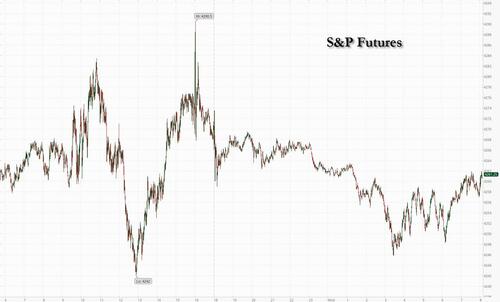

US equity futures are sliding - but off the lows of the session- setting up Wall Street for a lower open, with underperformance driven by Alphabet, whose shares have tumbled premarket after its cloud unit revenue disappointed. As of 8:00am ET, S&P futures were down -0.3% while Nasdaq futs drifted -0.5%, after Microsoft and Google delivered a mixed picture of big tech earnings, setting the stage for peers still reporting this week. The dollar is stronger for a second session tracking Treasury yields which also rose, while oil was little changed and there was a bounce for iron ore following the Chinese stimulus measures. In Europe, stocks reversed earlier losses as a 55% drop for French payments firm Worldline offsetting a gain for Deutsche Bank. Asian markets were also broadly higher on hopes that a new 1 trillion yuan in debt issuance will provide a fiscal stimulus for China's struggling economy. Today’s macro data focus is on new home sales and mtge applications

In premarket trading, Alphabet fell as much as 7% after its cloud unit reported a smaller than expected profit; analysts flagged weakness in the cloud computing business as a concern. Microsoft, on the other hand, climbed after results in its cloud business beat expectations. Meanwhile, Texas Instruments fell 5.4% as the chipmaker forecast revenue for the fourth quarter that missed the average analyst estimate; analysts noted that weakening in the industrial end-markets broadened, while automotive strength persisted. Here are some other notable premarket movers.

With earnings season in full swing, investors are looking for evidence on how companies are coping with high interest rates and whether consumer spending is changing because of inflation. Meta Platforms Inc., the parent company of Instagram and Facebook, is set to report later Wednesday, with Amazon.com Inc due Thursday.

“Tech earnings got off to a mixed start thanks to a focus on cloud computing, one of the big money spinners for the sector,” said Chris Beauchamp, chief market analyst at IG Group. “It’s now up to Meta tonight and Amazon tomorrow to provide the kind of good news that might give stocks a reason to rally into month-end.”

European stocks were modestly in the green reversing an earlier loss of as much as -0.3% as broad gains in mining and tech shares overshadowed earnings-driven drops in luxury and retail. Kering SA slid after the Gucci owner reported a drop in sales amid a global slowdown in luxury, while home products company Reckitt Benckiser Group Plc fell after sales missed expectations. Worldline SA plunged more than 50%, the most ever, after the French payment company lowered its outlook for this year. Peer Nexi SpA slumped more than 10%. Offsetting those misses, Deutsche bank AG gained as much as 7.5% after saying it plans to accelerate payouts to shareholders as higher income from its corporate bank and deposit inflows offset weaker trading results in the third quarter. Swedish steelmaker SSAB AB asnd French software company Dassault Systemes advanced after earnings beats. Here are some of the most notable European movers:

Earlier in the session, Asian stocks rose, led by gains in Hong Kong after China strengthened its efforts to support its flagging economy and markets. The MSCI Asia Pacifc Index climbed as much as 1.2%, the most in about two weeks, with Tencent, Alibaba and Toyota the biggest boosts. Benchmarks gained in Hong Kong, mainland China, Taiwan, Japan and most other Asian nations. Meanwhile, troubled Chinese developer Country Garden Holdings Co. was deemed to be in default on a dollar bond for the first time, amid the broader property-debt crisis that’s shaken China’s economy.

In FX, the Bloomberg Dollar Spot Index rose 0.2% following a 0.3% gain yesterday. The Aussie has pared an earlier advance to trade slightly lower, having rallied on hotter-than-expected inflation data. The Bloomberg Dollar Spot Index rose as much as 0.2%, The yield on 10-year Treasuries increased 4 basis points to 4.86%.

