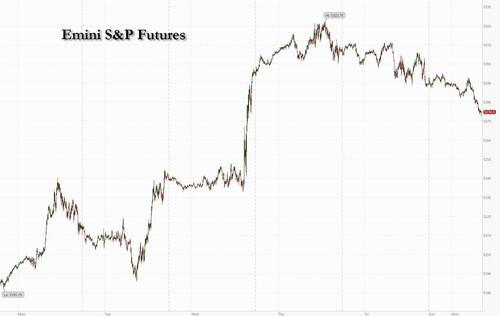

Futs are lower following the S&P's best weekly performance of the year (sparked by dovish comments by Fed chair Powell during the last FOMC) which sent the market up +2.3%. At 7:50am, S&P futures were 0.4% lower and Nasdaq futures dropped 0.6%, dragged by MegaCap tech names which were mostly lower with AMD and Intel down more than 2% after the FT reported they are being banned from Chinese government computers; NVDA swung from gains to losses after a report that Google, Intel and QCOM execs plan on battling NVDA on AI dominance (well what else can they do?). Meanwhile, JPM says to keep an eye on NFLX on bullish headlines; stock is +29% YTD which would be third among Mag7 names. Europe's Stoxx Europe 600 dipped following nine straight weeks of gains, the longest run in 12 years. Elsewhere, treasury yields ticked higher and the Bloomberg dollar spot index was slightly lower with the yen a tad stronger after some aggressive jawboning by cartoonish Japanese officials. Oil gained on escalating geopolitical unrest following the Moscow concert hall attack on Friday that killed at least 137 people. The next 2 weeks have a lighter macro data calendar so keep an eye on Fedspeak (3x this week) and bond auctions for bond yield catalysts which could Equity sector performance. Month-end/Quarter-end rebalancing could also pressure stocks.

In premarket trading, Intel and AMD declined after a FT report said China was seeking to limit the use of US-made chips in government computers. United Airlines shares fell as US aviation authorities mull measures to curb growth at the carrier following a series of safety incidents. Here are some other premarket movers:

As we enter a quiet week after multiple central bank shockers, traders are in wait-and-see mode ahead of economic data that will include the Fed’s preferred inflation gauge due Friday, when many markets will be closed for a holiday. While conviction has grown that the Fed will cut rates this year following dovish comments by Chair Jerome Powell last week, investors are becoming uneasy about stock valuations after the recent rally.

“When upward catalysts get rare and valuations are rich, risks become visible,” said Jeanne Asseraf-Bitton, head of research and strategy at BFT IM in Paris. “The coming weeks will be more complicated.”

European stocks slipped after a ninth straight week of gains for the index, the longest winning streak in nearly 12 years; the Stoxx slid 0.4% led by consumer product, retail and media shares which were the worst performers. Shares in European defense firms rose following a terrorist attack in Moscow on Friday evening that killed at least 137 people, in an assault claimed by the Islamic State. Dassault Aviation SA climbed 4.5% and Rheinmetall AG was up 3.6%. Swedish landlord SBB jumped after buying back a batch of bonds at a 60% discount, while Direct Line Insurance Group Plc plunged after Ageas said on Friday it won’t make a third takeover offer. Even after this year’s gains, European equity valuations are not yet over-stretched, according to Goldman Sachs Group Inc. strategists who forecast the Stoxx Europe 600 could still rise about 6% over the next 12 months. Here are some of the the biggest movers in Europe on Monday:

Earlier in the session Asian stocks edged lower, dragged by selloffs in Japan and South Korea after last week’s strong rallies, while Chinese stocks advanced. The MSCI Asia Pacific Index dipped as much as 0.3%, erasing an early gain. Sony and Samsung were among the biggest drags, while China delivery firm Meituan gained after it reported better-than-expected earnings. Japanese equities declined as some investors took profit following the Nikkei 225 Stock Average’s ascent to a record high last week even as the central bank ended its negative-rate policy.

