country, but it often attracts outsize interest since it’s one of the first to report inflation each month, so is seen as a potential leading indicator for what will happen elsewhere. We will find out more from the EU big-3 CPI prints today. Another supportive factor was that the relentless commodity decline of recent months showed no signs of abating, leaving Bloomberg’s Commodity Spot Index (-1.75%) at its lowest closing level in just over 22 months.

But on top of that, we also had another batch of weak economic data over the last 24 hours, which helped raise concern about the outlook heading into H2. For instance in the US, the Dallas Fed’s manufacturing index fell to -29.1 (vs. -18.0 expected), which is a new low for this cycle. And over in Europe, the European Commission’s economic sentiment indicator for May fell to a 6-month low of 96.5 (vs. 98.8 expected). All that came as various recession indicators continued to worsen, with the 2s10s Treasury yield curve (-4.5bps) closing at a post-SVB low of -76.8bps.

For equities, as we discussed at the top, tech led the way with the FANG+ Index (+1.54%) up to a new YTD high that now leaves its gains for 2023 at a massive +62.68%. It was a similar story for the NASDAQ (+0.32%), which also hit a new YTD high of +24.37%. However, elsewhere the story was mostly one of declines, with the equal-weighted S&P 500 -0.20%. Europe’s STOXX 600 shed -0.92%.

Asian equity markets are trading sharply lower this morning as disappointing factory activity in China is denting sentiment across the region. As I type, the Hang Seng (-2.33%) is leading losses, tumbling to a new low for 2023 while the mainland Chinese markets are also sliding with the CSI (-1.09%) and the Shanghai Composite (-0.73%) trading in the red as the economic recovery in the world’s second biggest economy is losing steam (more below). Elsewhere, the Nikkei (-1.12%) is also trading lower with the KOSPI (-0.20%) reversing earlier gains. Outside of Asia, US equity futures are slightly negative with those on the S&P 500 (-0.23%) and NASDAQ 100 (-0.13%) edging lower.

Coming back to China, the official manufacturing PMI came in at 48.8 (v/s 49.5 expected), the lowest reading since December 2022 and compared to 49.2 in April, rekindling concerns over a slowing Chinese economy. Additionally, the service sector activity expanded at the slowest pace in four months in May, with the official non-manufacturing PMI falling to 54.5 from 56.4 in April. The downbeat PMI surveys have again bolstered expectations that the policymakers may need to roll out stimulus measures to stimulate growth.

In Japan, retail sales surprisingly contracted -1.2% m/m in April (v/s +0.5% expected), following a downwardly revised increase of +0.3%. Separately, Japan’s industrial production also unexpectedly shrank -0.4% m/m in April (v/s +1.4% anticipated) as against last month’s +1.1% increase. Elsewhere, Australia’s inflation accelerated to +6.8% y/y in April (v/s +6.4% expected; +6.3% in March), mainly led by a jump in energy prices, thus increasing pressure on the Reserve Bank of Australia (RBA) to raise interest rates again when they meet next Tuesday.

Finally, there were a few other US data releases yesterday, such as the Conference Board’s consumer confidence measure. That fell to 102.3 in May (vs. 99.0 expected), but from an upwardly revised 103.7 in April. Nevertheless, there were other signs of softness, and the share describing jobs as plentiful fell to a 2-year low of 43.5%. Otherwise, we had some more backward-looking housing indicators, with the S&P CoreLogic Case-Shiller 20-City home index up by +0.45% in March (vs. unch expected), marking its strongest monthly growth since May 2022.

To the day ahead now, and data releases include the May CPI releases from Germany, France and Italy, along with German unemployment for May. In the US there’s also the JOLTS job openings for April, as well as the MNI Chicago PMI for May. From central banks, we’ll hear from the Fed’s Collins, Bowman, Harker and Jefferson, the ECB’s Villeroy and Visco, and the BoE’s Mann. In addition, the Fed will release their Beige Book, and the ECB will release their Financial Stability Review.