In rates, treasuries cheaper across the curve with futures near session lows around 4.86% into early US session and lagging core European rates. US yields cheaper by nearly 5bp across long-end of the curve in a bear-steepening move with 5s30s spread wider by ~2.5bp vs Tuesday close; 10-year yields near cheapest levels of the day into early US session near 4.86% while 30-year yields re-test 5% level to the upside. Losses are so far led by long-end, re-steepening the curve with 5s30s paring a portion of Tuesday’s aggressive flattening move. US session includes 5-year note auction, while Bank of Canada rate decision is at 10am New York time. For Bank of Canada decision, swaps market is pricing in around 3bp of tightening, or 12% odds of a 25bp rate increase. Treasury auction cycle resumes with $52b 5-year note sale at 1pm, ahead of $38b 7-year Thursday; Tuesday’s 2-year was solid, stopping in line with WI yield at bid deadline

“Rates will likely trade within recent ranges, but we do think that the latest US data provides some support to the higher-for-longer theme,” said Evelyne Gomez-Liechti, a strategist at Mizuho International. “We wouldn’t be surprised to see 10-year Treasury yields testing the 5% handle again.”

In commodities, oil prices are slightly higher, with WTI rising 0.1% to trade near $84. Spot gold is flat. Bitcoin rises 1.6%.

In bitcoin, it was another session of gains for the cryptocurrency which is managing to hold onto the lions share of Tuesday's pronounced upside which saw Bitcoin briefly eclipse USD 35k. As it stands, BTC is holding just above the USD 34k mark but has been below the figure at times during both the APAC and European sessions. DTCC said BlackRock iShares Bitcoin Trust ETF added to the eligibility file in August 2023; appearing on the list is not indicative of the outcome for any outstanding regulatory or other approval, according to Reuters

Turning to the day ahead. In terms of data releases, we will have US September new home sales, the German October Ifo survey, the French Q3 total jobseekers and Eurozone September M3. We also have the Bank of Canada rate decision. Finally, there will be earnings releases from Meta, Thermo Fisher Scientific, T-Mobile, IBM, KLA, and Hilton.

Market Snapshot

Top Overnight News

A more detailed summary of overnight news courtesy of Ransquawk

APAC stocks traded mixed following a firmer lead from Wall Street as eyes turned to earnings from heavyweights Microsoft and Alphabet. Shares of the former rose 3.9% and the latter tumbled 5.9% with cloud growth in focus. ASX 200 slipped into the red after Aussie CPI topped expectations across the board, which led to hawkish revisions to some analysts' RBA calls. Real Estate led sectoral losses, but the index was cushioned by outperformance in its Mining sector. Nikkei 225 was supported by recent JPY weakening as export-related sectors outperformed with some potential tailwinds after Bloomberg sources yesterday suggested that the BoJ saw little need to change its "will not hesitate to take additional monetary easing measures" forward guidance. Hang Seng and Shanghai Comp surged at the open with sentiment in the region boosted by reports that Chinese President Xi made an unprecedented visit to the PBoC in a "sign of focus on the economy." Hong Kong markets outperformed as large-caps posted gains between 4-6%, and tech also felt some tailwinds from Microsoft's earnings and guidance.

Top Asian News

European bourses reside in the red after a particularly busy morning of corporate updates, Euro Stoxx 50 -0.4%, and with broader macro drivers somewhat lacking thus far. Sectors are being dictated by earnings with Food, Beverage & Tobacco outperforming post-Heineken, Banking torn between Deutsche Bank and Lloyds while Kering weighs on Consumer names. Elsewhere, ASM International is among the best performers in the Stoxx 600 post-results. On the data front, better-than-expected German Ifo numbers sparked fleeting upside but have been unable to offset the pressure and general tone after the region's Flash PMIs. Stateside, futures are also in the red with the ES -0.4% & NQ -0.6% given the above and following after-market earnings from Microsoft (+3.6% pre-market) and Google (-6.8% pre-market), with the latter weighing on equity performance. Action which was exacerbated just after the European cash open following a bout of upward momentum in global yields.