In FX, the Bloomberg Dollar Spot Index dropped 0.1%, while the yen strengthened after Japan’s top currency official warned about excessive currency speculation. The focus remains on China’s yuan after the central bank signaled its support for the managed currency. The onshore yuan rose as much as 0.5% to 7.1902 per dollar, the most since December

In rates, treasuries were slightly cheaper across the curve following similar price action across core European rates, with rate futures near lows of the day. Treasury yields cheaper by 2bp to 3.5bp across the curve with losses led by belly, flattening 5s30s spread by 1.2bp on the day; 10-year yields around 4.23%, cheaper by 3bp with bunds and gilts marginally outperforming in the sector. The holiday-shortened week’s auction cycle begins with $66b 2-year note sale at 1pm; $67b 5-year and $43b 7-year follow Tuesday and Wednesday. WI 2-year yield at around 4.58% is ~11bp richer than February’s, which tailed the WI by 0.2bp

In commodities, oil gained on escalating geopolitical unrest following the Moscow concert hall attack on Friday that killed at least 137 people.

Bitcoin climbs higher and back on a USD 67k handle, whilst Ethereum sits just shy of USD 3.5k.

Looking at today's calendar, the US economic data schedule includes February Chicago national activity index (8:30am), new home sales (10am) and March Dallas Fed manufacturing activity (10:30am). Later this week we get data on durable goods orders, consumer confidence, 4Q GDP revision, University of Michigan sentiment, and personal income/spending with PCE deflators. Fed speakers scheduled include Bostic (8:25am), Goolsbee (9:05am) and Cook (10:30am). Waller, Daly and Powell are slated to appear later this week

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed amid a lack of major macro drivers heading into month-end and a slew of data releases. ASX 200 finished higher with early outperformance in property and tech owing to softer yields. Nikkei 225 pulled back from record highs as investors booked profits amid some mild yen strength. Hang Seng and Shanghai Comp. were initially indecisive as participants digested recent earnings releases, although eventually strengthened after the slew of rhetoric from Chinese officials including Premier Li who noted relatively big room for macro policy.

Top Asian News

European bourses, Stoxx600 (-0.2%) initially struggled to find direction, though succumbed to slight selling pressure as the session progressed. European sectors are mostly lower; Energy benefits from broader strength in the crude sector, whilst Kingfisher (-2.5%) weighs on Retail. US equity futures (ES -0.2%, NQ -0.3%, RTY U/C) are mostly but modestly lower, in-fitting with price action seen in Europe; AMD (-2.1%)/ Intel (-2.5%) suffer in the pre-market after China blocked the use of AMD/INTC chips in government computers. Modest pressure in Apple (AAPL), Alphabet (GOOG), and Meta (META) following the EU Commission announcing a digital-market probe into the names.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Moscow Terror Attack

Geopolitics: Other

US Event Calendar

Central Banks

DB's Jim Reid concludes the overnight wrap

This morning we'll publish the results of our latest Global Financial Market Survey. One of the most interesting implied threads running through it is that a "no landing" edges out "soft landing" as the most likely path for the US economy by YE 2024 with "hard landing" now a distant third. However, why aren't markets more concerned about a "no landing" at the moment? One possibility is that respondents seem happy for central banks to tolerate an extended period of above-target inflation while macro volatility is high. They feel comfortable with this perhaps due to the fact that their 5yr inflation expectations continue to edge down. So you could say a Goldilocks "no landing" for now with the economy running hot but with central banks not leaning against it! Whether that proves too optimistic time will tell but as you'll see at the end, US equities had their best week of the year last week largely because the FOMC seems very confident of their ability to cut rates in June even with recent hot inflation prints.

On a very related theme, the most exciting event of the week happens once markets are actually closed for the month and Q1 is done and dusted in performance terms. Strangely, the monthly US personal income and spending report, which contains the crucial core PCE, is released on Good Friday when bond and equity markets are closed. The flash CPIs in Italy and France also come out on Friday, with the Spanish print due on Wednesday. Staying on the inflation theme, Tokyo CPI is out on Thursday, with the summary of opinions from last week's BoJ meeting on Wednesday. This will garner some attention given the once-in-a-generation shift in policy. Australian CPI is out on Wednesday.

Staying with central banks, there are lots of Fed speakers this week that can add some colour to last week's generally dovish FOMC. They are listed in the day-by-day week ahead at the end. In terms of the key US data, today sees new home sales, tomorrow sees durable goods and consumer confidence, Wednesday the final consumer sentiment reading and pending home sales, while Thursday sees the final release of Q4 GDP, trade data, the Chicago PMI and, of course, initial jobless claims.

