After stocks hit a 4th consecutive record and a 30th All Time High on Thursday on absolutely atrocious breadth (more than two thirds of the S&P closed red), futures traded lower as the rally finally fizzled. At 8:00am ET, S&P futures were down 0.5%, but off session lows, while Nasdaq futures outperformed, down 0.2% after closing at a fresh all time high despite more than 70% of names in the index trading lower on the session! The strong US performance - this morning notwithstanding - which delivered a 1.6% advance since last Friday, stands in contrast to a sharp decline in European stocks, which are headed for their worst week since January on growing concerns about political turmoil in France, and culminated with French public development bank SFIL SA pulling the sale of a green bond after a week that saw the country’s government debt tumble ahead of upcoming elections. Bond yields tumbled some 5bps lower, pushing the 10Y yield to 4.20%, amid an almost panicked flight to safety out of Europe, which also helped push the USD higher and EUR lower. Commodities are reversing recent losses with both oil and gold/silver are higher. Overnight, the biggest focus was BOJ’s decision, which again came in more dovish than expected: BOJ said the reduction in government bond purchases would begin after the bank’s next meeting, and sent the yen plunging initially before cross-asset flows pushed it back to unchanged. Today, the macro focus will be the Michigan sentiment and inflation expectation data at 10am.

In premarket trading, semis and giga-tech names are again in focus. Adobe soared 14% after the creative-arts software company raised its full-year forecast on key metrics. NVDA +1.2%, SMCI +33bp, AVGO +89bp. Outside NVDA/TSLA, the rest of Mag7 are lower. Here are some other notable premarket movers:

Markets are increasingly anxious after French President Emmanuel Macron announced a snap legislative election following his party’s drubbing in the European Parliament elections. Investors fear a win for Marine Le Pen’s far-right National Rally party, which leads polls by a wide margin, will usher in looser fiscal policies.

“It’s a risk-off tone with concerns over France driving the markets,” said Mohit Kumar, chief economist for Europe at Jefferies International. “Particularly going into the weekend, investors would be taking some positions off the table.”

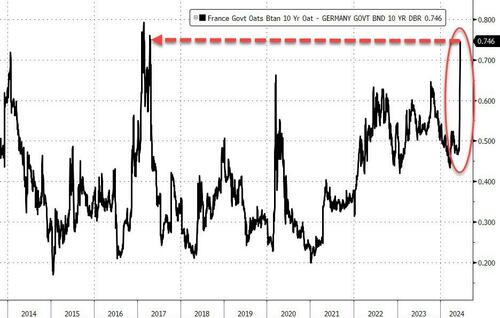

The uncertainty sent the yield spread between French and German bonds soaring this week, on pace for the most on record, while the yield on two-year debt for Germany set for the biggest drop since May 2023.

“It’s hard to ignore the parallels between our current situation and the time of the sovereign debt crisis, as there’s that familiar focus on election results, sovereign bond spreads and debt sustainability,” said Jim Reid, an analyst at Deutsche Bank AG. That’s “coupled with no obvious sign about where things are headed next.” Or as we put it...

The rising panic sent the Stoxx 600 sliding 1.2% extending losses since Monday to 2.6%; the week’s turmoil has wiped out all June’s gains for the European benchmark, with investors warning that the volatility may continue until the French vote is concluded in July. Sentiment also weighed on the Estoxx 50, which slumped nearly 2% with underperforming sectors including industrials and financials. France’s CAC 40 index plunged 2.6%, and erased its gains for the year and was on pace for its largest weekly drop since March 2022, with banking shares such as BNP Paribas SA and Societe Generale SA among the biggest losers. Here are the biggest European movers:

“Elections in France tend to be more volatile for equity markets than other developed markets,” Beata Manthey, head of European equity strategy at Citigroup Inc., told Bloomberg Television. “This volatility could continue for a bit longer.”

In Asia, MSCI’s Asia Pacific index slipped as losses in Australian and Chinese stocks offset gains in Japan’s benchmark. The Bank of Japan triggered renewed weakness in the yen after making investors wait until its July meeting for details on its paring of bond buying, a move that was also seen as a delay in the normalization in policy. Still, Governor Kazuo Ueda pushed back against the view that a rate hike was no longer possible next month.

In FX, the dollar rallied, boosted by growing political uncertainty in France, while Treasuries edged up, following gains in European bonds. The US currency also gained versus the yen after the Bank of Japan suggested it would take its time to scale back its bond-buying program. The yen fell 0.2% but was well off its worst levels, having dropped after the Bank of Japan offered little detail on its plans to reduce bond purchases. Investors await appearances later in the day by Federal Reserve speakers including Cleveland Fed President Loretta Mester and Chicago Fed President Austan Goolsbee for more clues on the outlook for US interest rates and inflation.