Top European News

FX

Fixed Income

Commodities

Geopolitics - Israel-Hamas

Geopolitics - Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

When 10% of the market cap of the S&P 500 reports after the closing bell, across just two companies, then that’s the only place to start this morning. Microsoft saw its shares rise +3.95% in after-market trading as revenues of $56.52 billion (+13% y/y) beat estimates of $54.54 billion and EPS came in at $2.99 (vs. $2.65 expected). The beat comes on the back of recovering cloud-computing growth with corporate customers spending more than expected. The other megacap, Alphabet, missed on their cloud revenue estimates at $8.4bn (vs. $8.6bn) with the share price falling -5.93% after hours as operating income and margins both surprised slightly to the downside. In overnight trading, S&P 500 (-0.23%) and NASDAQ 100 (-0.43%) futures are dipping after yesterday saw the S&P 500 (+0.73%) climb after 5 days of losses. As we'll see later China related risk is climbing after yesterday's surprise fiscal package.

Prior to the late results, bonds again whipped around yesterday but in a smaller range than in previous days. The biggest move came from 2yr US yields which rose +6.5bps with 10yr and 30yrs falling -2.7 and -6.1bps respectively and thus continuing the flattening trade this week after the dramatic steepening at the end of last week post Powell's speech late on Thursday. 2s10s finished yesterday at -29.3bps, largely reversing the post Powell steepening. We did get as flat as -11.5bps late-morning European time on Monday. So some wild swings.

Much of the discussions yesterday surrounded the transatlantic differences in the global flash PMIs with the US leading the way even if the composite came in only a point above the 50-point line that demarcates between expansion and contraction at 51.0 (50 expected and 50.2 last month). US services surprised to the upside at 50.9 (vs 49.9 expected), up from 50.1. In terms of manufacturing, the release rose to 50.0 (vs 49.5 expected) from 49.8. The release did see promising titbits on inflation, noting that the survey’s selling price gauge was now close to its pre-pandemic long-run average, perhaps more consistent with headline inflation dropping near to the Fed’s 2% target. It was noted that tensions in the Middle East did pose a risk to both growth and inflation, but in sum, the US PMI numbers remain resilient .

Markets subsequently dialled back their expectations of rate cuts in 2024. December 2024 pricing rose +10.5bp, bringing the expected rate to 4.66%, echoing the ‘higher for longer’ mantra of recent Fedspeak.

In Europe, both the ECB’s Q3 Bank Lending Survey (BLS) and the October flash PMIs delivered a concerning signal on the euro area growth outlook. The BLS results demonstrated only a marginal improvement in the last quarter’s credit conditions and again fell below the optimistic expectations of European banks from the last quarter. In fact the gap this quarter to what was expected was the largest on record.

Turning to the PMI’s, the Euro Area composite result fell beneath expectations at 46.5 (vs 47.4 expected), down from 47.2 in September. The decline was driven by both services and manufacturing, which printed below expectations at 47.8 (vs 48.6 expected) and 43.0 (vs 43.7 expected) respectively. Taken together, this reduces the probability of an additional rate hike by the ECB and raises the risk of a mild recession in the second half of 2023, alongside a greater likelihood of the ECB cuts beginning before that of the Fed. If bank lending expectations prove correct the PMIs are probably at the right level now. If they again prove too optimistic it leaves the prospect of further PMI declines and negative growth. See Peter Sidorov’s report on both releases here.

We also heard from the ECB’s President Lagarde, who was reported positing to presidents of the European Commission that the central bank’s fight against inflation was tracking well. Lagarde also stated that the euro-zone will stagnate over the next quarters, even as risks to prices become more balanced. However, coverage of the meeting highlighted that the ECB may need to act further if the delay to a fiscal overhaul necessitates it. Against this backdrop, 10yr German bund yields fell -4.6bps to 2.83%, while OATs (-3.0bps) and BTPs (-1.3bps) saw smaller rallies .