In terms of that core PCE print on Good Friday, DB expects +0.27% vs. 0.42% last month. In Powell's press conference, he remarked that the month-over-month print for core PCE could be "well below 30bps" at the end of the month. Taking him at his word does offer downside risk to our economists' forecast. They believe upward revisions to the January healthcare services prices could square these two numbers.

In Europe, our European economists' inflation chartbook covers recent trends and their forecasts here. For March readings, they expect the headline Eurozone index to come in at 2.5% (vs 2.6% in February) and core at 3.1% (3.1%). On a country level, their projections include 2.4% for Germany (2.8% next week), 2.5% for France (3.2% Friday), 1.3% in Italy (0.8% Friday) and 3.5% in Spain (3.0% Wednesday).

In Asia, the Nikkei (-0.64%) is the worst performer, retreating from its all-time high set on Friday as the Japanese yen saw some stabilisation after the nation’s top currency diplomat offered a verbal warning on potential intervention by the government (more below). Elsewhere, the KOSPI (-0.48%) is also losing ground after opening higher while Chinese stocks are bucking the regional trend with the Hang Seng (+0.48%), the CSI (+0.38%) and the Shanghai Composite (+0.44%) edging higher. S&P 500 (-0.12%) and Nasdaq futures (-0.11%) are slightly lower. 10yr UST yields (+1.2bps) are slightly higher at 4.21% as I type.

Coming back to Japan, top currency official Masato Kanda warned against the yen's recent weakness, commenting that it is not in line with fundamentals and is clearly driven by speculation. He added that the government is closely watching currency moves and stands ready to take appropriate action against excessive fluctuations.

Staying with Asian FX, the onshore yuan rose as much as +0.48% to 7.1943 per dollar, after the PBoC signaled its support for the currency via a stronger-than-expected daily reference rate, marking the largest strengthening bias since November.

Recapping last week now, the S&P 500 had the best week of the year, rising +2.29% amid growing optimism that rate cuts by many major central banks are now on their way. The index saw a marginal retreat on Friday (-0.14%) after hitting record highs for three consecutive sessions. Tech stocks led the gains, as the NASDAQ rose +2.85% (and +0.16% on Friday) and the Magnificent Seven jumped +4.31% (+0.89% Friday). That said, the rally in equity was still fairly broad, as the equal-weighted S&P 500 index rose +1.78% (-0.64% on Friday).

Global equities were also on the stronger side. The STOXX 600 gained +0.96% (-0.03% on Friday), whilst the DAX and FTSE 100 rose +1.50% and +2.63%, respectively. For the former, this was another record high, and for the latter, the largest weekly increase since September. Otherwise, the Nikkei was a key outperformer, soaring +5.63% (and +0.18% on Friday), after the BoJ decided to end negative rates earlier in the week without any negativity, quite the opposite as the country went a step closer to normality. The Yen fell -1.55% during the week (-0.14% on Friday) as the BoJ were seen as relatively dovish and at 151.41 closed the week within a whisker of 34 year lows.

This broader risk asset strength was driven by investors increasing their bets on the amount of expected rate cuts for this year, particularly after the relatively dovish central bank meetings across both sides of the Atlantic, including the first G10 rate cut of the cycle being delivered by the SNB. The amount of Fed cuts expected by December rose +12.4bps (and +4.4bps on Friday) to 84.5bps. The expected probability of a June cut is now 86%, up from just over 60% at the start of the week. Over in Europe, it was a similar story, with the amount of cuts priced in by year-end rising by +4.7bps for the ECB and by +18.9bps for the BoE.

The dovish backdrop drove a sharp decline in global sovereign bond yields last week. US 10yr yields fell -10.8bps on the week, including a -6.9bps fall on Friday, while 2yr yields were down -13.9bps (-4.7bps Friday). German bunds outperformed, with yields falling -11.9bps (and -8.2bps on Friday), as strong data in the latter half of the week limited the rally in US Treasuries.

The risk-on sentiment also supported a rally in other asset classes. US IG and high-yield spreads fell -1bps and -6bps, respectively, seeing their lowest weekly close since November 2021 and January 2022, respectively. In commodities, gold hit a record of $2,181/oz earlier on Thursday but fell -0.71% on Friday to $2,165/oz, although prices were still up +0.44% on the week.