In rates, treasuries pushed to fresh weekly highs with futures on best levels of the day heading into early US session, following sharp gains in bunds where German 2-year yields are richer by more than 10bp on the day. Political uncertainty in Europe is weighing on sentiment, with French and Italian bond spreads aggressively wider versus bunds. Focal points of US session, include University of Michigan sentiment survey and a busy Fed speaker slate. 10-year yields tumbled to 4.19%, down around 6bp vs Thursday’s close with bunds trading 6.5bp richer in the sector vs Treasuries

Bank of Japan policy announcement overnight lacked details on its bond-buying cuts, leaving investors to wait until its July meeting for figures or a timeline, which weighed on Japan bonds overnight, leaving the yen vulnerable to further declines

In commodities, oil prices reversed an earlier drop, with Brent rising 0.5% to trade above $83. Spot gold rises ~$15 to around $2,319/oz.

In crypto, Bitcoin was back on a firmer footing and holds just of USD 67k, whilst Ethereum climbs above USD 3.5k.

Looking to the day ahead now, and data releases from the US include the University of Michigan’s preliminary consumer sentiment index for June. Central bank speakers include ECB President Lagarde, the ECB’s Vasle and Lane, along with the Fed’s Goolsbee and Cook.

Market Snapshot

Top Overnight News

More detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly subdued after the mixed performance stateside where soft data took centre stage, while participants turned their attention to the BoJ policy announcement. ASX 200 was dragged lower by underperformance in tech and commodity-related sectors. Nikkei 225 recovered early losses and was underpinned after the BoJ policy decision in which the central bank maintained short-term rates at 0.0%-0.1% and kept bond purchases in accordance with its decision in March, while it announced to trim bond buying but will decide on a specific reduction plan for the next 1-2 years at the next policy meeting. Hang Seng and Shanghai Comp. were pressured with the former back below the 18,000 level amid tech and auto weakness, while the mainland is also lacklustre amid Western sanction threats on Chinese entities for supplying Russia's war machine.

Top Asian News

European bourses, Stoxx 600 (-0.4%) are entirely in the red, with sentiment hampered amid ongoing political uncertainty; approval polls showed President Macron rating drop to the lowest in 5yrs, whilst Finance Minister Le Maire said “yes”, when asked if the current political crisis could result in a financial crisis. CAC 40 has now erased gains for the year and is flat YTD, future lower by over 2.0% on the session. European sectors hold a negative bias, with a slight defensive tilt as Healthcare tops the index. Industrials are found at the foot of the pile, with Defence names underperforming, seemingly with no clear catalyst, but potentially amid the ongoing political woes; Rheinmetall (-6.5%), Thales (-3.5%), BAE (-2.2%). Banks also lag amid the political uncertainty in Europe, with French names the most impacted as it stands. US Equity Futures (ES -0.2%, NQ +0.1%, RTY -1.1%) are mixed, with clear underperformance in the RTY, in continuation of the prior day’s hefty losses. In terms of stock specifics, Adobe (+15%) soars in the pre-market after the Co. reported a beat on headline metrics and raised its Q3 guidance above analyst expectations.

Top European News

BOJ

UEDA

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

The divergence between US and European markets has continued over the past 24 hours, with further advances in the US whilst Europe lost further ground. Indeed, the S&P 500 (+0.23%) advanced for a 4th consecutive day to another record high, as soft PPI data added to hopes the Fed would cut rates. But in Europe it was a very different story, as the political uncertainty in Europe meant the STOXX 600 (-1.31%) suffered its worst daily performance since April. In fact as it stands, the S&P 500 is up +1.62% so far this week, whereas the STOXX 600 is down -1.43%, which if sustained would be the biggest weekly divergence between the two indices since the banking turmoil in March last year.

We’ll start with Europe, as French assets continued to decline ahead of the upcoming parliamentary elections, with further losses for bonds and equities there. To put the current moves in some perspective, the Franco-German 10yr spread has now risen by +21.7bps since the start of the week, and even if it’s unchanged today, that would be the biggest weekly jump in the spread since the height of the sovereign debt crisis in late-2011. To be honest, it’s hard to ignore the parallels between our current situation and the time of the sovereign debt crisis, as there’s that familiar focus on election results, sovereign bond spreads and debt sustainability, coupled with no obvious sign about where things are headed next.

In terms of the moves yesterday, the Franco-German 10yr spread widened by another +8.6bps on the day to 69.5bps. That’s the 4th consecutive day that it’s widened, and significantly, it now leaves the spread at its highest closing level since 2017, surpassing the recent peak in 2020 at the height of the initial wave of the Covid-19 pandemic. For reference, the last time it was this wide in 2017 came just before the first round of the presidential election that year, when Macron came first and set up a run-off in the second round against Marine Le Pen. Then spreads tightened again after Macron’s first-round win, as markets moved to price in a strong likelihood of a Macron presidency.