Prior to the after the bell results, the S&P 500 rose +0.73% on Tuesday, ending its five-day losing stream, with gains driven by telecoms (+5.84%), utilities (+2.57%), autos (+1.61%), and semiconductors (+1.48%%). Regarding semiconductors, after the close Texas Instruments (-4.5% in after-market trading) announced a lower-than-expected revenue target for the next quarter. This is important as the company is often watched as an industry bellwether given its broad range of customers. The FANG+ index of megacap stocks increased +1.24% ahead of the tech results .

In European equities, the STOXX 600 relatively underperformed, up a more modest +0.44%, with banks (-0.97%) the big laggard after the ECB lending survey results. The rally was led in part by defensives like utilities (+1.72%) and consumer products (+1.69%).

In the geopolitical sphere, we had comments from a couple of political leaders on the Middle East tensions. French President Macron visited Israel on Tuesday, stating that France would “share with Israel [the] challenge of having to deal with hostages” and called for an international coalition to fight Hamas. At the same time, Macron warned other Iranian-back militant groups to not wage war on new fronts. Israeli Prime Minister Netanyahu also released several comments, emphasising that once the conflict ceases, no one will live “under Hamas tyranny”, but warned that the war might take time. With few material developments in the conflict on the ground, concerns over oil supply continued to relax. Brent crude dropped -1.96% to $88.07/bbl, and WTI crude -2.05% to $83.74/bbl, in the third consecutive day of losses. Gold finished up +0.20% at $1,974.96/ounce.

Yesterday, Chinese President Xi announced additional fiscal support through the issuance of $137 billion in additional sovereign debt. The fiscal deficit was raised to 3.8%, well above the 3% target set in March that was generally considered a limit. It is unusual for the Chinese government to adjust its budget mid-year, clearly demonstrating support of the economy as it rises out of its trough, and to achieve a 5% growth in 2023. See our economists' review of the stimulus package here. It was also reported that President Xi had made his first known visit to the central bank since he became president over a decade ago. The details of the meeting were not publicised but the visit is in line with the government’s efforts to strengthen the economy and stabilise markets.

Chinese stocks are driving the rally in Asia with the Hang Seng Tech index (+3.07%) emerging as the best performer across the region powered by technology stocks while the Hang Seng (+1.82%), the CSI (+0.86%) and the Shanghai Composite (+0.54%) are also moving higher following the Chinese government’s stimulus plan to support the economy. Elsewhere, the Nikkei (+1.30%) is extending its gains while the KOSPI (-0.45%) is trading in the red in early trade.

We have data from Australia showing that inflation quickened in the September quarter, rising +1.2% q/q (v/s +1.1% expected), up from +0.8% in the June quarter thus increasing the probability of a rate hike in November. The annual pace of inflation slowed to +5.4%, down from +6.0%, but came above forecasts of a +5.3% gain. The Australian dollar moved upwards following the CPI data advancing + 0.71% to touch a high of 0.64 against the dollar before settling at 0.638 as we go to press. Meanwhile, yields on the 10yr Australian government bonds (+4.7bps) moved higher to trade at 4.74%.

In other news from yesterday, we had the release of the Richmond Fed manufacturing index survey, which posted in line with expectations at 3, down from 5 in September, but still at a 12-month high. Business conditions as measured by the Richmond Fed fell from -5 to -15. Over the Atlantic in Europe, we had the German November GfK consumer confidence result. This slipped beneath expectations to -28.1 (vs -27.0 expected), from -26.7, as German economic weakness persists. In the UK, the composite PMI index rose a tenth to 48.6 (vs 48.5 expected) due to strength in manufacturing.

Now turning to the day ahead. In terms of data releases, we will have US September new home sales, the German October Ifo survey, the French Q3 total jobseekers and Eurozone September M3. We also have the Bank of Canada rate decision. Finally, there will be earnings releases from Meta, Thermo Fisher Scientific, T-Mobile, IBM, KLA, and Hilton.