Elsewhere in France, the selloff was very strong, and the CAC 40 (-1.99%) posted its worst daily performance since July. That included further losses for bank stocks, including declines for BNP Paribas (-2.94%), Crédit Agricole (-2.50%) and Société Générale (-1.63%). That was echoed across Europe as well, and there were sizeable losses for the DAX (-1.96%), the FTSE MIB (-2.18%) and the IBEX 35 (-1.59%). Likewise, sovereign bond spreads widened across the continent, with yields on 10yr bunds down -6.0bps, even as those on OATs (+2.6ps) and BTPS (+1.7bps) moved higher. The euro itself also weakened by -0.67% against the US Dollar, and DB's head of FX research George Saravelos wrote yesterday (link here) about how recent events pose downside risks to their medium-term EUR/USD forecasts in the coming weeks. And in terms of the latest on the political situation, a poll by Elabe for Les Echos found that President Macron’s approval rating was down to 24%, which is its lowest level since December 2018, during the Yellow Vests protests. Later in the day, there was also confirmation of an alliance between left-wing parties, including the Greens, Socialists, Communists, and La France Insoumise, who will only put up one candidate in each district.

Markets weren’t helped by a fresh rise in European natural gas futures (+1.22%), which rose for a 4th consecutive day to €35.72/MWh. That’s very close to a six-month high, and comes as various global supply disruptions have pushed up prices, which has seen them rise by more than +50% since their recent low in mid-February. Now it’s worth remembering that this is still a long way away from their 2022 levels, but the direction of travel has again proved to be a headwind for markets, particularly at a time when European growth had been looking more positive in recent months.

But even as European markets slumped once again, US markets continued to outperform. That followed a couple of data releases, which led investors to grow more confident about the chance of rate cuts. First there were the weekly initial jobless claims, which spiked up to 242k (vs. 225k expected) in the week ending June 8. That’s their highest level since August, and coupled with the rise in the unemployment rate last week, it added to the signs that the labour market might be showing clearer signs of weakness. Alongside that, the PPI release for May was also softer than expected, which cemented the theme from the CPI the previous day. For instance, monthly headline PPI fell by -0.2% (vs. +0.1% expected), which left the year-on-year number at +2.2% (vs. +2.5% expected).

Given those data releases, investors dialled up the prospects of rate cuts from the Fed, and the amount priced in by the December meeting was up +6.2bps on the day to 50bps. In turn, that led to a fresh rally for US Treasuries, which got another boost from a strong 30yr auction later in the session that saw the highest bid-to-cover ratio in 12 months. By the close, the 2yr yield was down -5.5bps to 4.70%, whilst the 10yr yield was down -7.2bps to 4.245%. Overnight, there’s been a modest reversal of those moves, with 2yr (+2.2bps) and with 10yr yields (+1.9bps) moving higher to 4.72% and 4.26% respectively.

US equities were also resilient, with the S&P 500 (+0.23%) posting yet another record high. That was powered by the Magnificent 7 (+0.54%), which also hit a fresh record, and tech stocks generally did well after an upbeat AI-driven outlook from chip supplier Broadcom. Its shares spiked by +12.27%, their largest daily gain since March 2020. In turn this boosted other chipmakers, with Nvidia up +3.52%. In after hours trading, we also saw a +15% gain for Adobe following its results after the market close. Nevertheless, the equity gains were still fairly narrow, with the equal-weighted S&P 500 down -0.27%, whilst the small-cap Russell 2000 was down -0.88%.

Overnight in Asia, the main story comes from the Bank of Japan, who left their interest rates unchanged, and announced they would outline plans to cut their bond purchases at next meeting in July. That caused the Yen to weaken, and it’s currently down -0.53% against the US Dollar, as there had been some expectations that the BoJ might announce a reduction in purchases at this meeting. Japanese government bonds have also rallied, with the 10yr yield down -4.0bps this morning to 0.92%.

That backdrop has meant the Nikkei (+0.46%) and other Japanese equities are performing strongly this morning. However, it’s a different story elsewhere in Asia, with the Hang Seng (-0.67%), the CSI 300 (-0.40%) and the Shanghai Comp (-0.37%) all trading lower, although the KOSPI is up +0.30%. US equity futures are also pointing towards a stable performance, with those on the S&P 500 up +0.01%.

To the day ahead now, and data releases from the US include the University of Michigan’s preliminary consumer sentiment index for June. Central bank speakers include ECB President Lagarde, the ECB’s Vasle and Lane, along with the Fed’s Goolsbee and Cook.